5. New rules relating to charging for social care

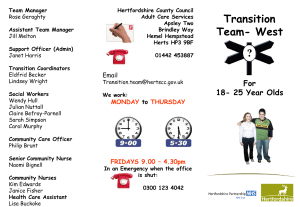

advertisement

Agenda Item No. HERTFORDSHIRE COUNTY COUNCIL ADULT CARE AND HEALTH CABINET PANEL FRIDAY 5 JULY 2013 AT 10.00AM 3 IMPACT OF DILNOT PROPOSALS IN HERTFORDSHIRE Report of the Deputy Chief Executive Author: Charles Crowe, Income Manager HCS, Tel: 01438 843434 Executive Member: Colette Wyatt-Lowe 1. Purpose of report 1.1. To update the Panel on the potential impact for Hertfordshire Council on the Government’s proposed changes to the rules on charging for adult social care based on a report by the Dilnot Commission. 2. Summary 2.1. The proposed changes to the way social care is charged for is intended to begin in April 2015 with a new nationally mandated ‘deferred payment scheme’, to be followed in April 2016 by a new cap on social care contributions of £72,000 per person. This is part of a wider social care reform bill. Whilst being very positive news to citizens who will be given more certainty about the costs of their social care in old age, the changes could have a major financial impact for councils if not fully funded by general taxation and increase in local government grant. 2.2. Under the provisions of the National Assistance Act 1948 and the Health and Social Security and Adjudications Act 1983, individuals who receive adult social care services can have their means assessed with a view to the local authority seeking a financial contribution form the individual towards the cost of their care. This is referred to as a “client contribution”. The manner in which this is taken forward in practical terms is governed by a number of pieces of Government guidance. A brief explanation of the respective pieces of guidance is found at Appendix A, with an internet link to their full content. 2.3. Expenditure on commissioned adult social care services is £250m per annum in Hertfordshire and the council receives client contributions towards these services of £39m per annum. 2.4. The Dilnot Commission recommends that the state pays for a greater proportion of people’s social care costs through general taxation. A significant number of people privately fund their own social care because they have the financial means to do so. These people would have a greater entitlement to state-funded services than at present. It is estimated by the Department of Health that 30-35% of people receiving social care are not in contact with their local authority. All Page 1 of 6 would become eligible for council-funded social care when they reach a new £72,000 cap or when they fall below a new £118,000 capital threshold for support. There is currently no maximum cap and a £23,250 capital threshold. The government has pledged to meet these new costs through an increase in local authority grant. 2.5. Dilnot’s proposals will create the need for the local authority to undertake more statutory community care assessments to determine the ‘eligible’ care needs of self-funding individuals, where the cost of meeting that eligible care need will count towards the £72,000 cap. Modelling which has been undertaken indicates this will require substantial additional social work staff – up to 140 posts at a cost of £5.8m per annum. This is likely to lead to more complaints from individuals who disagree with the social work assessment and contribution towards the cap. 3. Recommendation 3.1. The Cabinet Panel is invited to note and comment on the report. 4. Background 4.1. The Dilnot Commission was established by the Government to report on how to deliver a fair, affordable and sustainable funding system for adult social care in England. Local government and NHS finances are under significant pressure and the demand for services is increasing as the population ages. The Dilnot report suggested a costed way forward to support the White Paper which was followed up by the publication of the Care and Support Bill in 2012. Deferred Payments 4.2. The first wave of proposed change is the implementation of a nationally mandated ‘Deferred Payment Scheme’ across England by way of regulations. This scheme allows people to enter into an agreement with the local authority when they have been assessed as having sufficient capital to meet the cost of their residential care - but may have to sell their property to release the funds to pay for care home fees. This arrangement allows an individual to retain the ownership of their property with the local authority meeting the cost of the placement. The loan is secured by way of a legal charge on the property which is enforced when the estate is disposed of. 4.3. Hertfordshire already operates a deferred payment scheme under legislation currently in place which is compliant with the proposed regulations although the rules are likely to be changed to allow councils to charge interest for the whole duration of the loan rather than only after the person’s death, as now. Hertfordshire’s current scheme will be evaluated against the new regulations as soon as these are published. 