BSc Economic and Social Policy

advertisement

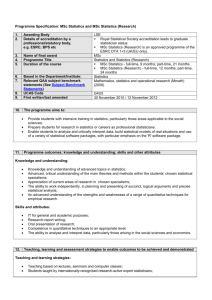

HANDBOOK MSc Financial Engineering 2004 – 2005 Birkbeck College School of Economics, Mathematics & Statistics http://www.ems.bbk.ac.uk SCHOOL OF ECONOMICS, MATHEMATICS & STATISTICS ACADEMIC STAFF Anne Sibert, PhD(Carnegie Mellon) - Head of School Professor in International Finance Andris Abakuks, PhD(Lond) Yunus Aksoy, Phd(Leuven) Lecturer in Statistics Lecturer in Economics Fiona Atkins, PhD(Lond) Parimal Bag, PhD (Cornell) Lecturer in Economics Senior Lecturer in Economics Brad Baxter, PhD(Cantab) Andrew Bowler, PhD(Lond) Lecturer in Financial Mathematics Lecturer in Mathematics Anthony Brooms, PhD(Brist) Lecturer in Statistics Raymond Brummelhuis, PhD(Amst) Alvaro Cartea, DPhil(Oxon) Jerry Coakley, PhD(OU) Arupratan Daripa, PhD(Princeton) Professor of Mathematical Finance Lecturer in Financial Mathematics Associate Professor in Economics Lecturer in Financial Economics John Driffill, PhD(Princeton) Suzanne Evans, PhD(Lond) Professor of Economics Lecturer in Statistics Anthony Garratt, PhD(Lond) Senior Lecturer in Economics Clemens Grafe, PhD(Lond) Kenjiro Hori, MPhil(Cantab) Lecturer in Economics Lecturer in Economics Simon Hubbert, PhD(Lond) Anthony Humm, PhD(Lond) Lecturer in Mathematical Finance Associate Lecturer in Economics Sandeep Kapur, PhD(Cantab) Marika Karanassou, Phd(Lond) Senior Lecturer in Economics Teaching Fellow Jihong Lee, PhD(Cantab) Lecturer in Economics Sarah Perkins, PhD(UMIST) Zacharias Psaradakis, PhD(So'ton) Lecturer in Mathematics Professor of Econometrics Hamid Sabourian, PhD(Cantab) Stephen Satchell, PhD(Lond) Visiting Professor Visiting Fellow Ron Smith, PhD(Cantab) Martin Sola, PhD(So'ton) Professor of Applied Economics Professor of Economics Stephen Wright, MA(Cantab) Lecturer in Economics Gylfi Zoega, PhD(Columbia) Senior Lecturer in Economics ADMINISTRATIVE STAFF Jan O'Brien, BA(Hons) Department Administrator 020 7631 6401 Barbara Rye, MSc(Lond) Beverley Downton, BA(Hons) Financial Economics Admin. Mathematics & Statistics Admin. 020 7631 6403 020 7631 6442 Vanesa Ho Tim Byne Economic & Social Policy Secretary Postgraduate Admissions Administrator 020 7631 6432 020 7631 6429 CONTENTS 1 MSC FINANCIAL ENGINEERING: GENERAL PROGRAMME INFORMATION 1 1.1 Aim of Handbook .................................................................................................. 1 1.2 Staff Responsible for the MSc Financial Engineering ....................................... 1 1.3 Other Sources of Information for Students ........................................................ 2 1.4 Fees and Enrolment .............................................................................................. 2 1.5 Important Dates .................................................................................................... 2 1.6 Programme Aims and Objectives ........................................................................ 2 1.7 Programme Structure ........................................................................................... 3 1.8 Brief Descriptions of Courses .............................................................................. 3 1.9 Allocation of Marks .............................................................................................. 5 1.10 A Brief Guide to the Marking System................................................................. 5 1.11 Results .................................................................................................................... 6 2 MSC FINANCIAL ENGINEERING COURSE UNITS .................................... 7 2.1 September Statistics 2.2 September Mathematics 2.3 September Introduction to Finance 2.4 Mathematical Methods FT and PT1 ................................................................ 10 2.5 Financial Econometrics FT and PT1 ................................................................ 12 2.6 Pricing FT and PT2 ........................................................................................... 13 2.7 Risk Management FT and PT2 ......................................................................... 14 2.8 Dissertation FT and PT2 ................................................................................... 15 3 FT and PT1 ........................................................... 7 FT ......................................................................... 8 FT and PT1 ................................... 9 TEACHING AND ASSESSMENT................................................................ 17 3.1 Course Assessment .............................................................................................. 17 3.2 Feedback on Coursework ................................................................................... 17 3.3 Examination Regulations ................................................................................... 18 3.4 Examination Registration .................................................................................. 18 3.5 Examination Deferment ..................................................................................... 18 3.6 Policy on Plagiarism ........................................................................................... 19 i 4 PROVISIONAL TIMETABLES .................................................................... 21 4.1 September Statistics, Mathematics & Introduction to Finance ...................... 21 4.2 MSc Financial Engineering Full-time AUTUMN TERM ............................... 22 4.3 MSc Financial Engineering Full-time SPRING TERM .................................. 23 4.4 MSc Financial Engineering Part-time Year 1 AUTUMN TERM .................. 24 4.5 MSc Financial Engineering Part-time Year 1 SPRING TERM ..................... 25 4.6 MSc Financial Engineering Part-time Year 2 AUTUMN TERM .................. 26 4.7 MSc Financial Engineering Part-time Year 2 SPRING TERM ..................... 