to the PDF

advertisement

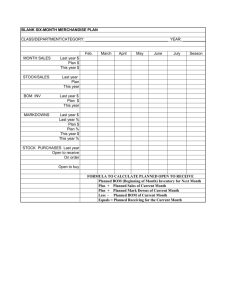

Buying Plan Spring/Summer 2015 for Work Wear Samantha Chandler and Lily Walton Table of Contents The Business Plan Executive Summary I. Merchandise Classification Pg. 1 Sales Plan for Merchandise Classification Pg. 1 Price Points Pg. 1 Price Position Expectations II. Market Research Pg. 2 Competitors Merchandise - Survey of LOFT and Competitors - Competitors Classifications and Sub-­‐Classifications - Analysis of Sub-­‐Classifications -­‐ Average Price by Sub-classification Pg. 4 Industry Trends III. Merchandise Plan Pg. 5 6-Month Budget Plan Pg. 5 Pricing Plan IV. Assortment Plan for February 2015 V. References VI. Appendices I. Merchandise Classification A. Sales Plan for Merchandise Classification Table 1. LOFT’s Classification & Sub-Classification Classification % Sales Spring 2015 Sales Plan ($) Work Wear 30% $794,608.20 Pants 40% $317,843.28 Blazer 10% $79,460.82 Dresses 15% $119,191.23 B. Price Points Table 2. LOFT’s Classification: Work wear SubClassification % Sales Price Points Pants 40% $49.50, $59.50, $69.50, $74.50, $79.50 Jackets 10% $79.50, $98.00, $118.00, $128.00, $148.0 Dress 15% $69.50, $79.50, $89.50, $98.00 C. Price Position Expectations We expect LOFT’s price position on pants to range from $49.50-­‐$79.50, their blazers to range from $79.50-­‐$148.00, and their dresses range from $69.50-­‐98.00. LOFT’s competitors have expected price points that will be above and below those of LOFT’s. Banana Republic has one price for pants that is $98.00. GAP also has one price point for pants that is $49.95.Therefore, LOFT’s price points for jeans are below that of Banana Republics and above market pricing for GAPs. Banana Republic’s price range for blazers goes from $89.5-­‐ 198.00. GAPs price range for blazers goes from $88.00-­‐$98.00. LOFT’s pricing for blazers are at market price for Gap but below market price for Banana Republic. Banana Republic price range for dresses goes from $98.00-­‐$150.00. GAPs price range for shorts are between $39.95-­‐$79.95. Loft falls below the market price for Banana Republic, but above market for Gap. II. Market Research A. Competitors Merchandise 1. Survey of LOFT and Competitors LOFT has competition within itself because of its close relation with Ann Taylor and our similar lines. Two of LOFT’s top competitors are Banana Republic and Gap in that similar merchandise and price points are offered from all three companies. Banana Republic Banana Republic offers clothing that is targeted to a similar consumer base as LOFT, ranging from 15 to 45. Banana Republic has a consumer base that tends to be energetic and work-oriented, much like the LOFT consumer base. The brand is also known for targeting the minority races, as well. The brand stays to its simple silhouettes and basic colors. Gap also offers that casual, but business style that LOFT seems to specialize in (Target, 2010). Gap Gap also offers that casual, but business style that LOFT seems to specialize in. Gap tends to be a little trendier than LOFT, but keep their straight lines and edges of their silhouettes. Gap has gained most of their success from their popular television commercials, which is something that we do not partake in. Like the Banana Republic, Gap also targets the minority consumer and does well in this area (Target, 2010). 2. Competitors Classifications and Sub-­‐Classifications Table3. SubClassification Price Points Brand(s) Pants 49.95, 54.95, 59.95, 69.96 Gap Blazers 88.00, 98.00 Gap Dresses 39.95, 49.95, 54.95, 59.95, 64.95, 69.95, 74.95, 79.95 Gap Table 4. SubClassification Pants 69.50, 79.50, 89.50, 98.00 Blazers 89.50, 130.00, 150.00, 158.00, 198.00 Dresses Price Points 98.00, 110.00, 120.00, 130.00, 140.00, 150.00 Brand(s) Banana Republic Banana Republic Banana Republic 3. Analysis of Sub-­‐Classifications Gap’s clothing leans towards the more casual when compared with ours. This is reflected in the price since their clothing is priced slightly below ours. This also causes their clothing to isolate older and more conservative prospective consumers. Loft on the other hand is able to appeal to women of a greater age variety since we offer more classic silhouettes. Banana Republic’s clothing is priced just above ours, which isolates the younger consumer market that is just starting out in their career and may need watch their spending. Loft offers clothing of the same quality as Banana Republic at slightly lower prices, which makes a difference to the price conscious woman. 4. Average Price by Sub-classification Figure 1. 