Futures problem from packet

advertisement

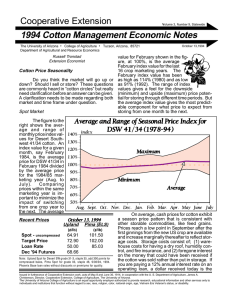

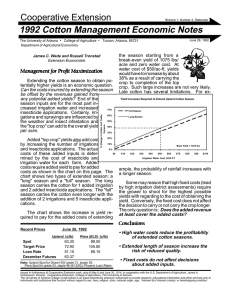

Futures problem from packet (15 points total) Suppose you are a weaver and you need 10,000 pounds of cotton to make handkerchiefs. Harvest time is six months from now and you want to lock in a price per lb now via a futures contract. Suppose you can make an agreement, that is, enter into a futures contract for 10,000 lbs with a cotton farmer with an agreed upon price of $1.00 lb (which happens to be the current spot price). a) (2 points) Explain the terminology of the transaction – that is, what exactly are you doing and why: what is the farmer doing and why? b) (2 points) Now suppose, due to a trade war and a great growing season, cotton prices plunge to 50 cents ($0.50) per pound at harvest time. Who looks smart for acquiring the futures contract, the cotton farmer or the weaver? Explain. c) (3 points) Now, let’s assume that they are both speculators. Plot the profit function (futures profit functions) for the speculator cotton farmer (in one graph) and the speculator weaver (in another graph). Locate the profit or loss for each with a label of point A (where the price equals $0.50). Please use the space below for your diagram. d) (3 points) Now assume that instead that the speculators play the futures options market. In particular, the speculator cotton farmer buys a futures options put for 10,000 lbs of cotton for $1000 (strike price = $1.00 lb) and the speculator weaver buys a futures options call for 10,000 lbs of cotton for $1000 (strike price = $1.00 lb). Assume that the price per pound plunges to 50 cents ($0.50) as before and that the futures options expire at harvest time. Add the futures option profit function for each speculator to your diagram above. Locate the profit or loss for both players in the futures options game as point B. Be sure to label your diagram with all the specific numbers that apply. Which option is “in the money?” e) (4 points) Are these results consistent with a zero sum game (hint, there are four players here)? Explain.