27 ii MSc Financial Engineering: General Programme Information 1 MSc Financial Engineering: General Programme Information Welcome to the School of Economics, Mathematics and Statistics. We hope that taking your degree will be an enjoyable experience both academically and personally. 1.1 Aim of Handbook This handbook has several aims: to help you understand the structure of the degree programme; to introduce you to the Departmental staff and their roles within the Department and the College; to provide details of procedures, rules and regulations etc. for the degree programme. 1.2 Staff Responsible for the MSc Financial Engineering Programme Director Raymond Brummelhuis Email: r.brummelhuis@bbk.ac.uk Programme Administrator Barbara Rye Room: 716 Tel: 020 7631 6403 Fax: 020 7631 6416 Email: b.rye@bbk.ac.uk Personal Tutors At the beginning of the Autumn term a list is posted on the main noticeboard (seventh floor) indicating Personal Tutor allocations for each course. School Computer Representative Nigel Foster Room 759 Tel: 020 7631 6402 Email: n.foster@bbk.ac.uk Lecturers Generally members of staff are available at certain times during normal office hours each week. These 'office hours' are posted on the noticeboards on the seventh floor. It is best to meet the staff members during these hours. Outside these hours you may leave a note for them in the School Office specifying the nature of the problem, and your contact number, etc. This procedure is especially useful for routine communication. If the matter is urgent you could call them to seek an appointment 1 MSc Financial Engineering: General Programme Information outside their office hours. We also encourage students to contact us by email. The email address of staff members is initial.surname@bbk.ac.uk. 1.3 Other Sources of Information for Students Much information can be obtained from the College web site. School-specific information is found at http://www.bbk.ac.uk/ems, and College information at http://www.bbk.ac.uk/. You can also get a copy of the current University Regulations for Internal Students if you present your College membership card at the Academic Enquiries Desk in the reception area of Senate House (in Malet Street, to the South of the main College building). 1.4 Fees and Enrolment You should receive enrolment/registration papers before you start the course. You will not be able to use the College facilities, such as the library, without a College membership card issued at enrolment. The sessional fee is due in full by the first day of the Autumn term. Self-financing students are offered the facility of paying by instalments either by direct debit or termly cheque, but only if this is arranged at the beginning of October. Queries on fee issues should be addressed to the Registry. Students who wish to withdraw from the programme must give immediate notice in writing or email to the School. 1.5 Important Dates September Quantitative Techniques (Statistics and Mathematics) Lectures: 6 September - 23 September, Revision classes 27 September. September QT Examinations: Wednesday 29 September (Mathematics); Thursday 30 September (Statistics) September Introduction to Finance: 8, 15 and 22 September. Term Dates 2004 – 2005 Autumn: Spring: Revision: Examinations: 4 October – 17 December 2004 (Reading week 8-12 November) 10 January – 18 March 2005 25 April – 27 May 2005 June First Meeting 6 September, full-time: 2pm, part-time: 6pm, Malet St. building. Part-time 2 start on the first Tuesday of term, 5 October. 1.6 Programme Aims and Objectives The entry requirement is a 2.1 or above from an established UK university or an equivalent qualification. A candidate’s first degree should normally be in a quantitative discipline such as physics, engineering, statistics or mathematics. Students who have completed highly quantitative economics degrees will also be eligible. Substantial relevant work experience may also be taken in to account. Students who complete the programme will be: 2 MSc Financial Engineering: General Programme Information trained in applicable areas of finance and in quantitative methods, as well as in specialist areas that fit their interests; competent in the fields of pricing and risk management as practiced by financial institutions; able to read and provide a critical interpretation of the scientific literature in finance; able to formulate propositions, test them using quantitative techniques and report the conclusions; able to conduct an independent research project and report on it; able to become professional specialists in finance for industry, the financial sector, the public sector or higher education; familiar with research at the frontier of the subject and be able (should they wish to do so) to undertake independent research for a PhD. 1.7 Programme Structure Throughout, the material is approached in a rigorous fashion. Having completed the programme, students have a solid grasp of a broad sweep of advanced applicable finance and are ready to work as quantitative analysts in financial markets or to study for a doctorate. Lectures are held between 6 and 9 in the evening. In addition to lectures, some courses involve classes. These provide opportunities to review material related to the lectures and to discuss solutions to problem sets. For full-time students, classes are sometimes held in the afternoon. Classes for part-time students are always in the evening. The structure of the degree is as follows. Students complete four compulsory courses, which are assessed through examinations in June. For some courses, problem sets also count towards the final grade. Full-time (FT) students are normally expected to complete the programme in one academic year, while part-time (PT) students normally take two years. Following their successful completion of four courses, students also complete a dissertation on a subject related to material covered in the programme. This dissertation has the same weight as one course in the final evaluation of a student’s performance. Private study Lectures and classes are only part of your overall learning experience. Private study is equally important. You are expected to spend at least as long in private study reading material on the reading lists, working through problems and exercises, writing essays, completing other assignments, revising for examinations - as you spend in lectures and classes. You must devote enough time each week to keeping up with the programme. 