Key Changes under UCP 600 compared to UCP 500

advertisement

Introduction

1. Relevant of the study

It is generally accepted that international trade transactions naturally carry more

risks than domestic ones due to differences in practice, culture, business processes, laws

and regulations. It is, therefore, important for traders to ensure that goods are dispatched

and payment is made complying with the contract provisions. One effective solution for

traders dealing with these risks has been documentary credit (D/C) or letter of credit

(L/C). Despite of its complexity in compliance and high cost, L/C still enjoys popularity

due to its safety with banks’ participation. It has been described as “the life blood of

international commerce” (D’Arcy, Murray & Cleave 2000, p. 166) and the importance of

L/C in trade transactions is evidenced by its global acceptance, with an estimated usage

in excess of 1 trillion USD per annum (SITPRO Ltd, 2003).

For more than 70 years, the International Chamber of Commerce ICC has

formulated the so-called UCP-The Uniform Customs and Practice for Documentary

Credits. The first attempt to codify letter of credit practice started in 1929 when ICC

introduced its “Uniform Regulations and Commercial Documentary Credits”. Although

the failure to gain wide acceptance, these rules provided a foundation for further

developments. Then, in 1933, ICC issued “The Uniform Customs and Practice for

Commercial Documentary Credits” and this set of rules received formal acceptance in

more than 40 countries all over the world. It is, however, not until the issue of UCP in

1962, that global acceptance took place. Since then the rules has been regularly updated

in 1974, 1983 (UCP 400), 1993 (UCP 500) and now we have the sixth Revision-UCP 600

which came into effect in July 2007.

From the fact that the old revision-UCP 500 has reached a ten year cycle of

usage and during its lifetime, it was proved to be more and more outdated, overcomplicated and ambiguous which led to series of queries, commercial disputes,

unjustified discrepancies leading to documentary rejections. Indeed, under ICC’s

estimate, there is up to a 70% documentary non-compliance rate in letter of credit

transactions (ICC Thailand, 2002). The new 2007 Revision, therefore, should be made to

improve its certainty and clarity, reduce discrepancy problem and facilitate international

trade activities using L/C product.

2. Aims of the study

This study, “An analysis of key changes in UCP 600 compared to UCP 500

and Recommendations for better application”, aims to consider the differences from

UCP 500 to UCP 600. The research questions posed in this study are: “Where the rules

have been amended?” and “Which results in a potential changes in practice?”. Basing on

the findings, this study will draw recommendations for parties involved in L/C

transaction in applying the new revision UCP 600 before reaching the conclusion.

3. Research methodology

The thesis relies on relevant literature, associated rules, articles, available

statistics and employs method of comparison, analysis, arguments and synthesis. Data for

the study was collected from various sources including reference books, magazines,

articles, reports, new letters and the Internet.

4. Object and scope of the study

Objects of the thesis are the two recent versions: UCP 500_1993 Revision and

UCP 600 having commencement date of 1 July 2007. To have an in-depth understanding

and appropriate application, associated rules that may have impact on these two revisions

have been used as reference documents.

5. Structure of the study

To achieve the above objectives, the study is divided into 3 chapters

Chapter I: “Literature review”, provides an in-depth background that covers all

theoretical issues relevant to UCP set of rules and documentary letter of credit.

Chapter II: “Key changes under UCP 600 in comparison to UCP 500”, points out

structural changes as well as key changes in UCP 600 in comparison with UCP 500. An

evaluation of improvements and remaining problems is also discussed in this chapter.

Chapter III: “Recommendations for better UCP 600 application”, based on the

findings, the chapter will put an end to the study with recommendations for main parties

involved in letter of credit transaction to suggest the best way in applying the new UCP

600.

Chapter I

Literature review

1.1 What is UCP?

The Uniform Customs and Practice for Documentary Credits (UCP) is a set of rules

on the issuance and use of letters of credit. The UCP is utilised by bankers and

commercial parties in more than 175 countries. About 11-15% of international trade

utilises letters of credit, totalling over a trillion dollars (US) each year (SITPRO Ltd,

2003).

Historically, the commercial parties,

particularly banks, have developed the

techniques and methods for handling

letters of credit in international trade

finance.

This

practice

has

been

standardized by the International Chamber of Commerce - ICC by publishing the UCP in

1933 and subsequently updating it throughout the years. Today, they have achieved

almost universal acceptance by practitioners in the countries worldwide.

It is important to note that The Uniforms and Practice for Documentary Credits

(UCP) is not law. It is private set of rules, which affects all the stakeholders involved in

letter of credit transactions if they choose to apply it. Stakeholders here refer to banks and

other institutions that issue, confirm or otherwise process L/Cs; buyers who cause L/Cs

to be issued; seller who look to L/Cs for payment; and service providers such as

forwarders, carriers, customs brokers who provide or use the documents that the credits

stipulate. Therefore, UCP is not a legal regime automatically applicable to all letters of

credit. It is just a voluntary self-regulatory rule system standardized by ICC when it is

expressly incorporated into the letter of credit.

Beside UCP, ICC Banking Commission also provides some other supplementary

publications specifying in more details the relationship between the banks themselves, i.e.

the rights and obligations of Advising, Confirming, Issuing and Nominated banks. The

latest up-to-date ones are ISBP 681 (International Standard banking Practice), eUCP 1.1

2007 (Supplementary to the Uniform Customs and Practices for Documentary Credits,

for Electronic Presentation), “Commentary on UCP 600”, ICC Banking Opinions and

many guide books for Documentary Operation as well.

1.1.1 The born of UCP 500

The considerable increase in litigation

under documentary credits and the fact that up to

50% of documents are rejected when first

presented to Banks led to ICC’s authorization of

the revision in November 1989 of UCP

Publication

No.

400

published

in

1983.

International judicial decisions and technological

innovations

were

considered

origins

and

foundation for the content of new revision. The

stated aim of this revision was to address

developments in the banking, transport and

insurance industries. It also sought to improve

the drafting of the UCP 400 in order to facilitate

consistent application and interpretation of UCP rules. A Working Group (WG) including

international banking experts, legal professors and banking lawyers was formed to draft

the proposed revision. After 4 years, with the tireless effort of WB, the final draft –UCP

500, 1993 Revision – was reached and came into effect since January 1st 1994.

In comparison with the earlier revision UCP 400, UCP 500 is more concise and

updated with 49 articles. It was divided into seven sections, which were lettered from A

to G and headed in turn: General Provisions and Definitions; Form and Notification of

Credits; Liabilities and Responsibilities; Documents; Miscellaneous Provisions,

Transferable Credit and finally Assignment of Proceeds.

After ten year of usage, UCP 500 has revealed lots of weaknesses due to the

advance in fields of global logistics and technologies which needed to be incorporated in

L/Cs. In addition, there was a high proportion of documentary rejection under UCP 500.

Seventy percent documentary discrepancy in letter of credit transaction is the statistic

collected by ICC Thailand in 2002. This fact together with the increasing demand in

international trade transaction has forced ICC to start a new revision process.

1.1.2. The born of UCP 600

The latest revision process started in 2003. A drafting group comprising nine people

together with a consulting group with forty-one members from more than 25 countries

were formed to develop proposed revisions for the ICC national committees worldwide.

In fact, it cannot be denied that no draft will satisfy everyone, thus the drafting committee

gave everyone an opportunity to express their own view by making comments.

