Document

advertisement

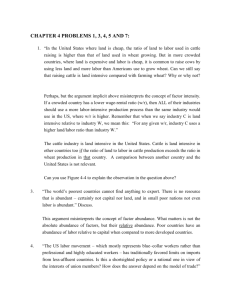

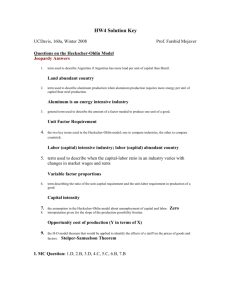

Part I: Chapter 4 (6th edition) , Problem 4, 5 4. In the Ricardian model, labor gains from trade through an increase in its purchasing power. This result does not support labor union demands for limits on imports from less affluent countries. Labor may gain or lose from trade in the context of the Immobile Factors model. Purchasing power in terms of one good will rise, but in terms of the other good it will decline. The Heckscher-Ohlin model directly addresses distribution by considering the effects of trade on the owners of factors of production. In the context of this model, unskilled U.S. labor loses from trade since this group represents the relatively scarce factors in this country. The results from the Heckscher-Ohlin model support labor union demands for import limits. 5. Conditions necessary for factor price equalization include both countries (or regions) produce both goods, both countries have the same technology of production, and the absence of barriers to trade. The difference between wages different regions of the United States may reflect all of these reasons; however, the barriers to trade are purely "natural" barriers due to transportation costs. U.S. trade with Mexico, by contrast, is also subject to legal limits; together with cultural differences that inhibit the flow of technology, this may explain why the difference in wage rates is so much larger. Chapter 6 (6th edition) , Problem 7 7. a. Suppose two countries that can produce a good are subject to forward-falling supply curves and are identical countries with identical curves. If one country starts out as a producer of a good, i.e. it has a head start even as a matter of historical accident, then all production will occur in that particular country and it will export to the rest of the world. b. Consumers in both countries will pay a lower price for this good when external economies are maximized through trade and all production is located in a single market. In the present example, no single country has a natural cost advantage or is worse off than it would be under autarky. Chapter 4 Resources and Trade: The Heckscher-Ohlin Model 33 Part II: 1. In the 2-factor, 2 good Heckscher-Ohlin model, an influx of workers from across the border would (a) move the point of production along the production possibility curve. (b) shift the production possibility curve outward, and increase the production of both goods. (c) shift the production possibility curve outward and decrease the production of the labor-intensive product. (d) shift the production possibility curve outward and decrease the production of the capitalintensive product. (e) None of the above. Answer: D 2. In the 2-factor, 2 good Heckscher-Ohlin model, a change from autarky (no trade) to trade will benefit the owners of (a) capital. (b) the relatively abundant factor of production. (c) the relatively scarce factor of production. (d) the relatively inelastic factor of production. (e) the factor of production with the largest elasticity of substitution. Answer: B 3. Empirical observations on actual North-South trade patterns tend to (a) support the validity of the Leontieff Paradox. (b) support the validity of the Heckscher-Ohlin model. (c) support the validity of the Rybczynski Theorem. (d) support the validity of the wage equalization theorem. (e) support the validity of the neo-imperialism exploitation theory. Answer: B 4. One way in which the Heckscher-Ohlin model differs from the Ricardo model of comparative advantage is by assuming that __________ is (are) identical in all countries. (a) factor of production endowments (b) scale economies (c) factor of production intensities (d) technology (e) opportunity costs Answer: D 5. If tastes differed between countries, this could affect (a) wage equalization due to trade with no specialization. (b) the direction of trade (who exports what to whom). (c) the fact that some groups in a country might lose welfare due to trade. (d) the fact that the country as a whole will gain from trade. 34 Krugman/Obstfeld • Seventh Edition (e) None of the above. Answer: B 7. The most common market structure is (a) perfect competition. (b) monopolistic competition. (c) small-group oligopoly. (d) perfectly vertical integration. (e) None of the above. Answer: C 10. Where there are economies of scale, an increase in the size of the market will (a) increase the number of firms and raise the price per unit. (b) decrease the number of firms and raise the price per unit. (c) increase the number of firms and lower the price per unit. (d) decrease the number of firms and lower the price per unit. (e) None of the above. Answer: C 14. If some industries exhibit internal (firm specific) increasing returns to scale in each country, we should not expect to see (a) intra-industry trade between countries. (b) perfect competition in these industries. (c) inter-industry trade between countries. (d) high levels of specialization in both countries. (e) None of the above. Answer: B 20. A monopoly firm will maximize profits by (a) charging the same price in domestic and in foreign markets. (b) producing where the marginal revenue is higher in foreign markets. (c) producing where the marginal revenue is higher in the domestic market. (d) equating the marginal revenues in domestic and foreign markets. (e) None of the above. Answer: D 23. The monopolistic competition model is one in which there is/are (a) a monopoly. (b) perfect competition. (c) economies of scale. (d) government intervention in the market. (e) None of the above. Answer: C Chapter 4 Resources and Trade: The Heckscher-Ohlin Model Essay Questions 6. Why are increasing returns to scale and fixed costs important in models of international trade and monopolistic competition? 