CHAPTER 1: Provisions of the 2003 Act that affect the

advertisement

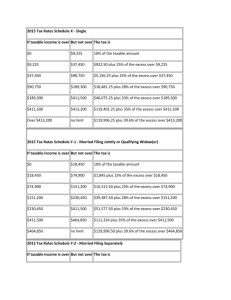

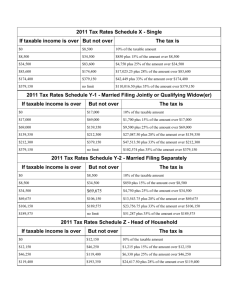

CHAPTER 1 UPDATE Provisions of the 2003 Act that affect the materials in Chapter 1. The Jobs and Growth Tax Relief Reconciliation Act of 2003 (2003 Act) reduced four of the six ordinary income tax rates for individuals and fiduciaries and reduced tax rates for certain long-term capital gains for individuals. The marriage penalty relief not schedules to take effect until 2005 was accelerated to 2003. 1. The 27%, 30%, 35% and 38.6% tax rates are replaced by tax rates of 25%, 28%, 33%, and 35% , respectively. These rates had previously been scheduled to take effect in 2006. Thus, the maximum tax rate for ordinary income in 2003 is 35%. 2. The 10% bracket is widened to $7,000 for single individuals and married persons filing separately, and to $14,000 for married couples filing jointly. 3. The 10% and 15% brackets for married couples are now double the width of these same brackets for single individuals and married persons filing separately. Additionally, the standard deduction for married persons filing jointly is increased to $9,500, double that of the standard deduction for single individuals and married persons filing separately ($4,750). Thus, a married couple’s income must exceed $15,600 ($9,500 + $3,050 + $3,050) before they are required to file a tax return. Note: Other than the general rate schedule changes, the head of household brackets and standard deduction are not affected by the 2003 Law. 4. The income tax rates for estates and trusts received the same reductions as the tax rates for individuals, but there were no changes to the tax bracket widths. The revised tax rate schedules and standard deductions are reproduced below. 5. The changes in long-term capital gains rates only affect those transactions involving the “20 percent-taxed long-term capital gains” for transactions that occur after May 5, 2003. The maximum rate for these asset gains is reduced from 20% to 15%; the 10% rate that applied to gains of individuals in the 10% and 15% tax bracket is reduced to 5%. There is no change in the tax rates for 25% (unrecaptured Section 1250 gains) and 28% (gains on collectibles and Section 1202 gains) tax rates for gains on the applicable assets. The full long-term capital gains tax rate schedule now provides for a minimum tax rate of 5% up to a maximum of 28% based on the date of sale and the type of asset on which gain was realized. The maximum tax rate on the most common long-term capital gains (stocks and securities) is 15%. Examples affected by the 2003 Law. Example 2: Tax on $47,450 is $6,417.50 ([$47,450 - $14,000] x .15 + $1,400); average tax rate is 13.52% ($6,417,50/$47,450). Tax on $114,650 is $22,282.50; average tax rate is 19.44% ($22,282.50/$114,650). Shelly and John now pay 3.5 ($22,282.50/$6,417.50) time Bill and Susan’s taxes. Example 3: Barbara’s tax on $57,325 is $11,141.25 ([$57,325 - $28,400] x .25 + $3,910; Shelly and John pay $22,282.50 in taxes. Shelly and John pay the same taxes now that they would pay if each filed as a single individual. Example 18: Patricia’s tax is now $4,810 (.10 x $7,000) + (.15 x $21,400) + (.25 x $3,600). Example 23: The trust’s tax on $5,900 of taxable income is $1,327. The tax savings is now $802 ($1,327 - $525). Example 29. Tom’s tax on the $330,000 on the after-tax corporate income at the marginal tax rate of 35% is $115,500. The total tax is $285,500 ($170,000 + $115,500). Problem solutions affected by the 2003 Law. Problem numbers: 16, 17, 18, 19, 20, 23, 25, 27, 28, 29, 30 (John’s marginal tax bracket is 35%), 31, 32, 40, 44, 47, 48, 58, 59, and 62 TABLE 1: Revised Tax Rate Schedules for 2003 Schedule X— Single If taxable income is: Not over $7,000 Over $7,000 but not over $28,400 Over $28,400 but not over $68,800 Over $68,800 but not over $143,500 Over $143,500 but not over $311,950 Over $311,950 Tax liability is: 10% of taxable income $700.00 + 15% of the excess over $7,000 $3,910.00 + 25% of the excess over $28,400 $14,010.00 + 28% of the excess over $68,800 $34,926.00 + 33% of the excess over $143,500 $90,514.50 + 35% of the excess over $311,950 Schedule Y-1—Married Filing a Joint Return If taxable income is: Tax liability is: Not over $14,000 10% of taxable income Over $14,000 but not over $56,800 $1,400.00 + 15% of the excess over $14,000 Over $56,800 but not over $114,650 $7,820.00 + 25% of the excess over $56,800 Over $114,650 but not over $174,700 $22,282.50 + 28% of the excess over $114,650 Over $174,700 but not over $311,950 $39,096.50 + 33% of the excess over $174,700 Over $311,950 $84,389.00 + 35% of the excess over $311,950 Schedule Y-2—Married Filing Separately If taxable income is: Tax liability is: Not over $7,000 10% of taxable income Over $7,000 but not over $28,400 $700.00 + 15% of the excess over $7,000 Over $28,400 but not over $57,325 $3,910.00 + 25% of the excess over $28,400 Over $57,325 but not over $87,350 $11,141.25 + 28% of the excess over $57,325 Over $87,350 but not over $155,975 $19,548.25 + 33% of the excess over $87,350 Over $155,975 $42,194.50 + 35% of the excess over $155,975 Schedule Z—Head of Household If taxable income is: Not over $10,000 Over $10,000 but not over $38,050 Over $38,050 but not over $98,250 Tax liability is: 10% of taxable income $1,000.00 + 15% of the excess over $10,000 $5,207.50 + 25% of the excess over $38,050 Over $98,250 but not over $159,100 Over $159,100 but not over $311,950 Over $311,950 $20,257.50 + 28% of the excess over $98,250 $37,295.50 + 33% of the excess over $159,100 $87,736.00 + 35% of the excess over $311,950 Revised Tax Rates for Estates and Trusts for 2003 If taxable income is: Not over $1,900 Over $1,900 but not over $4,500 Over $4,500 but not over $6,850 Over $6,850 but not over $9,350 Over $9,350 Tax liability is: 15% of taxable income $285 + 25% of the excess over $1,900 $935 + 28% of the excess over $4,500 $1,593 + 33% of the excess over $6,850 $2,418 + 35% of the excess over $9,350