After all the suggestions had

been considered, no matter how they

are minor or small, decision on the

new draft is taken by a voting system

and the final text of UCP 600 was

reached. The new revision replacing

the UCP 600 was approved by the

Banking Commission of the ICC at its

meeting in Paris on 25 October 2006

and had a commencement date of 1

July 2007. It is the fruit of more than

three years of work by the ICC's

Commission on Banking Technique

and Practice.

The main objective of the revision was to reduce documentary rejection by ensuring

transparence and clarity, limit potential disputes, seek to eliminate poor presentation by

beneficiaries and provide a clearer understanding of principles in UCP.

1.2 What is Documentary Credit?

Documentary credit (D/C) or Letters of Credit (L/C) has been a milestone of

international trade since the early 1900s. They continue to play a critical role in world

trade today. For any company entering the international market, letters of credit are a

payment mechanism, which help eliminate certain risks.

A letter of credit is a document issued mostly by a financial institution which

usually provides an irrevocable payment undertaking (it can also be revocable,

confirmed, unconfirmed, transferable or others e.g. back to back, revolving but is most

commonly irrevocable/confirmed) to a beneficiary against complying documents as

stated in the letter of credit. Letter of credit is abbreviated as an LC or L/C, and often is

referred to as a documentary credit, abbreviated as DC or D/C, documentary letter of

credit, or simply as credit (as in the UCP 500 and UCP 600). Once the beneficiary or a

presenting bank acting on its behalf, makes a presentation to the issuing bank or

confirming bank, if any, within the expiry date of the LC, comprising documents

complying with the terms and conditions of the LC, the applicable UCP and international

standard banking practice, the issuing bank or confirming bank, if any, is obliged to

honour irrespective of any instructions from the applicant to the contrary. In other words,

the obligation to honour (usually payment) is shifted from the applicant to the issuing

bank or confirming bank, if any. Non-banks can also issue letters of credit however

parties must balance potential risks.

Source: the free encyclopedia Wikipedia

Letter of credit is also defined by TD bank financial group as “a written instrument

issued by a bank at the request of its customers, the Importer (Buyer), whereby the bank

promises to pay the Exporter (Beneficiary) for goods or services provided that the

Exporter presents all documents called for, exactly as stipulated in the letter of credit, and

meet all other terms and conditions set out in the letter of credit. A letter of credit is also

commonly referred to as a Documentary Credit or Commercial Credit.”

In principle, letters of credit are commonly used to reduce credit risk to sellers in

both domestic and international sales arrangements. It is issued to substitute the bank's

credit worthiness for that of the customer. Basically, if you are an importer, you don't

want to send the money before you get the goods. On the contrary, the exporter does not

want to send the goods to you, unless they get their money. Therefore, an LC is a

statement of issuing bank, which tells that the buyer has the money, they gave the money

to issuing bank, once the goods arrive safely at the destination, and is confirmed to be

what it is supposed to be, this bank will give the money to the vendor. Usually, banks

play the role of the 3rd party since they are institutions recognized to be trustworthy for

this sort of thing, and they sometimes also obliged to convert the currency as well – one

of bank’s main functions. The bank will also charge a fee for the service and this is just

one of the ways banks make money in the field of international business.

However, traders should bear in mind that L/C is an independent agreement

separated from original sales contract. All parties in letter of credit transaction deal with

documents, not with goods which the documents refer. Thus, the Seller gets paid, not

after the Buyer has inspected the goods and approved them, but when the Seller presents

certain documents (typically a bill of lading evidencing shipment of the goods, an

insurance policy for the goods, commercial invoice, etc.) to his bank. The bank does not

verify that the documents presented are true, but only whether they “on their face” appear

to be consistent with each other and comply with the terms of the credit. After

examination, the bank will pay the Seller.

1.2.1. Classification

There are three basic ways to classify letters of credit including classification by

method of payment; by the manner in which the credit is issued and by other specific

features of the credit. Each type of credit has advantages and disadvantages for the buyer

and for the seller. Charges for each type will also vary. However, the more the banks

assume risk by guaranteeing payment, the more they will charge for providing the

service.

Classification by reference to method of payment

Letter of credit may be by “sight” payment, by “deferred” payment, by

“acceptance” or by “negotiation”. All the credits must clearly state whether they available

by sight payment, deferred payment, by acceptance or by negotiation.

A “sight” credit is one in which an issuing bank authorizes a seller of goods to

present documents for payment, without a bill of exchange or with a bill of exchange

drawn on it payable at sight, to the bank issuing the credit or its correspondent and

undertakes to pay the seller, or reimburse its correspondent upon the correspondent

paying the seller, against the documents presented.

A “deferred payment” credit or ussance credit follows the normal form as to

payment against documents, except that the paying bank is not called upon to pay until

some specific later date. The paying bank is, however, required to pass the documents to

its principal and may find itself under promise to pay in the future, having lost the

security of the documents. Moreover a confirming bank that makes payment to the

beneficiary before the deferred payment date without obtaining the authority of the

issuing bank does so as its peril. If , before the date for payment, it is proved that the

documents have been presented fraudulently the confirming bank cannot recover a

indemnity from the issuing bank and must pursue a claim against the beneficiary or

another fraudulent party.

An “acceptance” credit is one which a bank authorizes a seller of goods to draw a

bill of exchange on it or its correspondent in the country of the seller, and undertakes

either to the seller or an intermediary bank to accept and pay at maturity a bill drawn o it

or to pay a bill which has not been accepted by the bank on which it is drawn. It is

possible to stipulate in a credit that the issuing bank will pay a bill of exchange drawn on

the buyer in the event of non-acceptance by the buyer, but this is discouraged by the

UCP, which states that a credit should not be issued available by bills of exchange drawn

on the applicant (buyer).

A “negotiation” credit is, strictly speaking, one that authorizes the beneficiary to

draw on the issuing bank and to negotiate the draft with the intermediary bank advising

the credit or with his own or some other banks. The issuing bank’s obligation is to pay

without recourse to the drawer. The benefit of a negotiation credit is that the seller ca

discount the bills of exchange prior to the maturity date.

Classification by reference to the manner of which the credit is issued

Documentary letters of credit can be either Revocable or Irrevocable, although the

former is extremely rare. Irrevocable letters of credit can be Confirmed or Not

Confirmed.

Documentary Revocable credit may be modified or even canceled by the buyer

without the agreement of all the parties. Therefore, they are generally unacceptable to the

seller. The issuing bank gives a binding undertaking t the beneficiary provided all terms

and conditions are fulfilled. Under UCP 600 all letter of credit are irrevocable.

Documentary Irrevocable letter of credit is the most common form of credit used

in international trade. Irrevocable credits may not be modified or canceled by the buyer.

The buyer's issuing bank must follow through with payment to the seller so long as the

seller complies with the conditions listed in the letter of credit. Changes in the credit must

be approved by both the buyer and the seller. If the documentary letter of credit does not

mention whether it is revocable or irrevocable, it automatically defaults to irrevocable.

There are two forms of irrevocable credits: Unconfirmed credit (the

irrevocable credit not confirmed by the advising bank) and Confirmed credit (the

irrevocable confirmed credit).

In an unconfirmed credit, the buyer's bank issuing the credit is the only

party responsible for payment to the seller. The seller's advising bank pays only after

receiving payment from the issuing bank. The seller's advising bank merely acts on

behalf of the issuing bank and, therefore, incurs no risk.

