UBL internship report - Asif ullah khan BBA-IT

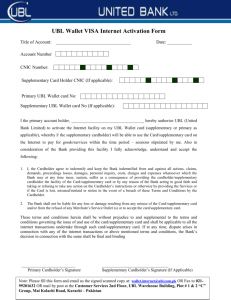

advertisement