Bearish Option Plays

advertisement

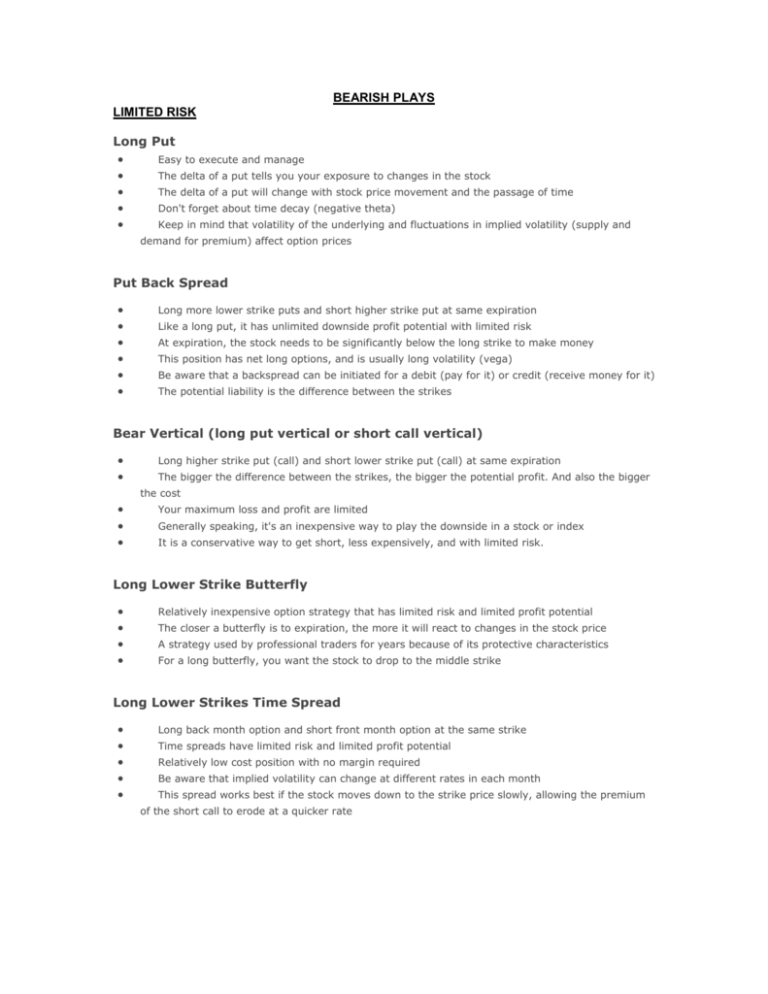

BEARISH PLAYS LIMITED RISK Long Put Easy to execute and manage The delta of a put tells you your exposure to changes in the stock The delta of a put will change with stock price movement and the passage of time Don't forget about time decay (negative theta) Keep in mind that volatility of the underlying and fluctuations in implied volatility (supply and demand for premium) affect option prices Put Back Spread Long more lower strike puts and short higher strike put at same expiration Like a long put, it has unlimited downside profit potential with limited risk At expiration, the stock needs to be significantly below the long strike to make money This position has net long options, and is usually long volatility (vega) Be aware that a backspread can be initiated for a debit (pay for it) or credit (receive money for it) The potential liability is the difference between the strikes Bear Vertical (long put vertical or short call vertical) Long higher strike put (call) and short lower strike put (call) at same expiration The bigger the difference between the strikes, the bigger the potential profit. And also the bigger the cost Your maximum loss and profit are limited Generally speaking, it's an inexpensive way to play the downside in a stock or index It is a conservative way to get short, less expensively, and with limited risk. Long Lower Strike Butterfly Relatively inexpensive option strategy that has limited risk and limited profit potential The closer a butterfly is to expiration, the more it will react to changes in the stock price A strategy used by professional traders for years because of its protective characteristics For a long butterfly, you want the stock to drop to the middle strike Long Lower Strikes Time Spread Long back month option and short front month option at the same strike Time spreads have limited risk and limited profit potential Relatively low cost position with no margin required Be aware that implied volatility can change at different rates in each month This spread works best if the stock moves down to the strike price slowly, allowing the premium of the short call to erode at a quicker rate UNLIMITED RISK Short Stock Sell short, close your eyes, and pray that it tanks – and don't forget that you owe the dividends Check the hard-to-borrow list before you short a stock Short stock requires the sale to occur on an up-tick or zero-plus tick in the stock Isolate your speculation – and you may find an option position that has more desirable risk characteristics than short stock Short Combo "Synthetically" short stock Long put and short call at same strike and expiration Has the same risk exposure as short stock, with interest and dividends built into the combo price Remember: there is no short stock rebate for retail customers A short combo is a way of getting past the down-tick ruleTemplate for shorting stock Unlike short stock, short combos expire, and unless it is exactly at the money, short stock will be the result of the put exercise or the call assignment. Short Semi-Stock (off strike combo) Similar to short combo, but has smaller negative delta Long lower strike put and short higher strike call at same expiration The position is generally initiated as premium-neutral but that can change quickly as the stock price moves Requires less margin than either short stock or same-strike combo Short Call Potential profit is limited to the price of the call Risk is unlimited Generally requires less margin than shorting stock Call Ratio Spread for Credit Long lower strike call and short more higher strike calls at same expiration The most common ratio between short and long is 2:1 Ratio spreads have unlimited upside risk – monitor your position carefully At expiration, greatest profit at the higher strike price Because the position is net short options, there is an increased volatility risk