In a confirmed credit, the advising bank adds its guarantee to pay the seller

to that of the buyer's issuing bank. Once the advising bank reviews and confirms that all

documentary requirements are met, it will pay the seller. The advising bank will then

look to the issuing bank for payment. Confirmed Irrevocable letters of credit are used

when trading in a high-risk area where war or social, political, or financial instability are

real threats. Also common when the seller is unfamiliar with the bank issuing the letter of

credit or when the seller needs to use the confirmed letter of credit to obtain financing its

bank to fill the order. A confirmed credit is more expensive because the bank has added

liability.

Classification by reference to other specific features of credit

Standby letter of Credit

This credit is a payment or performance guarantee used primarily in the United

States. They are often called non-performing letters of credit because they are only used

as a backup should the buyer fail to pay as agreed. Thus, a stand-by letter of credit allows

the customer to establish a link with the seller by showing that it can fulfill its payment

commitments. Standby letters of credit are commonly used to assure the refund of

advance payments; support the obligation of a successful-bidder to accept a contract and

to perform under the terms of the contract; back up bonds issued by insurance companies;

and stand behind a monetary obligation under a promissory note or another like

commitment (rental payments, etc.). The beneficiary to a standby letter of credit can cash

it on demand. Stand-by letters of credit are generally less complicated and involve far

less documentation requirements than irrevocable letters of credit. If the seller performs

his other obligation, there will be no need for the buyer to draw against the standby letter

of credit, which supports the obligation.

Back-to-Back letter of Credit

Back-to-back L/C is a type of L/C issued in case of intermediary trade. When one

L/C is issued as security to obtain the issuance of the second L/C covering the same

transaction, and when all terms and conditions and terms of both credits are identical,

excepts for amounts and dates in the second L/C which must be smaller and earlier, the

arrangement is defined as a back-to-back L/C. It is usually requested by middle persons

who do not have sufficient credit available at their banks to open their own L/Cs to the

ultimate suppliers. Under back-to-back L/C, the middleman will ask a bank to issue a

second L/C in favor of the ultimate suppliers, while using the L/C issued by the buyer as

collateral.

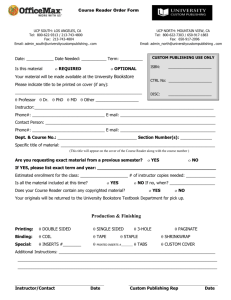

Figure 1:

Back-to-back letter of credit transaction

Many banks are reluctant to issue back-to-back letters of credit due to the level of

risk to which they are exposed, whereas a transferable credit will not expose them to risk

higher than that under the original credit.

Green clause L/C

A clause in a letter of credit enabling the seller to receive pre-shipment advances

against a collateral represented by, for example, warehouse receipts/warrants. It is

commonly used in the export of agricultural commodities, where the company may raise

funds to harvest new crops for export by pledging available stocks as collateral.

Red Clause letter of credit

Red Clause letters of Credit provide the seller with cash prior to shipment to finance

production of the goods. A red clause L/C using the term “red” is derived from the

traditional practice of writing the clause identifying this option in red ink. Upon

instruction from the buyer, the issuing bank authorizes the confirming bank to make a

cash advance to the beneficiary against the beneficiary's written guarantee that the

documents evidencing shipment will be presented in compliance with the credit terms. In

case the beneficiary fail to ship the goods or meet the credit requirements, the paying

bank looks to the issuing bank to obtain reimbursement of the amount of the advance plus

the interest charges on the advance. The issuing bank then charges the account of the

buyer--who may or may not have received the goods.

Transferable letter of credit

“Transferable’, ‘transmissible” and “assignable” convey the same meaning referring

to the same type of credit. This kind of L/C allows the seller to transfer all or part of the

proceeds of the original letter of credit to a second beneficiary, usually the ultimate

supplier of the goods. The letter of credit must clearly state that it is transferable. This is a

common financing tactic for middlemen and is common in East Asia.

Revolving letter of credit

With a Revolving letter of credit, the issuing bank restores the credit to its original

amount once it has been used or drawn down. Usually, these arrangements limit the

number of times the buyer may draw down its line over a predetermined period.

Revolving letter of credit can revolve in relation to time or value. If the credit is time

revolving, once utilized it is re-instated for further regular shipments until the credit is

fully drawn. If the credit revolves in relation to value, once utilized and paid the value

can be re-instated for further drawings.

Freely negotiable letter of credit

L/Cs which state “this credit is not restricted to any bank for payment” or such

similar words and do not indicate any particular bank who is authorized to pay, negotiate

or accept are unrestricted or open credit.

Restricted negotiable letter of credit

When any specific bank is authorized to pay, negotiate or accept, the credit is called

restricted or special credit.

1.2.2. The mechanics of letter of credit transaction

The mechanics of the letter of credit transaction can be quite complex and has been

standardized by a set of rules published by the International Chamber of Commerce

(ICC) under the Uniform Customs and Practice for Documentary Credits (UCP).

The basic letter of credit transaction has two sides: an import side (the buyer) and an

export side (the seller). Both sides ordinarily have a bank, which makes a total four

parties to the transaction. The bank on the importer or the buyer’s bank normally issues

the letter of credit, which obligates the bank to honour upon the receipt of the specified

documents. Letter of credit rules typically describe the importer as the applicant and the

applicant’s bank as the issuing bank or the issuer of the letter of credit. The fees differ

significantly from market to market and from customer to customer . Indeed, better

customers paying much less. Alternatively, the bank on the exporter or seller’s bank

plays a different role. The seller hopes to receive the funds offered by the letter of credit

as payment for shipment, and is thus identified as the “beneficiary” of the letter of credit.

Because the beneficiary and applicant ordinarily are in different countries, the beneficiary

often has its own bank oversea and then forwards the documents to seek payment from

the issuer when the seller ships goods. The beneficiary’s bank normally assumes one of

two roles: if it only ‘advises’ the beneficiary of the issuance of letter of credit, it just

processes the documents and has no direct liability on the letter of credit; besides, it

might “confirm” the letter of credit, in which case beneficiary’s bank directly obligates

itself on the letter of credit, pays the beneficiary directly, and then forwards the

documents to the issuer for reimbursement.

The following is the basic set of steps used in a letter of credit transaction. Specific

letter of credit transactions follow somewhat different procedures.

Step 1. An Importer {Buyer) and Exporter (Seller) agree on a purchase and sale of

goods where payments is made by letter of credit.

Step 2. The Importer completes an application requesting its bank (issuing bank) to

issue a L/C in favor of the Exporter provided that the Importer must have a line of credit

with the issuing bank in order to request that a letter of credit be issued.

Step 3. The issuing Bank issues the letter of credit and sends it to the Advising bank

by telecommunication or registered mail in accordance with the Importer’s instructions.

A request may be included for the Advising bank to add its confirmation. The Advising

Bank is typically located in the country where the Exporter carries on busiess and may be

the Exporter’s bank but does not have be.

Step 4: The Advising bank will verify the letter of credit for authenticity and send a

copy to the Exporter. Figure 2 illustrates the typical transaction

Figure 2:

Issuance of letter of credit

Step 5. The Exporter examines the letter of credit to ensures that it corresponds the

the terms and conditions in the purchase and sale agreement, documents stipulated in the

letter of credit can be produced and the terms and conditions of the letter of credit may be

fulfilled.

Step 6. If the Exporter is unable to comply with any terms and conditions of the L/C

or if the L/C differs from the purchase and sale agreement, the Exporter should notify the

Importer and request an amendment to the L/C.

Step 7. When all the parties agree to the amendment, they are incorporated into the

terms of the L/C and advised to the Exporter through the Advising bank. It is not

recommended that the Exporter does not make any shipments against the L/C until the

required amendment have been received.

