BAC Review of WI Petition for Membership

advertisement

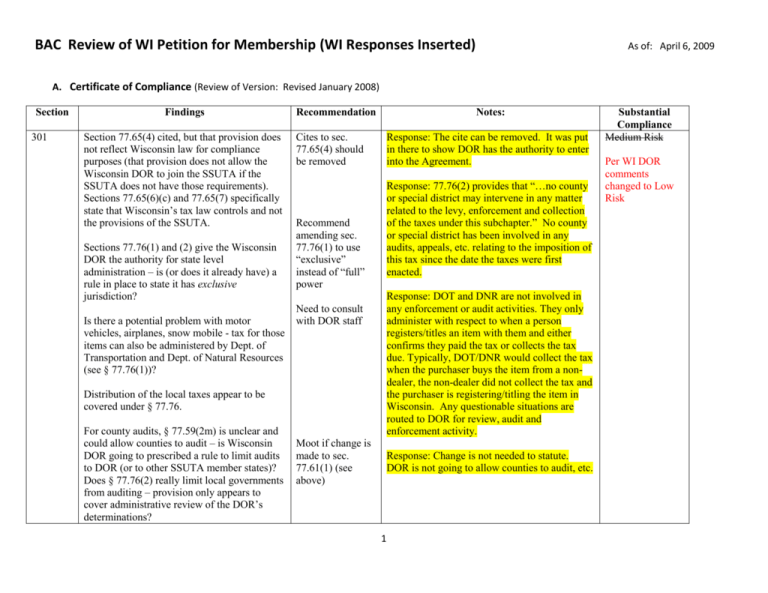

BAC Review of WI Petition for Membership (WI Responses Inserted) As of: April 6, 2009 A. Certificate of Compliance (Review of Version: Revised January 2008) Section 301 Findings Section 77.65(4) cited, but that provision does not reflect Wisconsin law for compliance purposes (that provision does not allow the Wisconsin DOR to join the SSUTA if the SSUTA does not have those requirements). Sections 77.65(6)(c) and 77.65(7) specifically state that Wisconsin’s tax law controls and not the provisions of the SSUTA. Sections 77.76(1) and (2) give the Wisconsin DOR the authority for state level administration – is (or does it already have) a rule in place to state it has exclusive jurisdiction? Is there a potential problem with motor vehicles, airplanes, snow mobile - tax for those items can also be administered by Dept. of Transportation and Dept. of Natural Resources (see § 77.76(1))? Recommendation Notes: Cites to sec. 77.65(4) should be removed Response: The cite can be removed. It was put in there to show DOR has the authority to enter into the Agreement. Response: 77.76(2) provides that “…no county or special district may intervene in any matter related to the levy, enforcement and collection of the taxes under this subchapter.” No county or special district has been involved in any audits, appeals, etc. relating to the imposition of this tax since the date the taxes were first enacted. Recommend amending sec. 77.76(1) to use “exclusive” instead of “full” power Response: DOT and DNR are not involved in any enforcement or audit activities. They only administer with respect to when a person registers/titles an item with them and either confirms they paid the tax or collects the tax due. Typically, DOT/DNR would collect the tax when the purchaser buys the item from a nondealer, the non-dealer did not collect the tax and the purchaser is registering/titling the item in Wisconsin. Any questionable situations are routed to DOR for review, audit and enforcement activity. Need to consult with DOR staff Distribution of the local taxes appear to be covered under § 77.76. For county audits, § 77.59(2m) is unclear and could allow counties to audit – is Wisconsin DOR going to prescribed a rule to limit audits to DOR (or to other SSUTA member states)? Does § 77.76(2) really limit local governments from auditing – provision only appears to cover administrative review of the DOR’s determinations? Moot if change is made to sec. 77.61(1) (see above) Response: Change is not needed to statute. DOR is not going to allow counties to audit, etc. 1 Substantial Compliance Medium Risk Per WI DOR comments changed to Low Risk BAC Review of WI Petition for Membership (WI Responses Inserted) Section 302 Findings Central registration system not yet complete Identical tax base, reference to tax on tangible personal property in § 77.52(1)(a) is not the same as in § 77.71(1), (2), (3) and (4). § 77.52(1)(a) contains “including accessories, components, attachments, parts, supplies and materials”. Should this be corrected? Recommendation As of: April 6, 2009 Notes: Set follow-up to verify completed Per Craig Johnson, DOR is currently working with a vendor that has assisted other states with the central registration system. (It will be ready by July 1.) Response: The phrase “including accessories…” means that these things are included in the definition of TPP. These same types of things would also be subject to the county tax because they are TPP. In addition, sec. 77.79 provides that the provisions of subch. III (county tax) that are consistent with subch. V. (county/stadium tax) also apply to the taxes under subch. V. Need to consult with DOR staff 2 Substantial Compliance Medium Risk Per WI DOR comments, retain Medium Risk because a tribunal could note difference and apply tax differently BAC Review of WI Petition for Membership (WI Responses Inserted) Section 303 Findings Ability to pull registration information is a Wisconsin DOR technology issue. § 73.03(50)(b) only allows Wisconsin DOR to waive the fee – it does not say a person does not have to register (and will a rule be put in place stating the fee is waived). Recommendation As of: April 6, 2009 Notes: Need to consult with DOR staff Response: DOR Technology people are getting this system ready. We have also had discussions with David Thompson and Gary Centilvre to make sure our system will be configured correctly. We are anticipating that this system will be ready around July 1, 2009. Substantial Compliance Low Risk Per WI DOR comments, retain Low Risk Response: The fees will be waived for any volunteer seller that registers through the Streamlined Central Registration System if they do not have a legal obligation to register. We can put this in an Admin. Rule as well. Need to consult with DOR staff Response: This will be prescribed on the forms. For not requiring a signature, has the Wisconsin DOR prescribed anything under § 77.51(17r)? Agent under § 77.524(1)(ag) is probably okay, but it should be modified to allow persons to represent sellers as provided for in the Agreement. 