160 140 120 100 Gap 80 Banana Republic 60 Loft 40 20 0 Pants Jackets Dresses B. Industry Trends According to Vogue, spring will ring in a fresh season of bold colors, floral prints, longer lengths, metallic, lace materials, sporty cuts, and pleated embellishments. While Loft is not a trendy store nor is it known for fast fashion, we will do our part to insure that our customer is among the best dressed wherever she might find herself. A turn away from the traditional black/grey suit will keep the Loft customer is traditional cuts while incorporating color and print into her business wardrobe. As these trends hit the market, Loft will be there to ease the monotone chromatic customer into a daring and bright new world. The market will be positive as new college graduates continue to build their workplace closet. A major industry trend will be the continuing incorporation of technology while interacting with the customer. (Vogue’s). III. Merchandise Plan A. 6-Month Budget Plan Table 5. February Net Sales % 8% Net Sales $ $63,568.66 Reductions 20% % Reductions $31,784.33 $ BOM SSR 5 BOM stock $317,843.28 EOM stock $429,088.43 Purchases R $206,598.13 Purchases C $45,451.59 March 18% $143,029.48 20% April 21% $166,867.72 15% May 21% $166,867.72 14% June 17% $135,083.39 16% July 15% $119,191.23 15% Total 100% $794,608.20 20% $31,784.33 $23,838.25 $22,249.03 $25,427.46 $23,838.25 $158,921.64 3 $429,088.43 $417,169.31 $162,894.68 $35,836.83 2.5 $417,169.31 $417,169.31 $190,705.97 $41,955.31 2.5 $417,169.31 $432,266.86 $204,214.31 $44,927.15 3.2 $432,266.86 $476,764.92 $205,008.92 $45,101.96 4 $476,764.92 $480,700.70 $146,965.26 $32,332.36 $2,490,302.10 $2,653,159.52 $1,116,387.26 $245,605.20 1. The departmental seasonal sales were found by projecting a yearly sales figure for Loft assuming an 11.5% sales growth from previous years. 2. The total planned seasonal sales figure for the classification (794608.2) was derived from Loft’s projected sales for 2015 and work wear’s 30% makeup. 3. The monthly planned sales are based on the knowledge that post Christmas time is slow (February-March), springtime months typically have the greatest % of sales (AprilMay), and things slow down slightly during the summer (June-July). 4. The overall reductions are equal to 20% of the sales. 5. The months with the lower sales % have greater reductions % and vice versa. 6. The desired inventory TO is 2.79 based on our yearly goal of TO being 5.58. 7. The SSR for February-July are as follows: 5, 3, 2.5, 2.5, 3.2, and 4. This is because the month’s with higher planned sales have lower SSR and vice versa. 8. The BOM for each month is derived from multiplying the monthly SSR by the monthly sales. 9. We predict that July will have the highest EOM of all the month’s (480700.7). 10. Average inventory at retail is planned to be $186,090.91 (divide sales by TO). 11. Average inventory at cost will then be $102,350.00. 12. Our actual TO is 2.21 which is extremely close to the goal of 2.79 so no changes will be made to SSR. 13. Planned purchases at retail per month are based on the equation in which you take monthly NS add monthly reductions subtract BOM stock and add EOM stock. Planned purchases at cost are found by multiply the monthly purchases at retail by the difference between 100% and IMU (in our case 78%). 14. GM will be 45% this was found converting the yearly projected GM into a usable and applicable figure for this department and season then dividing it by the projected seasonal/departmental sales. 15. GMROI for this classification will be 180.82 over the season. B. Pricing Plan We are using a 78% initial markup plan to help raise our net sales and our profit. The prices will also attract our target customers. We will have many markdowns such as marking items down to clearance prices. This will help us move through slow moving merchandise and will help us raise our raise our net sales and profit. Moving items into clearance helps us move our merchandise that is from the past season much quicker. The last markdown we will have is sales promotions. We will have a monthly sale on the entire store for the clients that are in our loyalty program or on our email list. This will increase traffic and increase excitement on the sale day. This will also increase brand loyalty from our regular customers and from first time customers. We will have coupons sent to all of our customers to attract the price sensitive customers. Coupons will intrigue interest in new customers and make them regular customers. They will also make regular customers have much larger purchases and move merchandise more quickly. IV. Assortment Plan for February 2015 The BOM stock for February is $317,843.28 