Chapter Six – Corporations: Redemptions and Liquidations

advertisement

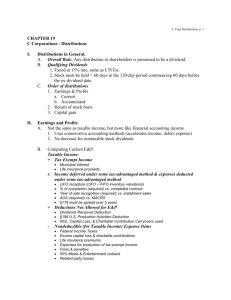

Chapter Six – Corporations: Redemptions and Liquidations I. Redemptions of Stock A. General 1. Occurs when a corporation acquires its stock from a shareholder in exchange for cash or property 2. Qualifying distributions receive sale or exchange treatment. Thus, capital gain treatment normally results. 3. Nonqualifying redemptions receive dividend treatment. B. Effect of a Redemption 1. Noncorporate shareholders - qualified redemption generally more tax beneficial 2. Corporate shareholders – nonqualified redemption (i.e., dividend treatment) generally more beneficial (due to dividends received deduction) 3. If qualified as a redemption: (Concept Summary 6-1 of Qualifying Stock Redemption Rules, p. 6-12) –Shareholder reports gain or loss on surrender of stock • Gain (amount realized less basis in stock) taxed at favorable capital gains rates (0%/15%) • Shareholder reduces amount realized by basis in stock redeemed • Capital gains may be offset by capital losses, if available • Losses could be disallowed under related party rules (>50% owned directly or indirectly) –Shareholder’s basis in property received in a stock redemption, qualifying or nonqualified, generally is the property’s fair market value at date of redemption • Holding period of property begins on date of redemption 4. If transaction has appearance of a dividend, redemption will not be qualified: –For example, if shareholder owns 100% and corporation buys ½ of stock for $X, shareholder still owns 100% 5. If not qualified as a redemption: –Shareholder reports dividend income (assuming adequate E&P) • Individual shareholders may be taxed at 0%/15% rates • But, redemption proceeds may not be offset by basis in stock surrendered • Cannot be offset by capital losses • Basis of stock redeemed attaches to remaining stock –Corporate shareholders may prefer dividend treatment because of the dividends received deduction C. Transactions Treated as Redemptions 1. The following types of distributions may be treated as a redemption of stock rather than as a dividend (so will receive sale/exchange treatment): –Distributions not essentially equivalent to a dividend (subjective test) –Disproportionate distributions in terms of shareholder effect (mechanical rules) –Distributions in complete termination of shareholder’s interest (mechanical rules) –Partial liquidations of a corporation where shareholder is not a corporation, and either (1) Distribution is not essentially equivalent to a dividend, or (2) An active business is terminated (May be subjective (1) or mechanical (2)) –Distributions to pay death taxes (limitation on amount of allowed distribution is mechanical test) 2. Stock attribution rules (i.e., constructive ownership) must be applied, so distribution which appears to meet requirements may not qualify D. Stock Attribution (Exhibit 6-1, p. 6-6) – generally constructive ownership rules apply in determining whether a distribution is a qualified stock redemption 1. Qualified stock redemption must result in substantial reduction in shareholder’s ownership –Stock ownership by certain related parties is attributed back to shareholder whose stock is redeemed 2. Attribution from family members –Stock owned by spouse, children, grandchildren, or parents attributed back to individual (note: not grandparents) 3. Attribution from entity to owner: –Partner: deemed owner of proportionate number of shares owned by partnership –Beneficiary or heir: deemed owner of proportionate shares owned by entity –50% or more shareholder: deemed owner of proportionate shares owned by corporation 4. Attribution from owner to entity: –Partnership: deemed owner of total shares owned by partner –Estate or trust: deemed owner of total shares owned by heir or beneficiary –Corporation: deemed owner of total shares owned by 50% or more shareholder 5. S corporations are treated the same as a partnership for purposes of the attribution rules (and a shareholder of an S corporation is treated the same as a partner) 6. Family attribution rules do not apply to redemptions in complete termination of shareholder’s interest (i.e., family attribution rule can be waived ) 7. Stock attribution rules do not apply to partial liquidations or redemptions to pay death taxes 8. Examples: o Keith owns 60 shares of stock in Purple Corporation. The remaining 40 shares are owned by the following relatives of Keith: Keith’s wife (5); Keith’s son (2); Keith’s daughter (3); Keith’s father (10); Keith’s brother (6); and Keith’s aunt (14). Keith is deemed to own a total of 80 shares in Purple. Only the stock of his brother and his aunt are not attributed to him. o Lori has a 20% interest in a partnership which owns 30 shares in White Corporation. Lori is deemed to own 6 (20% of 30) shares in White. However, if Lori owned 30 shares in White (rather than the partnership), the partnership would be deemed to own all of Lori’s 30 shares. o Arnold has a 10% beneficiary interest in a trust. The trust owns 50 shares in Green Corporation. Arnold is considered as owning 5 (10% of 50) of these shares. However, if Arnold owned the 50 shares (rather than the trust), the trust would be deemed to own all of Arnold’s 50 shares. o Nancy owns 60% of Gray Corporation. Gray owns 20 shares of Blue Corporation, and Nancy owns 50 shares of Blue. Nancy is deemed to own 62 shares in Blue, her own 50 shares plus 60% of Gray’s 20 shares, or 12 more shares. Gray, on the other hand, is deemed to own 70 shares of Blue, its 20 shares and Nancy’s 50 shares. (Class Exercise #1) E. “Not Essentially Equivalent to a Dividend” Redemptions (§ 302(b)(1)) 1. Redemption qualifies for sale or exchange treatment if “not essentially equivalent to a dividend” –Subjective test –Provision was added to deal specifically with redemptions of preferred stock • Shareholders often have no control over when preferred shares redeemed • Also applies to common stock redemptions 2. To qualify, redemption must result in a meaningful reduction in shareholder’s interest in redeeming corporation (reduction in voting control is important) • Stock attribution rules apply 3. If redemption is treated as ordinary dividend –Basis in stock redeemed attaches to remaining stock owned (directly or constructively); If do not own any stock, then would be a complete termination redemption discussed on next page. F. Qualifying Disproportionate Redemptions (§ 302(b)(2)) 1. Redemption qualifies as disproportionate redemption if: –Shareholder owns less than 80% of the interest owned prior to redemption –Shareholder owns less than 50% of the total combined voting power in the corporation after the redemption –Attribution rules apply 2. Example: Prior to Redemption: Owns 60 of 100 shares, or 60% ownership Redemption: Shareholder transfers 25 voting shares to corporation in exchange for cash and property After Redemption: Shareholder now has 46.7% ownership (35/75 shares) Redemption is a qualified disproportionate redemption because: –Shareholder owns < 80% of the 60% owned prior to redemption (80% × 60% = 48%), and –Shareholder owns < 50% of total combined voting power of corporation after the redemption G. Complete Termination Redemptions (§ 302(b)(3)) 1. Termination of entire interest generally qualifies for sale or exchange treatment –Often will not qualify as disproportionate redemption due to stock attribution rules –Family attribution rules will not apply if: • Former shareholder has no interest (other than as creditor) for at least 10 years (stock acquired by bequest or inheritance not considered) • Agree to notify IRS of any disallowed interest within 10 year period (Class Exercise #2) H. Redemptions in Partial Liquidations (§ 302(b)(4)) 1. Noncorporate shareholder gets sale or exchange treatment for partial liquidation including: –Distribution not essentially equivalent to a dividend –Under a safe-harbor rule, distribution pursuant to termination of an active business 2. To qualify, distribution must be made within the taxable year that plan is adopted or the succeeding taxable year 3. Not essentially equivalent to a dividend test looks at effect on corporation (not the shareholder) –Requires genuine contraction of the business of the corporation • Difficult to apply due to lack of objective tests • Advanced ruling from IRS should be obtained 4. Under the safe-harbor rule, to meet the complete termination of a business test, the corporation must: –Have two or more active trades or businesses that have been in existence for at least five years • Distribution must consist of the assets of a qualified trade or business or the proceeds from the sale of such assets –Terminate one trade or business and continue a remaining trade or business (Class Exercise #3) I. Redemptions to Pay Death Taxes (§ 303) 1. Allows sale or exchange treatment if value of stock exceeds 35% of value of adjusted gross estate –Stock of 2 or more corps may be treated as stock of single corporation for 35% test if 20% or more of each corporation was owned by decedent –Special treatment limited to sum of: • Death Taxes • Funeral and administration expenses –If redemption exceeds amount