1.8 Brief Descriptions of Courses 1. a) September Statistics Full-time and Part-time 1 b) September Mathematics Full-time Prior to the start of the MSc programme, there are preliminary quantitative techniques courses in September, at the end of which qualifying examinations are held in each subject. Resits are not held. Full-time students with very strong mathematical backgrounds may apply to omit the mathematics preliminary course. 3 MSc Financial Engineering: General Programme Information c) September Introduction to Finance Full-Time and Part-time 1 This course is intended for students who have not had an academic background in Finance. 2. Mathematical Methods a) Stochastic Processes for Finance After an introduction to Matlab, the course will treat the basic stochastic calculus needed for modern finance: Brownian motion, Ito calculus, filtrations and martingales, culminating in the Feynman-Kac theorem. Simple Matlab exercises will be used to illustrate the material numerically, where appropriate. b) Theoretical Numerical Methods for Finance The course will provide rigorous analysis of the numerical methods required to solve parabolic differential equations of the Black-Scholes style, including a treatment of the Cox-Ross-Rubinstein binomial method. Some more general numerical methods will also be treated briefly, including (i) Monte Carlo simulation and its algorithmic efficiency, (ii) numerical methods for solving nonlinear equations and some basic optimization techniques, and (iii) more general numerical methods, such as data fitting. 3. Financial Econometrics This course develops students’ theoretical and practical grasp of important statistical and econometric techniques commonly applied in analysing financial data. The first part of the course consists of foundational material on regression analysis and estimation techniques such as Maximum Likelihood and Generalised Least Squares. The second part consists of more advanced topics and modelling approaches used specifically in financial applications. The course is assessed through a three-hour examination in June. 4. Pricing This course covers continuous time price theory. It comprises two modules. The first provides a basic treatment of non-measure-theoretic pricing theory applied to financial options, default-free bonds and defaultable debt. The second introduces students to matingale theory techniques (Girsanov’s theorem and representation theorems) and then shows them how to price derivative securities using martingale methods in an arbitrage-free market setting. Changing numeraire techniques will also be covered in connection with option pricing in both defaultable and non-defaultable term structure models (HJM and LIBOR). Applicaions to interest rate and credit derivatives will be given. The two modules are assessed via coursework and a three-hour examination in June. 5. Risk Management This course introduces students to the modern theory of risk management as practiced by banks and other financial institutions. The first part of the course covers risk measures such as Value at Risk based on loss distribution tails. Modelsused to analyse market, credit and operational risk in bank portfolios are examined. The second section of the course deals with risk management techniques employed by investment funds. Topics covered include capital asset pricing models, asset allocation and performance assessment. 4 MSc Financial Engineering: General Programme Information The course is assessed through a three-hour examination in June and a take-home problem set in the Easter vacation. 6. Dissertation After the June examinations, students complete a project under the supervision of a faculty member. The project offers students an opportunity to pursue a topic of their own choosing and to apply in a practical way the knowledge they have acquired in the courses. All students are required to submit a dissertation by the last Friday of August of their last year of study. Full-time students Full-time students do September Statistics and Mathematics, with qualifying exams in each at the end of September. They then take five units –Mathematical Methods, Financial Econometrics, Pricing, Risk Management and the dissertation - in one year. Part-time students First-year part-time students do September Statistics, with a qualifying exam at the end of September. They then take Mathematical Methods and Financial Econometrics. Second-year part-time students Pricing and Risk Management, and produce the dissertation. 