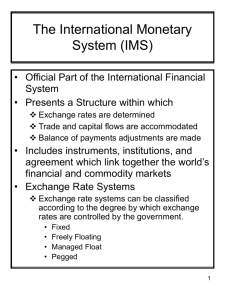

The International Monetary System - Chapter 3

advertisement

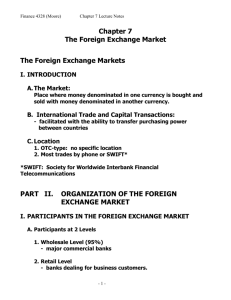

Finance 4328 (Moore) Chapter 3 Lecture Outline The International Monetary System - Chapter 3 PART I. ALTERNATIVE EXCHANGE RATE SYSTEMS I. FIVE MARKET MECHANISMS A. Freely Floating (Clean Float) 1. Market forces of supply and demand determine rates. 2. Forces influenced by a. price levels b. interest rates c. economic growth 3. Rates fluctuate over time randomly. B. Managed Float (Dirty Float) 1. Market forces set rates unless excess volatility occurs. 2. Then, central bank determines rate. (China) C. Target-Zone Arrangement 1. Rate Determination a. Market forces constrained to upper/lower range of rates. b. Members to the arrangement adjust their national economic policies to maintain target. D. Fixed Rate System 1. Rate determination a. Government maintains target rates. b. If rates are threatened, central banks buy/sell currency. c. Monetary policies coordinated. 2. Some Government Controls: a. On global portfolio investments. b. Ceilings on direct foreign direct insurance. c. Import restrictions. E. Current System 1. A hybrid system a. Major currencies: use freely-floating method b. Others move in and out of various fixed-rate systems. -1- Finance 4328 (Moore) Chapter 3 Lecture Outline PART II. BRIEF HISTORY OF THE INTERNATIONAL MONETARY SYSTEM I. THE USE OF GOLD A. Desirable properties B. In short run: High production costs limit short-run changes. C. In long run: Commodity money insures stability. D. Still used as Inflation hedge and “safe haven” PART III. THE EUROPEAN MONETARY SYSTEM I. INTRODUCTION A. The European Monetary System (EMS) 1. A target-zone method (1979) 2. Close macroeconomic policy coordination required. B. EMS Objective: provide rate stability to all members by holding exchange rates /in specified limits. C. European Currency Unit (ECU) A “cocktail” of European currencies with specified weights as the unit of account. 1. Exchange rate mechanism (ERM): each member determines mutually agreed upon central cross rate for its currency. 2. Member Pledge: To keep within 15% margin above or below the central rate. D. EMS ups and downs 1. Foreign exchange interventions failed due to lack of support by coordinated monetary policies. 2. Currency Crisis of Sept. 1992 a. System broke down b. Britain and Italy forced to withdraw from EMS. E. Failure of the EMS: members allowed political priorities to dominate exchange rate policies. -2- Finance 4328 (Moore) Chapter 3 Lecture Outline F. Maastricht Treaty 1. Called for Monetary Union by 1999 (moved to 2002). 2. Established a single currency: the euro 3. Calls for creation of a single central EU bank. 4. Adopts tough fiscal standards. G. Costs / Benefits of A Single Currency A. Benefits 1. Reduces cost of doing business. 2. Reduces exchange rate risk B. Costs 1. Lack of national monetary flexibility. -3-