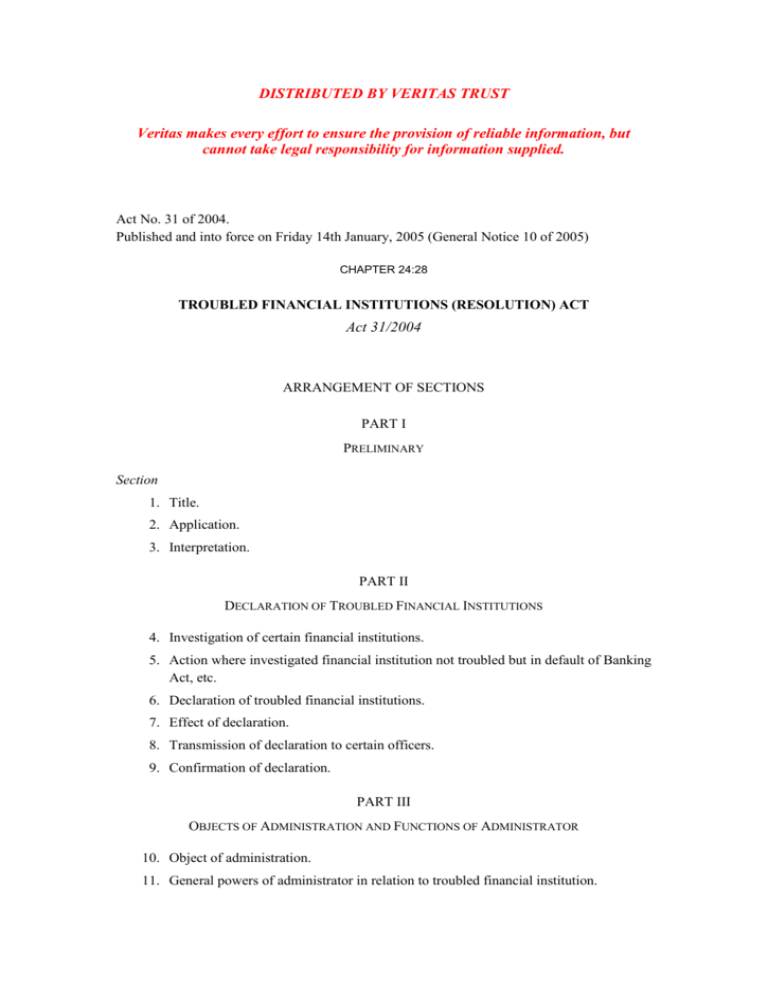

Troubled Financial Institutions Act

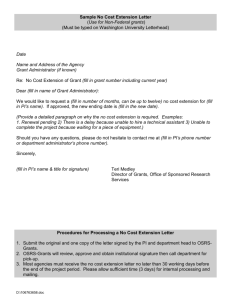

advertisement