MLC Horizon 4 - Balanced Portfolio

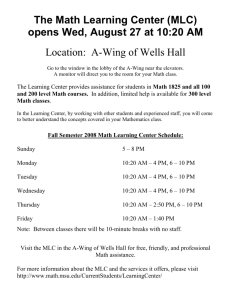

advertisement

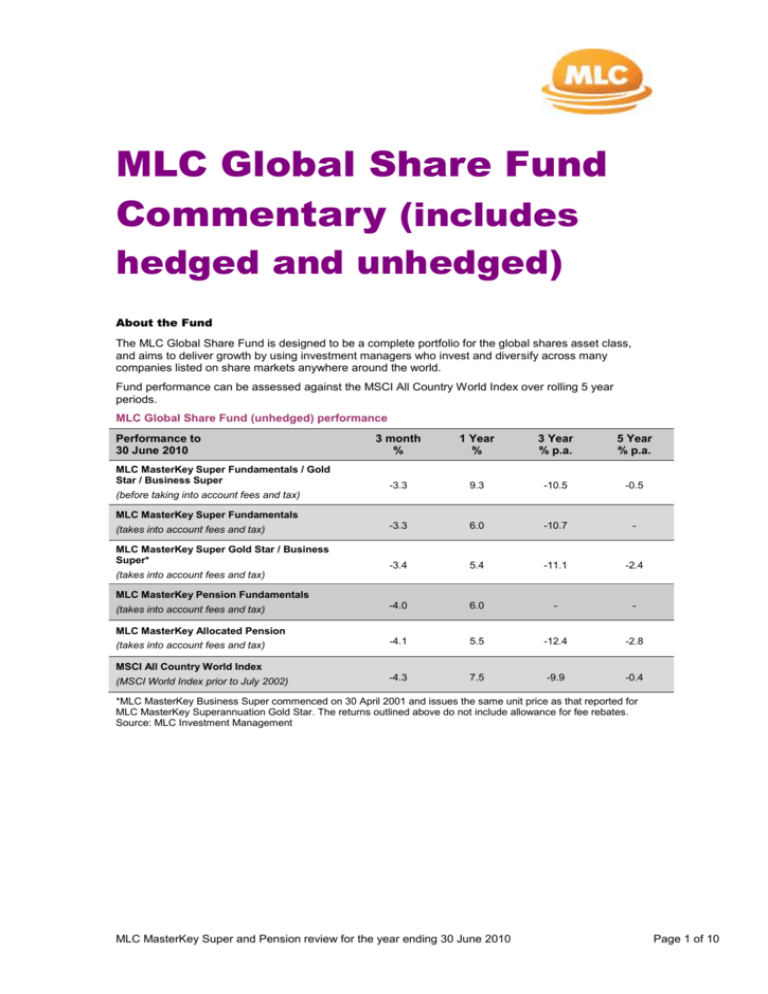

MLC Global Share Fund Commentary (includes hedged and unhedged) About the Fund The MLC Global Share Fund is designed to be a complete portfolio for the global shares asset class, and aims to deliver growth by using investment managers who invest and diversify across many companies listed on share markets anywhere around the world. Fund performance can be assessed against the MSCI All Country World Index over rolling 5 year periods. MLC Global Share Fund (unhedged) performance Performance to 30 June 2010 MLC MasterKey Super Fundamentals / Gold Star / Business Super 3 month % 1 Year % 3 Year % p.a. 5 Year % p.a. -3.3 9.3 -10.5 -0.5 -3.3 6.0 -10.7 - -3.4 5.4 -11.1 -2.4 -4.0 6.0 - - -4.1 5.5 -12.4 -2.8 -4.3 7.5 -9.9 -0.4 (before taking into account fees and tax) MLC MasterKey Super Fundamentals (takes into account fees and tax) MLC MasterKey Super Gold Star / Business Super* (takes into account fees and tax) MLC MasterKey Pension Fundamentals (takes into account fees and tax) MLC MasterKey Allocated Pension (takes into account fees and tax) MSCI All Country World Index (MSCI World Index prior to July 2002) *MLC MasterKey Business Super commenced on 30 April 2001 and issues the same unit price as that reported for MLC MasterKey Superannuation Gold Star. The returns outlined above do not include allowance for fee rebates. Source: MLC Investment Management MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 1 of 10 MLC Hedged Global Share Fund performance^ Performance to 30 June 2010 3 month % 1 Year % 3 Year % p.a. 5 Year % p.a. -9.0 17.5 - - -10.5 13.8 - - -9.0 15.8 - - -10.2 16.2 - - MLC MasterKey Super Fundamentals (before taking into account fees and tax) MLC MasterKey Super Fundamentals (takes into account fees and tax) MLC MasterKey Pension Fundamentals (takes into account fees and tax) MSCI All Country World Index Hedged into AUD (MSCI World Index Hedged prior to July 2002) ^Please refer to www.mlc.com.au for performance since inception. Source: MLC Investment Management Executive summary Global share investors continued to enjoy positive returns for the year from most markets and sectors. The MSCI All Country World Index (ACWI) delivered +7.5% (unhedged) and +16.2% in hedged Australian dollar terms. The Australian dollar ($A) strengthened 4% over the year against a basket of currencies which constitute the major trading partners. Hedged global share investors are protected when the $A strengthens and see higher returns versus unhedged global share investors. However, the $A lost momentum during the June quarter with rising global risk aversion, and lost -6.1% over the quarter. The MLC Global Share strategy (unhedged) returned +9.4% for the year, before fees and taxes, beating the benchmark by +1.9%. The Hedged MLC Global Share strategy returned +17.5%, beating the hedged benchmark by +1.4%. The excess performance difference (relative to the benchmark) of the two strategies is due to the mechanisms used to hedge the currency exposure. While all managers provided positive absolute returns, four out of the seven managers in the strategy outperformed the benchmark for the year. Carnegie is a new manager appointed to the strategy in May 2010, and as such doesn’t have a full year’s performance. The portfolio benefited being overweight to defensive sectors, especially during the last quarter when market returns were negative. Being substantially underweight to financials helped side step much of the European woes. The portfolio continues to be defensively positioned as we expect further market volatility over the next year. Investors can take heart in having eight well-credentialed managers who each utilise different styles and multiple criteria when choosing companies to own. Many have taken the opportunity during the current volatile market environment to add attractively priced companies to the strategy and expect these to perform well through the cycle. Absolute returns The graph shows absolute total returns of the Fund over 1 year and 5 year periods. Historical Absolute Performance MLC MasterKey Super Gold Star Global Share Fund (after taking into account fees and tax) 40% 30% Return % p.a. 20% 10% 0% -10% -20% 1 Year Ended 30 June 20 10 20 09 20 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 19 99 19 98 19 97 19 96 19 95 19 94 19 93 19 92 19 91 19 90 19 89 -30% 5 Years Ended 30 June MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 