Microsoft Word version

advertisement

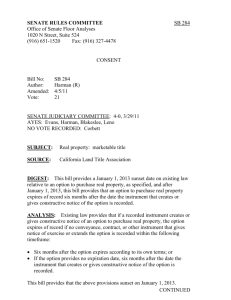

SENATE JUDICIARY COMMITTEE Senator Noreen Evans, Chair 2011-2012 Regular Session SB 284 (Harman) As Introduced Hearing Date: March 29, 2011 Fiscal: No Urgency: No BCP:rm SUBJECT Real Property: Marketable Title DESCRIPTION This bill would provide that an option to purchase real property expires of record six months after the date the instrument that creates or gives constructive notice of the option is recorded. BACKGROUND Recording statutes play an important role in resolving conflicts as to who may own a piece of property. California, a “race-notice” jurisdiction, requires conveyances of real property to be recorded in order to be valid against other purchasers of the same property from the owner, provided certain conditions are met. A subsequent purchaser of the same property for value “wins” if they had no knowledge of the prior transfer, and they record before the prior purchaser. As a result of that principle, prospective purchasers must search records to see if there are any adverse records that may create a cloud on title, and, upon purchase, must record as soon as possible to preserve clear title. (Essentially, a cloud on title is a property interest that prevents a party from receiving a clear title to the property.) To address issues relating to obsolete recorded interests, the California Law Revision Commission (CLRC) recommended enacting several provisions to address some of the most common title-clouding interests in California. That recommendation resulted in the enactment of the Marketable Record Title statute in 1982, which included a provision that recorded notices of options to purchase real property expire, by operation of law. Those options give the potential purchaser the ability to purchase the property during the stated option term, subject to the conditions of the contract. Under existing law, those notices expire of record either within: (1) six months after the option expires according to its own terms; or (2) if there is no expiration date, six months after the notice of option is recorded. (Civ. Code Sec. 884.010.) It should be noted that the (more) SB 284 (Harman) Page 2 of 5 statute expires the “record notice” of the option, not the actual option itself; that record notice is important due to California being a “race-notice” jurisdiction. In 2009, the CLRC identified a gap in coverage of the above statute that could cause an obsolete option to cloud title in cases where “off-record” information is used to determine the option’s expiration. This bill, sponsored by the California Land Title Association, would implement the CLRC’s recommendation to clarify that an option whose expiration date is not ascertainable from the recorded instrument expires of record six months after recording. CHANGES TO EXISTING LAW Existing law provides that if a recorded instrument creates or gives constructive notice of an option to purchase real property, the option expires of record if no conveyance, contract, or other instrument that gives notice of exercise or extends the option is recorded within the following timeframe: Six months after the option expires according to its own terms; or If the option provides no expiration date, six months after the date the instrument that creates or gives constructive notice of the option is recorded. This bill would revise those timeframes to, instead, expire those options of record: Six months after an expiration date that is ascertainable from the recorded instrument; or Six months after the recordation of the instrument that creates or gives notice of the option if: (1) the expiration date of the option is not ascertainable from the recorded instrument; or (2) the recorded instrument indicates that the option provides no expiration date. This bill would also make a technical change to a related section. COMMENT 1. Stated need for the bill According to the author: In most cases, the status of record notice of an option can be readily determined from the information provided in the notice itself, without any need to consult off-record information. However, there are circumstances in which the status of record notice cannot be determined from the title records alone. That is because the status of record notice of an option depends on the expiration date of the option (if any). That information might not be included in the record, in which case off-record information would be required to determine the status of the record notice. SB 284 (Harman) Page 3 of 5 That would make it difficult or impossible for a title researcher to determine whether the record notice is effective, creating a cloud on title that may persist long after the underlying option has become obsolete. Judicial proceedings could be required to determine the status of title. The author notes that SB 284 would correct this issue by allowing the statute at issue to “operate entirely on the basis of information that is ascertainable from the recorded document.” 2. Expiring record notice of options to purchase The Marketable Record Title statute seeks, among other things, to limit the cloud on title created by obsolete unexercised options to purchase. Those options to purchase essentially give the option holder the right to purchase the property subject to any deadlines or conditions contained within the option. Upon the recordation of that option, any future owner would have to purchase the property subject to that option, unless the record notice of that option expires (thereby lifting the cloud from title). The CLRC’s original 1982 recommendation noted that expiring record notice of those options “[would] enhance the marketability of property . . . by removing the cloud on title simply by the passage of time without the need for resort to judicial proceedings.” Absent the expiration of the option, title may be cleared by obtaining a quitclaim deed from the option holder (deeding any interest they may have), or by the purchaser bringing a quiet title action in court (arguably time consuming and costly). Existing law addresses the issue of obsolete options clouding title by providing that record options to purchase expire by operation of law: (1) six months after the option expires according to its own terms; or (2) if the option provides no expiration date, six months after the option is recorded. (See Comment 3 for a discussion on how the statute expires the record notice of that option, not the option itself.) This bill, based on a 2009 CLRC recommendation, would additionally provide that where the expiration date of the option is not ascertainable from the recorded instrument, the option expires of record six months after recordation. CLRC notes that the proposed change would address a gap in existing law where offrecord information may be required to determine whether an option has expired. Since the status of a record notice of option depends on the option’s expiration date, a recorded document that does not contain information about an expiration date creates potential problems. In that circumstance, the CLRC notes that off-record information would be required to determine the status of the record notice and that it would be “difficult or impossible for a title researcher to determine whether the record notice is effective, creating a cloud on title that may persist long after the underlying option has become obsolete.” SB 284 (Harman) Page 4 of 5 By expiring the record notice of those options six months after recordation of the instrument that creates or gives constructive notice of the option, this bill would allow the record notice status of those options to be determined from the public record. Staff notes that the proposed expiration of those options appears consistent with the current requirement that options with no expiration date expire (as a matter of law) six months after recordation. The proposed change also appears consistent with the Legislature’s codified public policy that “[t]he status and security of real property titles should be determinable to the extent practicable from an examination of recent records only.” 3. Change would expire record notice, not wipe out option California, as a race-notice jurisdiction, requires conveyances of real property to be recorded in order to be valid against subsequent bona fide purchasers. The statutes at issue that provide for the expiration of record notices of option do not expire or wipe out the option – the statues merely expire the “record notice” of that option. After the expiration of that record, a subsequent purchaser could arguably record a conveyance and receive clear title under California’s race-notice rules. On the other hand, if an option holder does seek to continue his or her option after its expiration, that same individual could record a new notice of the option. The key issue for a prospective purchaser is whether there is record notice for an option in effect at the time they acquire an interest in the property – if there is a record notice of option, the purchaser takes the property subject to the recorded option. 4. Need for a deferred operative date CLRC’s recommendation included a one year delayed operative date “[i]n order to avoid any unfair surprise to those who have recorded notice of an option to purchase real property under existing law . . . .” That delayed operation is necessary so as to “provide sufficient time for those who have recorded notices to adjust to the change in the law.” Consistent with that recommendation, the bill should be amended to include a one year delayed operative date. Suggested amendment: On page 3, after line 2, insert: SEC. 3. This act shall become operative on January 1, 2013. Support: None Known Opposition: None Known SB 284 (Harman) Page 5 of 5 HISTORY Source: California Land Title Association Related Pending Legislation: None Known Prior Legislation: None Known **************