BEFORE THE PUBLIC SERVICE COMMISSION OF UTAH

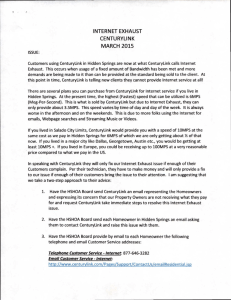

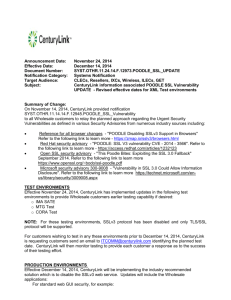

advertisement