2 of 10 Source: MLC Investment Management The performance for the year had two distinct parts to it. While the performance for the year is positive, the June quarter produced negative returns for both the hedged and unhedged strategies on the back of European woes and receding risk appetites. Returns for the year from all sectors were double digit, except for energy and utilities, when measured in unhedged terms. Over the quarter exposures in Europe was a drag on performance, even though many of these holdings include multi-nationals such as Nestle with very little balance sheet exposure to problems in Europe. A star contributor to returns was the 0.9% allocation to Li & Fung, the Hong Kong listed global supply chain management firm, mainly in the retail consumer goods sector. The share price advanced 71% in the year to 30 June 2010, on the back of increased acquisition activity and moderate global growth in retailing. Exposure to companies listed in Emerging Markets continues to add value to the strategy. Exposure to developments in these markets in the strategy is also capitalised through holdings in multi-nationals listed in developed markets, but with major revenue and profits coming from these regions. All the managers in the strategy provided positive returns in line with expectations during the year. Sands Capital was the best performer for the year (+24.3%) and June quarter (+0.4%). However, a very small holding of BP (0.49% of the strategy) going in to the oil disaster, was a drag on performance for both Mondrian (-4.7%) and Capital International (-5.1%) during the June quarter. Five year returns for the strategy remain weak on the back of turbulent market conditions and extremely weak returns from global equity markets during this period. Comment on the impact of currency The Australian dollar ($A) had a volatile year, although it was marginally up by +4% when measured against a basket of currencies. The $A is considered a risk asset by investors overseas, and as such the currency tends to rise when other risky assets rise and fall when those fall. The $A retreated in the June quarter, by a substantial -6.1%, along with the fall in global markets. On the back of these movements, the MLC Hedged Global Share Fund outperformed its unhedged counterpart for the year by +8.1%, but the situation reversed for the quarter with the unhedged strategy beating the hedged strategy by +5.7%. Relative returns The graphs show returns of the Funds relative to index Rolling Performance in Excess of the Index MLC Global Share Fund (before taking into account fees and tax) 25% Consistency of strategy outperformance 1 year 54% 3 year 62% 5 year 63% Annualised Excess Return (MSCI All Country World Index) 20% 15% 10% 5% 0% -5% -10% Dec-90 Jun-91 Dec-91 Jun-92 Dec-92 Jun-93 Dec-93 Jun-94 Dec-94 Jun-95 Dec-95 Jun-96 Dec-96 Jun-97 Dec-97 Jun-98 Dec-98 Jun-99 Dec-99 Jun-00 Dec-00 Jun-01 Dec-01 Jun-02 Dec-02 Jun-03 Dec-03 Jun-04 Dec-04 Jun-05 Dec-05 Jun-06 Dec-06 Jun-07 Dec-07 Jun-08 Dec-08 Jun-09 Dec-09 Jun-10 -15% 1 Year to Jun 2010 3 years to Jun 2010 5 Years to Jun 2010 Source: MLC Investment Management MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 3 of 10 Rolling Performance in Excess of the Index MLC Hedged Global Share Fund (before taking into account fees and tax) Annualised Excess Return (MSCI All Country World Hedged Index) 25% Consistency of strategy outperformance 1 year 47% 3 year 37% 5 year 51% 20% 15% 10% 5% 0% -5% -10% -15% 3 years to Jun 2010 Jun-10 Jun-09 Dec-09 Jun-08 Dec-08 Jun-07 Dec-07 Jun-06 Dec-06 Jun-05 Dec-05 Jun-04 Dec-04 Jun-03 Dec-03 Jun-02 Dec-02 Jun-01 Dec-01 Jun-00 1 Year to Jun 2010 Dec-00 Jun-99 Dec-99 Jun-98 Dec-98 Jun-97 Dec-97 Jun-96 Dec-96 Jun-95 Dec-95 Jun-94 Dec-94 -20% 5 Years to Jun 2010 Source: MLC Investment Management Contributors to the Fund’s relative returns Over the year, the strategy was +1.9% ahead of the benchmark (+7.5%) on an unhedged basis. This number has been driven by strong excess returns from Sands Capital (+16.8% over the benchmark) and Tweedy, Browne (+4.9% over the benchmark). Performance for the year from Sands Capital was driven by being underweight Euro and Yen denominated companies and by maintaining a disciplined hurdle for any investments exposed to European consumers. Top five contributors included Las Vegas Sands, Salesforce.com, Apple, New Oriental Education and Li & Fung. Tweedy, Browne provided excess returns by avoiding major European financial stocks and being defensively positioned to non-cyclical companies. Top