1.9 Allocation of Marks The marking scheme for the course units is as follows: Mathematical Methods 80% June exam + 20% for coursework Financial Econometrics June exam Pricing 80% June exam + 20% for coursework Risk Management 80% June exam + 20% for coursework Dissertation Coursework 1.10 A Brief Guide to the Marking System For each course unit, the following classification applies: The final degree classification is made from the five course units. The mark for each unit is interpreted as follows: 70 Distinction 60 - 69 Merit 50 - 59 Pass 49 Marginal Pass < 49 Fail Students who receive a Distinction for at least three course units (and no less than a Merit in the other two) are awarded an overall mark of Distinction. Students who receive a Merit for at least four units (and no less than a Pass in the other) receive a Merit overall. Students who receive a Pass for at least four units (and no less than a Marginal Pass in the other), receive a Pass overall. Candidates who fail any one of the courses are allowed one resit for each course that they fail, which will normally be taken the following June. You cannot resit in order to improve a pass mark. 5 MSc Financial Engineering: General Programme Information The earliest you can take a resit is the next academic year. When you resit a course, the Examiners may permit you to carry over the mark for the coursework component. However, you are advised to do the coursework even if you do not submit it for evaluation. Also, when resitting the examination, it is your responsibility to keep track of any alterations in the syllabus. (Fuller details of the marking scheme are given in the Assessment of Course and Award of Degrees Booklet.) 1.11 Results The examination scripts are marked by two internal examiners and then a large selection of scripts are sent to our external examiners. All this takes time. The Examiners' Meeting usually takes place towards the end of the first week of July, and letters are sent to students indicating how well they have performed. At this stage, the School gives an indication to the broad degree classification, that is Distinction, Merit, Pass or Fail, dependent on successful completion of the dissertation. University Regulations do not allow us to tell you the marks, or even give any indication of them. The marks are notified routinely by the University in October/November. 6 MSc Financial Engineering Course Units 2 MSc Financial Engineering Course Units 2.1 September Statistics FT and PT1 Lecturer: Ali Tasiran Course Objectives This course is intended to provide the necessary statistical background for the Financial Econometrics course. At the beginning, it covers basic facts about random variables and their distributions. It then provides an introduction to statistical inference. At the end of the course a qualifying examination is held. You are required to pass this examination to continue on the MSc programme. No resits are held Textbook D. Wackerly, W. Mendenhall and R. Scheaffer, Mathematical Statistics with Applications, 5th edition, Duxbury Press, 1996. ISBN 0-534-20916-5. Outline of Topics Probability and Distribution Theory Random variables Moments of a random variable Some specific probability distributions The distribution of a function of a random variable Joint distributions Conditioning in a bivariate distribution The bivariate normal distribution Multivariate distributions Statistical Inference Samples and sampling distributions Point estimation of parameters Interval estimation Hypothesis testing 7 MSc Financial Engineering Course Units 2.2 September Mathematics FT Lecturers: Arup Daripa and Sandeep Kapur Course Objectives This is an introductory course in mathematical techniques which are needed for the courses of the MSc. It involves revision of material that you should have covered as part of your earlier training in economics and finance. While we start with the basics, the material covers some advanced topics. At the end of the course a qualifying examination is held. You are required to pass this examination to continue on the MSc programme. No resits are held. Outline of Topics Introductory calculus and basic linear algebra Linear algebra, and something on sets Advanced calculus and introduction to optimisation Optimisation Recommended Texts Hoy, M et al., Mathematics for Economics, Addison-Wesley, 1996. A. C. Chiang, Fundamental Methods of Mathematical Economics, 3rd edition, McGraw-Hill. Pre-Course Reading If you think you need to prepare for the course over the summer, use the above text (or indeed one that you have already used) to revise: basic calculus: differentiation and integration (functions of one variable); basic matrix operations: matrix addition, multiplication, determinants. 8 MSc Financial Engineering Course Units 2.3 September Introduction to Finance FT and PT1 September Lecturer: Stephen Wright Aims This short optional course of three lectures is intended to give a broad brush outline of the key ideas in finance. It is aimed at students coming on to the MSc programmes with little or no prior training in finance or economics. Objectives By the end of the course, students should be familiar with the following key concepts and their applications in finance. No arbitrage pricing conditions, in particular as applied to bond and option prices Risk-return tradeoffs and the Capital Asset Pricing Model Inter-temporal choice as a basis for asset pricing. Teaching Arrangements The course is taught over 3 weeks. There is a double lecture on Wednesday evenings starting 8 September. Some lectures will involve a degree of student interaction in problem solving to test understanding of core ideas. Course Assessment Since the course is optional it is not examined formally. Textbooks There is no set text, and no required reading. Handouts will be provided that cover key ideas. Those wishing for additional background on some topics may also find the following texts useful (but not essential): Copeland, Thomas E & JF Weston, Financial Theory and Corporate Policy, Addison Wesley Hull J, Options, Futures and Other Derivative Securities, Prentice-Hall Cochrane, J, Asset Pricing 9 MSc Financial Engineering Course Units 2.4 Mathematical Methods FT and PT1 Autumn and Spring Terms Lecturers: Raymond Brummelhuis and Brad Baxter Aims To introduce the student to the main mathematical and numerical techniques used in present-day quantitative finance. The course is divided into three submodules and illustrated by examples drawn from this subject area. To become acquainted with suitable languages and computer packages for financial applications (C++ and Matlab). a) Stochastic Processes for Finance Objectives To understand the basic concepts of stochastic calculus, in particular Brownian motion