MS Word - Sabanci University Research Database

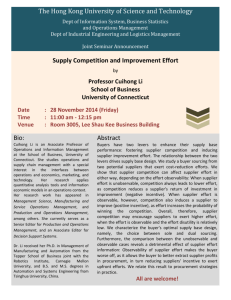

advertisement