contributors have been in Machinery, Household Products, Railroads, Industrial Conglomerates and Food related businesses. Companies such as Kone, Krones, and Fraser & Neave have been leading contributors to portfolio returns for the year. Dimensional (+3.7% above benchmark) continued to benefit from being exposed to those stocks that fell quite heavily during the Global Financial Crisis, which subsequently rebounded strongly. Harding Loevner (+2.7% above benchmark) was aided by good stock selection in Health Care, Technology and Consumer Discretionary sectors for the year. The five largest contributors for the year were: Autonomy, Li & Fung, Swatch Group, EMC, and Keyence. Sands Capital (+4.7% above benchmark), Tweedy, Browne (+2.0% above benchmark) and Harding Loevner (+1.3% above benchmark) continued to be the best performers for the quarter. Sands Capital benefited from being overweight Emerging Asia (the only region to post a positive absolute return for the quarter), as well as significantly underweight to Western Europe. Tweedy, Browne was helped by industrial holdings that held up best during the quarter. Companies such as Kone, Krones, Akzo Nobel and Fraser & Neave produced mid single-digit positive returns during the quarter. Harding Loevner continued to be aided by good selections within Health Care, Energy and Industrials sector over the quarter. Detractors from the Fund’s relative returns Capital International (-4.8% below benchmark), Mondrian (-2.6% below benchmark) and Walter Scott (-1.2% below benchmark) were a drag on relative returns for the year While Capital International eliminated a small position they had with BP, therefore limiting the drag on relative returns, Utilities (Electricite de France, Veolia Environnement), Information Technology (Research in Motion) and Materials (Monsanto) sectors were the main detractors for the year. MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 4 of 10 Capital International has moved the portfolio to a more conservative position by the end of the quarter compared with March. Mondrian's allocations to the German, UK and French markets undermined returns, partially offset by Finland and Canada. Further, weak security selection within UK, United States and France had a negative impact on performance, offset by stronger security selection within Japan, Canada and Switzerland. While exposure to BP was a drag for the year, we continue to view Mondrian’s dividend-focused investment style as beneficial to investors during times of heightened market volatility. Walter Scott with a bias towards companies with conservative balance sheets, and strong pricing power to grow through the cycle, wasn’t favourably positioned in a year where riskier components of the market drove much of the returns. This isn’t surprising and is line with how we expect Walter Scott to perform during significantly bullish market conditions. Dimensional (-1.1% below benchmark) and Capital International (-0.8% below benchmark) were the largest detractors over the quarter. As risk appetites shrank globally over the quarter, the highly volatile small-cap value market retreated, dragging the performance of Dimensional. For Capital International, Information Technology (Juniper Networks, Research in Motion) and Utilities (Veolia Environnement) sectors weighed on results over the June quarter. Manager returns The chart shows manager performance relative to index Manager Performance in Excess of the Index MLC Global Share Fund (before taking into account fees and tax) (annualised for periods greater than 1 year) Excess Return vs MSCI All Country World Index 20% 15% 10% 5% 0% -5% -10% Capital International Carnegie Walter Scott Quarter to Jun-10 Harding Loevner Sands Capital 1 Year to Jun-10 Mondrian Tweedy, Browne 3 years to Jun-10 Dimensional Global Share Fund 5 Years to Jun-10 Source: MLC Investment Management MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 5 of 10 Manager summary Manager Style/Role in Portfolio Current Positioning Capital International 130 stock portfolio with a mid-large cap Growth At a Reasonable Price (GARP) bias, expected to provide through the cycle performance. Capital International is focused on three broad themes that may impact future returns including, rising wage pressures in China, increased consumption in Emerging Markets and the benefits to some European companies through a weaker Euro. Overall, the portfolio is more defensively positioned than in previous quarters. The largest position relative to the index remains in Information Technology, which should continue to benefit from new product development cycles. They remain significantly underweight Financials while moving from an underweight to an overweight position in Industrials on the back of purchases of FedEx, Siemens and Fanuc. 