and stochastic integrals. To understand Ito calculus and its applications to stochastic differential equations (SDEs). To understand the numerical solution of an SDE. To appreciate the connections between probability theory and partial differential equations via the Feynman-Kac formula. b) Theoretical Numerical Methods for Finance Objectives To obtain basic fluency in Matlab. To solve SDEs using Monte Carlo simulation. To understand the fundamental algorithms for the numerical solution of parabolic partial differential equations (PDEs). To understand the binomial method for option pricing as a finite difference method, particularly its disadvantages. To appreciate the importance of stability in numerical algorithms for PDEs. To understand numerical methods for the solution of nonlinear equations and some basic optimization techniques. To know the basics of more general relevant numerical methods, such as data fitting. To illustrate the above by examples and exercises in Matlab. c) Programming in C++ Objectives To understand the language fundamentals of C and C++. To know the basic use of arrays, dynamic memory allocation and data input/output. 10 MSc Financial Engineering Course Units To understand and construct classes, illustrated by classes for complex numbers and matrix algebra. To use numerical libraries. Teaching Arrangements The course is taught over 20 weeks, divided into two terms. There are extra tutorial sessions (approximately 12 hours) for Matlab and C++. Course Assessment The material presented in 2.4 (a) and 2.4 (b) will be assessed via coursework (20%) and a three-hour examination in June (80%). Students will be strongly encouraged to apply their knowledge of C++ in their final-year dissertation. Textbooks The courses will be based on fairly extensive lecture notes. Detailed reading lists will be provided during term. 11 MSc Financial Engineering Course Units 2.5 Financial Econometrics FT and PT1 Autumn and Spring Terms Lecturers: Zacharias Psaradakis and Martin Sola Aims The course provides an introduction to the modern econometric techniques used in the analysis of financial time series. The interaction between theory and econometric analysis is emphasised, and students will be trained in formulating and testing financial models. Objectives At the end of the course, students will be able to demonstrate that they can: derive standard estimators (OLS, GLS, GIVE, ML, GMM) and establish their finite-sample and asymptotic properties; develop exact and/or asymptotic specification and misspecification tests; develop and analyse models for stationary univariate and multivariate time series; develop and analyse models for nonstationary and long-memory time series; develop and analyse nonlinear time-series models; understand and explain empirical articles in the literature of the sort that appear in the main economics and finance journals. Topics Least squares theory Maximum likelihood theory Hypothesis testing and model evaluation Instrumental variables and GMM Univariate time-series models Multivariate time-series models Nonstationary time series and cointegration Switching models Applications Teaching Arrangements The course is taught over 20 weeks. There is a double lecture a week and one class. Course Assessment The final grade is determined through a three-hour exam in June. Recommended Textbooks W. H. Greene, Econometric Analysis, 4th edition, Prentice-Hall, London, 2000. J. D. Hamilton, Time Series Analysis, Princeton University Press, 1994. 12 MSc Financial Engineering Course Units 2.6 Pricing FT and PT2 Autumn and Spring Terms Lecturers: Alvaro Cartea and Raymond Brummelhuis Aims To understand and be able to implement contingent claim and bond pricing by a variety of methods: binomial, PDE and martingale pricing methods. Objectives To develop problem-solving abilities to value derivative securities. To become acquainted with standard derivative and bond pricing models. To understand equivalent martingale measures and their role in pricing. To understand the concepts of complete and incomplete markets. To understand techniques based on change of numeraire. To apply martingale pricing to a variety of contexts: option pricing and term structure models (defaultable and non-defaultable). Teaching Arrangements The course is taught over 20 weeks, divided into two terms. Course Assessment The material will be assessed via coursework (20%) and a three-hour examination in June (80%). Textbooks The courses will be based on fairly extensive lecture notes. Detailed reading lists will be provided during term. 13 MSc Financial Engineering Course Units 2.7 Risk Management FT and PT2 Autumn and Spring Terms Lecturers: Simon Hubbert, Steve Satchell and John Knight Aims The course provides an introduction to modern risk management theory and practice. Students will develop problem-solving skills in risk management applications and become conversant with up-to-date techniques employed by financial institutions. Objectives To develop knowledge of statistical techniques applicable to measuring risk in portfolios. To learn how to apply these techniques in practice. To become acquainted with standard risk models and to have a thorough critical understanding of the strengths and weaknesses of these models. Topics Loss distribution risk measures such as VaR and TVaR Market risk modelling VaR with derivative portfolios Extreme Value Theory techniques applied to VaR measurement Credit risk modelling Copula techniques Models for operational risk The Basel proposals for bank capital requirements Capital Asset Pricing Arbitrage Pricing Theory Strategic Asset Allocation Tactical asset allocation Performance measurement Teaching Arrangements The course is taught over 20 weeks. There is a double lecture a week. Problem sets will be distributed and reviewed in the lectures. Course Assessment The final grade is determined through a three-hour exam in June and a take-home exercise in the Easter vacation. Textbooks Lecture notes will be distributed. 