Step 8: The Exporter arranges for shipment of the goods, prepares and/or obtain the

documents specified in the letter of credit and makes demand under the letter of credit by

presenting the documents within the stated period and before the expiry date to the

‘available with” bank. This may be the Advising/Confirming Bank. That bank check the

documents against the letter of credit and forwards them to the Issuing Bank. The

drawing is negotiated, paid or accepted as the case may be.

Step 9. The Issuing Bank examines the documents to ensure they comply with the

letter of credit terms and conditions. The issuing bank obtains payment from the Importer

for payment already to make the “available with” or the Confirming bank.

Step 10. Documents are delivered to the Importer to allow them to take possession

of the goods from the transport company. The trade cycle is complete as the Importer has

received its goods and the Exporter has obtained payment. Figure 3 will illustrate the

payment process.

Figure 3: Payment under a letter of credit

1.2.3. Parties involved in a letter of credit transaction

In the process of a letter of credit transaction, there are essentially five parties

involved: importer, exporter, importer’s banks, exporter’s banks and service providers. In

general, except for importer, exporter and service provider, there are nine functions

concerning letter of credit transaction, which banks can undertake. It does not mean that

each documentary credit transaction requires all those actions. It depends on requirements

of the sales agreement, relationship between importer and seller as well as relationship

between the two parties in commercial contract and their banks to choose or skip some

certain phases without affecting the principles of original sales arrangement.

Applicant

The party who applies to the opening (issuing) bank for the issuance of a letter of

credit. Normally, it is the buyer or importer.

Beneficiary

The party in whose favor the letter of credit has been established. The beneficiary is

the party who demands payment under the letter of credit.

Service providers

Service providers in letter of credit transaction include forwarders, carriers, customs

brokers who provide or use documents that credits stipulate.

Issuing bank (Opening Bank)

The bank issues the letter of credit on behalf of the applicant.

Confirming bank

A bank that at the request of the issuing bank, assures that drawings under the credit

will be honored (provided the terms and conditions of the credit have been met).

Advising bank

The party gives notification of the terms and conditions of a letter of credit to the

beneficiary (seller). The advising bank also takes reasonable care to check the apparent

authenticity of the letter of credit, which it advises.

Accepting bank

The bank named in a letter of credit on whom term drafts are drawn and who

indicates acceptance of the draft by dating and signing across its face, thereby incurring a

legal obligation to pay the amount of the draft at maturity.

Paying bank

The bank authorized in the letter of credit by the issuing bank to honor sight or

deferred payments under the terms specified in the credit. If this bank is the advising

bank, it has no obligation to honor documents; however, if this is a confirming bank, it is

obligated to pay against complying documents.

Drawee bank

The bank on which the drafts specified in the credit are drawn and from which

payment is expected.

Discounting bank

A bank, which discounts a draft for the beneficiary after it, has been accepted by an

accepting bank.

Negotiating bank

Bank, other than the issuing bank, which elects to "negotiate" (advance funds or

give value to the beneficiary) against presentation of complying documents.

Reimbursing bank

The bank authorized by the issuing bank to reimburse the drawee bank or other

banks submitting claims under the terms of the credit.

Presenting bank

The bank forwards the documents directly to the issuing bank to obtain settlement.

Transferring bank

A bank authorized by the issuing bank as specified in the credit that can transfer the

issuing bank's documentary credit from one beneficiary to another at the request of the

first beneficiary.

Chapter 2

Key Changes under UCP 600 compared

to UCP 500

2.1. Changes in Structure of UCP 600 compared to UCP

500

The new rules UCP 600 is more concise than its predecessors with 39 articles as

opposed to 49 articles in UCP 500. It is not divided into the same seven sections as the

UCP 500, which were lettered from A to G and headed in turn: General Provisions and

Definitions, Form and Notification of Credits, Liabilities and Responsibilities,

Documents, Miscellaneous Provisions, Transferable Credit and finally Assignment of

Proceeds.

Despite the fact that the UCP 600 does not expressly follow this allocation of

Articles by subject- master, it is still possible to divide those Articles up. The framework

of the UCP 600, which provides specific background on General Provisions and

Definitions, is stipulated in article 1-5. Article 6-13 specify the structure of a

documentary credit and obligations of parties under documentary credits including

issuance, advising, confirmation, amendments, availability and nomination. The next six

articles from Article 14 to 18 and article 28 look at two difference aspects including the

compliance of the documents and the definition of an original document. Requirements

of the UCP 600 regarding transport documents, standard for checking documents as well

as insurance provisions are itemized in articles 19-27. From Article 29-37, these nine

rules cover solutions for potential problems arisen during the process of the sales contract

implementation, which includes extension, tolerance, partial shipment, installments,

disclaimers, force majeure. The two remaining articles regulate the transferable credits

and assignment of proceeds.

2.1.1. UCP 500 articles not included in UCP 600

There are 5 articles of UCP 500 that have not covered in UCP 600. Article 8 and

part of Article 6 refer to revocable letters of credit. The limited usage of such instruments

in today’s letter of credit business led to the general viewpoint that there was no necessity

to remain in UCP 600. If an applicant or bank desire to use a revocable credit in the

future, they have two options: using the credit subject to UCP 600 and incorporate all the

conditions applicable to the revocability; or using the revocable credit subject to UCP

500 provided that all parties are in agreement to the usage of those rules.

Article 5 (Instruction to issue/ Amend Credits). This article is related to instructions

to issue and amend credits, which was seen as an article stated the obvious. Instructions

for the issuance of a credit and an amendment as well as the credit and the amendment

themselves must be surely complete and precise in order to make payment, acceptance or

negotiation. In addition, the absence of a specific rule in UCP 600 concerning the

instructions to issue and amend credits does not relieve Issuing banks from their duty of

care for the proper creation, completeness and content of their credit or any amendment

(if any).

Article 12 (Incomplete or Unclear Instructions) covered the issuance of preface

notification, by the Advising Bank, in the event a credit or an amendment was incomplete

or unclear in its terms. If a credit is received that is unworkable or incomplete, there is no

need for a rule to instruct Advising Bank that they should seek clarification or request a

complete message. Therefore, it is not necessary to provide a rule that the Issuing Bank

must give the appropriate information “without delay”. Similarly, the absence of a

specific rule in UCP 600 with regard to Incomplete and Unclear Instructions does not

relieve the Issuing Bank for their duty of care for the proper creation, completeness ad

content of their credit or any Amendment too.

Finally, Article 38 under the heading “Other Documents” was removed at a very

early stage of the revision process. The usage of this article’s content was considered

marginal because the basic for the issuance of any credit is that it will specify the type of

document that is required for the presentation and its content. If a condition such as a

verification of certification of weight is required, the the credit should specify the form

and documents in which such information is to present.

In addition, there are some content of 12 articles consisting of article 2, 6, 9, 10, 20,

22, 30, 31, 35, 36, 46, 47 that were moved or merged with other articles in UCP 600. The

rationale behind those changes will be explained further more in the following chapter

focusing on analyzing the changes in one-by-one articles.

2.1.2. New articles for UCP 600

There are 6 articles that are not found in UCP 500. They are Article 2 (Definitions),

Article 3 (Interpretations), Article 9 (Advising of Credits and Amendments), Article 12

(Nomination), Article 15 (Complying Presentation) and Article 17 (original documents

and Copies). Each of these will be covered right after in the subsequent section.