500 stock portfolio with a small-mid cap deep value bias, which may provide volatile market relative performance. Dimensional remain focused on small-cap deep value portion of both developed and Emerging Markets. This segment of the market has had a volatile quarter ending with negative returns in June, and growth is expected to moderate over the next few quarters. 50 stock portfolio with a mid-large cap quality growth bias, which may provide volatile market relative performance. Harding Loevner's investment process pivots around the four criteria of growth, competitive advantage, financial strength and management quality. They continually look for investment opportunities among the approximately three hundred companies around the world that have successfully passed through their investment process, forming the basis for portfolio construction. They’re paying particular attention to the securities of three Spanish companies at the moment whose valuations are becoming increasingly attractive, in their view. 90-100 stock portfolio with a large cap value (dividend) bias, which is expected to provide capital preservation during volatile market conditions. According to Mondrian, although there are signs of recovery, it’s not clear that strong growth is imminent in the global economy. Given that, using a sector-approach, their valuations are tending to find value among areas traditionally characterised as being defensive, such as, Telecoms, Healthcare and Consumer Staples. Further, they’re not so exposed to pro-cyclical sectors such as Consumer Discretionary and Materials. They remain comfortable with an underweight allocation to emerging markets, where estimates suggest that the risk-reward doesn’t favour a full allocation to these regions. 25-50 stock portfolio with a mid-large cap secular growth bias which is expected to participate in major market rallies to capture potential upside. Sands Capital have taken advantage of recent volatility to add to several existing positions. This has happened where they think shorter term market issues have provided them with an opportunity to increase weightings at relatively attractive valuations given their understanding of the continued long-term strength of the underlying businesses. This includes recent purchases across existing holdings such as Visa (regulatory concerns), Qualcomm (handset pricing concerns) and Tingyi (weakness in the overall Chinese equity market). At the same time, they have also taken advantage of market volatility on the upside to selectively reduce a handful of our largest positions such as Las Vegas Sands, Apple and Salesforce.com. 30-50 stock portfolio with a mid-large cap value bias, which is expected to provide capital preservation during volatile market conditions. Tweedy, Browne revelled at the buying opportunities provided by recent market volatility. They made three purchases in the quarter in Bangkok Bank, Baxter International and Teleperformance. They remain well focused in putting more money to work, should further volatility throw up more attractively priced opportunities in the next few quarters. The strategy remains significantly overweight defensive sectors such as Consumer Staples and Industrials. 50 stock portfolio with a small-mid cap real return bias, which is expected to provide capital preservation during volatile market conditions. Walter Scott's investment philosophy and process remains unchanged. Indeed their conviction in bottom-up, fundamental, research driven, stock-picking approach has only been strengthened by the condition markets have been experiencing. Volatility in markets provides opportunities to align the portfolios with attractively valued companies that (12.5%) Dimensional (12.5%) Harding Loevner (12.5%) Mondrian (12.5%) Sands Capital (12.5%) Tweedy, Browne (12.5%) Walter Scott (12.5%) MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 6 of 10 Manager Style/Role in Portfolio Current Positioning meet their investment criteria. The overall sector and geographic structure of the portfolio hasn’t changed. Only a small number of stocks have been bought or sold this year. This is in line with the buy and hold approach to compound growth investing. CSL, Precision Castparts and Google were purchased during the quarter. Carnegie (12.5%) 25-30 stock portfolio with a mid-large cap growth bias which is expected to participate in major market rallies to capture potential upside. Carnegie was appointed to the portfolio in May 2010 and doesn’t have a long performance history in the strategy. They have begun auspiciously in the portfolio, outperforming the MSCI ACWI by +3.5% during the month of June. Recent volatility has created opportunities for Carnegie who focus structural winners (over 3-5 years), companies which can capitalise on the most significant trends and themes around the globe. A 3% stake in Newmont mining was initiated on the back of their belief that gold prices should remain strong given the pressure on currencies due to high debt levels of many national governments. MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 7 of 10 Sector and regional exposures The strategy is well diversified across countries, industries and companies. This diversification is a result of each manager making decisions on which companies to invest in. The chart shows the regional exposure of the Fund Global Regional Exposure MLC Global Share Fund Other, 1.9% Africa, 1.2% South America, 2.5% Japan, 8.3% America, 43.2% Europe, 32.0% Australia, 1.9% Asia, 8.9% Source: MLC Investment Management The chart shows the industry exposure of the Fund Industry Exposure MLC Global Share Fund Other, 6.0% Utilities, 1.7% Consumer Discretionary, 10.0% Telecommunication Services, 3.9% Materials, 6.3% Consumer Staples, 13.7% Information Technology, 14.2% Energy, 8.4% Industrials, 9.2% Financials, 15.8% Health Care, 10.6% Source: MLC Investment Management MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 8 of 10 The following table shows the top ten stocks by portfolio weight in the MLC Global Share Fund, as at 30 June 2010. Company Country Industry Sector Portfolio % NESTLE SA REG Switzerland Food products 2.1% GOOGLE INC United States Internet Software and Services 1.5% ROCHE HOLDING AG GENUSSS Switzerland Pharmaceuticals 1.2% APPLE INC United States Computers and Peripherals 1.1% BRITISH AMERICAN TOBACCO United Kingdom Tobacco 1.1% CANON INCORPORATED Japan Office Electronics 1.1% CISCO SYSTEMS INC United States Communications Equipment 1.0% STANDARD CHARTERED PLC United Kingdom Commercial Banks 1.0% LI AND FUNG LIMITED Bermuda Distributors 1.0% VODAFONE GROUP PLC United Kingdom Wireless Telecommunication Services 1.0% Source: MLC Investment Management Stock story As volatility ratcheted up during the June quarter, many managers used the opportunity to either purchase or add to existing positions of various companies, as they were presented with discounted pricing opportunities. Tweedy, Browne lead the pack with three additions during the June quarter (a big number for a low turnover manager who believes in a long-term buy and hold approach to investing). Among the new buys was Bangkok Bank, where civil unrest gave them a very attractive entry price into what they believe is a conservatively managed and successful bank that has few of the balance sheet challenges facing Western banks. Source: Bangkok Bank presentation, April 2010 available at www,bangkokbank.com. Figure 1: Fee Income and the figure as a percentage of total income is shown for Bangkok Bank. Tweedy, Browne also began to build a position in Baxter International, the US-based medical products business as growth concerns in the plasma derivative market brought its stock down to attractive levels. Baxter is active in bioscience, producing drugs for hemophilia and immune deficiency disorders, and has the largest share in these markets. Baxter also produces medical delivery products such as intravenous solutions, premixed drugs and infusion pumps, and renal products for kidney failure. At initial purchase, the company’s shares were trading at roughly a third discount from a conservative measure of intrinsic value (11 x earnings before interest, taxes, and intangible amortization). MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 9 of 10 They also initiated a position in Teleperformance. This French company operates call centers, conducts programs to attract new customers and offers customer service and technical support services. Teleperformance is the largest company of its kind. It operates 248 call centers in 46 countries. They bring advantages of scale and global presence allowing them to compound their intrinsic value at roughly 10% per year. Tweedy, Browne believe this company will continue to benefit from the growth of outsourcing as companies try to