UCP 600 may be applied to A) Documentary Credits only B) Standby

advertisement

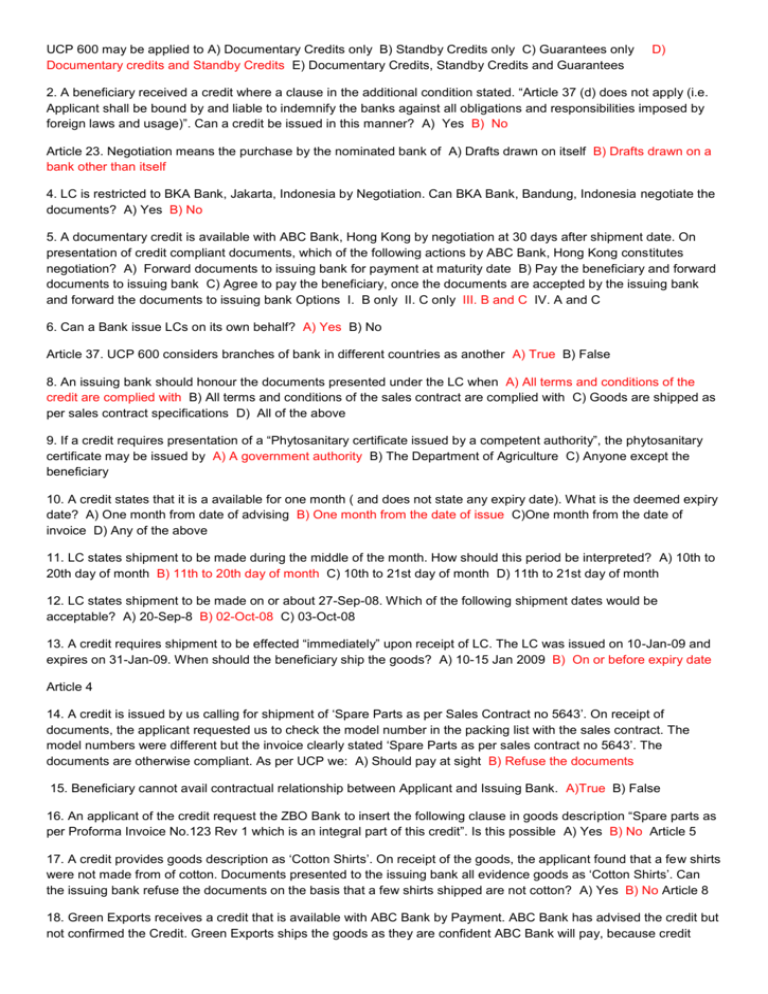

UCP 600 may be applied to A) Documentary Credits only B) Standby Credits only C) Guarantees only Documentary credits and Standby Credits E) Documentary Credits, Standby Credits and Guarantees D) 2. A beneficiary received a credit where a clause in the additional condition stated. “Article 37 (d) does not apply (i.e. Applicant shall be bound by and liable to indemnify the banks against all obligations and responsibilities imposed by foreign laws and usage)”. Can a credit be issued in this manner? A) Yes B) No Article 23. Negotiation means the purchase by the nominated bank of A) Drafts drawn on itself B) Drafts drawn on a bank other than itself 4. LC is restricted to BKA Bank, Jakarta, Indonesia by Negotiation. Can BKA Bank, Bandung, Indonesia negotiate the documents? A) Yes B) No 5. A documentary credit is available with ABC Bank, Hong Kong by negotiation at 30 days after shipment date. On presentation of credit compliant documents, which of the following actions by ABC Bank, Hong Kong constitutes negotiation? A) Forward documents to issuing bank for payment at maturity date B) Pay the beneficiary and forward documents to issuing bank C) Agree to pay the beneficiary, once the documents are accepted by the issuing bank and forward the documents to issuing bank Options I. B only II. C only III. B and C IV. A and C 6. Can a Bank issue LCs on its own behalf? A) Yes B) No Article 37. UCP 600 considers branches of bank in different countries as another A) True B) False 8. An issuing bank should honour the documents presented under the LC when A) All terms and conditions of the credit are complied with B) All terms and conditions of the sales contract are complied with C) Goods are shipped as per sales contract specifications D) All of the above 9. If a credit requires presentation of a “Phytosanitary certificate issued by a competent authority”, the phytosanitary certificate may be issued by A) A government authority B) The Department of Agriculture C) Anyone except the beneficiary 10. A credit states that it is a available for one month ( and does not state any expiry date). What is the deemed expiry date? A) One month from date of advising B) One month from the date of issue C)One month from the date of invoice D) Any of the above 11. LC states shipment to be made during the middle of the month. How should this period be interpreted? A) 10th to 20th day of month B) 11th to 20th day of month C) 10th to 21st day of month D) 11th to 21st day of month 12. LC states shipment to be made on or about 27-Sep-08. Which of the following shipment dates would be acceptable? A) 20-Sep-8 B) 02-Oct-08 C) 03-Oct-08 13. A credit requires shipment to be effected “immediately” upon receipt of LC. The LC was issued on 10-Jan-09 and expires on 31-Jan-09. When should the beneficiary ship the goods? A) 10-15 Jan 2009 B) On or before expiry date Article 4 14. A credit is issued by us calling for shipment of ‘Spare Parts as per Sales Contract no 5643’. On receipt of documents, the applicant requested us to check the model number in the packing list with the sales contract. The model numbers were different but the invoice clearly stated ‘Spare Parts as per sales contract no 5643’. The documents are otherwise compliant. As per UCP we: A) Should pay at sight B) Refuse the documents 15. Beneficiary cannot avail contractual relationship between Applicant and Issuing Bank. A)True B) False 16. An applicant of the credit request the ZBO Bank to insert the following clause in goods description “Spare parts as per Proforma Invoice No.123 Rev 1 which is an integral part of this credit”. Is this possible A) Yes B) No Article 5 17. A credit provides goods description as ‘Cotton Shirts’. On receipt of the goods, the applicant found that a few shirts were not made from of cotton. Documents presented to the issuing bank