2.2. key Changes under UCp 600 compared to UCP 500

2.2.1. Changes application method

The UCP 500 provided that it applied to all documentary credits where

“incorporated into the text of the credit”. Courts, however, would generally found that

this provision was not forceful enough and these rules would apply when expressly stated

or by implication. The UCP 600 more clearly states that it applies only “when the text of

the credit expressly indicates that it is subject to these rules”.

More significantly, with regard to modification and exclusion of its terms, UCP 500

only provided that its terms applied “unless otherwise expressly stipulated”. In contract,

the UCP 600 clearly stipulates that the rules applied “unless expressly modified or

excluded by the credit”. It opens to exporters and importers to modify or exclude the

provisions of UCP 600 expressly and thus they can even continue with the provisions of

UCP 500 if they choose. The application of UCP 600 give more contractual freedom and

autonomy to parties because if there is an express exclusion of UCP 600 and parties

include their own provisions, any conflict between the express provisions and UCP 600

will be resolved in favor of the former instead of UCP 600 rules.

2.2.2. Changes in Definitions and interpretations

The big difference between UCP 500 and UCP 600 is the precision of the language

in the new rules makes them easier to read and understand, especially for people whose

daily life is not concerned with L/C world. Article 2 (Definitions) and Article 3

(Interpretations) provide general background on series of expressions which are

considered the international language of the L/C world.

UCP 600 introduces in Article 2 the following new definitions: Advising Bank,

Applicant, Banking day, Beneficiary, Complying Presentation, Confirming Bank,

Honour, Issuing Bank, Negotiation, Nominated Bank, Presentation and Presenter which

are absent in UCP 500. Other definitions found in UCP 500 also moved to this Article

with several modifications making them more clearly and precise such as “Credit” and

“Confirmation”. UCP 600 defines credit in Article 2 as “any arrangement, however

named or described, that is irrevocable and thereby constitutes a definite undertaking of

the issuing bank to honour a complying presentation” This simple definition is an

improvement on the earlier definition and uses new term such as Honour and Complying

Presentation which are also defined in this Article.

“Honour” is considered a new word in the documentary credit banking language

that is borrowed from the US law. It is used to group together three types of payment

known to trade-finance namely “ to pay at sight if the credit is available by sight

payment”; or “ to incur a deferred payment undertaking and pay at maturity if the credit

is available by deferred payment”; or “to accept a Bill of exchange (draft) drawn by the

Beneficiary and paying at maturity if the credit is available by acceptance”. All these

actions are merged under one concept –“Honour”. Accordingly, instead of speaking of

paying at sight or at maturity or incurring a deferred payment or negotiation, now under

UCP 600 we would only speak of honour or negotiation. The term “Honour’ covers three

types of payment methods that are already in practice. In addition, definition of honour

helps us to distinguish a payment under negotiation credit from an honour.

The expression “Complying presentation’ is also a modification of what UCP 500

says “in compliance with the terms and conditions of the credit”. This alternative concept

not only means a presentation that is in accordance with the terms and conditions of the

credit but also is considered the applicable provisions of the rules and international

standard banking practice.

Among new definitions, the most remarkable one, which received lots of critical

attention, is “Negotiation”. From the definition of UCP 500 identifying “negotiation

means the giving of value for draft(s) and/or documents to the bank authorized to

negotiate”, different interpretations were given but overall consensus on the meaning of

“negotiation’ has not reached. A number of banks failed to understand the meaning of the

term in connection with the L/C transaction because the phrase “giving of value” may be

interpreted as either making immediate payment or undertaking an obligation to make

payment. The new UCP redefines “negotiations in Article 2 as “the purchase by the

nominated bank of draft (drawn on a bank other than the nominated bank) and/or

documents under a complying presentation, by advancing or agreeing to reimbursement

funds to the beneficiary on or before the banking day on which reimbursement is due to

the nominated bank”. The language of this new definition is clearer and more specific

than the old one. This is a kind of prepayment by the Nominated Bank if the credit is

available by negotiation. Once, the Nominated Bank has negotiated (prepaid) the credit

against complying presentation, the Issuing Bank has obligation to reimburse the

nominated bank under Article 7 of UCP 600. Negotiation credit may use time bills and if

the nominated bank agrees to negotiate, the exporter can get paid before maturity date.

In Banking day definition, there are two points: a day that “bank is regularly open”

and “at the place at which an act subject to the rules is to be performed”. A bank may

regularly open Mondays to Saturdays but its trade department is only open Mondays to

Fridays. Thus, in this context, a banking day would be any day between Monday to

Friday. National holidays would be a day on which a bank regularly be open.

UCP 600 has a new article named “Interpretations” which contains all sub-articles

in UCP 500 relating to interpretation. They are Singed; Legalized; Branches; First-class;

Prompt; On or About; To and Until; From and after; First half and second haft;

Beginning, middle and end. Besides, UCP 600 added two new interpretations on Single

or Plural and the default position of irrevocable letter of credit.

2.2.3. Changes in types of credit

As mentioned, there is a significant change in UCP 600 in terms of L/C

classification. UCP 500 provided that a L/C could be either irrevocable or revocable. If it

was silent, it is would be assumed to be irrevocable. UCP 600 also remains the same

preference for the irrevocable credit. However, it goes in more details by making it

clearer that an irrevocable letter of credit is deemed as the default status: “A letter of

credit is irrevocable even if there is no indication o that effect”. Accordingly, it continues

to expressly provide that a credit cannot be cancelled without the agreement of the seller.

In spite of the fact that the parties can still open a revocable letter of credit, they will need

to ensure that those terms in the UCP 600 that are inconsistent with a revocable credit are

expressly deleted or amended.

In terms of availability of L/C, there are four types of credits in UCP 600. They are

sight payment credit, deferred payment credit, acceptance credit and negotiation credit.

The Article 6b identifies that a credit must state whether it is available by sight payment,

deferred payment, acceptance or negotiation. Once an L/C is issued in any one of the

above methods, it is an authorization to honour or negotiate. However, Article 12(a)

states clearly that an authorization to honour or negotiate does not impose any

implication of the Nominated Bank to honour or negotiate, unless that Nominated Bank

expressly agrees to do so. If it agrees to undertake any one of the two methods of

payment, payment should be at maturity. Nevertheless, Article 12(b) enables the

Nominated Bank to prepay. Previously, only Confirming Bank can make prepayment and

Nominated Bank is just allowed to incur a deferred payment undertaking. Now,

Nominated bank is authorized both to incur such an undertaking and to make

prepayment. This would give banks more additional concern. On the other hand, with this

stipulation, not only negotiation credits but also acceptance and deferred payment credits

can be negotiated or prepaid by Nominated Bank.

2.2.4. Changes in time required for examination of documents

Under the UCP 500, the procedure set out under Article 13(b) is that a bank must

complete its examination of the documents in a “reasonable time not exceeding seven

banking days” and “without delay”. The question has arisen that how reasonable time is

for the banks to discover a discrepancy. For example, the bank informed the seller of

discrepancies six days after the presentation of the documents, and the seller argued that

this was not a “reasonable time”. Although the bank is enabled to consult the applicant

before it reaches decision, the time spent on the process does not reach the ultimate dead

line of seven days. Therefore, it was suggested that the reference to “a reasonable time

not exceeding seven banking days” should be replaced by a fixed time limit; and five or

just three days were thought to be adequate. The UCP 600 now stipulates a fixed period

of five banking days for bankers’ examination process and refusal of documents. This

new regulation, beside the advantage of reducing time for banks to process documents,

has revealed its short-coming. Indeed, the fixed period of “five banking days” will make

bank use automatically five banking days even if they may pay earlier since there is no

breach if they choose to take advantage of the full five-day period.