5. New rules relating to charging for social care 5.1. The second wave of change is to introduce new rules on charging for social care – both for people living in care homes and people receiving care and support in their own home. Current guidance on how local authorities charge for this Page 2 of 6 support can be found at Appendix A. 5.2. Guidance is still emerging on how the new charging system will operate but in summary the new rules that have been communicated currently are: a. A cap of £72,000 per person (in 2016 values) will apply on social care costs; b. This cap applies to care in both care homes and in the person’s own home; c. The total spend on social care by both the person and the local authority will count towards the capped amount; d. Only ‘eligible’ care needs assessed by social services will count towards the cap, and it is understood that the cost will be at the council’s funding levels; e. Once the person has reached the cap, they will not be required to pay towards their social care again regardless of means; f. Residents living in care homes will be required to pay “hotel” costs for their food and accommodation, around £12,000 per annum (in 2017 values). This cost will not count as ‘care costs’ either towards the cap or after the cap is reached; g. People receiving social care before age 18 will not be required to pay at all; h. There will be different rules for people who have or develop long-term social care needs when aged under 65; i. For people in residential care homes, the upper capital limit before charging from capital starts will increase from £23,250 in assets or savings - to £118,000. When someone falls below this financial threshold, they may be eligible for funding but will still have to pay a contribution from their capital (on a sliding scale). Those receiving care at home will continue to have an upper capital limit of £23,250. 6. Implications and risks of new charging rules for the County Council 6.1. Loss of income from current service users: The county council currently collects approximately £27m of income per annum from people living in care homes and £12m of income from people living in their own home who receive social care input and who have been assessed as having the financial means to contribute. The change in rules will result in a loss of direct income from people who use services who reach the £72,000 cap or who fall below the new higher upper capital limit threshold of £118,000. The government have pledged to meet this income gap from general taxation through an increase in local authority grant but it is unclear how this funding will be allocated to councils. The direct income lost to Hertfordshire is estimated to be £6.3m per year initially in 2016. However over the following 4 years this will increase to a loss of £10.1 million per year. This does not include demographic pressures or adjustment for future inflation. 6.2. New duty to pay for self-funding people who have reached the cap: A large number of people who pay privately for their own care and support and who have not approached the council before will become eligible for funding when they reach the £72,000 cap. These people are not expected to be a cost pressure to councils for up to four years after the new rules come into effect (until they reach the £72,000 care cap from a 2016 start date). However, based on Department of Health estimates this will cost a minimum of £9m a year to Hertfordshire from 2020. Future demographic pressures and cost inflation will exacerbate those financial pressures. The government have also pledged to meet this new burden from general taxation. Page 3 of 6 6.3. New care assessment activity: Given that any spending on care does not count towards the £72,000 cap until a formal community care assessment has been carried out by social services, there are likely to be a large number of people who are currently funding the cost of their own care who will approach the council for an assessment when the new rules come into effect. It has been estimated by the Department of Health that 30-35% of people in receipt of care are funding the full cost and have not approached the local authority. This would equate to up to 6,000 people who currently fund their own care in Hertfordshire requesting an immediate assessment when the new rules apply. This will present recruitment difficulties as additional staff will be required for the year 2016 to undertake these one-off assessments. 6.4. The new rules will also lead to a significant permanent increase in the total number of community care assessments requested by self-funders who wish to start recording eligible care costs counting towards their £72,000 cap after 2016. Similarly more people who have assets of less than the new upper capital limit of £118,000 will present for assessment and care services. Based on estimates, this will require an additional 2,000 care assessments every year – meaning approximately 140 extra staff at a variety of grades, based on current levels of efficiency. This staffing cost will be £5.8 million per year. There will also be significant training and recruitment costs and difficulties to sourcing large numbers of new trained staff. This cost is estimated to be in the order of £5.5 million over 4 years. The Association of Directors of Social Services (ADASS) is lobbying the government to meet the costs of this new burden from taxation. 