IFRS update

advertisement

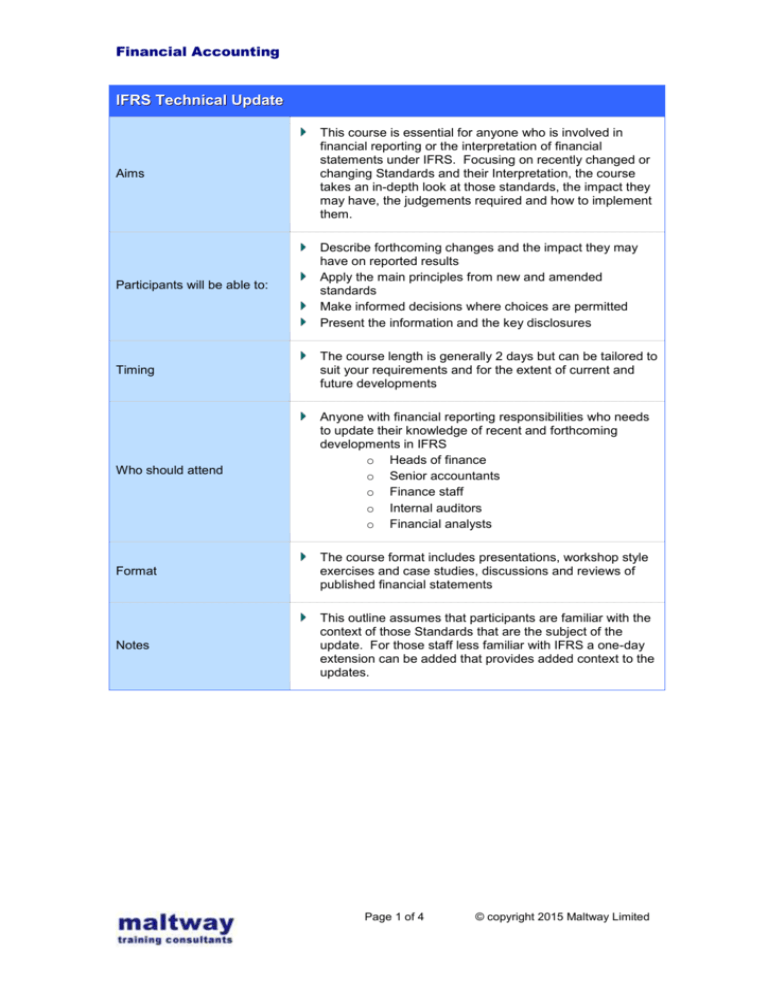

Financial Accounting IFRS Technical Update Aims This course is essential for anyone who is involved in financial reporting or the interpretation of financial statements under IFRS. Focusing on recently changed or changing Standards and their Interpretation, the course takes an in-depth look at those standards, the impact they may have, the judgements required and how to implement them. Participants will be able to: Describe forthcoming changes and the impact they may have on reported results Apply the main principles from new and amended standards Make informed decisions where choices are permitted Present the information and the key disclosures Timing The course length is generally 2 days but can be tailored to suit your requirements and for the extent of current and future developments Who should attend Anyone with financial reporting responsibilities who needs to update their knowledge of recent and forthcoming developments in IFRS o Heads of finance o Senior accountants o Finance staff o Internal auditors o Financial analysts Format The course format includes presentations, workshop style exercises and case studies, discussions and reviews of published financial statements Notes This outline assumes that participants are familiar with the context of those Standards that are the subject of the update. For those staff less familiar with IFRS a one-day extension can be added that provides added context to the updates. Page 1 of 4 © copyright 2015 Maltway Limited Financial Accounting IFRS overview As an introduction to the issues and update, this session provides a brief refresher of the key presentation, recognition and measurement principles covered by IFRS The role of the IASB and convergence projects with other GAAP Reporting performance and position – the presentation of financial statements Reporting assets; review of property plant and equipment, intangible assets and inventory Reporting liabilities; provisions, deferred taxes and employee benefits The IASB’s conceptual framework and its development The role of fair value measurement and reporting in IFRS Issues and Update overview Summary of required changes for 2014 and 2015 year ends Summary of recently issued & revised standards & interpretations The IASB’s work plan and agenda consultation Mandatory for 2014 year ends Each topic will begin with an overview of the current reporting requirements before proceeding to review the new standards or amendments. This session is a comprehensive review of all changes introduced for 2013 year ends. The topics in this outline assume participants are interested in IFRS as endorsed by the European Union but the precise topics presented here can be tailored to your needs. Accounting for subsidiaries, associates and joint arrangements IFRS 10, Consolidated financial statements IFRS 11, Joint arrangements IFRS 12, Disclosures of interests in other entities IAS 27 (revised 2011) Separate financial statements IAS 28 (revised 2011) Associates and joint ventures Recent amendments to the forgoing with later mandatory effective dates including treatment by investment entities and application of IFRS 10 and IAS 28 to the sale or contribution of assets and IFRS 11 to the acquisition of joint ventures Case studies – identifying control, impact on results and deals, including SPV’s arising from new control definitions and impact on ratios of moving from proportional consolidation to equity method Page 2 of 4 © copyright 2015 Maltway Limited Financial Accounting Round up of other recent changes to IFRS Amendments to IAS 32 (and IFRS 7) on financial instruments asset and liability offsetting Amendment to IAS 19 – employee benefits on defined benefit plans Amendment to IAS 39 – novation of derivatives and hedge accounting Annual improvements 2010-2012 and 2011 - 2013 Recoverable amount disclosures (IAS 36) IFRIC 21 Levies Later mandatory application Financial Instruments o IFRS 9, Financial instruments; comprehensive review o Business models and classification o Recognition and de-recognition o Initial and subsequent measurement o Impairment o Hedge accounting o Examples from business already applying IFRS 9 o Status of adoption by EU o Consequential changes to IFRS 7 o Case studies – comparing the impact on balance sheet and results of the categorisation and measurement of financial assets and financial liabilities under IAS 39 and IFRS 9 IFRS 15 Revenue From Contracts with Customers The five-step process o Application and impact on specific industries o Status of adoption by EU o Case studies in revenue recognition Brief round up of other changes including: o IFRS 14 Regulatory Deferral Accounts o 2012-14 improvements projects o IAS 1 and IAS 7 disclosure initiative Page 3 of 4 © copyright 2015 Maltway Limited Financial Accounting New and forthcoming Standards and other publications expected in 2015: In this session we look at the work we expect to see published by the IASB during 2014. Each topic will include a brief overview of current reporting requirements. Round up of key issues and progress on other projects in progress: Conceptual framework Disclosure initiative and classification of liabilities and amendments to IAS 7 Discussion paper on financial instruments (IFRS 9) macro hedge accounting Exposure draft (re exposure) Leases Exposure draft (re exposure) on insurance contracts Annual improvements 2014-2016 Case studies – impact of accounting treatments proposed under the leasing exposure draft IASB current and future work programme and priorities Other projects A high level review of other projects that have been started but not completed and possible projects for the future Close Page 4 of 4 © copyright 2015 Maltway Limited