2.2.5. Changes in addresses of of beneficiaries and applicants

The UCP 600 under Article 14(j) states when addresses of beneficiaries and

applicants must be the same as in the credit. This article allows address of the seller and

or buyer on the invoice need no longer be as mentioned in the documentary credit. It

must, however, in the same country. Contact details such as phone, fax numbers may be

disregarded and if stated they need not as in the credit. An exception to this is when the

address and the contact details are used in the transport documents as part of the

consignee or notify party. In that case, they must be as stated in the L/C. This would give

some advantage to trading parties when Back-to-Back or transferable L/C is used in

transactions having intermediary involved.

2.2.6. Changes in refusal notice

There are two points in UCP 600 that should be pay attention to regarding the

refusal notice. UCP 600 states that refusal notice must state that the bank is refusing to

negotiate or honuor (sub-Article 16(c) (i)) while UCP 500 implies such a requirement.

Besides, UCP 600 allows refusal notice to state that “the issuing bank is holding the

documents until it receives a waiver from the applicant and agrees to accept it, or receives

further instructions from the presenter prior to agreeing to accept a waiver” while under

UCP 500, it is not allowed. This article allows seller to provide instructions on how the

discrepant documents should be dealt with when Issuing Bank rejects them. This, to some

extents, would give the seller some control over the discrepancies especially when

dealing with high value contract.

2.2.7. Changes in transport documents

The transport articles of UCP 600 are covered by articles 19-25. When UCP 500

was born, the transport articles increased from two articles (one covering sea and the rest

covering all other forms of transports) to individual transport articles covering the more

poplar means of shipment or despatch. UCP 500 articles 23-29 sought to standardize the

way in which the individual requirements would be expressed and to bring some

commonality to their structure. With UCP 600, this process went even further to not only

look at changes in transport industry practices but also at common standards for signing

parties and authority, requirements for on board notations and transhipment provisions.

In general. reference to “unless otherwise stipulated in the credit” no longer

appears in the articles. Transport documents, except Charter Party Bills of Lading and

Courier Receipts, Post Receipts or Certificates of Posting, must indicate the name of the

carrier (in the same manner as was required under UCP 500). The transport articles no

longer make reference to “on its face” (except for one place in sub-article 14(a)).

A consistent and standard style for signing transport documents should indicate the

name of the carrier and be signed by the carrier or a named agent for or on behalf of the

carrier, or the master or a named agent for or on behalf of the master. Any signature by

the carrier, master or agent must be identified as that of the carrier, master or agent. Any

signature by an agent must indicate whether the agent has signed for or on behalf of the

carrier or the master. Where an agent signs for or on behalf of the master under articles

19- 22, there is no longer any need to add the name of the master. These articles no

longer make reference to vessels propelled by sail, yet they add reference to “at the place

stated in the credit” or “at the port of loading stated in the credit” to reflect that the bank

needs to be able to ascertain, from the transport document, that the goods have been taken

in charge, dispatched or shipped on board at the place or port stated in the credit

Each transport article in UCP 500 contained reference to “in all other respects meets

the stipulations of the credit”. With UCP 600, this is not repeated in the transport articles

as the principle is captured in the definition of “Complying presentation” in article 2.

2.2.8. Changes in some other articles

Discount of deferred payment undertaking under Article 7c, 8c and 12

Nomination of a bank includes authorizing a bank to prepay or purchase. This has

also been included in Article 7 Issuing Bank Undertaking and Article 8 Confirming Bank

Undertaking.

Sub-Article 7 (c) provides the reimbursement undertaking for the issuing Bank. It

stipulates that when the nominated bank has acted and the issuing bank must reimburse

when a complying presentation is made. Next, it continues emphasizes that

reimbursement is due at maturity, under an acceptance or deferred payment credit,

whether or not the nominated bank has prepaid or purchased. Lastly, it focuses on the

obligations of the issuing bank undertaking in relation to nominated bank (to reimburse

where they act) and a beneficiary (where they may present documents directly or

nominated bank does not act). Sub-article 8(c) showing reimbursement obligation of

confirming bank to any nominated bank (if any) is exactly the same text as that which

appears in sub-article 7(c), except the word “confirming” replaces ‘issuing”.

Article 12 - Nomination adds a new concept specifying the ability of a nominated

bank to pre-pay or purchase under an acceptance or deferred payment credit. It states ‘By

nominating a bank to accept a draft or incur a deferred payment undertaking, an issuing

bank authorizes that nominated bank to prepay or purchase a draft accepted or a deferred

payment undertaking incurred by that nominated bank’. This represents a major change

in scope of the UCP. Previously, UCP has not

involved in the area of financing.

However, due to recent court cases (including Banco Santander Vs. Banque Paribas,

Canada Bank Vs. Credit Lyonnais), under sub-article (b), UCP 600 provides that when a

documentary credit is available with a nominated bank by acceptance or deferred

payment, such issuance includes an authority for nominated bank to prepay or purchase,

providing that the nominated bank agrees to accept a draft or incur a deferred payment

undertaking. Now, the courts will now recognize the issuance of such a documentary

credit conveys an explicit authority to discount. This article provides an authority for the

nominated bank prepay or purchase, not an obligation to do so.

Discrepant documents, Waiver and Notice under article 16

This article describes the requirements for banks when they determine that the

presentation does not comply. An issuing bank may still approach an applicant for waiver

of any discrepancies, prior to sending a refusal notice. Sub-article (c) outlines the

structure of a required refusal notice. Sub-article (c) (iii) provides four options regarding

the status of documents while under UCP 500, only two actions of banks are mentioned

when sending notice, which are holding the documents pending further instructions from

the presenter or returning documents. The two added options for banks to dealing with

discrepancies are holding the documents until receiving a waiver from the applicant, or

receiving further instructions from the presenter prior to agreeing to accept a waiver; and

acting in accordance with instructions previously received from the presenter.

Original documents and copies under article 17

In this article, sub-article (b) and (c) have been taken from ICC Decision paper

publicized in 1999. Sub-article (b) describes how a document is an original and subarticle (c) defines how a document may be created as an original. Sub-article (a)

emphasizes that when a credit requires a document in the singular then this document

must be presented as an original. Sub-article (d) provides that originals may be presented

when copies are requested. This situation arises where a beneficiary may be required to

present a document in four copies. To meet this requirement, the beneficiary may create

one original invoice and then photocopy it three times or print four copies and sign each

one manually.

Insurance documents under article 28

Previously in UCP 500 Article 34 Insurance Documents; Article 35 Types of

Insurance Cover; Article 36 All Risks Insurance Cover. In this article, insurance

document must be issued and signed by an insurance company, an underwriter or their

agents or their proxies. Cover notes will not be accepted (previously cover notes issued

by brokers). The Insurance document must indicate that risks are covered at least between

the place of taking in charge or shipment as stated in the credit and the place of discharge

or final destination as stated in the credit. Amount of insurance coverage must be at least

110% of the CIF or CIP value of the goods. An insurance document may contain

reference to any exclusion clause.

