Abstract

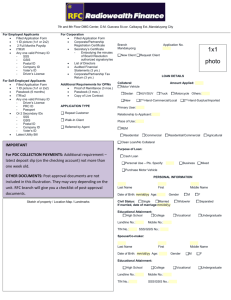

advertisement

Private Sector Initiatives in Old-Age Security: The Philippine Experience Geodicio T. Sison Professor School of Labor and Industrial Relations University of the Philippines E-mail: ir204@yahoo.com Abstract The subject of retirement funding has caught the attention of most governments and economic planners. People are living longer, a significant portion of the population is aging, creating greater demands for old-age social security. Most economies in the developed world may be prepared, in various degrees, to deal with this demographic reality. In the case of the developed economies however, the demographic concern is further magnified by the fact that their birth rate is declining. The situation in the developing economies is different. Demographics indicate that people are equally living longer, but with a birth rate that is higher than in the developed countries. This is particularly true of the Philippines, where the birth rate is highest in the ASEAN region. Another situation particularly true of the Philippines is the way the pension funds are structured and managed. There is no significant involvement of the private sector in pension-fund management. The companies engaged in pension funds are preneed companies, with the bigger volume of business in educational plans, a product line that is now experiencing problems. In a few reported cases, the financial viability of these pre-need companies are seriously threatened. The state-owned pension funds are having problems in their actuarial valuation, with the management of investments (losses are reported) and the way income from investments are used or diverted to purposes other than supporting or subsidizing insurance operations. Geodicio T. Sison 55 Private Sector Initiatives in Old-Age Security: The Philippine Experience Overview: The Global Situation There is a growing awareness among both industrialized and industrializing countries of “a great economic policy challenge in this century” - a looming crisis in retirement funding – and its collateral effect on private savings, investment, government budgets (and deficits), levels of taxation and international economic relations as well. The world’s population is aging rapidly, birth rates are falling in most industrialized countries (less so in industrializing countries) and life expectancy still increasing. It is anticipated that the ratio of retired people to working people will increase dramatically in many countries. The estimate is that about 6 percent of the Philippine population is above 60 years of age compared to 25 percent in Japan. This means that in a state-funded program, the burden of supporting retired pensioners will steadily shift to the younger working sector of the population. Most countries have some form of state funding (social security on a pay-as-you-go basis) for the retired and elderly but only a few have well-developed private pension programs. The United States, Britain, Switzerland, Holland, Denmark and other Englishspeaking countries have large, well-funded private pension programs with assets equal to 50 to 100 percent of their GDP. Specifically, 75 percent for the US, 100 percent for Switzerland and 121 percent for Holland. A few developing countries like Singapore, Malaysia and Chile have also developed comprehensive retirement savings programs, with assets equal to half of national income. Japan’s private pension funds account for about one-fourth of the country’s $1.8 trillion pension assets. Most countries however, have modest private pension funds. (David D. Hale, 1996) The Philippines devotes only about 0.6 per cent of GDP to public pensions, with less than 20 percent of the labor force covered with contributions to a social security system, and with a very limited coverage at that. Thus, while the earlier intention of this paper is to focus on the role of private pension funds in the Philippine scenario, it became inevitable that a good portion of the paper was devoted to state-funded pensions, if only to present a total and more meaningful picture of old-age social security efforts existing in the country today. Since 1996, under then Philippine President Fidel V. Ramos, the possibility of merging the two state-owned pension funds had been studied. The Philippines has the Government Service Insurance System (GSIS) that looks after the needs of the government bureaucracy and the Social Service System (SSS) for the private sector employees. Thus far, the only concrete step taken in this direction is a law making contributions to either system “portable” i.e. service credit is transferable from either system (GSIS or SSS) if the beneficiary worked in both private and government institutions. This may eventually pave the way for the unification of the two. But the ultimate objective is to create a national provident fund that would consolidate state-owned and private sector funds, eventually privatizing the whole system. President Ramos has said that “privatization