304 Relief for state tax changes should be in the law, or at a minimum in a regulation – even if the state presently has a law requiring 30 notice before there is a change to the tax rate Need to consult with DOR staff Response: Our language is actually broader than that required by the SSUTA in that they can represent sellers before the SSTP states without limitation. The agent can clearly register the seller per 73.03(50)(d). Need to consult with DOR staff Recommend law change Response: SSUTA requires 30 days notice and providing relief if they do not provide 30 days notice. Since our law (77.61(18)) requires 30 days notice, this is a moot issue. 3 Medium Risk Per WI DOR comments, changed to Yes BAC Review of WI Petition for Membership (WI Responses Inserted) Section 305 306 307 Findings Art. XIII, Sec. 7 addresses counties with an area of less than 900 square miles not being divided, but that provision does not appear to restrict the creation of new sales/use tax taxing districts No problem with seller and CSP relief from certain tax liability Rates and Boundaries database not yet complete Recommendation As of: April 6, 2009 Notes: Recommend law change Response: Although this has never happened in the past and we do not believe this will ever happen, the worst case scenario is that if it does happen the seller, CSP and purchaser would be relieved of their liability as provided in sec. 77.59(9n). Set follow-up to verify completed Per Craig Johnson, DOR has obtained a draft from vendor of rates and boundaries using 9 digit postal zipcodes which should accurately reflect local tax jurisdictions. DOR also plans to post a rate lookup feature on its Website. Substantial Compliance Medium Risk Per WI DOR comments changed to Low Risk Yes Low Risk Response: The rate and boundary database has been finalized. The files have been provided to David Thompson, Charles Collins and Brian Ertmer. 308 No problems with state and local tax rates Yes 4 BAC Review of WI Petition for Membership (WI Responses Inserted) Section 310 Findings Recommendation As of: April 6, 2009 Notes: No problems found with general sourcing provision in § 77.522(1)(b)(1) to (5). Leasing provision in § 77.522(3) contains the intermittent use exception but does not provide the example of intermittent use: “such as business property that accompanies employees on business trips and service calls.” Response: The use of “business property that accompanies employees on business trips and service calls” is just one example of “intermittent use” and it was not felt that this was needed in the statute. It is anticipated a provision will be included in the Administrative Rules for leasing to cover this example as well as other examples of intermittent use. Need to consult with DOR staff Substantial Compliance Medium Risk Per WI DOR comments, retain Medium Risk because preservation of lease under former law should be done legislatively No problems w/transportation equipment definition. Concern with new definition of “lease” under § 77.51(7) – need to verify new lease provision only applies prospectively (leases entered into under former law stay leases notwithstanding new definition of “lease”) 310.1 311 Alternative sourcing provision is not applicable “Receive” excluding a shipping company under § 77.522(1)(a)(1) does not apply to services or digital goods (I don’t think this is an issue). Response: If an item meets the existing definition of “lease” that definition would continue to apply until such time as the “lease” is modified, renewed or extended, at which time the new definition of “lease” would apply. Information will be included in the Admin. Rules giving some examples. In addition, sec. 77.58(6) specifically provides that leases shall be reported in accordance with the rules prescribed by DOR. See also 77.54(18), Wis. Stats. Need to consult with DOR staff – suggest law change or rule to clarify new definition only applied prospectively N/A Need to consult with DOR staff and determine if this is an issue Response: BAC indicated they are OK with this. Low Risk Per WI DOR comments, changed to Yes 5 BAC Review of WI Petition for Membership (WI Responses Inserted) Section 313 Findings Concern with whether DOR will allow SSUTA exemption certificate for direct mail or only its prescribed exemption form Recommendation As of: April 6, 2009 Notes: DOR needs to accept SSUTA form Response: DOR will accept either. Language was changed to “exemption certificate claiming direct mail” since that is the language that is being used in all of the “direct