and the work wear classification is responsible for 30% of the sales. Pants are responsible for 40%, blazers responsible for 10%, and dresses are responsible for 15% of the BOM stock for February. We plan to have a total of $127,137.31 BOM stock for pants, $31,784.33 for blazers, and $47,676.49 for dresses. To make our BOM stock we need to sell a total of 1,831 pants, 319 blazers, and 561 dresses. We multiplied each sub-­‐classification percent by February BOM stock to find the total BOM stock for each sub-­‐classification. We calculated the BOM stock for each assortment factor by multiplying the distribution percent for that assortment by the total BOM stock for the sub-­‐classification. Diving the BOM stock by each price point lets us find how many units we need to sale for each price point and adding those tells us the total number of units we need to sell. We then multiply each assortments distribution percent by the total number of units to find the number of units we need to sell for each assortment. To find the distribution percent for each assortment we divide the BOM stock units by the total BOM stock units. Table 6. BOM stock for Feb. $317,843.28 Sub-­‐classification % of sales Sales Plan ($) Pants 40% $127,137.31 Blazers 10% $31,784.33 Dresses 15% $47,676.49 Table 7. Assortment Factor for pants Style Color Size Price Points Total Element s Bootcut Trousers Cropped Ankle Skinny Light gray Dark gray Brown Khaki White Black 0 2 4 6 8 10 12 $49.50 $59.50 $69.50 $74.50 $79.50 % Distr. ($) 10.00% 20.00% 35.00% 20.00% 15.00% BOM Stock ($) $12,713.73 $25,427.46 $44,498.06 $25,427.46 $19,070.60 % Distr. (units) 10.00% 20.00% 35.00% 20.00% 15.00% BOM Stock (units) 183 366 641 366 275 10.00% $12,713.73 10.00% 183 10.00% 5.00% 20.00% 25.00% 30.00% 5.00% 10.00% 25.00% 25.00% 15.00% 10.00% 10.00% 5.00% 15.00% 40.00% 10.00% 30.00% 100% $12,713.73 $6,356.87 $25,427.46 $31,784.33 $38,141.19 $6,356.87 $12,713.73 $31,784.33 $31,784.33 $19,070.60 $12,713.73 $12,713.73 $6,356.87 $19,070.60 $50,854.92 $12,713.73 $38,141.19 $127,137.31 10.00% 5.00% 20.00% 25.00% 30.00% 5.00% 10.00% 25.00% 25.00% 15.00% 10.00% 10.00% 7.02% 17.50% 39.96% 9.32% 26.20% 100% 183 92 366 458 549 92 183 458 458 275 183 183 128 321 732 171 480 1831 Table 8. Assortment Factor for blazers Style Color Size Price Points Total Eleme nts Linen Denim Cotton Twill Tweed Navy Blush Brown Tan White Black 0 2 4 6 8 10 12 $79.50 $98.00 $118.0 0 $128.0 0 $148.0 0 % Distr. BOM Stock ($) ($) 20.00% $6,356.87 10.00% $3,178.43 35.00% $11,124.52 20.00% $6,356.87 15.00% $4,767.65 10.00% $3,178.43 5.00% $1,589.22 5.00% $1,589.22 20.00% $6,356.87 25.00% $7,946.08 35.00% $11,124.52 5.00% $1,589.22 10.00% $3,178.43 25.00% $7,946.08 25.00% $7,946.08 15.00% $4,767.65 10.00% $3,178.43 10.00% $3,178.43 20.00% $6,356.87 50.00% $15,892.17 % Distr. (units) 20.00% 10.00% 35.00% 20.00% 15.00% 10.00% 5.00% 5.00% 20.00% 25.00% 35.00% 5.00% 10.00% 25.00% 25.00% 15.00% 10.00% 10.00% 25.06% 50.81% BOM Stock (units) 64 32 112 64 48 32 16 16 64 80 112 16 32 80 80 48 32 32 80 162 20.00% $6,356.87 16.88% 54 5.00% $1,589.22 3.89% 12 5.00% 100% $1,589.22 $31,784.33 3.36% 100% 11 319 Table 9. Assortment Factor for dresses Style Color Size Price Points Total Elemen ts A-Line Maxi Sheath Shift Shirt Dress Blue Cream Brown Pink White Black 0 2 4 6 8 10 12 $69.50 $79.50 $89.50 $98.00 % Distr. BOM Stock ($) ($) 35.00% $16,686.77 10.00% $4,767.65 20.00% $9,535.30 20.00% $9,535.30 15.00% 10.00% 5.00% 5.00% 20.00% 25.00% 35.00% 5.00% 10.00% 25.00% 25.00% 15.00% 10.00% 10.00% 20.00% 20.00% 25.00% 35.00% 100% $7,151.47 $4,767.65 $2,383.82 $2,383.82 $9,535.30 $11,919.12 $16,686.77 $2,383.82 $4,767.65 $11,919.12 $11,919.12 $7,151.47 $4,767.65 $4,767.65 $9,535.30 $9,535.30 $11,919.12 $16,686.77 $47,676.49 % Distr. (units) 35.00% 10.00% 20.00% 20.00% BOM Stock (units) 196 56 112 112 15.00% 10.00% 5.00% 5.00% 20.00% 25.00% 35.00% 5.00% 10.00% 25.00% 25.00% 15.00% 10.00% 10.00% 24.47% 21.40% 23.76% 30.37% 100% 84 56 28 28 112 140 196 28 56 140 140 84 56 56 137 120 133 170 561 V. References Cited Work Cited Clothes, Shoes, and Accessories for Women and Men | Free Shipping on $50 | Banana Republic. (n.d.). Retrieved March 31, 2014, from http://bananarepublic.com LOFT: Women's Clothing, Petites, Dresses, Pants, Shirts, Sweaters. (n.d.). Retrieved March 31, 2014, from http://Loft.com Shop Clothes For Women, Men, Baby, and Kids | Free Ship on $50 | Gap. (n.d.). Retrieved March 31, 2014, from http://gap.com Vogue's Guide to the Fashion Trends for Spring 2014 - Vogue. (n.d.). Retrieved March 31, 2014, from http://vogue.com/guides/vogues-guide-to-spring-2014fashion/ VI. Appendices