Partial drawings or shipments under article 31

Partial shipments occur when the goods are loaded in more than one vessel, aircraft,

truck, ect. It should be noted that partial shipments could not be considered through the

number of transport documents that are issued. On the other hand, if it is only one

transport document is presented, it does not necessarily reflect that a partial shipment has

not occurred. When the goods are loaded in the same vessel for the same journey or

destination, it will not be regarded as a partial shipment, even when separate bills of

lading are issued covering the loading of goods on different date. For example, the credit

covers shipment of 50MT of rice and partial shipment is not allowed. Bills of lading

covering in the same vessel are issued as followed: 127 May-20MT, 28 May-20MT and

28May-10MT. Sub-article (b) indicates that the latest bills of lading (29 May) will be

considered as the date of shipment. Therefore, when a credit requires shipment by truck

and does not allow partial shipment, the beneficiary must ensure that the goods are

capable of being loaded in the truck. If more than one truck is needed, if will considered

as being a partial shipment even if they are leave on the same day for the same

destination.

Disclaimer on transmission under article 35

This article includes a new rule with regard to the loss of documents in transit

between a nominated bank and the confirming bank or issuing bank. The basis for this

rule is to avoid the situation when an issuing bank states that “we will reimburse the

nominated bank upon receipt of documents” and if the documents are not received, they

will have no liability to reimburse.

When a beneficiary presents documents that the nominated bank finds to comply

with the terms and conditions of the credit, the confirming or issuing bank must honour

or negotiate regardless of the nominated bank honours or negotiates, or the documents are

sent to the confirming bank, issuing bank or lost in transit.

2.3. Improvements and remaining problems under UCP 600

2.3.1. UCP 600’s improvements

After ten year of usage, UCP 500 has revealed lots of weaknesses and led to a high

proportion of documentary rejection. Seventy percent documentary discrepancy in letter

of credit transaction is the statistic collected by ICC Thailand in 2002. This fact along

with the increasing demand in international trade transaction have forced ICC to start the

revision process in 2003 and UCP 600 was born three years later. Right from the drafting

time, UCP 600 has received lost of comments, which are not merely from the LC

community. That is to say, UCP 600 rules are the fruit of the tireless efforts and constant

innovation of ICC Commission on Banking Technique and Practice (Banking

Commission) in general as well as the Drafting Group from twenty-six countries all over

the world in particular. The most significant achievements of UCP 600 are concise and

complete content, logic structure and easily understandable language in comparison with

its predecessor UCP 500.

In terms of content, UCP 600 has constituted by 39 articles as opposed to 49 articles

in UCP 500. The reduction in the number of articles does not means that UCP 600 rules

do not cover full aspects in L/C transaction as stipulated in UCP 500. On the contrary, by

being moved unnecessary articles and added essential provisions, 39 articles has provided

a more comprehensive content to avoid discrepancies in documentary presentation due to

inadequate stipulations.

Along with the conciseness, there are significant changes in the structure. Unlike

UCP 500, UCP 600 is not divided into seven sections, which were lettered from A to G

and headed in turn: General Provisions and Definition, Form and Notification of Credits,

Liabilities and Responsibilities, Documents, Miscellaneous Provisions, Transferable

Credit and finally Assignment of Proceeds anymore. Instead of allocating articles by

subject-master, UCP 600 just numbers articles from 1 to 39. Besides, order of certain

articles as well as sub-articles has been changed to meet the requirement that provisions

concerning the same effect and the same content are placed together. For example, under

UCP 500, provisions regarding “General Expression as to Dates for Shipment” and

“Dates Terminologies for Periods of Shipment” stipulated in Article 46 and 47

respectively are now moved to UCP 600 Article 3 stipulating Interpretations. Next,

Article 14 named “Standard for Examination of Documents” in UCP 600 contains all

requirements for Documents issued and presented, which were previously allocated in

series of articles including Article 13 (Standard for Examination of Documents), Article

21(Unspecified Issuers or Content of Documents), Article 22 (Issuance Date of

Documents v. Credits) and finally Article 43 (Limitation on the Expiry Date). In addition,

there are many other sight modifications in terms of structure making the new draft more

systematically and logic.

With the regard to language, UCP 600 has achieved a considerable progress when

using precise, explicable definitions as well as interpretations making the set of rules

easier to understand and follow, even for people whose everyday life do not have a close

relation with the L/C world. In addition, the clear language also helps to reduce

arguments and disputes relating to the way to interpret and apply these rules in practice.

UCP 600 introduces in Article 2 a number of definitions, most of which are newly added

(namely Advising Bank, Issuing Bank, Confirming Bank, Nominated Bank, Negotiation,

Honour, Banking Day, Complying Presentation, ect); or modified in a more simply way

such as “Credit” definition. Interpretations on terms or words appearing frequently in

letters of credit also explained more clearly and sufficiently in Article 3 under UCP 600.

2.3.2. Remaining problems in UCP 600

In fact, no rule can satisfy everyone, especially for internationally applied ones like

UCP, the draft UCP 600 is also not an exception. Despite the Drafting Committee gave

everyone opportunities to express their own point of view, the final draft is reached

subject to a “yes” or “no” voting system, solely based on the content of that draft. If the

majority vote is positive, then the UCP will take effect. As the result, there are several

shortcomings in the content of the new revision, which continue to cause concern for

stakeholders involved in L/C transaction.

Instructions to documentary discrepancies under Transferable Credits

There is no article found in UCP 600 giving instructions to deal with documentary

discrepancies as to Transferable Credits. Or, at least, there should be a provision stating

that all the documentary discrepancies under Transferable Credit transaction would be

handled as for non-transferable L/C, in particular, making a reference to Article 16 under

UCP 600. The absence of such position may lead to the failure in achieving the uniform

in dealing with this problem between banks, countries or between different cases that is

contrary to the spirit of UCP rules.

Description of goods

Next, there are some issues remain unresolved relating the description of goods on

the commercial invoice. The problem with the description of the goods on the

commercial invoice is the level of accuracy demanded by the UCP rules, and this mainly

leads to documentary discrepancies in L/C transaction. In fact, there is no change in the

content of the provision on commercial invoice, except for the change in position from

Article 37 in UCP 500 to article 18 in UCP 600. It states “The description of the goods,

services or performance in the commercial invoice must correspond to that appearing in

the credit”. From the exporter’s point of view, one of the most crucial steps is the

presentation of documents to receiving bank to get payment. However, banks will decide

whether payment is made or not, mainly basing on checking documents presented by the

exporter, not by specifying goods. Among many required documents, commercial invoice

is the most vital one because there are a number of parties who rely on it to perform their

duties. Banks do not expect the description of goods to be laid out exactly as shown in the

L/C, but the data elements contained in the invoice must be match to the L/C. In other

words, the sequence or the order of the details may different. The problem lies in the

way banks understand the word “correspond”. For example, a spelling error between

commercial invoice and letter of credit, regardless of how minor ad irrelevant this error

may be, still enables banks opportunities to reject documents presented and decide to

dishonour. In addition, trend of “inventing discrepancies” now becomes a commonplace

with banks who want to utilize the cash flow of the exporters. This due to the fact that reexamination of documents represented not only creates a considerable fees but also

causes longer settlement periods since no funds are transferred until the documents are

re-examined and finally accepted. This situation will make negative impact on the

exporter’s cash flow and even increase the rate of documentation error.

Confirmed letter of credit

There are two points of caution need to be made. First, while the UCP 600 clearly

favour irrevocable over revocable credits, there is no similar assumption in favour of

confirmed credits. From a seller’s perspective, of course, a confirmed credit brings the

advantages of “a definite undertaking of the confirming bank, in addition to that of the

issuing bank”: Thus, “confirmation” is defined in Article 2 without assuming that all

credits will be confirmed where they do not say otherwise. Consequently, if a seller wants

to impose upon his buyer an obligation to organize the opening of a confirmed letter of

credit, he must impose such an obligation in the sale contract (e.g. “Payment by

irrevocable letter of credit to be confirmed by first class bank acceptable to the

Sellers…”) and – when he receives the letter of credit – to make sure that it has been

confirmed by an acceptable confirming bank.

