Own It Your Way - HSB-LHS

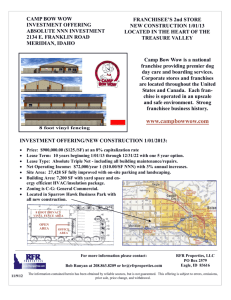

advertisement

Own It Your Way Types of Business Ownership So What? • • • Why do you need to know about the forms of business ownership? Different business options affect the way business activities are conducted Many options are designed to legally protect the business owner in terms of responsibility and loss Legal Structure • • The way you structure your business depends on your: – Personal circumstances – Financial needs – Type of business Your business structure affects your venture’s: – Taxation – Liability – Ownership control Business Ownership • • • • Sole proprietorship Partnership Corporation Hybrid, which is a relatively new structure Sole Proprietorship • • Attributes: – Defined as a business owned by one person – This person receives all of the profits – Accept responsibility for all the risks • Experiences unlimited liabilities – any debts that the business owner owes can be collected from the owner's personal assets or belongings to pay off the debt • Examples of personal assets include car, home, boat – Other characteristics include: • Over 70% of businesses in the U.S. are operated as sole proprietorships • Usually small, employing fewer than 50 people • Chosen because it can easily be managed by the owner or someone the owner hires – Home-based operations – Service businesses – Retail businesses – Home-renovation businesses Most do not need to address legal issues before setting up shop; there is little government intervention – Possible exceptions: local permits or licenses to operate (machinery, equipment, vehicles) – Owners might be required to hold certification in the state they reside • • Hair stylists, CPAs (certified public accountant) Financial aspects – Do not need a lot of capital to get started – Some use personal savings or loans from family members or banks – Business taxes claimed on business owner’s personal income tax return which is filed annually Partnerships • • • Attributes – Defined as businesses owned by two or more persons – Purpose is to combine each individual’s: • Capital • Experience • Abilities or skills – Partners share the risk of loss and the chance of profit – Decide what each person will contribute – Decide what each person will get out of the business Two types of partnerships: – General partnership – each partner has unlimited liability; each partner is liable for the business’s losses; business debts can be paid by taking some of all of each partner’s personal assets – Limited partnership – permits a partner to invest in a business but have limited liability; partner investing capital does not usually perform managerial duties; U.S. government requires limited partnerships to comply with a number of restrictions and legalities Partnerships can be used in most types of businesses – Often used in businesses that offer more than one good or service Corporations • Attributes – Defined as an “artificial being, invisible, intangible, and existing only in the contemplation of the law.” (U.S. Supreme Court) – Functions independently of its owners – It is treated as a person in terms of • Legal rights • Duties • Powers – The owners are not liable for the actions of the company • Owner’s personal property cannot be taken to pay outstanding debts • Owner is liable only for the amount of money that s/he invested in the company – Corporations can: • Borrow or loan money • Buy and sell goods • Make contracts • Sue or be sued • Perform business activities • Have an unlimited life – To be an owner, a person purchases shares, or units, of stock in the company • Person who purchases stock is called a shareholder or stockholder • The more shares of stock a person owns the more control the person has over the – – – – – – – businesses As a form of ownership, corporations are suitable for most any type of business or industry • An ideal structure for businesses that need a lot of capital such as airlines or manufacturing companies • Also for ventures with uncertain futures such as new magazine publishers or entertainment venues Less than 20% of U.S. businesses are structured as corporations and generate 90% of U.S. sales Corporations are subject to more government regulation than sole proprietorships or partnerships Governed by a board of directors • Consists of a few people and possibly shareholders • Makes decisions about the activities of the business • Company officers (i.e., president, financial officer) execute decisions and run the day-to-day activities of the business Corporations are established as one of four types: • Close • “S” • Open • Nonprofit Each type must meet specific guidelines as established by law The type of corporation determines the way it is taxed by the government Characteristics • • • Close (private) – Does not offer shares for sale to the general public – Company might have a few shareholders – Not usually required to make its financial activities public – Taxation requirements • Must prepare reports for state it operates • Taxed by government in two ways, which is called dual taxation – Taxed on the profits made by the company itself – Shareholders are taxed on the dividends they earn on their investments The Subchapter “S” or “S” – A type of private corporation – State-chartered – Special benefits include helping small business owners