14 MSc Financial Engineering Course Units 2.8 Dissertation FT and PT2 Summer term Supervisors: members of the School Aims The summer projects provide students with the opportunity to apply the techniques and knowledge they have acquired from the rest of the programme. The dissertation should provide an in depth analysis of a specific financial issue. Students either perform a statistical or numerical analysis or, less commonly, examine a question using a theoretical model. Objectives Students should: show that they have a good knowledge of the relevant literature on their chosen topic; identify an interesting question associated with that topic and analyse this question either in a new way or with new data; demonstrate they have a good grasp of techniques (statistical, numerical or theoretical) relevant for analysing the question; show they can exposit the results of their analysis in a clear and convincing manner. Teaching Arrangements Supervision by member of the School is provided for work on the dissertation from the end of the examinations in June to the end of August. Students should plan to see their supervisors several times during this period. Course Assessment The dissertations are marked in September. Guidance Notes for MSc Financial Engineering Dissertations Students should prepare a single-page proposal that they should hand in on or before the first day of the summer term. This proposal should state succinctly the basic idea of the project, what data and computing facilities will be required and whether or not these are known to be available. The School will allocate a supervisor to each student within a few days. The project (which has a word limit of 8000 words) must be completed by the last Friday in August. Students are strongly advised to keep in touch with their supervisor while working on the project. An initial meeting to obtain advice on data, techniques and overall direction is essential. In addition, students should see their supervisor two or three times in the course of the research to discuss results and receive further guidance. As a general rule, it is very important that the project contain an interesting question or issue to be analysed. Simply applying a well-known statistical technique to a new dataset will not generally earn a good mark. Any subject that relates to material covered in the course is admissible, but it is generally sensible to stick to projects 15 MSc Financial Engineering Course Units which contain some substantial element of statistical or numerical analysis. Theoretical projects are difficult although occasionally students have produced good work of this type. Purely institutional topics are not permitted. On data, it is important not to be too ambitious. Often students spend inordinate amounts of time collecting large datasets and then find they have no time to perform analysis. Interesting analysis motivated by some genuine, substantive question earns high marks. Whatever is done, it is important that students time their work realistically. Going away on holiday and expecting to be able to complete in the last fortnight before the deadline is a recipe for trouble. If you are unfamiliar with econometric packages (as most of you will be) then everything takes longer than you expect. A good source of financial data is Datastream, which can be accessed using a computer in the Library. The principal databases cover equities, bonds, company accounts, economic series, international market indices, interest and exchange rates and financial and commodity futures and traded options. 16 Teaching and Assessment 3 Teaching and Assessment 3.1 Course Assessment For most course units, you will do coursework and sit exams (further information on written exams is found below and in the relevant Assessment Handbook). The relative weights of these components toward your mark for the course unit will vary from unit to unit and you will be given this information on the individual unit syllabus/reading list. You should also take care to note the deadlines for submission of coursework and realise that there are penalties for late submission. There are several types of coursework that you will be asked to produce in your degree. The particular type of coursework assignments will vary from unit to unit, so you will need to pay close attention to the instructions given by the lecturer. Some examples of the types of coursework assignments that you will be expected to produce are given below. Essays You may be asked to write brief essays on particular questions. The marking criteria are given in the Assessment Handbook. Problem Solving Technical course units are likely to give exercises to test your ability to use concepts and techniques. Mid-Term Tests These may be provided by lecturers where necessary. 3.2 Feedback on Coursework Coursework can constitute a significant proportion of the expected workload for a course unit. If coursework is an integral part of the examination for a unit, this means that it is absolutely NOT optional. You MUST attempt all coursework for a course unit, otherwise you will obtain zero for the coursework. It will always be requested that you submit coursework on or before a certain deadline. This deadline is an integral part of the assignment rather than an arbitrary date conjured to annoy and/or penalise students. This rationalisation notwithstanding, we do attach penalties for breaking submission deadlines as late submission of work disrupts the marking and feedback procedures and can confer an unfair advantage on students who delay submitting work. For each piece of marked coursework, the lecturer will be the first marker and a second member of staff will act as moderator of the marks, to ensure that they have been of the correct standard. The mark will be provisional since it will only finally be confirmed by the Degree Board. Coursework will be returned with comments and your provisional mark. In some cases, individual lecturers may offer additional feedback devices: for example, a general commentary addressed to the entire class, or an additional form that addresses a specific assignment directly. 