allowed, then excess may be treated as a dividend unless qualifies under another section of § 302(b) 2. Basis of stock is stepped up to fair market value on date of death (or alternate valuation date) –When redemption price equals stepped-up basis, no tax consequences to estate (Class Exercise #4) II. Effect of Redemption on Corporation A. Gain or loss recognition –If property other than cash used for redemption • Corporation recognizes gain on distribution of appreciated property as if sold at fmv (if subject to a liability, then value of property is treated as not less than the liability so if related liability > fmv, then deemed fmv is amount of related liability) • Loss is not recognized – Corporation should sell property, recognize loss, and use proceeds from sale for redemption (Class Exercise #5) B. Effect on Earnings and Profits –E & P is reduced by lesser of (1) fair market value of property distributed, or (2) ratable share of E&P attributable to stock in a qualified stock redemption (so reduction cannot exceed the ratable share of E & P attributable to stock redeemed) *Example: If 30% of stock is redeemed, then calculate 30% of E&P. Compare that amount to fmv of property distributed. Reduce E&P by lesser amount –Balance of distribution, if any, decreases paid-in capital C. Corporate expenditures incurred in a stock redemption are not deductible –e.g., accounting, brokerage, legal and loan fees III. Stock Redemptions – No Sale or Exchange Treatment A. Redemptions not qualifying under previous provisions –Treated as dividend distribution to extent of E & P –Attempts by taxpayers to circumvent redemption provisions led to rules covering: • Preferred stock bailouts • Sales of stock to related corporations IV. Liquidations A. In General 1. Corporation winds up affairs, pays debts, and distributes remaining assets to shareholders –Produces sale or exchange treatment to shareholder –Liquidating corporation recognizes gains and losses upon distribution of its assets, with certain exceptions B. Effect on Corporation 1. Gain or loss is recognized by corporation on distribution in complete liquidation –Loss may be disallowed or limited if: • Property distributed to related parties • Property distributed has built-in losses • A subsidiary’s liquidating distribution to its parent corporation or to its minority shareholders –Property treated as if sold for FMV (fmv cannot be less than amount of any related liability) –Result: Liquidating distribution subject to corporate level tax (gain), and shareholder level tax (receipt of proceeds) 2. Limitations on losses—Related Party Situations (a.k.a. Antistuffing rules) –Losses are disallowed on liquidating distributions to related parties if: • Distribution is not pro rata – In pro rata distributions, each shareholder receives their share of each asset • Property distributed is disqualified property – Disqualified property is property acquired by corporation in a §351 transaction during the five-year period ending on date of distribution 3. Limitations on losses—Built-in Loss Situations –Losses are disallowed when property distributed was acquired in a §351 transaction and principal purpose was to cause recognition of loss by corporation on liquidation –Purpose is presumed if transfer occurs within two years of adopting liquidation plan –Loss disallowed is built-in loss determined when property was acquired by corporation –Distributions of Loss Property by a Liquidating Corporation: Figure 6-1, p. 6-22 C. Effect on Shareholder 1. Gain or loss recognized on receipt of property from liquidating corporation –Amount = FMV of property and cash received - basis in stock – liabilities assumed • Generally, capital gain or loss –Basis in assets received in liquidating distribution = FMV on date of distribution –Special rule for installment obligations • Shareholder may defer gain recognition to point of collection • Corporation must recognize all gain on distribution (Class Exercises #6-8) D. Parent-Subsidiary Situations (§332 and §338) 1. Parent corporation does not recognize gain or loss on liquidation of subsidiary (§332) –Also, subsidiary recognizes no gain or loss on liquidating property distributions to its parent 2. To qualify: –Parent must own at least 80% of voting stock and 80% of total value of all subsidiary’s stock –Subsidiary must distribute all property in complete cancellation of all its stock within three years from close of the tax year in which the first distribution occurred –Subsidiary must be solvent (if not, then parent claims ordinary loss deduction for basis in worthless subsidiary stock)