mail” proposals. Information will also be included in the Admin. rules explaining this. Substantial Compliance Medium Risk Per WI DOR comments changed to Low Risk Yes 314 No problems found with telecom sourcing rule 315 No problems found with telecom sourcing definitions Still pending review Yes No problems found with administration of exemptions – Wisconsin repealed provision not allowing drop shipper to accept resale cert. Yes 316 317 Pending Review 6 BAC Review of WI Petition for Membership (WI Responses Inserted) Section 318 Findings Need clarification on resort area tax – is DOR stating it is a separate tax from its sales tax (it does not appear to have a use tax) and that tax should not be part of the sales tax return Recommendation Need to consult with DOR staff and determine if this is an issue As of: April 6, 2009 Notes: Response: The premier resort area tax is separate from sales tax, does not have a use tax and is not identified as one of the taxes covered by the SSUTA as indicated in our Membership Petition. However, DOR will pursue a change to provide a hold harmless provision for “delivery” transactions until a database is available from DOR. Premier resorts are political subdivisions where at least 40% of the equalized assessed value of the taxable property in a political subdivision is used by tourism-related retailers and where the governing body of the political subdivision has voted to be a premier resort area. There are currently four such political subdivisions in the state created between 1997 and 2006. The 1/2 percent premier resort tax must be used for tourism infrastructure within the premier resort area. Relevant statistics are as follows: -Total state sales tax registrants = 175,000 -Total premier resort registrants = 600 -Total state sales tax returns FY 08 = 958,100 -Total premier resort returns FY 08 = 2800 (0.3% of state returns) -Total state sales taxes collected FY 08 = $4.3 billion -Total premier resort taxes collected FY 08 = $2,744,000 Provision to file an annual tax return for tax under $1,000 annually not found (does a regulation already cover this?) Need to consult with DOR staff and determine if this is an issue Response: DOR has the authority in 77.58(5) to require returns on other than a quarterly basis. This could be on an annual basis, monthly basis, etc. We are not going to expect retailers to file 7additional returns in the month the retailer has collected $1,000 or more of tax. Substantial Compliance Medium Risk Per WI DOR comments, retain Medium Risk because annual tax return filing needs to be in the law (or a regulation) BAC Review of WI Petition for Membership (WI Responses Inserted) Section Findings 319 Does DOR have a rule stating it will accept payment by ACH credit or debit? 320 No problems found with bad debt provisions 321 No problems found with confidentiality and privacy protections Wisconsin does not have sales tax holidays 322 323 Part 1 - Cap/threshold for manufactured or mobile homes is permitted by Section 323 C of the Agreement. Part 2 - However the exemption threshold that currently exists for Internet Broadband Equipment is limited to Dept. of Commerce threshold or cap amounts and is not permitted. Part B - Statutory reference contains open parenthesis – technical change needed Recommendation As of: April 6, 2009 Notes: Need to consult with DOR staff and determine if this is an issue Substantial Compliance Low Risk Response: The FAQs on our website contain the information relating to both ACH Debit and ACH Credit. Here is the link: Per WI DOR http://www.revenue.wi.gov/faqs/pcs/eft.html#eft comments, 5 In addition, information on ACH Debit and changed to Yes Credit is contained in Admin. Rule 1.12. Yes Yes N/A Need to decide whether this satisfies the agreement. s. 77.54(48)(a) Wis. Stats was converted from and exemption to a return deduction under s. 77.585(9)(a) Wis. Stats. This work around avoids retailer collection burdens and allows purchaser a way to recover tax in same period it is paid Response: This is allowed per Section 323 A.2. since it places no additional burden on the retailer. Wisconsin has converted a capped exemption to a return deduction by the purchaser No additional sections were omitted or intended per Craig Johnson Response: Will remove open parenthesis on Cert. of Compliance. Legislative change - delete open parenthesis 8 Low Risk Per WI DOR comments, changed to Yes BAC Review of WI Petition for Membership (WI Responses Inserted) Section 324 Findings “As appropriate” used for calculation of the tax on a per item or on an invoice basis under § 77.61(3m), is DOR going to do a rule to clarify “as appropriate” is up to the seller and not DOR? In addition, that provision states that the rounding formula is used to collect the tax but the last sentence states a seller using this rounding provision is not relieved