will allow an enlarged provident fund system to widen its coverage, increase management flexibility in 56 Geodicio T. Sison Private Sector Initiatives in Old-Age Security: The Philippine Experience investing its portfolio, decentralize its operations, and raise minimum contributions.” ( Yves Guerard, 1996). Pensions today are a major subject of concern in many countries as a result of particular schemes reaching maturity, a change in the economic and social environment and changing demographic forecasts. The process of change is actually inherent in the way a national pension system works and the way they are financed. In the UK and Japan they pay a flat-rate pension, in the US, Germany and Spain, payments are earnings-related and in Italy and Sweden based on cumulative contributions. Either way all systems are based on balancing resources (contributions) and expenditures (benefits payments) to ensure its sustainability. As in private insurance operation, the earnings from the accumulated “investible” funds is expected to “subsidize” the payment of benefits. Thus, for sustainability of a system, efficient fund management involves judicious placements (possibly low-risk, low-yield) and reinvestments of earnings. Background: The Philippine Labor Force: Philippine population is currently estimated at 86 million. Data from the October 2004 Labor Force Survey of the National Statistics Office showed an increase in the country’s economically active population, where labor force posted a 1.4 percent growth from 35.120 million employed in October 2003 to 35.629 million in October 2004. This is due to the rise in the working age population over the period. Consequently, both the employment and unemployment levels expanded by 0.6% and 9.0% respectively. On the other hand, labor force participation rate slightly decreased by 0.6% point from 67.1 per cent in 2003. Employment level reached 31.741 million, an additional 188,000 from the 31.553 million employed in October 2003. Part-time employment or those who worked less than 40 hours during the week grew by 1.3% or 147,000 to reach 11.218 million in October 2004. Unemployment rate (10.9%) or that portion of the labor force that did not work but actively looked for work increased by a negligible 0.7% from last year. In absolute terms, unemployed persons reached 3.888 million, up by 321,000 from the 3.567 million unemployed in October 2003. The number of underemployed persons or those employed but still wanting additional hours of work grew by 7.5% in October 2004 from the same period a year ago. Classified by sector, employment in the agriculture, fishery and forestry sector posted minimal growth of 0.4 % (+ 44,000) while industry sector slipped by 1.4% (-68,000). The services sector which grew by 1.4% (211,000) accounted for the bulk of employment creation during the period. Deployed Overseas Filipino Workers (OFWs) went up from 867,969 in 2003 to 933,588 in 2004 or a 7.6 percent increase. These OFWs were mostly land-based comprising -----------------------------------------------------------------------------------------------------------------------------------Geodicio T. Sison 57 Private Sector Initiatives in Old-Age Security: The Philippine Experience 75.5% or 704,586, while the rest were sea-based. Saudi Arabia continued to be the foremost country of destination for most OFWs accounting for 26.7 percent of the total land-based workers. Hong Kong ranked second with 12.4 percent, while Japan was third with 10.6& share. Economic Fundamentals: Based on estimates as of January 2005, the Gross Domestic Product (GDP) or the amount of goods and services produced within the country for 2004 summed up to P1,148.0 billion (Philippine Pesos, at 1985 prices), a growth of 6.1 percent from the P1,081.5 billion reported in 2003. Note: US $ 1.00 is equivalent to P55.89 Philippine Peso, 0.82 Euro ( 23 July 2005). Incorporating the net income factor from abroad, the resulting Gross National Product (GNP) or the amount of goods and services produced by the nationals of the country likewise increased by 6.1 percent from P1,168.8 billion in 2003 to P1.239.6 billion in 2004 (both amounts based on 1985 prices). Based on Bangko Sentral ng Pilipinas (Central Bank) reports, OFWs remitted an aggregate amount of US$ 8.544 billion in 2004. This is 11.8 percent higher than the 2003 figure of US$ 7.640 billion. The bulk of remittances came from OFWs in the United States of America (56.2%), Saudi Arabia (9.6%), and Italy (4.8%). Registered inward foreign investments infused to the economy reached an aggregate of US$ 4,151.8 billion in 2004. Of this amount, portfolio investments or those investments made by non-residents of the country in government securities, commercial papers and short-term portfolio investments comprised 83.6 percent, with direct equity investments accounting for the remaining 16.4 percent. The Government Service Insurance System (GSIS) The GSIS was created by Commonwealth Act No. 186 passed on November 14, 1936 and was mandated to