cybertax45attach

advertisement

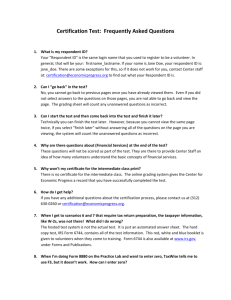

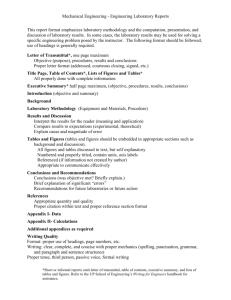

TY 2010 ERO Paper Flow and Transmittal Documents The procedures for submitting documents to the IRS Service Centers and SPEC have changed this year. This document describes these changes. And a new transmittal form (Form 3210) is being introduced that provides verification that documents sent to the IRS have been received. See Page 2 for instructions on using Form 3210. NEW: Form 8879 - mail to the IRS Cincinnati Processing Center: NOTE: Regular mailing of the 8879’s is recommended to minimize the potential for loss or theft. [USE PRE-PRINTED LABEL – Doc _______, Cat No._________][Obtain from your SPEC rep] NEW: Partners should include (2 copies) Form 3210, Document Transmittal, to confirm shipment and allow for receipt of package. Cincinnati employees will sign and return a copy of Form 3210 back to acknowledge the receipt of your mailings. Use of Form 3210 is the preferred method for Cincinnati mailings, but not required. Signed Forms 8879, for returns accepted by the IRS, with these attachments: Federal filing copy (Copy B) of ALL Forms W-2, W-2G and 1099R. Federal filing copy (Copy B) of any Forms 1099 that show any federal withholding. NOTE: Forms 8879 and their supporting documents do not need to be in sequential order. NOT NEW: Mail at the end of the tax season to your State’s IRS SPEC rep: [USE PRE-PRINTED LABEL – Doc _______, Cat No._________][Obtain from your SPEC rep] All TaxWise Federal Acknowledgement Reports For each return accepted by the IRS, these attachments, if used: o Form 8453, and all of its attachments (see above) o Form 1310, Refund in respect of a Decedent o Form 2120, Multiple Support Declaration o “any other supporting documents not included in the electronic return data” Check with your local SPEC office to see what reports, if any, they want included. For TaxWise Desktop only, a complete TaxWise backup of all transmitted returns (CD or flash drive). NOT NEW: Form 8453 - mail within three days of the return being accepted to the IRS Austin Service Center. [USE PRE-PRINTED LABEL – Doc 9282E, Cat No. 33261H] NEW: If you want a return receipt for the mailing, use Document Transmittal Form 3210 addressed to the Austin Center (2 copies). Use of Form 3210 for Forms 8453 to Austin is Optional. Forms 8453 is the transmittal document for returns that have any of these commonly used forms: (A complete list of other forms and supporting documents that require an 8453 is listed on the form) Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes (or equivalent contemporaneous written acknowledgement) Form 8332, Release of Claim to Exemption for Child of Divorced or Separated Parents (or certain pages from a post-1984 pre-2009 decree or agreement, see instructions) Schedule D-1, Continuation Sheet for Schedule D (Form 1040) (or a statement with the same information), if you elect not to enter all details of capital gain (loss) transactions into TaxWise. Be sure to check the box on TaxWise Schedule D if using this option. Form 2848, Power of Attorney (or any POA used to sign the return) AARP Tax-Aide National Technology Committee Page 1 of 2 taxaidetech@aarp.org TY 2010 ERO Paper Flow and Transmittal Documents Using Form 3210 1. 2. 3. 4. 5. Release Date – Enter the date of shipment Quantity – Number of forms sending (Numeric) Description Line – Brief description of forms sent – Ex: Forms 8879 for SITE NAME Releasing Official Signature – Whoever is sending – signature From – Sender’s return address here AARP Tax-Aide National Technology Committee Page 2 of 2 taxaidetech@aarp.org