Anthony & Govindarajan - Ch 11 50KB Sep 10 2013

advertisement

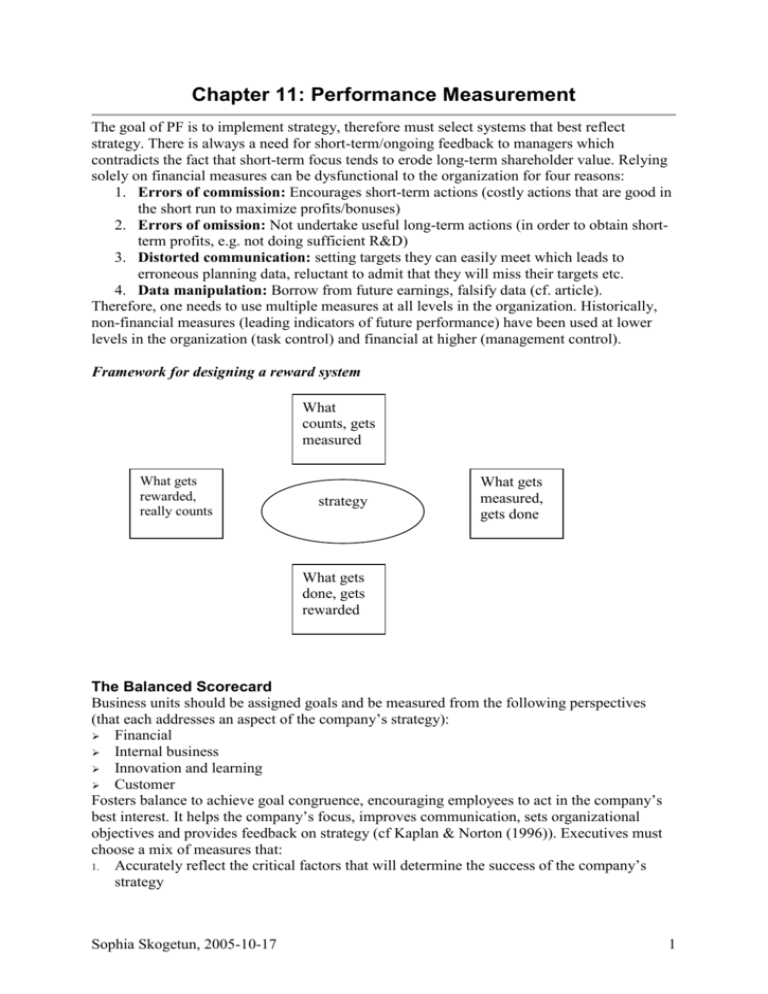

Chapter 11: Performance Measurement The goal of PF is to implement strategy, therefore must select systems that best reflect strategy. There is always a need for short-term/ongoing feedback to managers which contradicts the fact that short-term focus tends to erode long-term shareholder value. Relying solely on financial measures can be dysfunctional to the organization for four reasons: 1. Errors of commission: Encourages short-term actions (costly actions that are good in the short run to maximize profits/bonuses) 2. Errors of omission: Not undertake useful long-term actions (in order to obtain shortterm profits, e.g. not doing sufficient R&D) 3. Distorted communication: setting targets they can easily meet which leads to erroneous planning data, reluctant to admit that they will miss their targets etc. 4. Data manipulation: Borrow from future earnings, falsify data (cf. article). Therefore, one needs to use multiple measures at all levels in the organization. Historically, non-financial measures (leading indicators of future performance) have been used at lower levels in the organization (task control) and financial at higher (management control). Framework for designing a reward system What counts, gets measured What gets rewarded, really counts strategy What gets measured, gets done What gets done, gets rewarded The Balanced Scorecard Business units should be assigned goals and be measured from the following perspectives (that each addresses an aspect of the company’s strategy): Financial Internal business Innovation and learning Customer Fosters balance to achieve goal congruence, encouraging employees to act in the company’s best interest. It helps the company’s focus, improves communication, sets organizational objectives and provides feedback on strategy (cf Kaplan & Norton (1996)). Executives must choose a mix of measures that: 1. Accurately reflect the critical factors that will determine the success of the company’s strategy Sophia Skogetun, 2005-10-17 1 2. 3. Show the relationships among the individual measures in a cause-and-effect manner (show how short-term affect long-term) and Provide a broad-based view on the current status of the company. A blend of different strategic measures …to address the need of different stakeholders: Outcome and driver measures: Outcome measures/lagging indicators tell what’s happened. Driver measures/leading indicators show the progress of key areas in implementing a strategy. These are inextricably linked. Financial and nonfinancial measures: many organizations have failed to incorporate nonfinancial measures into their performance reviews because they are less sophisticated than financial measures. Internal and external measures: needs balance between external (customer) and internal (manufacturing). Measurements drive change: most important aspect is the system’s ability to measure outcomes and drivers that direct the company towards its strategies. Measures must be… Strategy- and organization specific Linked from top to bottom (tied to specific targets and clarified by objectives) Show cause-and-effect relationships …and measures should not be a laundry list, but linked together. Relationships must be understood Process for implementing a performance measurement system (iterative process): 1. Define strategy: BSC is a link between strategy and operational action. Single industry firm: should be developed at the corporate level and cascaded down. Multi-business firm: should be developed at the business unit level and aggregated in a corporate-wide BSC. 2. Define measures of strategy: focus on a few, linked measures that support the strategy. One single measure is not sufficient, and too many measures make the system too complex. By making trade-offs, the manager can choose btw behaviours that benefit the short- or long-term success. 3. Integrate measures into the management system 4. Review measures and results frequently: to be able to revise the strategy. Most important, the reviews should i) tell how and whether the strategy is working, ii) show that the measures are really important, iii) keep the measures aligned and iv) improve measurement. Sophia Skogetun, 2005-10-17 2 Possible implementation problems …which could limit the usefulness: Poor correlation between nonfinancial measures and results: hard to determine the cause-effect relationships/proxy measures for nonfinancial objectives. Fixation on financial results: … due to short-term pressure. This overwhelms the longterm, uncertain payback of nonfinancial measures. An incentive system that only rewards financial results creates additional pressure. Measures are not updated Measurement overload (1<x<50) Difficulty in establishing trade-offs: could give weights to the individual measures in the BSC. Without them, it is more difficult to establish trade-offs between financial and nonfinancial measures. Interactive control/Learning organizations In industries that are subject to rapid environmental changes, it is important that the organization can continuously adapt to the changes through interactive controls; a way of using the management control system as a source of information. Interactive controls alert management to strategic uncertainties, which forms the basis for managers to adapt to the changing environment by creating new business models. Examples are technological discontinuities (internet, e-commerce growth, shifts from physical goods to services…) and globalization discontinuities (deregulation, competition moving freely across borders…). Chapter 14: Service Organizations MC differs in service organizations from manufacturing organizations: Absence of an inventory buffer between production and sales Difficulty of measuring quality Labor intensive Professional service organizations: No dominant goal of return on assets employed Behavioural characteristics do not include attention to costs Output measures are subjective No clear line between marketing and production Performance appraisal by peer revivews which are subjective Financial services organizations: Raw material is money – the value in each unit of money in inventory is the same for all organizations (cost of using money of course varies) Profitability cannot be measured until several years after a commitment has been made – continual periodic audits are necessary Healthcare organizations: Current control and deliver system is unworkable. Costs cannot be standardized. Nonprofit organizations: Cannot use the profit measure for control but must account for contributed capital instead Expenditure decisions are subjective (are becoming more effective due to shrinking sources of funds) Sophia Skogetun, 2005-10-17 3