File

advertisement

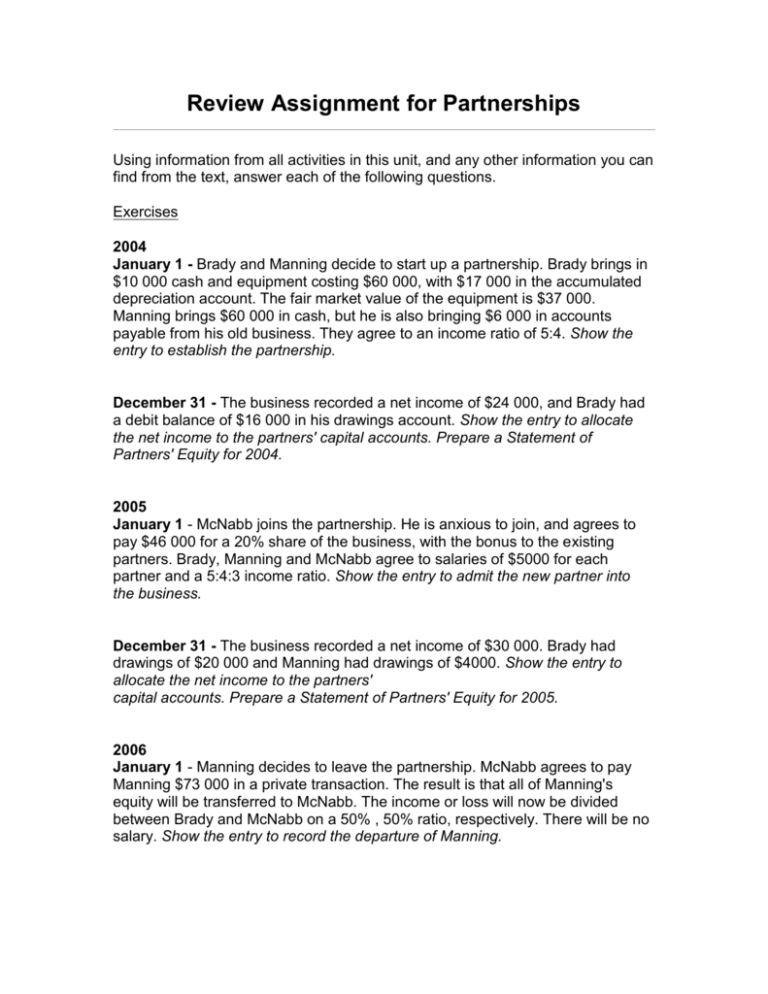

Review Assignment for Partnerships Using information from all activities in this unit, and any other information you can find from the text, answer each of the following questions. Exercises 2004 January 1 - Brady and Manning decide to start up a partnership. Brady brings in $10 000 cash and equipment costing $60 000, with $17 000 in the accumulated depreciation account. The fair market value of the equipment is $37 000. Manning brings $60 000 in cash, but he is also bringing $6 000 in accounts payable from his old business. They agree to an income ratio of 5:4. Show the entry to establish the partnership. December 31 - The business recorded a net income of $24 000, and Brady had a debit balance of $16 000 in his drawings account. Show the entry to allocate the net income to the partners' capital accounts. Prepare a Statement of Partners' Equity for 2004. 2005 January 1 - McNabb joins the partnership. He is anxious to join, and agrees to pay $46 000 for a 20% share of the business, with the bonus to the existing partners. Brady, Manning and McNabb agree to salaries of $5000 for each partner and a 5:4:3 income ratio. Show the entry to admit the new partner into the business. December 31 - The business recorded a net income of $30 000. Brady had drawings of $20 000 and Manning had drawings of $4000. Show the entry to allocate the net income to the partners' capital accounts. Prepare a Statement of Partners' Equity for 2005. 2006 January 1 - Manning decides to leave the partnership. McNabb agrees to pay Manning $73 000 in a private transaction. The result is that all of Manning's equity will be transferred to McNabb. The income or loss will now be divided between Brady and McNabb on a 50% , 50% ratio, respectively. There will be no salary. Show the entry to record the departure of Manning. December 31 - The business recorded a net loss of $46 000. There were no drawings. Show the entry to allocate the net income to the partners' capital accounts. Prepare a Statement of Partners' Equity for 2005. 2007 January 1 – The partners decide to liquidate the partnership. They have the following balances: Cash $12 000 Accounts Receivable $8 166 Equipment $ 110 000 Accumulated Depreciation $ 25 000 Accounts Payable $ 11 000 The partners were able to collect $3500 of the accounts receivable and sell the equipment for $52 000. Record the entries to sell off the assets, allocate the loss on sale to the partners and to dissolve the partnership, assuming Brady pays for the shortfall from personal funds.