from liability of the tax under the subchapter. Recommendation As of: April 6, 2009 Notes: Need to decide whether this satisfies the agreement. Response: Admin. Rule will contain examples showing how to calculate the tax, depending on which option the taxpayer chooses to use. Response: If a seller collects tax on an item by item basis and then when filing their return the tax they actually collected is less than the tax computed to be due by multiplying their total taxable sales times the applicable rate, the retailer still owes the amount computed by multiplying their total taxable sales times the applicable rate. Likewise, if the seller collects tax on an item by item basis and then when filing their return the tax they actually collected is more than the tax computed to be due by multiplying their total taxable sales times the applicable rate, the retailer only owes the amount computed by multiplying their total taxable sales times the applicable rate. Need to consult with DOR staff and decide whether this satisfies the agreement. Substantial Compliance Medium Risk Per WI DOR comments, retain Medium Risk because option to collect the tax needs to be the sellers and “tax due” to WI should be based on rounding under this section 325 No problems found with refund provisions Yes 326 No problems found with direct pay permits Yes 9 BAC Review of WI Petition for Membership (WI Responses Inserted) Section 327 Findings Digital code language in § 77.51(3pc) does not match Sec. 332 of the Agreement. Recommendation As of: April 6, 2009 Notes: Need to decide whether this satisfies the agreement Response: Our definition takes into account the definition contained in the SSUTA as well as the requirements and restrictions contained in the SSTGB Rule 332.1.G.2 through 5. Direct mail definition in § 77.51(3pd) is more expansive in defining packaging. Need to decide whether this satisfies the agreement Response: Our definition takes into account both the definition contained in the SSUTA and CRIC Interpretation 2006-12. Concern with “prepared food” definition under § 77.51(10m)(a) – more expansive than Agreement. Need to decide whether this satisfies the agreement Tangible personal property definition is in the bill twice, first version contains “regardless how it is delivered to the purchaser” language, § 77.51(20) – looks like subsequent provision repeals the first? There is also an issue with the effective date of the change – is it 10/1/2009 or 1/1/2010? Need to consult with DOR and decide whether this satisfies the agreement New definition of “lease”, addressed above in Sec. 310 of SSUTA, need to verify new lease provision only applies prospectively (leases entered into under former law stay leases notwithstanding new definition of “lease”) Wisconsin “lease or rental” definition excludes D. Need to consult with DOR and decide whether this satisfies the agreement “Sales price” – question with whether or not it conforms to the SSUTA and concern that “purchase price” not the same. Need to consult with DOR and decide whether this satisfies the agreement Response: Our definition takes into account both the definition contained in the SSUTA and CRIC Interpretations 2006-04 and 2006-11. Response: Section 332 of Wisconsin Act 2 applies from March 6, 2009 through September 30, 2009. Section 333 repeals the first version and applies from October 1, 2009 and forward. Not sure where they are getting the 1/1/2010 date from. Response: If an item meets the existing definition of “lease” that definition would continue to apply until such time as the “lease” is modified, renewed or extended, at which time the new definition of “lease” would apply. Information can be added to the Admin. Rules giving some examples. 77.58(6) specifically provides that leases shall be reported in accordance with the rules prescribed by DOR.. See also sec. 77.54(18), Wis. Stats. Response: The difference between the WI definition and the SSUTA is because of certain drafting requirements (i.e., references to 77.52(1)(b)(c) and (d)), and also because of special exceptions relating to motor vehicles, 10modular home and manufactured homes allowed per sec. 302 and 323 of the SSUTA. Substantial Compliance Medium Risk Per WI DOR comments, retain Medium Risk because sale price and purchase price need to be the same – regulation may work to address special exceptions BAC Review of WI Petition for Membership (WI Responses Inserted) Section 328 Findings Part C - State has noted specified digital products in the taxability matrix, however additional digital products are not included in the matrix Additional Digital Products – should this category be included? i.e., taxability of greeting cards, finished artwork, periodicals, video and electronic games As of: April 6, 2009 Recommendation Notes: Determine whether agreement requires additional digital goods