all evidence goods as ‘Cotton Shirts’. Can the issuing bank refuse the documents on the basis that a few shirts shipped are not cotton? A) Yes B) No Article 8 18. Green Exports receives a credit that is available with ABC Bank by Payment. ABC Bank has advised the credit but not confirmed the Credit. Green Exports ships the goods as they are confident ABC Bank will pay, because credit says so. Which of the following is true? A) Green Exports is correct, as nominated bank i.e. ABC Bank has to pay B) ABC Bank is not obligated to pay as they have not confirmed the credit and specifically indicated that they will pay C) ABC Bank will pay if they are satisfied about Green Exports creditworthiness 19. ABC Bank negotiates documents presented by Green Exports, Indonesia and sends it to issuing bank. The issuing bank accepts documents and sends it to the applicant. The applicant finds that the inspection certificate does not conform to the LC and demands issuing bank reverse debit. Who must bear the loss? A)Applicant B) Issuing Bank C)Negotiating Bank D) Reimbursing Bank 20. In field 46A (Documents Required), a draft to be drawn on applicant is called for. Must the draft be checked for compliance with terms and conditions of the credit? A)Yes B)No 21. Extract from the LC Issuing Bank : Navy Bank, Chittagong Beneficiary : Smith Inc, New York Nominated Bank : Red Bank, New York Confirming Bank : Maroon Bank, Chicago LC is available by : Negotiation Credit compliant documents are presented to Red Bank, New York for negotiation. Red Bank, New York checks the documents and finds it compliant but is unwilling to negotiate. Smith Ltd sends the documents to Maroon Bank, Chicago and requests them to negotiate the documents. Is Maroon Bank, Chicago obligated to negotiate? A) Yes B) No 22. In Question 21, if Maroon Bank, Chicago advances funds to Smith Ltd, do they have recourse to Smith Inc, in case of payment default by Navy Bank? A)Yes B) No 23. A confirmed Credit constitutes a irrevocable undertaking of the Confirming Bank provided 1. Terms and conditions of the Credit are complied with 2. Documents are presented to Issuing Bank 3. Documents are presented to Confirming Bank 4. Documents are presented to Confirming Bank or Nominated Bank Options A) 1 and 2 B) 1 and 3 C)1 and 4 Article 9 24. If a Bank elects not to advise the Credit, It must inform ____________without delay A)Applicant B) Beneficiary C) Issuing Bank 25. Which of the following is a responsibility of an advising bank? A) Establish authenticity of the credit B) Advise the opening bank if they are not willing to advise the credit C) Revert to the opening bank if the authenticity cannot be established D) All of the above 26. A credit was advised through Navy Bank, Taipei. Can an amendment to this credit be advised through Maroon Bank, Taipei? A) Yes B) No 27. An LC is sent via authenticated teletransmission by the issuing bank to the advising bank. Subsequently the advising bank receives an airmail confirmation of the same LC which is sent to the beneficiary. The beneficiary noticed that some of the terms were different in the airmail LC. However, they had already shipped the goods in terms of the teletransmission and presented documents to the advising bank (who is also the nominated bank) for negotiation. The documents are found to comply with the terms and conditions as outlined in the teletransmission. Which of the following statements are true? A) The advising bank must contact the issuing bank for clarification before negotiation B) The advising bank should have checked the airmail LC C) The advising bank may negotiate and the issuing bank must honour 28. An LC amendment extends the late shipment date and curtails the LC expiry date. The beneficiary only wishes to accept the extension of late shipment date. The beneficiary: A) Is only permitted to accept or reject both terms B) Can choose to accept either term without giving notice to anyone