cut costs and outsource some of their call volume. They bought Teleperformance at a discount of roughly one-third of their estimated intrinsic value. Harding Loevner also used the opportunity to initiate positions in three firms during the quarter, which they think can provide strong growth in line with the four key criteria they use in their investment process: growth, competitive advantage, financial strength and management quality. Apple shares were purchased early in the quarter after concluding the company's growth prospects are in fact not discounted in its share price despite Apple's strong historical out-performance. In their view, Apple is enabling and benefiting from a global shift to ‘smart’ mobile devices which will increasingly generate recurring revenue streams given the success of third party applications developed for these devices. They note that Apple will soon launch a mobile advertising platform across its devices which could generate a meaningfully new revenue stream. They purchased shares in Talecris Biotherapeutics, a US company operating in the protein plasma industry, after its shares fell sharply on a profit warning from a large competitor. The protein plasma industry is consolidated, consisting of five primary companies globally, and is characterized by steady growth globally. It’s also possible that plasma proteins could be effective in treating Alzheimer's disease, a potential that they don’t believe is reflected in share prices. They purchased shares in Unicharm, a Japanese Consumer Staples company with leading domestic market shares in diapers (for both babies and adults) and feminine products. Unicharm's earnings growth is driven by its Asian operations which now contribute approximately one third of operating income. Sales growth is particularly strong in China and Indonesia as rising incomes create growing demand for sophisticated yet low-priced baby diapers and feminine care products. They believe Unicharm will generate nearly half of its long duration profit stream from its rapidly growing Asian operations within two to three years. This is while continuing to raise returns on capital, increase its dividend and contining share buy backs. Important information This information has been provided by MLC Limited (ABN 90 000 000 402) a member of the National Group, 105-153 Miller Street, North Sydney 2060. This material was prepared for advisers only. Any advice in this communication has been prepared without taking account of individual objectives, financial situation or needs. Because of this you should, before acting on any information in this communication, consider whether it is appropriate to your objectives, financial situation and needs. You should obtain a Product Disclosure Statement or other disclosure document relating to any financial product issued by MLC Investments Limited (ABN 30 002 641 661) and MLC Nominees Pty Ltd (ABN 93 002 814 959) as trustee of The Universal Super Scheme (ABN 44 928 361 101), and consider it before making any decision about whether to acquire or continue to hold the product. A copy of the Product Disclosure Statement or other disclosure document is available upon request by phoning the MLC call centre on 132 652 or on our website at mlc.com.au. An investment in any product offered by a member company of the National group does not represent a deposit with or a liability of the National Australia Bank Limited ABN 12 004 044 937 or other member company of the National Australia Bank group of companies and is subject to investment risk including possible delays in repayment and loss or income and capital invested. None of the National Australia Bank Limited, MLC Limited, MLC Investments Limited or other member company in the National Australia Bank group of companies guarantees the capital value, payment of income or performance of any financial product referred to in this publication. Past performance is not indicative of future performance. The value of an investment may rise or fall with the changes in the market. Please note that all return figures reported are before management fees and taxes, and for the period up to 30 June 2010, unless otherwise stated. The specialist investment management companies are current as at 30 June 2010. Funds under management figures are as at 30 June 2010, unless otherwise stated. Investment managers are regularly reviewed and may be appointed or removed at any time without prior notice to you. MLC MasterKey Super and Pension review for the year ending 30 June 2010 Page 10 of 10