6.5. Additional complaints: Due to the new financial implications of determining ‘eligible’ care needs by social services, it is expected that there will be an increase in the number of appeals and complaints about the outcome of these assessments, particularly from people who have been funding their own care but whose needs are not deemed as being ‘eligible’ using national eligibility criteria. 6.6. Loss of unpaid family carers: The new system introduces a significant financial disincentive for the family of vulnerable adults to provide informal care. As family care is not covered as an expense and would therefore not count towards the cap, this care provision would lengthen the time that an individual would need to fund their own care. Unless the service user was paying the full cost of their support, it would ultimately result in a worse financial situation. This anomaly has been identified to the Department of Health but as a significant risk both in financial terms to individuals but also in terms of the potential need for an increased social care workforce in the medium-term. 7 Equality Implications 7.1 When considering proposals placed before Members it is important that they are fully aware of, and have themselves actively considered, the County Council’s statutory obligations in relation to equalities. This will include paying close attention to any equalities impact assessment produced by officers. Page 4 of 6 7.2.1 The Equality Act 2010 requires the County Council when exercising its functions to have due regard to the need to (a) eliminate discrimination, harassment, victimisation and other conduct prohibited under the Act; (b) advance equality of opportunity between persons who share a relevant protected characteristic and persons who do not share it and (c) foster good relations between persons who share a relevant protected characteristic and persons who do not share it. The protected characteristics under the Equality Act 2010 are age; disability; gender reassignment; marriage and civil partnership; pregnancy and maternity; race; religion and belief, sex and sexual orientation. 7.3 As a result of the proposed changes it will be necessary to monitor their impact on those with protected characteristics as the changes are implemented. It is proposed that this will be taken forward by considering the information so far obtained/considered and undertaking an Equality Impact Assessment which will be reviewed on an on-going basis. Page 5 of 6 Appendix A – Background papers Current charging rules and regulations: Fairer Charging Guidance: In 2003, the Government provided guidance for local authorities on setting charges for non-residential social care services. That guidance seeks to ensure that people who use services are treated fairly and are not asked to make a contribution towards their care that will leave them in financial hardship. This is called the Fairer Charging Guidance and ensures that the charge levied by local authorities is fair, does not exceed the cost of the social care service provided and people are only charged for what they have received. https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/127104/Updat ed-Fairer-Charging-Guidance1.pdf.pdf Fairer Contributions: This guidance is for councils in England to use when determining what contribution, if any, a person receiving social care should make towards it. It ensures people are left with a minimum amount to live on after their social care charge is calculated, that councils take into account their disability related expenses and that councils consult publicly on any changes to their local charging policy. https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/147697/dh_12 1223.pdf.pdf Charging for Residential Accommodation Guide (CRAG): Under the National Assistance Act 1948, where a local authority arranges residential care for a person it is required to carry out a financial assessment and charge the person such sums as they are assessed as being able to pay. The financial assessment is made using the National Assistance (Assessment of Resources) Regulations 1992. The regulations are updated annually. The latest amendment to the 1992 regulations is S.I. 2011/724. People’s property assets may be taken into account when determining the charge for residential care. https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/151959/d h_125836.pdf.pdf Deferred Payment Scheme: When people enter Residential/Nursing care, their home may be taken into account as a capital asset in their financial assessment. Hertfordshire County Council already has a deferred payment scheme that enables people to defer the sale of their property until they die. This loan is interest free until either the property is sold or 56 days after the resident’s death. This scheme was reviewed in 2012 and eligibility criteria put in place. The Dilnot Commission Report: http://webarchive.nationalarchives.gov.uk/20130221130239/http://www.dilnotcommission.dh. gov.uk/our-report/ Page 6 of 6