ch6p1

advertisement

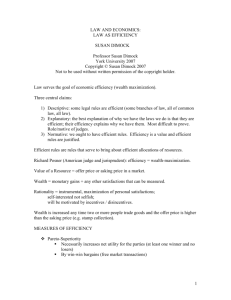

CHAPTER 6 TORT LAW1 §6.1 The Economics of Accidents and the Learned Hand Formula of Liability for Negligence Everybody takes precautions against accidents; the interesting question is how extensive the precautions taken are. If you were deciding whether to buy an auxiliary generator to make sure that a power failure didn't cut off the oxygen supply to your collection of rare South American lizards, you would surely balance, at least in a rough and ready way, the benefits of the auxiliary generator in preventing the loss of the lizards against its costs. The benefits can be expressed, at least as a first approximation, as the product of the probability of the lizards' being killed over some interval of time (say a year) by a power failure, and the dollar magnitude of the loss. Assume that the probability and the magnitude--P and L (for loss), call them--are .001 and $10,000 respectively. Therefore the expected accident cost, PL, will be $10. Granted, this is a measure of expected disutility as well as expected cost only if you are risk neutral, but put risk aversion to one side by assuming that the insurance that you carry on the lizards' lives will cover death through power failure at an additional premium equal to PL plus some modest loading charge (assumed for the sake of simplicity to be zero) to cover the insurance company's expenses of administration. Thus the expected benefit of the auxiliary generator to you is $10 a year. Suppose its annualized cost is $8. Then you will buy the generator, provided of course that no cheaper alternative precaution is available. If the generator cost more than $10, you would not buy it. When, as in this example, the person taking precautions and the person who may be injured if they are not taken are the same, the optimal precautions will be achieved without legal intervention. But change the example; suppose the hazard is the loss not of your lizards but of your pinky finger in an automobile accident, and the cheapest way to avoid the accident is for some other driverma complete strangerinto drive more slowly. Suppose that as before your expected accident cost is $10 (.001 × $10,000) and the cost to the other driver of driving more slowly (and thus taking longer to get to his destination) is $8. Efficiency requires that the driver drive more slowly. But because transaction costs with potential victims such as yourself are prohibitive, he will not do so unless the legal system steps in, as by holding him liable in damages (= $10,000) should an accident occur. Then he has (if we 1. See Prosser and Keeton on the Law of Torts (W. Page Keeton et al., 5th ed. 1984). 167 168 / v Tort Law ignore legal expenses, legal error, and other frictions) an expected legal judgment cost of $10. This will induce him to invest $8 in a precaution that will drive his expected judgment cost to zero by preventing the accident. The example illustrates the operation of the law of negligence as summarized in the negligence formula of Judge Learned Hand. ~ Defining P and L as we have, and denoting by B the cost of the precaution, Hand wrote that a potential injurer is negligent if but only if B < PL, which is what our example implied would be the formula for optimal accident avoidance. There is, however, an ambiguity both in Hand's formulation and in ours. Suppose that the PL of $10 would be totally eliminated by the driver's reducing his speed by 25 m.p.h, at a cost to him of $9. But suppose further that PL could be reduced to $1 aside by by the driver's reducing his speed by only 5 m.p.h., at a cost to him of only $2. This implies that to get PL pointing out down from $1 to zero costs the driver $7 ($9-$2), for a net social loss of $6. Clearly we want him to that people reduce his speed just by 5 m.p.h., which yields a net social gain of $7. This example shows that expected can buy accident costs and accident prevention costs must be compared at the margin, by measuring the costs and insurance, benefits of small increments in safety and stopping investing in more safety at the point where another and yet we dollar spent would yield a dollar or less in added safety. 2 Fortunately the common law method facilitates know from a marginal approach, simply because it will usually be difficult for courts to get information on other than Chz/pter 4 small changes in the safety precautions taken by the injurer. that the The Hand Formula in its correct marginal form is presented graphically in Figure 6.1. The horizontal doctrines of axis represents units of care, the vertical axis (as usual) dollars. The curve marked PL depicts the marginal contract law change in expected accident costs as a function of care and is shown declining on the assumption that care do not on has a diminishing effect in preventing accidents. The curve marked B is the marginal cost of care and is similar shown rising on the assumption that inputs of care are scarce and therefore their price rises as more and grounds more are bought. The intersection of the two curves, c,* represents due care. (Must PL be falling and B rising?) To the left of c* the injurer is negligent; B is smaller than PL. To theright, where the costs of care are greater than the benefits in reducing expected accident costs, the injurer is not negligent; this is the region of accidents that (subject to qualifications discussed later) are unavoidable in an economic sense. A possible objection to the Hand Formula is that it assumes risk neutrality. We waved this point k.. §6.1 1. See United States v. Carroll Towing Co., 159 E2d 169, 173 (2d Cir. 1947). For contemporary applications of the formula, see Dob v. Berg Lumber Co., 7 P. 3d 922,936 n. 3 (Wyo. 2000); Brotherhood Shipping Co. v. St. Paul Fire & Marine Ins. Co., 985 F. 2d 323, 327-329 ( Cir. 1994); I & M Rail Link, LLC v. Northstar Navigation, Inc., 198 F.3d 1012, 1016 (7th Cir. 2000). 2. The marginal Hand Formula is easily derived with a bit of calculus. The problem is to find the optimal level of care (c*) i.e., the lev prevention, B. Both P and B are functions of the potential injurer's care, c (we are assuming that potential victims can do nothing to prevent the A, the total social costs of accidents, with respect to c, where A(c) (total accident costs as a function of amount of care) = P(c)L + B(c), both P satisfied, minimization requires taking the first derivative of A with respect to c and setting the resulting expression equal to zero: PcL + B expenditures on care, reduces (hence the negative sign) expected accident costs by the same amount. This is the point d in Figure 6.1. 