provide and administer the following social security benefits for government employees: compulsory life insurance, optional life insurance, retirement benefits, disability benefits for work-related contingencies and death benefits. In addition, the GSIS is entrusted with the administration of the General Insurance Fund. It provides insurance coverage to assets and properties which have government insurable interests. Republic Act No. 8291, otherwise known as the “Government Insurance Act of 1977” increased and expanded the social security protection of government workers and enhanced the powers and functions of the GSIS to better respond to the needs of its members. The GSIS covers all government workers irrespective of their employment status, except employees who have separate retirement schemes under special laws, e.g. 58 Geodicio T. Sison Private Sector Initiatives in Old-Age Security: The Philippine Experience members of the judiciary and constitutional commissions, uniformed members of the Armed Forces, the National Police, Bureau of Fire Protection and contractual employees with no employee-employer relation with their agencies. Benefits & Services: The principal benefit package of the GSIS consist of compulsory and optional life insurance, retirement, separation and employee’s compensation benefits. Service Privileges: Active GSIS members are entitled to the following loan privileges: salary, policy, emergency and housing loans. Membership & Clientele: The GSIS membership in its social security package is the estimated 1.425 million employees of the Philippine government. In addition, the GSIS also services the members’ dependents and beneficiaries, the retirees and pensioners, and the survivors of the deceased members or pensioners. Assets: By the end of December 2004, assets of the Social Insurance Fund increased by 3.48 percent, from 271.249 billion Philippine Pesos (US$ 4.84 billion) in 2003 to 280.686 billion Pesos (US$ 5.02 billion) in 2004. Life and Retirement Benefits: By 2004, an aggregate of P30.528 billion(US$ 553 million) in life and retirement benefits were disbursed to 190,605 members or an increase of almost 80% compared to year 2000 figures. Annual Dividends and Cash Gifts: A total of 1.204 billion Pesos in dividends went to active members and P684 million cash gifts were paid out to pensioners in 2004. Retirement: The GSIS offers four retirement benefit packages: Retirement under Republic Act 8291 Retirement under Republic Act 7699 or the Portability Law – the retirement mode applicable if the retiree’s years of service in the government does not meet the required number of years under a certain retirement law and he has enough number of years service in the private sector to compensate/substitute for the service requirement. Retirement under Presidential Decree 1146 – the retirement mode applicable if the retiree has been in service after May 31, 1977 but before June 24, 1997. Retirement under Republic Act 660 or the Annuity (Pension) Benefit Plan as Amended – the retirement mode applicable if the retiree was in the service on or before May 31, 1977. -----------------------------------------------------------------------------------------------------------------------------------Geodicio T. Sison 59 Private Sector Initiatives in Old-Age Security: The Philippine Experience Retirement under Republic Act 1616 or Gratuity Retirement Benefit – The retirement mode applicable if the retiree was in the service on or before May 31, 1977. Presently there are about 108,588 disability and old-age pensioners with the GSIS. Social Security System (SSS) The Social Security System administers social security protection to workers in the private sector. It provides replacement income for workers in times of death, disability, sickness, maternity lesve and old age. Members: 25.7 million individual members 750,000 employer- members Assets: 175. 731.2 billion Pesos (US$ 3.14) in 2004, up by 2.8% from 2003. Benefits/Contributions: Contribution collection in 2004 is P43.9 billion (US$ 786 million) versus benefit payments of P44.9 billion (US$ 803 million). Positive net revenue came from investment earnings. The SSS was able to narrow down the contributions/benefits gap from P7.6 billion in 2001 to P947 million in 2004. Areas of Concern about the two State Insurance Funds: SSS & GSIS Social Security Service (SSS) In a span of 10 years, the estimated actuarial life of the fund has diminished dramatically – from perpetuity per the 1990 valuation report, to 2040 per the 1995 valuation report to 2015 per the 1999 valuation report. SSS actuaries warned of fund depletion by 2015. A one percentage point increase in SSS contribution rate was effected in 2003, a first in 23 years. The SSS has extended its actuarial life by 10 years to 2018 after it had brought down the deficit between its disbursements and income in 2004 but warned that it has no choice but to raise the contribution rate of members should Congress (presently there are three bills in the Senate, all seeking