17 Teaching and Assessment 3.3 Examination Regulations When you start the course, you will be issued with an Assessment Handbook outlining the principal University of London Examination Regulations and Procedures. It is important to note requirements on entry and withdrawal from examinations. Students are deemed to have failed an examination if they do not notify the appropriate authorities of their withdrawal. 3.4 Examination Registration The registration process for the June examinations is controlled by the University Examinations Office and it is your responsibility to ensure that things go right. During the Spring Term, the College Registry sends entry forms to all degree students at their home address. If you do not receive an entry form (and other students have got theirs') you should contact the Examinations Office. You must fill these in promptly and as accurately as possible. Once you have made your entry, some flexibility exists for subsequent alteration, but given the administrative difficulty of making such changes, try not to. The examination entry tickets are sent to the candidates between April and May. These contain your examination number and the examination dates etc. Check it immediately to make sure that you have been entered for the right examination. 3.5 Examination Deferment Permission to defer the examination or any part of the examination, including submission of an essay, project, dissertation or other written work, may only be granted for reasons judged adequate in the particular case at the discretion of the College. Application for permission to defer examination(s) shall be made in the case of summer examinations at least 14 days in advance of the first examination or by 1 May whichever is the earlier, or in the case of September examinations by 1 August. Application must be made in writing to the Programme Director of the programme for the degree or diploma for which the student is registered. The Programme Director shall exercise on behalf of the College the discretion to grant or refuse such applications and may consult as necessary before doing so and may require the submission of documentary evidence in support of the application. In cases where permission is granted to defer the examination until the following year the relevant examination entries shall be designated as ‘withdrawn’ and the candidate will be required to submit entries for the examination(s) on an examination entry form in the following year. All other candidates will be regarded as having made an entry or re-entry, except that in the case of illness or other adequate cause for which certification must be provided a candidate may be permitted at the discretion of the College to withdraw his/her entry to the examination in the week before the commencement of the examination and up to and including the date of his/her first paper provided that (s)he has not entered the examination hall. Candidates who do not attend an examination or who do not submit written work without being granted permission to defer or withdraw their examination entry shall be deemed to have failed the examination on that occasion. Deferment is not a right, and each case is judged on its merit. The earliest you can resit the examination is the next summer. Note also that deferment is not a very sensible option - the courses change slightly from one year to the next, if only in emphasis on particular topics, and students who defer may end up being at a slight disadvantage. Do not consider this route unless you have to. 18 Teaching and Assessment 3.6 Policy on Plagiarism You are reminded that all work submitted as part of the requirements for any course must be expressed in your own words and incorporate your own ideas and judgements. Plagiarism – that is, the presentation of another person’s thoughts or words as though they were your own – must be avoided, particularly in coursework essays and reports written in your own time. Direct quotations from published and unpublished work or from web sites must always be identified as such by being placed inside quotation marks, and a full reference to the source must be provided in the proper form. Remember that a series of short quotations from several different sources, if not clearly identified as such, constitutes plagiarism just as much as does a single unacknowledged quotation from a single source. If you summarise another person’s ideas or judgements, you must refer to that person in the text and include the work referred to in your bibliography. Failure to observe these rules may result in an allegation of cheating. Copying another student’s work is also a form of plagiarism. You must consult your tutor or course co-ordinator if you in doubt over what is permissible. Remember, the marker of your assignment requires evidence of your understanding and effort. Borrowed material that is unacknowledged attracts no marks. Unacknowledged copying of text and/or ideas is called plagiarism, and YOU MUST NOT PLAGIARISE. You must ensure that all work you submit is entirely your own, unless you declare otherwise. Plagiarism will incur severe penalties, which may include exclusion from your degree programme! There are two situations in which plagiarism commonly occurs: Fraud. This applies when a student submits the written work of another person (who might be a fellow student), in whole or part, as his/her own. Such fraud may occur with or without the author’s consent, but having obtained the author’s consent does not excuse the crime! Deception of this kind devalues the coursework of the perpetrator and is grossly unfair to his/her