C) Can choose to accept either term by giving notice to the issuing bank. 29. Iris Bank requests Canary Bank to add its confirmation to a credit issued by it. Iris Bank subsequently increased the credit amount and Canary Bank advised the amendment to the beneficiary. On receipt of credit compliant documents, Canary Bank refused to pay stating that its confirmation was not extended to the amendment. Which of the following is true? A) Canary bank must pay B) Canary bank need not pay C) Canary bank must pay to the extent of the original credit 30. Which of the following parties need to agree to an LC amendment in order for it to be binding on them? A) Advising Bank, Issuing Bank, Applicant and Beneficiary B) Issuing Bank, Advising Bank and Beneficiary C) Issuing Bank, Confirming Bank and Beneficiary 31. A Credit issued for USD 10,000 states that partial shipments are allowed. An amendment to the credit is issued increasing the credit amount to USD20,000. The Beneficiary does not explicitly accept/ reject the amendment but presents documents USD20,000. This means that the: A)Beneficiary has accepted the amendment B) Not accepted the amendment as the beneficiary has not given a express communication 32. A credit issued for USD10,000 states that partial shipments are allowed. An amendment to the credit is issued increasing the credit amount to USD 20,000. The Beneficiary does not explicitly accept/ reject the amendment but presents documents USD10,000. This means : A) Beneficiary has accepted the amendment B) Beneficiary has not accepted the amendment as the beneficiary has not given a express communication C) We do not know if the beneficiary has accepted/ rejected the amendment at this point 33. A credit issued for USD 10,000 states that partial shipments are not allowed. An amendment to the credit is issued increasing the credit amount to USD 20,000. The beneficiary does not explicitly accept/ reject the amendment but presents documents USD 10,000. This means : A) Beneficiary has accepted the amendment B) Beneficiary has not accepted the amendment 34. A credit issued for USD 10,000 states that partial shipment are not allowed. An amendment to the credit is issued increasing the credit amount to USD 20,000. The beneficiary does not explicitly accept/ reject the amendment but presents documents USD 15,000. This means A) Beneficiary has accepted the amendment B) Beneficiary has not accepted the amendment C)We do not know if the beneficiary has accepted/ rejected the amendment at this point (and we can quote discrepancy as LC Overdrawn/ Partial Shipment) 35. A preliminary advice of a credit indicates the latest shipment date as 10-Aug-2009. The applicant of the LC wishes to extend it to 10-Sep-2009. What should be the issuing bank’s course of action? A) Keep 10-Aug as the last date of shipment while issuing the credit B)Include 10-Sep as the last date of shipment while issuing the credit as it is beneficial to the beneficiary C) Issue credit with 10-Aug as the last date of shipment date and issue amendment with 10-Sep as the last date of shipment 36. Extract from the LCLC issue date: 06-Nov-2008 Issuing :Export Import Bank, Tokyo Beneficiary : Green Cars Ltd, Mumbai Applicant : New Age Cars Ltd, Tokyo Partial shipment : Not allowed Amount : EUR 200,000Goods Description : 10 Electric Cars Nominated Bank : Maroon Bank, Mumbai LC Amendment No 1 issued on 19-Dec-2008Goods description – 20 electric cars LC Amount – EUR 400,000 On 20-Dec-2008, documents presented by Maroon Bank, Mumbai reach Exports Import Bank, Tokyo Maroon Bank’s covering schedule stated discrepancies – Over shipment effected and LC amount overdrawn. The invoice presented shows shipment of 20 electric cars for EUR 400,000. Goods were shipped on 05-Dec-2008 The issuing bank refused documents stating (a) Over shipment (b) LC overdrawn (c) Amendment will not apply as it was issued on 19-Dec and shipment was made on 05-Dec. Is the issuing bank