to increase the minimum pension of retirees) push through with plans to increase benefits, otherwise the pension fund can only last up to 2011. (Today, 30 December 2004). Since 1993, the number of SSS retirement pensioners has been increasing at an average rate of 8 percent per year. As of the end of 2003, SSS retirees have reached more than 455,000 or about half of the total number of pensioners totaling nearly 60 Geodicio T. Sison Private Sector Initiatives in Old-Age Security: The Philippine Experience 1.0 million. This means that the old age dependency ratio which represents financial support given by paying-members to retiree pensioners has grown to 6.3 percent from5.4 percent in 2000, contributing to the imbalance between contributions and benefit disbursements. Presently, only 16 active paying members are supporting one retiree compared to 19 paying members per retiree back in 2000. (Philippine Daily Inquirer, September 3, 2004) In 2004, for the first time since 1999 premium contributions exceeded benefit payments during the same period. (Philippine Daily Inquirer, 3 September 2004) Since 1980, pensions were increased 19 times at an average of 13.4 percent without corresponding increase in contribution rates. (Philippine Daily Inquirer, 3 September 2004) Five senators filed a case before the high court (Supreme Court) questioning why the SSS is willing to sell 187 million shares (a 26 % stake) of Equitable-PCI Bank to Banco de Oro Capital when it knows full well that it can fetch a much higher price. (Manila Standard, 4 October 2004) Government Service Insurance System (GSIS) Defaults and under remittances on the Employee Compensation Fund, where most government agencies remit P30.00 per employee instead of the required P100.00. The increase in assets in the administered funds would have been substantially more if most agencies remitted the required amount of premiums. Expected steady decline in members’ contribution as a result of the government’s continuing effort to streamline the bureaucracy. (Manila Bulletin, 1994) President Gloria Macapagal-Arroyo’s plans to “reengineer” (downsize) the government bureaucracy and provide “silver parachutes” (separation payments) for redundant offices could mean an estimated 33,000 employees (3% of the bureaucracy from 49 agencies recommended for abolition) will avail of the early retirement program. The GSIS has allocated 15 billion pesos for this program. The National Power Corporation (a state-owned utility firm), the biggest money-losing corporation of the government spent 12 billion pesos for an early retirement package, but ended up rehiring some of the terminated employees just the same. This occasioned calls for an inquiry from the Philippine Senate. (Philippine Daily Inquirer, 27 September 2004) The Department of Finance is currently reviewing the proposal from the Insurance Commission to increase its supervisory power over the SSS and the GSIS. This is to empower the Commission to examine various operations of the pension fund, including their investment activities. (Manila Bulletin, 14 July 2004) -----------------------------------------------------------------------------------------------------------------------------------Geodicio T. Sison 61 Private Sector Initiatives in Old-Age Security: The Philippine Experience The Senate will look into complaints of a group of teachers, GSIS members and employees asking for the ouster of GSIS President Winston Garcia . Some of the complaints include: “selective processing of GSIS loans (favors friends of GSIS management), payments for housing loans not accurately recorded in the pension fund’s books (or missing records of payments), borrowers “erroneously” classified as delinquent. A senator claims that these practices eventually affects other benefits including retirement as these amounts are deducted from benefits received at retirement. (Manila Standard, October 5, 2004.) Private Pension Funds - The Pre-Need Industry: Pre-need companies sell plans or contracts that promise to pay a certain amount (which may be fixed or not) when the service is availed of, or upon maturity of the plan. A pre-need sells the plan at a discounted rate or at an amount that is less than its face value. The plan holder would pay that discounted rate for several years and then allow the funds to grow for a few more years until it reaches its face value, which is normally upon maturity. To deliver on its promise the pre-need company would place the proceeds of its plan sales and subsequent amortizations in a trust fund and other investment instruments. This is where a pre-need company makes money, especially in times when the returns on its investments are in excess of agreed-upon amounts that it needs to cover with existing plans. The pre-need business is said to be unique to the Philippines, where the industry’s beginnings may be traced to 1967 when a local company partnered with a Hawaiian- based trust fund to form a memorial plan company that promised to pay the actual cost of memorial (funeral) services. The product gained wide public acceptance, encouraging other participants to enter the market. Soon, there were demands for other services and a pioneering company ventured into educational plans. They launched high-school and college open-ended plans in 1980. Educational Plans gained such wide market acceptance that several companies, including the top life insurance companies were soon competing for what then seemed a very rich market. Open-ended or traditional educational plans promised to shoulder the actual cost of tuition and other school fees at the time that the beneficiary enters school or avails of the service. For some time such promise was viable as the government regulated tuition increases and allowed schools to raise tuition fees to at most only10% in a given school year. But in 1990, the Philippine government removed the cap or restriction on secondary and collegiate tuition increases. In 1993, the government further deregulated tuition in the elementary schools and in 1994 totally lifted all restrictions. Schools were given the freedom to raise tuition fees at will and it was not long when educational cost became exorbitant, and educational plan schemes were suddenly beleaguered. Late 2004 and early 2005, two of the biggest pre-need companies failed to deliver on obligations and this has shaken the industry, with almost all the forty companies in the business receiving bad press and subjected to scrutiny by regulatory agencies and the public itself. The Philippine Congress is presently considering extending to distressed pre-need companies assistance in the form of tax relief to help alleviate their financial burdens and at 62 Geodicio T. Sison Private Sector Initiatives in Old-Age Security: The Philippine Experience the same time enable them to service their plan holders. The source of funding however, remains a big question mark because of the country’s huge fiscal deficit. Two of the distressed firms, Pacific Plans, Inc. and CAP (College Assurance Plan) are reported to have a base of at least 800,000 educational plan-holders. Lawmakers have long expressed concern over lack of regulation over the pre-need companies. Additional legislation that has been filed in Congress includes establishment of a plan-holders’ protection fund, the imposition of rules and guidelines for directors and officers and stronger penalties for offenses, including suspension of operations or revocation of license to do business. Congress is also considering a proposal to create an insurance corporation for pre-need firms, performing a role very similar to that of the Philippine Deposit Insurance Corporation for the banking industry. This is in the light of the Central Bank refusal to extend financial assistance to the pre-need firms, in the manner they do for distressed banks. Prior to the recent problems encountered, most of the pre-need companies were able to branch out into other products, notably pension plans. The educational plans however remain the more significant product in terms of marketability and customer base. Data for the pre-need companies are not complete, e.g. the more significant information is on the business-in-force, which is lacking Following are sales/volume figures that will give some idea of the state of the industry. Number and Amount (Gross Contract Price) of Pension Plans Sold by Pre-Need Corporations: From January to December 2003: Number - 280,734 Amount - Pesos 17,570,893,200 Initial Collection - Pesos 2,080,498,463 From January to December 2004: Number - 253,828 Amount - Pesos 19,424,724,627 Initial Collection - Pesos 2,615430,392 From January to May 2005: Number - 69,194 Amount - Pesos 5,128, 682,344 Initial Collection - Pesos 601,083,664 Profitability Ratio (%), Net Income to Net Sales of Some of the Top Pre-Need Companies in the Philippines (Consolidated Product Lines) Ayala Plans, Inc Berkley International Plans, Inc. CocoPlans, Inc. Grayline Plans, Inc. Himlayang Pilipino Plans, Inc. Loyola Plans Consolidated, Inc. 0.07 5.84 0.66 3.51 (10.86) 14.35 -----------------------------------------------------------------------------------------------------------------------------------Geodicio T. Sison 63 Private Sector Initiatives in Old-Age Security: The Philippine Experience Manulife Plans, Inc. Mercantile Careplans, Inc. Millenium Plans, Inc. Pacific Plans, Inc. PET Plans, Inc. Philam Plans, Inc. Provident Plans International Sun Life Financial Plans, Inc. Transnational Plans, Inc. 10.69 15.96 (14.20) (14.81) (19.33) ( 7.58) 10.22 0.33 5.85 For the pre-need companies, solvency and liquidity can be nagging problems. The matter of solvency is encountered by companies whose liabilities are bigger than their trust fund assets. Liquidity, on the other hand, is encountered even by companies who may actually have enough assets to cover for their liabilities but its composition is not favorable to client needs. e.g. real estate, while an acceptable investment, may not easily be disposed to meet maturing obligations. The profitability