169 The Economics of Accidents $ B PL Ca Units of Care Figure 6.1 assume that the people affected by that law are risk neutral. There is an economic reason for this difference. It is difficult to buy insurance against business losses, because a businessman insured against loss will have little incentive to try to prevent loss and because business losses are potentially so openended; an unexpected rise in the price of a key input could cause even a large business to go broke. Hence contracts and contract law have a role to play in reducing risk--illustrating the more general point that market insurance is not the only social institution for risk reduction (diversified investment portfolios, discussed in Chapter 15, are another). However, there have been well-developed markets in insurance against personal injury and death for a long time, and although this insurance also involves, as we discussed in Chapter 4, a "moral hazard" problem, it is not so severe (why not?), or the losses to be insured against so open-ended, as to prevent the market from working. (But should the cost of the potential victim's accident insurance premium be added to PL in applying the Hand Formula?) Although the Hand Formula is relatively recent, the method it capsulizes has been used to determine negligence ever since negligence was first adopted as the standard to govern accident cases. 3 For example, in Blyth v. Birmingham Water Works4 the question was whether a water company had been negligent in failing to bury its water pipes deep enough to prevent them from bursting because of frost and damaging the plaintiff's home. In holding for the water company, the court emphasized that the frost had been of unprecedented severity--i.e., the probability of the loss had been low. The damage was not so great as to make the expected cost of the accident greater than the cost of prevention, which would have involved a heavy expense in burying the pipes deeper. In Adams v. Bullock, 5 a 12-year-old boy, while crossing a bridge over the defendant's trolley tracks, swung an 8-foot-long wire over the bridge. The wire touched the defendant's trolley wire, which ran over the tracks and beneath the bridge, 3. See Richard A. Posnet, A Theory of Negligence, 1 J. Leg. Stud. 29 (1972); Henry T. Terry, Negligence, 29 Harv. L. Rev. 40 (1915). 4. 11 Exch. 781, 156 Eng. Rep. 1047 (1856). 5. 227 N.Y. 208, 125 N.E. 93 (1919) (Cardozo, J.). 170 TortLaw resulting in an electric shock that injured the boy, who sued. The court held for the defendant. Pwas low because it was unlikely that anyone using the bridge would touch the trolley wire. And B was high, the court remarking the difference between electric light and trolley wires in terms suggestive of economic insight: The distinction is that the former may be insulated. Chance of harm, though remote [low P], may betoken negligence, if needless [very low BI. Facility of protection may impose a duty to protect. With trolley wires, the case is differ-ent. Insulation is impossible. Guards here and there are of little value. To avert the possibility of this accident and others like it at one point or another on the route, the defendant must have abandoned the overhead system, and put the wires underground [very high B]. And here is a case that went the plaintiff's way: Hendricks v. Peabody Coal Co. 6 A 16-year-old boy was seriously injured while swimming in the defendant's abandoned strip mine, which had become filled with spring water. The defendant, aware both that the mine was being used as a swimming hole and that it was dangerous because of a concealed ledge beneath the surface at the pointwhere the boy had dived and been hurt, undertook to police the area but did not do so effectively. The court remarked, "The entire body of water could have been closed off with a steel fence for between $12,000 and $14,000. The cost was slight compared to the risk to the children involved." Bear in mind that the application of the Hand Formula depends on the interaction of the three elements, rather than on any one of them taken separately. For example, "it does not follow that, no matter what the circumstances may be, it is justifiable to neglect a risk of such a small magnitude [low P]. A reasonable man would only neglect such a risk if he had some valid reason for doing so, e.g., it would involve considerable expense to eliminate the risk [high B]. He would weigh the risk against the difficulty of eliminating it." 7 But what if a precaution would benefit the potential injurer as well as the potential victim? That would be true in the usual case in which a driver endangers other users of the road; he is endangering himself as well. Does this imply that the standard of care should be lower, because he already has an incentive to avoid an accident, or higher, because the expected accident cost is now higher? It implies the latter. Because the benefits of avoiding an accident are greater, the optimal expense in avoiding the accident is also greater. 8 To see this, suppose that L~ (the loss to the victim if the accident occurs) is 100, Li (the loss to the injurer) is also 100, the probability of the accident (P) is .1, and the accident can be avoided at a cost (B) of 15. If both L's are included in the formula, the injurer will be found negligent if he fails to take the precaution (because 15 < .1 (200)), but if only ~ is included, he will not be found negligent (because 15 > .1 (100)). In this example, even though the potential injurer is himself at risk, the risk is not great enough to induce him to take the precaution; but if he were made liable should an accident occur to another, then he would take the precaution and the result would be a net social benefit. 6. 115 Ill. App. 2d 35, 253 N.E.2d 56 (1969). 7. Wagon Mound (No. 2), Overseas Tankship (U.K.), Ltd. v. Miller Steamship, [1966] All E.R. 709, 718 (Privy Council). 8. See Robert Cooter & Ariel Porat, Does Risk to Oneself Increase the Care Owed to Others? Law and Economics in Conflict, 29J. Leg. Stud. 19 (2000).