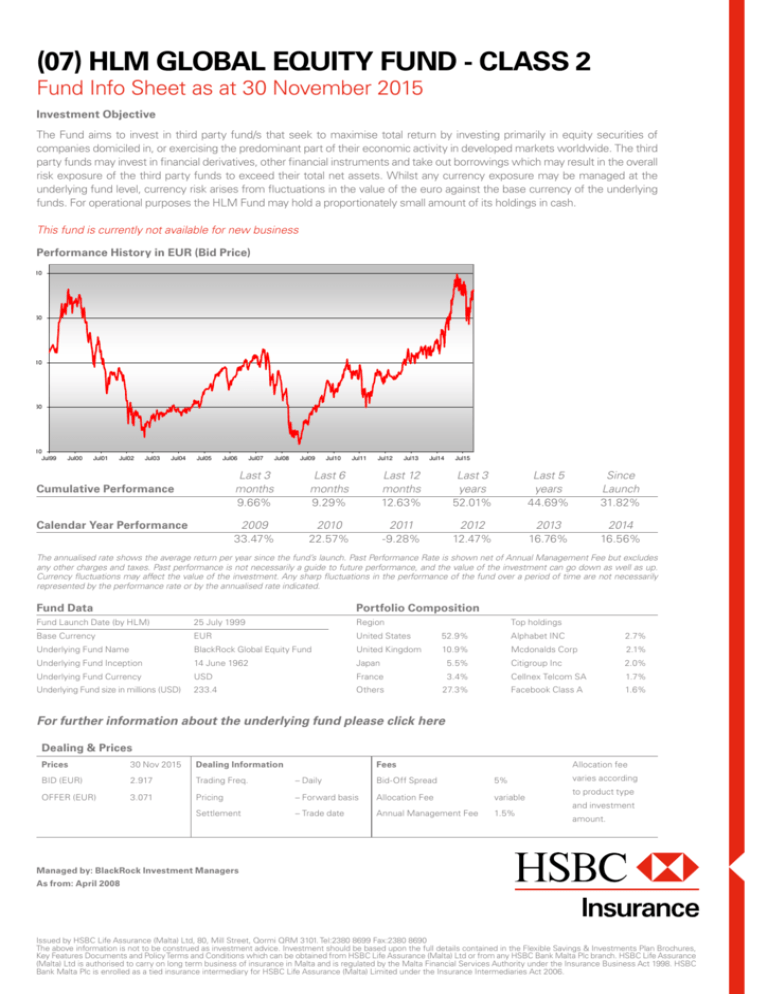

(07) hlm global equity fund - class 2

advertisement

(07) HLM GLOBAL EQUITY FUND - CLASS 2 Fund Info Sheet as at 30 November 2015 Investment Objective The Fund aims to invest in third party fund/s that seek to maximise total return by investing primarily in equity securities of (07) HLM Global Equity Fund - Class 2 companies domiciled in, or exercising the predominant part of their economic activity in developed markets worldwide. The third FUND INFO SHEET AS AT 30-Nov-15 Managed by: BlackRock Investment Managers party funds may invest in financial derivatives, other financial and take out borrowings which may result in the overall as from: instruments April 2008 risk exposure of the third party funds to exceed their total net assets. Whilst any currency exposure may be managed at the Investment Objective The Fundunderlying aims to invest in third party fund/s that seek to maximise return from by investing primarily in equityin securities of companies domiciled in, oragainst exercising the fund level, currency risk total arises fluctuations the value of the euro the base currency of the underlying predominant part of their economic activity in developed markets worldwide. The third party funds may invest in financial derivatives, other financial instruments and take out borrowings which operational may result in the overall risk exposure the third Fund party funds to exceed total net assets. Whilst any currency exposure of mayits be holdings in cash. funds. For purposes theofHLM may holdtheir a proportionately small amount HSBC Life Assurance (Malta) Ltd managed at the underlying fund level, currency risk arises from fluctuations in the value of the euro against the base currency of the underlying funds. For operational This fund not is currently available The fund is currently available for not new business for new business Performance History in EUR (Bid Price) Performance History in EUR (Bid Price) 3.10 2.60 2.10 1.60 1.10 Jul99 Jul00 Jul01 Jul02 Jul03 Jul04 Jul05 Jul06 Cumulative Performance Jul07 Jul08 Jul09 Jul10 Jul11 Jul12 Jul13 Jul14 Jul15 Last 3 Last 6 Last 6 Last 12Last 5 Last 3 Last 5 Since Last 3 Last 12 Last 3 Since months monthsmonthsmonths months years years Launch months years years Launch 9.66% 9.29% 12.63% 52.01% 44.69% 31.82% 9.66% 9.29% 12.63%52.01% 44.69%31.82% Cumulative Performance Global Equity Fund Calendar Year Performance Global Equity Fund 2009 2010 2011 2012 2013 2014 33.47% 22.57% 2010 -9.28% 12.47%20112012 16.76% 16.56% Calendar Year Performance 2009 20132014 The annualised rate shows the average return per year since the fund's launch. Past Performance Rate is shown net of Annual Management Fee but excludes any other charges and taxes. Past performance is not necessarily a guide to future performance, and the value of the investment can go down as well as up. Currency fluctuations may affect the value of the investment. Any sharp fluctuations in the performance of the fund over 33.47% 22.57%-9.28%12.47% 16.76%16.56% a period of time are not necessarily represented by the performance rate or by the annualised rate indicated. The annualised rate shows the average return per year since the fund’s launch. Past Performance Rate is shown net of Annual Management Fee but excludes any other charges and taxes. Past performance is not necessarily a guide to future performance, and the value of the investment can go down as well as up. fund over a period of time are