to be in the matrix or is it acceptable to include in a supplemental matrix Craig Johnson did not feel it was a requirement to include additional digital goods in the taxability matrix Decide whether this category should be added to the matrix Response: Section 328 does not require that these items be included in the taxability matrix. They could, however, be added or included in the optional supplemental taxability matrix. Substantial Compliance Low Risk Per WI DOR comments, changed to Yes Per Craig Johnson, other states appear to include additional taxable categories in a supplemental matrix. Key consideration is that in the future, any new digital product or service must be specifically enumerated as taxable or nontaxable. 329 No problems found with effective date of tax rate changes for services Yes 330 No problems found with bundled transaction language No problems found with relief provisions Yes 331 Yes 11 BAC Review of WI Petition for Membership (WI Responses Inserted) Section 332 Findings Digital code language in § 77.51(3pc) does not match Sec. 332 of the Agreement Division (H), tangible form of product is exempt, then digital form is also exempt under s.77.54(50) Wis. Stats. 333 Clarification is needed on whether product transferred electronically is part of tangible personal property definition - there are two § 77.51(20) provisions in the bill There is also an issue with the effective date of the change – is it 10/1/2009 or 1/1/2010? 401 No problem with seller participation 402 Has DOR “prescribed” the manner a person can register for amnesty? Recommendation Need to decide whether this satisfies the agreement Review any changes that WI may make to individual exemptions to cover digital vs. tangible application Need to consult with DOR and decide whether this satisfies the agreement Need to consult with DOR Need to consult with DOR As of: April 6, 2009 Notes: Response: (Same as response to 327 question) Our definition takes into account the definition contained in the SSUTA as well as the requirements and restrictions contained in the SSTGB Rule 332.1.G.2 through 5. Substantial Compliance Low Risk Per WI DOR comments, changed to Yes Craig Johnson indicated that the blanket exemption was created to cover the requirement of 332H of the Agreement Response: Section 332 of Wisconsin Act 2 applies from March 6, 2009 through September 30, 2009. Section 333 repeals the first version and applies from October 1, 2009 and forward. 77.51(20) that is compliant with the SSUTA is effective 10/01/2009. Response: Documents and rules not prepared but will require to register pursuant to the SSUTA (i.e., through Central Registration System, etc.) Medium Risk Per WI DOR comments, changed to Low Risk – does 1/1/2010 date on compliance certificate need removed? Yes Low Risk 12 month versus “365 days” terminology 12 months versus 365 days is a drafting convention issue. 403 No problems found with method of remittance Yes 12 BAC Review of WI Petition for Membership (WI Responses Inserted) Section 404 No problems found with agent registration Substantial Compliance Yes 501 No problem with certification Yes 502 Is a regulation needed to implement this authority under sec. 77.65(3) 601 602 603 604 Findings Recommendation As of: April 6, 2009 Need to consult with DOR Notes: Response: 73.03(61)(b) provides that DOR will certify CSPs and CASs. A “certification rule” is not required. No problems found with Model 1 monetary allowance No problems found with Model 2 monetary allowance No problems found with monetary allowance for others Additional monetary allowance for SSUTA sec. 310.1 sales Low Risk Per WI DOR comments, changed to Yes Yes Yes Yes N/A Drugs Cannot conclude on taxability, unless “sold to” or “sold by” is known. Also exemptions exist for use on farm livestock Break matrix down to additional granularity if permitted Insulin Medical Oxygen OTC Drugs Medical Equip. Same as above Same as above Same as above Same as above Response: There are use-based and entity-based exemptions that could apply. Like other things, many times you are not going to know the proper tax treatment unless you know either who the seller is or who the purchaser is. This is a result of the way the taxability matrix is drafted. To correct this, the taxability matrix will need to be revised by the SSTGB. Response: Same as above. Response: Same as above. Same as above Same as above Response: Same as above. Admin. Code reference used for exempt sales if paid by Medicare or Medicaid Add reference to statute: s.77.54(1) Craig Johnson agreed that this would be an appropriate statutory reference to add. 13 BAC Review of WI Petition for Membership (WI Responses Inserted) Section Findings Recommendation As of: April 6, 2009 Notes: Wis. Stats. i.e,. state is prohibited from taxing under constitution or laws of the U.S. 14 Substantial Compliance