Syllabi FIN3121 Principles of Finance

advertisement

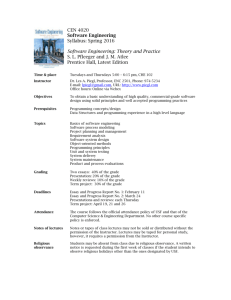

Kazakhstan Institute of Management, Economics and Strategic Research Bang College of Business (BCB) Spring Semester 2014 Course Syllabus for: FIN3121 Principles of Finance 1. Basic Information Course Code and Title: FIN3121 Principles of Finance Course Meeting Time and Place: Course Credit: Three (3) credits Instructor Information: Maya Katenova, PFM Office: Room # 339 Dostyk (Administrative) Building Phone: 2704440 (2018) E-mail: mayak@kimep.kz Prerequisite: ACC2101 2. Instructor Availability Office Hours: 3. Instructional Resources Required Textbook - Brooks, Raymond. 2010. Financial management: core concepts. 1st ed, The Prentice Hall series in finance. Boston: Prentice Hall. Cases and Additional Readings: Listed in Course Schedule below, available on L-Drive, etc. 4. Course Description/Overview Financial Management is an introductory course to the field of finance with a broad scope and emphasis on general principles. The course focuses on the tools based approach to present key concept of finance with personal and business related examples. The course will present basics of financial system, time value of money and discounting, financial performance analysis, basics of capital budgeting, stock and bond valuation, and introduction to corporate finance. Learning objectives At the end of the course, students should be able to do the following: KNOWLEDGE & Skills 1. Understand fundamental concepts and basic tools of finance 2. Valuing stock and bonds and understand risk and return 3. Understand Capital Budgeting decisions 4. Evaluate financial performance of a company 1 5. Understand Optimal Capital structure 6. Understand company`s dividend policy, stock repurchase etc. 7. Understand basic principles of International Financial Management APPLICATION ABILITIES: Students will be able to get basic knowledge of finance with application to other courses in finance, as well as personal and business situation. VALUES AND ATTITUDES: Students practice KIMEP Core Values Academic honesty Respect for peers and instructors 6. Teaching Methodology The format of the course is basically lectures but also includes the following: Homework assignments, case studies, and discussions 7. Assessment Scheme Continuous Assessment Tests No. 1-2 Final Assessment TOTAL Tutorial tests will follow the tests given on Lecture sessions 60% 60% 40% 100% ASSESSMENT IN DETAIL Tests & Examination: Exam will contain theoretical questions, and quantitative problems. Cell phones are not allowed during an exam. Formula sheet can be used by students during an exams or quizzes. Formula sheet should contain only formulas. Class participation: Guideline to lectures: Come to the class prepared, reading the chapter before the class. Be ready to answer the questions from the lecture as well as case questions related to chapter in the text reading. It is extremely important that students prepare for the class, especially for the tutorial classes. To emphasize the importance of class participation frequency and quality of students’ contribution will make up 15% of the grade. Evaluating the frequency and quality of a student’s contribution to class relative to other students is the instructor’s discretion. Bonuses: 10 points will be given as bonuses to students for class participation. Bonuses are limited to 10 points maximum. 8. Grading Scale Letter grades for the course will follow the same standards as specified in the Catalog. See the following table for grading scale: 2 Letter grade A+ A AB+ B BC+ C CD+ D DF Numerical scale or percentile 90-100 85-89 80-84 77-79 73-76 70-72 67-69 63-66 60-62 57-59 53-56 50-52 Below 50 9. Course Policies and Instructor’s expectations of students Students must attend the classes but there will be no formal attendance for lectures. Academic honesty: We have a zero tolerance policy for academic dishonesty. Check the catalog for details. Cell phones: should be turned off at the beginning of the class, or put it on vibrate or silent mode (in case of emergency). Information dissemination: Information regarding this course and assignments will be given by the instructor during the class or can be found on the L-drive. Enrollment in the course constitutes an agreement with the terms and requirements in this syllabus. 10. Period-by-period Schedule (Tentative) Weeks 1 2 Topics or activities Course syllabus presentation Readings (Brooks) Chapter 3, 4 3 The Time Value of Money Interest rates 4 5 6 7 8 9 10 11 12 13 14 Quiz No. 1 Valuing Bonds Valuing Stock Risk and return Quiz No 2 Financial Statements Capital Budgeting Decision Models Cash Flow Estimations The cost of capital Quiz No. 3 Capital Structure 15 16 17 Dividends, dividends policy and stock splits Chapter 5 Final Exam 3 Chapter 6 Chapter 7 Chapter 8 Chapter 2, 14 Chapter 9 Chapter 10 Chapter 11 Chapter 16 Chapter 17 4