by taxing the business as individuals in a partnership which avoids dual taxation – Must have 75 or fewer shareholders – Must fiscally operate on a calendar year basis – Must follow a number of other government policies Open (public) corporation – Can sell millions of shares of stock to the general public – There can be thousands of stockholders – Subject to more government regulation and taxation than other forms of business • • ownership – Must provide financial information including earnings, assets, and debts to the public and investors in an annual report – Subject to dual taxation Nonprofit corporation – Operates to accomplish a specific mission; generally, to help society – Does not operate for the sole purpose of making a profit • Income used to cover operational expenses – Types of institutions that are established as nonprofits include: • Charities • Schools • Religious organizations • Research – Example: the American Heart Association; defines purpose as: “A national voluntary health agency whose mission is to reduce disability and death from cardiovascular diseases and stroke.” To accomplish its mission, the organization develops education programs, conducts scientific research, and informs the public about heart care – Financial issues • Exempt from some or all taxation obligations • Funding is generally received through donations, grants, and/or membership fees Hybrid – Have emerged in recent years and become a popular option for establishing business ownership – Owners are called members – Members enjoy the advantages of corporations as either sole proprietorships or partnerships – Can be structured in two forms: • Limited liability partnership (LLP) • Limited liability company (LLC) – Characteristics of both hybrid forms of business ownership: Characteristics of Hybrids • Limited liability: personal assets cannot be taken to pay the company’s debts • Limited life: most states require that the company dissolve after a certain amount of time and/or upon the death, retirement, or resignation of an owner • Limited taxation: taxes are claimed only on the individual members’ personal income tax return • Articles of Organization must be filed in the state in which the business operates • Members determine how the company will be managed and how the profits will be shared • Unlimited members (owners) are permitted; however, there are usually just a few – Limited liability company (LLC) attributes: • Minimum number of owners determined by state where business is located – Many states require at least two owners – Some state require only one owner • Should develop an operating agreement that identifies each member’s role in the company • LLC’s are suitable for most any type of buinsess – Limited liability partnership (LLP) attributes: • Used by many professional service businesses – Doctors – Lawyers – Accountants • Used to protect innocent partners from the malpractice of another partner Ways to Start a Business • You can start a business by yourself, with other people, or by acting as an agent to an existing company – Franchising – Multi-level marketing – Licensing – Joint ventures Franchising • • • Defined as a method of distributing goods and services through legal agreement between two parties – Franchisor is the seller or parent company • Owns the name or trademark rights of the company – Franchisee is the buyer • Acquires the right to operate the business using the parent company’s name General characteristics: – Desirable ownership option because the product has a(n): • Established brand • Solid reputation – You must sign a franchise agreement with the franchisor (parent company) – You might need to pay an initial franchise fee to the parent company • Fee amounts vary • Can be as high as $45,000-$100,000 – Franchisee is financially responsible for costs related to: • Facility construction or leasing • Equipment • Insurance • Legal fees – Other fees that might be required by the parent company: • Royalty fees: based on a percentage of the franchisee’s profits • Advertising fees: helps to offset national advertising campaigns Ways franchisors obtain franchisees: – Master license • Another person or firm who helps the parent company find franchisees for a particular region • May or may not provide support to franchisees in terms of training and warehousing – Multiple-unit franchise ownership • Land developers, other groups, or individuals who purchase franchise rights to open several outlets in a specific area • A growing trend in the world of business ownership Franchising • Franchise formats – Business-format franchise • Available to most anyone who has the capital to invest • Requires a close, continuous working relationship between the franchisor and franchisee to be successful – Franchisors often provide the franchisee with: » Training » Guidance » Supply channels • Franchise advantages: – Benefits from the parent company’s advertising programs – Reduced risk of business failure • Franchisee disadvantage due to limits on: – Products they can offer – Vendors that they can use – Hours that they can operate – The appearance of the outlet • Business-format franchises can be found in almost any industry • Piggyback franchising is a form of the business-format franchise arrangement and consists of a retail franchise that operates within the facilities of