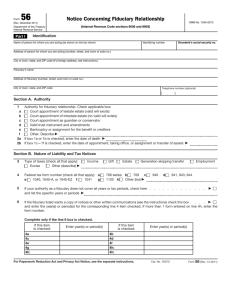

Fiduciary Law - people

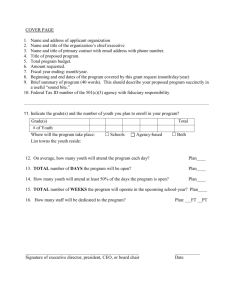

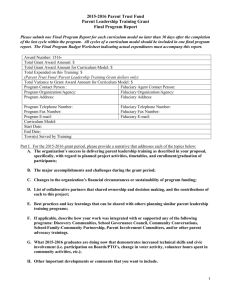

advertisement