not necessarily Fund Data Portfolio Composition Currency may affect the1999 value of the investment.Region Any sharp fluctuations in the performance of the Fund Launch Date (byfluctuations HLM) 25 July Top holdings represented by the performance rateEUR or by the annualised rateUnited indicated. Base Currency States 52.9% Alphabet INC BlackRock Global Equity Fund United Kingdom 10.9% Mcdonalds Corp Underlying Fund Name Underlying Fund Inception 14 June 1962 Japan 5.5% Citigroup Inc Cellnex Telcom SAU Underlying Fund Currency USD France 3.4% Facebook Class A Underlying Fund Launch size in millions (USD) 233.4 25 July 1999 Others 27.3%Region Fund Date (by HLM) 2.7% 2.1% 2.0% 1.7% 1.6% Fund DataPortfolio Composition Top holdings Base Currency EUR United States 52.9% Alphabet INC Underlying Fund Name BlackRock Global Equity Fund United Kingdom 10.9% Mcdonalds Corp 2.1% Underlying Fund Inception 14 June 1962 Japan Citigroup Inc 2.0% For further information about the underlying fund please click here Dealing & Prices Currency USD Prices Underlying Fund 30-Nov-15 Dealing Information Fees - Daily Bid-Off Spread BID (EUR) 2.917 Trading Freq. Underlying Fund size in millions (USD) 233.4 - Forward basis Allocation Fee OFFER (EUR) 3.071 Pricing - Trade date Annual Management Fee Settlement 5.5% France 5% Others variable 1.5% 3.4% 27.3% Allocation fee and service charge varies according to product investment amount. type 2.7% Cellnex Telcom SA 1.7% Facebook Class A 1.6% and For further information about the underlying fund please click here Issued by HSBC Life Assurance (Malta) Ltd, 80, Mill Street, Qormi QRM 3101. Tel: 23808699 Fax:23808690 Dealing & Prices The above information is not to be construed as investment advice. Investment should be based upon the full details contained in the Flexible Savings & Investments Plan Brochures, Key Features Documents and Policy Terms and Conditions which can be obtained from HSBC Life Assurance (Malta) Ltd or from any HSBC Bank Malta Plc branch. HSBC Life Assurance (Malta) Ltd is authorised to carry on long term business of insurance in Malta and is regulated by the Malta Financial Services Authority under the Insurance Business Act 1998. HSBC Bank Malta Prices Dealing Fees 30HSBC NovLife2015 Plc is enrolled as a tied insurance intermediary for Assurance (Malta) LimitedInformation under the Insurance Intermediaries Act 2006. Allocation fee BID (EUR) 2.917 Trading Freq. – Daily Bid-Off Spread 5% OFFER (EUR) 3.071 Pricing – Forward basis Allocation Fee variable Settlement – Trade date Annual Management Fee 1.5% varies according to product type and investment amount. RESTRICTED Managed by: BlackRock Investment Managers As from: April 2008 Issued by HSBC Life Assurance (Malta) Ltd, 80, Mill Street, Qormi QRM 3101. Tel:2380 8699 Fax:2380 8690 The above information is not to be construed as investment advice. Investment should be based upon the full details contained in the Flexible Savings & Investments Plan Brochures, Key Features Documents and Policy Terms and Conditions which can be obtained from HSBC Life Assurance (Malta) Ltd or from any HSBC Bank Malta Plc branch. HSBC Life Assurance (Malta) Ltd is authorised to carry on long term business of insurance in Malta and is regulated by the Malta Financial Services Authority under the Insurance Business Act 1998. HSBC Bank Malta Plc is enrolled as a tied insurance intermediary for HSBC Life Assurance (Malta) Limited under the Insurance Intermediaries Act 2006.