Asset Specificity and Transaction Structures: A Case Study of

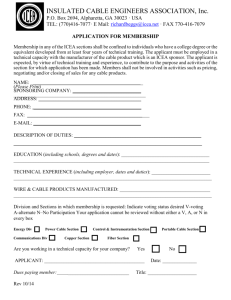

advertisement