another store (host) – A Wal-Mart store hosts a McDonald’s franchise • The host benefits by increasing its product line • The franchisee benefits by having access to the host store’s customers • The franchisee must agree to the terms established by both the parent company and host company Franchising • Product trade-name franchise – An independent sales relationship between a supplier (franchisor) and a dealer (franchisee) to stock and sell a specific or exclusive line of products – Often referred to as dealerships or exclusive distributorships – Characteristics • Products are usually bought on consignment or straight from the supplier/manufacturer • The name of the business is chosen by the franchisee • The prospective dealer usually must have a great deal of experience and financial ability before the franchisor will agree to the arrangement – Examples of industries that use the product trade-name franchise format: • Automobile • Large appliance • Soft-drink • Petroleum Multi-level Marketing Business • • • • A type of business that pays commissions on sales to people at two or more levels – Sales representatives usually work independently of the company – Sales representatives sell the products and try to get others to sell the products as well – Sales representatives receive pay outs from the sales of other people whom they convince to become representatives Characteristics of legitimate multi-level marketing businesses: – People become reps (distributors) because they have used the product and liked it – Most distributors in multi-level marketing businesses are home-based and offer flexible scheduling – Most reps can get started for $100 or less • These monies are generally used to cover the cost of instruction, samples, and promotional materials that are provided by the company – Commission and bonus structures differ between companies • Some companies offer incentives or prizes, such as cars, for attaining a set sales – The distributors determine how much income they generate by the time and energy they put into developing their business contacts Examples of multi-level marketing businesses include: – Shaklee vitamins – Mary Kay cosmetics – Pampered Chef kitchen products – Creative Memories scrapbooking supplies Multi-level marketing issues: – Pyramid schemes (clubs) operate illegally • Typically require potential members to pay an investment fee up front • Emphasis is placed on recruiting new members so that more investment fees can be collected • Little emphasis is placed on product attributes or quality – If you are considering multi-level marketing as a way to own your own business, check out an unfamiliar company carefully • Better Business Bureau • Direct Selling Association Licensing • Refers to an owner’s authorization or permission for another entity to use material that is: – Trademarked – Copyrighted • Logo • Name – Patented – The authorization is usually granted for: • A specific activity • A limited time period – The arrangement benefits both parties, which include: • • • The licensor: the owner of the material • The licensee: the buyer of the material Licensing characteristics: – Exclusive licensing: the licensee is the only entity that has licensing rights to the goods, materials, or information – Nonexclusive licensing: several people or companies are granted licensing rights – Licensees might be required to pay: • Initial licensing fees • Royalties or a percentage of the profits to the licensor – Licensing agreements should be developed with help from an attorney because: • Each situation is unique and terms vary • Terms are usually specific in nature • Improper use of licensed material may result in a lawsuit – Licenses can be granted by many types and sizes of businesses – Purposes of licensing: • Technological information • Intellectual information (i.e., research findings) • Industrial processes or methods • Formulas or recipes • Customer lists, manuals • Recognized brands, such as a logo or name • Music and art • Inventions Licensing ownership options: – You can be the licensee • Perhaps, you have a great product idea • You want to use your favorite professional sports team logo on your product • You are the licensee because you need permission to use the logo – You can be the licensor • You develop an invention or process and have it trademarked or copyrighted • Another business wants to manufacture or distribute your invention or process • You are the licensor because you grant permission for others to use your work Joint Ventures • • • Two or more businesses that enter into a mutually beneficial relationship, usually shortterm or for a single transaction or project, by combining complementary resources – Technology – Skills – Capital – Distribution channels Also referred to as strategic alliances Attributes of joint ventures: – Becoming a popular way to expand businesses for less money than it takes to do it alone • Allows companies to reach new markets • Allows companies to develop new profit centers – This type of business strategy can work at all levels from sole proprietorships to corporations • Used in real estate development • For businesses that want to expand internationally – Each party must understand and agree to all terms regarding the relationship – It is a good idea to formalize the venture in a written contractual agreement