correct? A) Yes B) No Article 12 37. XYZ Bank, London issued a letter of credit with the following terms Available with: ABC Bank, Hong Kong by acceptance Drafts at: 60 days after bill of lading date Drawn on: ABC Bank, Hong Kong ABC Bank, Hong Kong has not added its confirmation to the LC. The beneficiary presented credit compliant documents to ABC Bank, Hong Kong along with a draft drawn on ABC Bank, Hong Kong as per LC terms. Should ABC Bank, Hong Kong accept the draft? A) Yes B) No 38. In question 37, can ABC Bank, Hong Kong request that the drafts be replaced with a draft drawn on XYZ Bank, London? A) Yes B) No 39. A credit is restricted to ABC Bank, Seoul by Negotiation. Documents presented to ABC Bank, Seoul and are found credit compliant. ABC Bank does not wish to negotiate. Can the beneficiary insist that they negotiate the documents? A) Yes B) No Article 13 40. An issuing bank should not require a claiming bank to supply a certificate of compliance with the terms and conditions of the LC to the reimbursing bank A) True B) False 41. The claiming bank incurred a loss as reimbursement is not provided by the reimbursing bank on first demand in this case, the: A) Issuing Bank should bear the loss B) Advising Bank should bear the loss C) Claiming Bank should bear the loss D)Reimbursing Bank should bear the loss 42. If a credit is silent as who should bear the reimbursing bank’s charges, who will bear the charges? A)Claiming Bank B) Issuing Bank C) Reimbursing bank should waive its charges 43. Documents are received by the issuing bank on 04-Dec-2008 (THU). What is the latest date by which the issuing bank can communicate its rejection of documents? (Assume that there are no bank holidays except Saturday and Sunday) A) 08-Dec-2008 B)11-Dec-2008 C) 10-Dec-2008 44. The additional condition in a credit states. “Goods to be shipped in a vessel no more than 15 years of age” No other further reference is made to this in the LC. Documents presented did not contain any reference to the age of the vessel. A nominated bank should A)Disregard the clause B) Request the beneficiary to include the age of the vessel on one of the documents C) Refuse documents D) Seek clarification from issuing bank 45. A nominated bank received a document not required in the credit. They paid the beneficiary as the presentation was compliant. Along with the payment advice, the nominated bank returned the additional document. The beneficiary did not realize that the document was returned. The applicant was unable to take over the goods because the ‘additional’ document was not provided. Who is responsible for the applicant’s loss? A)Beneficiary B) Nominated Bank C) Applicant themselves D) Depends on a case tot case basis 46. A credit requires presentation of a draft. The beneficiary presents a bill of exchange satisfying the LC condition. The issuing bank is unwilling to pay the confirming bank stating that bill of exchange format is not sufficient. Is their claim valid? A) Yes B) No 47. A credit requires presentation of a certificate quality. A document titled ‘Certificate of quality’ was presented which only contained the following: “The Gross Weight and Net Weight is 1,000 kilos and 950 kilos respectively”. Is the document acceptable? A) Yes B) No 48. A credit requires presentation of a certificate of inspection to be issued by XYZ Inspection Company. The certificate of inspection presented was issued by XYZ Inspection Company and mentioned that the goods were of poor quality. Is the document acceptable? A) Yes B) No 49. A credit requires presentation of a certificate of inspection. The certificate of inspection presented was issued by the beneficiary. Is the document acceptable? A) Yes B) No 50. The beneficiary presented an invoice which was dated prior to the date of the LC. The nominated bank should: A) Refuse the documents B) Treat invoice as complying to change the date C) Request the beneficiary to change the date