of a company’s operation, may also depend on the following factors: 1. External factors: change in equity market performance, interest rates, currency exchange rates and regulations 2. Mortality and Morbidity rates 3. Surrender and Lapse rates 4. Product Pricing 5. Risk Management 6. Composition of Assets 7. Maintenance of spreads between investment returns and interest credited to clients Summing Up: Budget deficits, political instability, administrative inefficiency and patronage politics in the bureaucracy seems to point in the direction of privatization of the pension funds. This could come in several steps and will take some time to accomplish. A necessary first step is to restore the viability of both the GSIS and SSS funds. Closer supervision of its operation can be done by an outside agency like the Insurance Commission, which has been doing a good job of monitoring the operations of the insurance industry in the country. Presently, the pre-need companies are under the supervision of the Securities and Exchange Commission and the body may not be as technically equipped (from the actuarial point of view) to monitor insurance-type operations. Streamlining of operations of both organizations can come in the form of “reengineering” its business processes and restructuring the organization. Good governance may be the necessary element that will make the difference. It has been reported many times and widely believed to be true, that successive administrations have used GSIS and SSS funds to finance activities remotely related to supporting operations or enhancing services to members. If successful, a merger 64 Geodicio T. Sison Private Sector Initiatives in Old-Age Security: The Philippine Experience of the two funds may be a viable proposition, a new valuation can be done and much needed legislation to increase contributions can follow. Privatization can be the last step. Since the combined funds will be very substantial by Philippine standards, a consortium of local and foreign- based banks, insurance companies and other financial institutions may be invited to “take-over” management of the consolidated operation. The necessary element that comes with privatization will be the hiring of professional managers with the needed competencies – something quite difficult to implement in an environment of political patronage. Government intervention should be limited henceforth to regulatory functions. -----------------------------------------------------------------------------------------------------------------------------------Geodicio T. Sison 65 Private Sector Initiatives in Old-Age Security: The Philippine Experience References Bureau of Labor & Employment Statistics. Current Labor Statistics, Fourth Quarter, 2004. Cabacungan Jr., Gil C. “P1 million for early government retirees proposed”, Philippine Daily Inquirer, September 27, 2004, p. A1, A2. Cabuag, V.G. “SSS narrows deficit gap.” Today, December 30, 2004, p. 2. Calucag, Ernesto B. “Actuarial reserve: the root of controversy?” Business World, S1/3. De la Paz, Corazon S. Opening Statement to Senate Committee on Government Corporations and Public Enterprises, December 17, 2004.. Ferriols, Des. “P 15 B retirement package for gov’t employees set.” Philippine Star, August 8, 2004, pp. B1, B6. Gaylican, Christine A. “SSS collections up in H1.” Philippine Daily Inquirer, September 3, 2004, p. B2. Guerard, Yves. “Retirement Savings in ASEAN.” Council on Foreign Relations, November 15-16, 1996. Hale, David D. “How the Rise of Pension Funds Will Change the Global Economy in the 21st Century.” Council on Foreign Relations, November 15-16, 1996. Magsajo, Dong. “The Philippine Pre-Need Industry: Shaken but not Stoned.” Philippine Star, May 30,2005, M-1. Manila Bulletin. “Proposed IC oversight on SSS, GSIS reviewed.” July 19, 2004, p. B3. Manila Standard, Special Feature GSIS. “GSIS approves big pension hike.” May 31, 2001, Section D. Maragay, Fel V. “49 agencies up for abolition.” Manila Standard, July 29, 2004, p. A5. Ortiz, D’Laarni A. and Alria M. Ventanilla. “pre-need education investment: at what Cost?” Business Worl, July 14, 2005, 2/S1. Polovello, Roy. “ Sale of SSS bank stake bucked.” Manila Standard, p. A4 Requejo, Rey E. “GSIS playing favorites? Biazon sets probe of pension fund policy.” Manila Standard, p. A3 Reynaud, Emmanuel. 2000. Social Dialogue and Pension Reform. Geneva, ILO. 66 Geodicio T. Sison Private Sector Initiatives in Old-Age Security: The Philippine Experience Rubio, Ruby Anne M. “Solon says Swiss Challenge for SSS stake a bad precedent.” Business World, November 18, 2004, pp. 1,2. . Sanchez, Elizabeth L. “GSIS puts off stock trading, mulls over exit from PSE.” Philippine Daily Inquirer, July 22, 2004, p. B2. Securities and Exchange Commission. Sales of Pre-need Corporations, December 2004, May 2005. January 28, 2005. SSS. 2004. Annual Report. -----------------------------------------------------------------------------------------------------------------------------------Geodicio T. Sison 67