peers. Markers find this easy to spot as they keep some record of the coursework of past and present students. Pirated text. This refers to copying (sometimes word for word) from a publication. Pirated text is not difficult to detect, for even if the marker does not know the source of the text (but often he/she will), the style of the plagiarised text betrays the fraud. The cohesiveness of argument, the structure of the text (formal scientific writing has a form seldom found in student essays) and English usage differ substantially from the usual output of the plagiariser. Group work is an area where students may be unsure, justifiably, about whether their submitted work constitutes plagiarism. The key to dealing with group work is to ensure that your coursework assignment has a content that is distinctively your own. For example, if you are collecting and commenting on data, even where the data are the same, your work will have different introductory sections, different tabular or graphic presentation and different discussion. Such elements must be your own effort and not be copied from others. 19 Teaching and Assessment Recourse to the services of “ghost-writing” agencies (for example in the preparation of essays or reports) or of outside word-processing agencies which offer “correction/improvement of English” is strictly forbidden, and students who make use of the services of such agencies render themselves liable for an academic penalty. 20 Provisional Timetables 4 Provisional Timetables 4.1 September Statistics, Mathematics & Introduction to Finance The September quantitative courses begin with lectures on Monday 6 September, three days per week for three weeks. Full-time students attend mathematics during the afternoon and statistics in the evening. Part-time students (Year 1) take statistics in the evening. There are also three Introduction to Finance lectures on Wednesdays, starting 8 November. These are for students who have not had an academic background in Finance. Revision classes: Monday 27 September Examinations: Mathematics Wednesday 29 September, 6-8 pm Statistics Thursday 30 September, 6-8 pm Room locations will be posted in the reception. Monday Tuesday Wednesday Full-time only Full-time only Full-time only 2-4.30pm 2-4.30pm 3.30-5pm Mathematics Mathematics Mathematics Full-time and Year 1 Full-time and Year 1 Full-time and Year 1 Full-time and Year 1 6-8pm 6-8pm 6-8pm 6-8pm Statistics Statistics Introduction to Finance Statistics 21 Thursday Provisional Timetables 4.2 MSc Financial Engineering Full-time AUTUMN TERM 4 October - 17 December 2004 Reading week: 8-12 November L: Lecture C: Class Monday Tuesday Wednesday Thurs Friday 3-4 pm Financial Econometrics C: K Ait Chabane Starts week 2 Room 6-7.30pm 6-7.30pm 6-7.30pm 6-7.30pm 6-7pm Mathematical Methods Pricing Financial Econometrics Risk Management Pricing L: R Brummelhuis L: Z Psaradakis L: S Hubbert (weeks 1-8) Room (weeks 1-7) (Starts week 2) L: B Baxter L: S Satchell Room (weeks 9-11) (weeks 8-11) Room Room L: A Cartea Room 7.30-9pm 7.30-9pm 7.30-9pm 7.30-9pm Mathematical Methods Pricing Financial Econometrics Risk Management L: Z Psaradakis L: S Hubbert Room (weeks 1-7) L: A Cartea L: R Brummelhuis (weeks 1-8) Room L: B Baxter L: S Satchell (weeks 9-11) (weeks 8-11) Room Room 22 C: M Figuera Provisional Timetables 4.3 MSc Financial Engineering Full-time SPRING TERM 10 January - 18 March 2005 L: Lecture Monday C: Class Tuesday Wednesday Thursday Friday 3-4pm Financial Econometrics C: K Ait Chabane (Starts week 2) Room 6-7.30pm 6-7.30pm Mathematical Pricing Methods L: R Brummelhuis L: B Baxter Room 6-7.30pm 6-7.30pm 6-7pm Financial Econometrics Risk Management Pricing L: J Knight C: M Figuera (weeks 1-7) (Starts week 2) L: S Satchell Room L: M Sola Room Room (weeks 8-10) Room 7.30-9pm 7.30-9pm Mathematical Pricing Methods L: R Brummelhuis L: B Baxter Room 7.30-9pm 7.30-9pm Financial Econometrics Risk Management L: M Sola Room Room L: J Knight (weeks 1-7) L: S Satchell (weeks 8-10) Room 23 Provisional Timetables 4.4 MSc Financial Engineering Part-time Year 1 AUTUMN TERM 4 October - 17 December 2004 Reading week: 8-12 November L: Lecture C: Class Monday Tuesday Wednesday Thursday 6-7.30pm 6-7.30pm 6-7.30pm Mathematical Methods Financial Econometrics Financial Econometrics L: R Brummelhuis L: Z Psaradakis C: K Ait Chabane (weeks 1-8) Room (Starts week 2) L: B Baxter Room (weeks 9-11) Room 7.30-9pm 7.30-9pm Mathematical Methods Financial Econometrics L: R Brummelhuis L: Z Psaradakis (weeks 1-8) Room L: B Baxter (weeks 9-11) Room 24 Friday Provisional Timetables 4.5 MSc Financial Engineering Part-time Year 1 SPRING TERM 10 January - 18 March 2005 L: Lecture Monday C: Class Tuesday Wednesday Thursday 6-7.30pm 6-7.30pm 6-7.30pm Mathematical Methods Financial Econometrics Financial Econometrics L: B Baxter L: Z Psaradakis C: K Ait Chabane Room (Starts week 2) Room Room 7.30-9pm 7.30-9pm Mathematical Methods Financial Econometrics L: B Baxter L: Z Psaradakis Room Room 25 Friday Provisional Timetables 4.6 MSc Financial Engineering Part-time Year 2 AUTUMN TERM 4 October - 17 December 2004 Reading week: 8-12 November L: Lecture Monday C: Class Tuesday Wednesday Thursday Friday 6-7.30pm 6-7.30pm 6-7pm Pricing Risk Management Pricing L: A Cartea L: S Hubbert C: M Figuera (weeks 1-7) (Starts week 2) L: S Satchell Room Room (weeks 8-11) Room 7.30-9pm 7.30-9pm Pricing Risk Management L: A Cartea L: S Hubbert (weeks 1-7) Room L: S Satchell (weeks 8-11) Room 26 4.7 MSc Financial Engineering Part-time Year 2 SPRING TERM 10 January - 18 March 2005 L: Lecture C: Class Monday Tuesday Wed Thursday Friday 6-7.30pm 6-7.30pm 6-7pm Pricing Risk Management Pricing L: R Brummelhuis L: J Knight C: M Figuera (weeks 1-7) (Starts week 2) L: S Satchell Room Room (weeks 8-10) Room 7.30-9pm 7.30-9pm Pricing Risk Management L: R Brummelhuis L: J Knight (weeks 1-7) Room L: S Satchell (weeks 8-10) Room 27