Secondly, going back to revocable credits, although the UCP 600 have been clearly

in favour of irrevocable credits, the new Rules have not made it impossible for revocable

credits to be opened. It must be remembered that Article 1 of the UCP 600 allows parties

to credits (and the parties who first generate the credit are, of course, the buyer as

applicant and the issuing bank) to modify or exclude any part of the Rules. It is

consequently still possible for a buyer to apply for the opening of a revocable credit and

there is nothing in the UCP 600 which makes that credit inoperable. Therefore, it remains

prudent for sellers to continue to stipulate in their sale contracts that the buyer will open

an irrevocable letter of credit – and, of course, to make sure when the credit arrives that it

incorporates UCP 600 or expressly describes itself as irrevocable.

Instruction to clear and complete letter of credit

The UCP 500 had contained, in Article 5, helpful advice to buyers when applying

for the opening of a letter of credit: to give complete and precise instructions to the

issuing bank, to avoid excessive detail in those instructions, and to avoid opening one

credit by referring to instructions given in an earlier one. There is now no equivalent of

Article 5 in the UCP 600. This is together with a general move in the new UCP Rules

towards retaining only those Articles which actually impose a duty or lay down a

principle, omitting Articles which simply set out best practice. Does the omission of the

old Article 5 mean that the advice there given is any less helpful to the smooth running of

credits? The answer is that this advice is still worth. Instructions need to be clear without

being too detailed. In fact, the more detail in the letter of credit, the more likely it will

become a mechanism for delaying rather than facilitating payment. However, traders

must remember that banks do not look at the commercial value of the documents. For

instance, a credit requiring simply an “Inspection Certificate” would be satisfied by an

Inspection Certificate recording the goods to be unfit for human consumption. In this

situation, bank has no right to refuse such “Inspection Certificate” because there is no

provision in the L/C stipulating how the quality of goods must be. Therefore, the credit

must call for “An Inspection Certificate confirming the goods are fit for human

consumption” or “An Inspection Certificate confirming that goods comply with the

following specifications … ” if the credit is to protect the buyer.

Standard for examination of documents

The last but not the least is the problem concerning the standard for examination of

documents. The undertaking of bank to pay under a letter of credit transaction lies on the

documentary compliance. Then, standard for deciding complying presentation is based on

a combination of different definitions given by UCP rules. Article 2 defines that

“Complying presentation means a presentation that is in accordance with the terms and

conditions of the credit, the applicable provisions of these rules and the standard banking

practice”. There is nothing in the article means that international banking practice is

necessarily the ISBP alone. Even when L/C clearly refers to ISBP, this publication still

stops in “guideline” status and lack of real authority. Moreover, it would be possible for

any bank to develop its own “standards”. As the result, the uniformity of UCP rules

would be break-downed and risks in international payment would increase.

Additionally, the expression “on their face” in relation to the checking of documents

for compliance has been remained, despite the fact that the “no” votes had overcome the

“yes” opinion. This expression has created arguments because of its unclear meaning, not

only in English but also in other language. For instance, there is no equivalent concept in

the French language. It appears that the ICC Drafting Group has ignored the demand for

change to this article despite of the obvious difficulties in implementing its requirements.

Chapter III

Recommendations for better UCP 600

application

It is clearly that the UCP set of rules has been standardized by ICC to affect parties

involved in documentary credit transaction. The word “parties” here mainly refer to

banks and other institutions that issue, confirm or otherwise process them; buyers or

applicants who cause L/C to be issued and finally sellers or beneficiaries who look to L/C

for payment. To ensure a letter of credit is workable, trouble-free and provides security of

payment, it is essential to take simple and effective precautions at the start. Wellpreparation for all steps relating to L/C will help to reduce discrepancies and associated

unplanned costs for parties, especially the exporters. Statistics have shown that well in

excess of fifty percent of documents presented by exporters to banks for payment under

letters of credit are rejected on first presentation. This can cause expensive delays for

both the exporter and the importer and may even result in a lesser payment or no payment

at all. A great many of those rejections could be avoided if more care was taken to ensure

that the documents called for in the credit are properly completed.

3.1.

Recommendations

for

exporters

involved

in

L/C

transaction

In principle, it is for the exporter to provide the definitive “yes” or “no” as to

whether a letter of credit and required documents are in a workable form. It is imperative

that, upon receipt of the credit or amendment, a full review is undertaken to ensure that

the conditions meet those agreed or envisaged. Exporters should follow four key steps to

ensure payment when receiving a letter of credit issued in the favour of themselves which

include checking detailed content on receipt of the letter; preparing documents for

presentation to the bank; presenting documents to the banks without delay and within the

expiry date and transport documents time limit; and finally dealing with discrepancies.

3.1.1. Checking detailed content on receipt of the letter

First of all, exporters should make sure that the letter of credit states it is subject to

the 2007 revision of the Uniform Customs and Practice for Documentary Credits (UCP)

of the International Chamber of Commerce (here referred current revision UCP 600). He

also recommended to recognize the authenticity of the credit. If exporter is still unclear as

to what the wording of the credit implies, he should check what UCP 600 has to say on

the point and with its bank. Normally, credits are sent through an Advising or a

Confirming bank. Any departure from this routine should be viewed with suspicion, for

example if it comes to the exporter direct from overseas or if he do not recognize the

Advising or Confirming bank, he need check its authenticity with his own bank.

According to UCP 600 Article 9(b), the Advising bank shows its satisfaction by advising

the credit with the apparent authenticity. If he receives an unexpected credit from a buyer

unknown to him, even under cover of a well-known bank, he should check with the bank

to ensure that everything is in order - particularly if it calls for goods to be shipped direct

to the buyer. Exporter should bear in mind, as mentioned, that over half of credit

documents are rejected on first presentation to the banks. The main reason for this is

matters that could have been put right. Therefore, making the key checks on the day the

credit arrives, consulting other departments accordingly and carrying out the following

detailed checks immediately afterwards will enable difficulties to be recognized in better

time to take action.

Type of credit issued

Exporter should be sure that the type of credit issued gives him the level of

payment security, which he sought. In principle, an irrevocable credit carries only the

undertaking of importers’ bank in their country while an irrevocable and confirmed one

carries the extra and separate undertaking of a second bank in most countries. A bank

may not state it but credits issued under UCP 600 should be irrevocable if there is no

reference to other stipulations.

Then, exporter need make sure that he will be paid at the time and place he planned.

The credit may specify payment some time after shipment or after documents and/or

drafts have been deemed compliant by the paying bank (Nominated or Issuing bank).

Additional delays and other problems may arise if payment/acceptance is to take place

abroad. If he is not expecting payment to be made abroad but are prepared to consider it,

he need be sure that he understands the position, i.e. that he responsible for postal delays

in presenting documents overseas within the time limits set by the credit. It also gives less

time for replacing non-compliant documents with compliant ones. Under UCP 600,

whether a credit is available by sight payment, deferred payment, acceptance or

negotiation, a credit can be available with any bank.

If the credit has been sent electronically to a bank ("Teletransmitted”), exporter has

to check that it provides details of the credit that he can act upon and that is not just a preadvice. Unless it says otherwise, and provided it refer to UCP 600, the Teletransmitted

credit can be taken as the operative and safely acted upon one as well as overrides any