FIN 3680-101: Introduction to Finance

advertisement

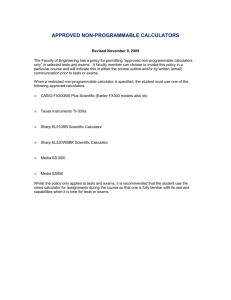

SYLLABUS FIN 4580: Financial Planning Spring 2008 Instructor: Dr. Ivan C. Roten Office: 3086 Raley Hall Office Phone: 262.6943 e-mail: rotenic@appstate.edu Class Schedule: MW 12:30 – 1:45 p.m. Web page: www.appstate.edu/~rotenic Office Hrs: MW 9:00 – Noon, MW 3:30–4:00 pm and/or by appointment Purpose of Course: FIN 4580 is a comprehensive financial planning course where the most common financial planning concepts will be examined. The goals of the course include, but not limited to, providing a descriptive knowledge of financial planning, learning how to determine and evaluate financial goals, exploring money management, and learning investment techniques and strategies for formulating financial goals in light of risk and return tradeoffs. Prerequisites: FIN 3071 Risk Management and Insurance Planning FIN 3890 Survey of Investments FIN 3880 Retirement and Employ Benefit Planning FIN 3780 Estate Planning Course Description: This course will engage the student in critical thinking and decision-making about personal financial management topics in the context of the financial planning process. Course Objectives: Upon successful completion of this course, the student should be able to: Integrate knowledge gained in other financial planning and support courses Demonstrate the ability to analyze, synthesize, and evaluate personal financial situations Demonstrate the ability to develop and justify the economic assumptions used in a financial plan Prioritize goals and determine the feasibility of achieving these goals Demonstrate the ability to clearly discuss and justify recommendations Synthesize a comprehensive plan of action based on the full picture of the client’s financial situation Communicate effectively with the client and present information at an appropriate level Understand the CFP Board’s Code of Ethics and Professional Responsibility and Financial Planning Practice Standards as they apply to the financial planning process Understand the compliance issues that exist in the financial services workplace Intellectual Development: Students will develop a comprehensive financial plan. Plans will be based on prepared client households. Students will solve cases questions from a broad spectrum of financial planning areas. Students will develop technical expertise in the course subject matter. In addition, students will develop or improve on their: Communication skills, both written and oral Critical thinking Decision-making Intellectual curiosity and lifelong learning Textbook Readings: Financial Planning Journals CFP Board’s: Code of Ethics and Professional Responsibility, Financial Planning Practice Standards, Disciplinary Rules and Procedures and Candidate Fitness Standards Attendance No attendance policy. All material covered in class, regardless of the source, will be considered when making exams. Note: A seating chart will be used in class Cheating The Appalachian State University Code of Academic Integrity will be enforced. The minimum punishment for academic dishonesty is an “F” in the course. Exams 1. The exams are closed book and notes. Calculators are necessary, but the use of calculator instruction books or the sharing of calculators is not permitted. Financial calculators SHOULD be used on the exams. Programmable financial calculators may also be used; however, the instructor may clear the memory of the calculator immediately before the exam. 2. Exams will be briefly reviewed in class. Students will not be allowed to keep the exams. Exams will be available for review in the instructor’s office for a period of one week after the exams are reviewed in class, however. 3. Make-up exams or assignments will NOT be given for unexcused absences. Note: The instructor will not be available to entertain questions on exam day. ADA If you believe you have special needs as addressed by the Americans with Disabilities Act, you should notify me immediately. Criteria for excused absences 1. The key criteria for an absence to be considered ‘excused’ is that it is unavoidable and verifiable. 2. To attend a university-sanctioned activity, you must provide written and verifiable evidence of the activity and receive permission from the instructor prior to the class period to be missed. 3. For a medical excuse, you must provide written and verifiable documentation from a medical doctor. Family emergencies must also be handled in this manner. 4. Interviews: You should attempt to schedule on campus interviews at a time that does not conflict with your class schedule. In the event that you miss class for an on campus interview, bring written documentation from the placement office to verify your interview schedule (a copy of the placement office’s interview schedule with your name listed will suffice). Attempt to schedule off campus interviews to avoid conflicts with your class schedule. If you miss class for an interview, you must bring written documentation indicating the time and place of your interview. 5. Other incidents leading to an absence will be evaluated on a case-by-case basis by the instructor. For any incident that you feel justifies an excused absence, you must provide written and verifiable documentation of the incident. Student responsibilities 1. You are responsible for all material in the assigned readings, handouts, homework, and class presentation. It is your responsibility to obtain any relevant information missed due to nonattendance. The instructor’s notes are not available for copying. 2. It is expected that you will have read the assigned reading prior to the material being covered in class. 3. You should bring your textbook, handouts, and calculator to class. 4. Homework questions and problems at the end of each chapter are assigned as each chapter is covered. These terms, questions and problems are closely related to the items we cover in class and/or items that I expect you to know from your reading and studying (even though we may not specifically cover it in class). While these assignments will not be collected and graded directly, we will discuss some of these questions/problems from time to time. Past experience indicates that doing the homework contributes greatly to understanding the material on which you will be tested. Grading: 2 Exams @ 25% each = Case Studies = Grading Scale 92.0 - 100.0 = A 90.0 - 91.9 = A87.0 - 89.9 = B+ 82.0 - 86.9 = B 80.0 - 81.9 = B77.0 - 79.9 = C+ 50% 50% 72.0 70.0 67.0 62.0 60.0 00.0 - 76.9 71.9 69.9 66.9 61.9 59.9 = = = = = = C CD+ D DF