35 Answer: There are many answers. Three of these are (a) Increasing returns to scale, and high fixed costs may be inconsistent with perfect competition. In such a case, the initial autarkic state may be a suboptimal equilibrium. For example, relative prices may not equal marginal rates of transformation. It follows from this that a change in output compositions associated with trade may result in a national welfare for one or both trading countries that is inferior to that associated with the initial autarkic conditions. Hence no “gains from trade.” (b) In a case of increasing scale economies at the firm or plant level, the determination of which product will be exported by which country is ex-ante indeterminate. Therefore, deriving clear implications concerning the effects of trade on income distributions such as may be derived from the Samuelson-Stolper Theorem is no longer generally possible. (c) Market structures containing positive scale economies and imperfect competition may allow for “two-way trade,” or intra-industry trade. As in b. above, the various theorems derivable from the Heckscher-Ohlin model concerning directions of trade and income distributions are no longer generally applicable. 36 Krugman/Obstfeld • Seventh Edition 6. Assume that only two countries, A and B, exist. Consider the following data: Countries Factor Endowments Labor Force Capital Stock A 45 15 B 20 10 If good S is capital intensive, then following the Heckscher-Ohlin Theory, (a) country A will export good S. (b) country B will export good S. (c) both countries will export good S. (d) trade will not occur between these two countries. (e) Insufficient information is given. Answer: B Chapter 4 Resources and Trade: The Heckscher-Ohlin Model Quantitative/Graphing Problems 1. Two countries exist in this model, P and R. P is relatively labor (L) abundant, as is evident in the bottom right horizontal axis. If Country P were to be completely specialized in the labor-intensive product, C, it would be producing at point 4. In fact, it produces both C and P, at point 5. The (autarky) relative price of C (in terms of F) of Country P is at point 3; and of Country R at point 1. If trade were to open up between these two countries, which would export C and which would export F? Is this consistent with the Heckscher-Ohlin model? Explain. Answer: Country R would export F. This is consistent with the H-O model. The country which is relatively capital abundant exports the product which is relatively capital intensive. 37 38 Krugman/Obstfeld • Seventh Edition 2. If trade were to open up between P and R, where would the world terms of trade locate in the figure above (somewhere on the PC/PF axis)? Would relative wages (w/r) in the two countries become equal? Is this consistent with the Heckscher-Ohlin model? Explain. Answer: The terms of trade would settle somewhere between the two autarky relative prices on the PC/PF axis. The relative wages (w/r) will be lower than the highest and higher than the lowest on the vertical axis above, but will not coincide. This last result is in contradiction to the factor price equalization expectation we have from the model. 3. Now repeat the exercise but substitute country M for country R. How do the answers differ from those in question 2 above? Explain the reason for any differences you note. Answer: All the answers are the same except that one single relative wage will be established for both countries. This happens because the two countries do not differ in relative factor availability by much, and hence a zone of overlap exists which allows for this result. 4. In autarky, Country P was producing at point 5. With trade, would its production point be found above or below point 5? Explain why. What must happen in the K/L intensity ratio in the production of each of the products in this country when moving from autarky to free trade? Answer: The point of production with trade will be above point 5. The country will be shifting its production composition to be more heavily weighted in labor intensive good, C. Within each industry, the production technique will be more capital intensive, since with the rising relative wage, the optimal point of production will involve sliding around the isoquants in the direction of saving on the now relatively more expensive labor. 5. Using the answers to question 4, can you guess which group of producers in Country P might lobby against free trade? Answer: In Country P, the owners of the relatively scarce factor of production are the owners of capital. Their relative and real incomes will decrease, and so they may well attempt to lobby for protectionism, which may prevent the country from moving to a free trade equilibrium. 6. The following Table describes the labor-input coefficients needed to produce one Widget in England and Portugal. Both countries are identical in size, tastes, technology. This technology is described in the table below: To Produce This Many Widgets, Or This Many Apples 1 2 3 4 5 6 7 Labor-Hour Requirements 3 5 6 7 8 9 10 Chapter 4 Resources and Trade: The Heckscher-Ohlin Model 39 Let us assume that each country has 10 labor-hours available. Further, consumers always consume an equal amount of apples and widgets. (a) How of each product will be produced in England under autarky? (b) Judging from autarky conditions, which country has a comparative advantage in widgets? (c) If England (completely) specialized in widgets, how many widgets would be produced, and how many apples? (d) If the world terms of trade were established at 3.5 widgets 3.5 Apples, which country would enjoy gains from trade (as compared to The autarky solution?) (e) If Portugal were to completely specialize in widgets, how would the answers to c and d change? (f) What would the production possibility curve look like in each country? Answers: (a) (b) (c) (d) 2 widgets and 2 apples None 7 widgets in England and 7 apples in Portugal both would gain from trade. Instead of consuming 2 widgets and 2 apples, they would each consume 3.5 widgets and 3.5 apples. (e) Same numbers as c, except that the countries will each be assigned a different product. Exactly the same answer for d. (f) convex to the origin. 40 Krugman/Obstfeld • Seventh Edition