Peaking of Global Oil Production

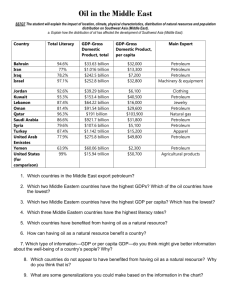

advertisement

Issues in the “Peaking of Global Oil Production” Debate David L. Greene Oak Ridge National Laboratory Workshop on Trends in Oil Supply and Demand and Potential for Peaking of Conventional Oil Production National Academies Washington, DC October 20-21, 2005 The glass is half full. The glass is half empty. Ø Ø Ø Pessimism: “an inclination to emphasize adverse aspects, conditions, and possibilities or to expect the worst possible outcome” Optimism: “an inclination to put the most favorable construction upon actions and events or to anticipate the best possible outcome” Science: “the state of knowing: knowledge as distinguished from ignorance or misunderstanding” Webster’s Ninth New Collegiate Dictionary. “Running out of” or “running into” oil? Ø Ø “Pessimists” Geology rules Discoveries lag production Peaking, not running out matters Expect peak between now and 2010 “Optimists” Markets & technology rule Rate of technological progress > rate of depletion Market system and technology expand & redefine resources Stone age did not end for lack of stones; oil age will not end for lack of oil. The debate about oil peaking hinges on several key questions. Ø Ø Ø Ø Ø Ø Ø Ø Hubbert curve v. technology curve: Which dominates? What is oil? What is a resource? How much is there? Will OPEC provide? What other energy resources are available? What about the demand for oil? What about the environment? Rate of production proportional to cumulative production x remaining resource → Hubbert Curve. Figure 8. Curves of discoveries and production during a complete production cycle of a finite resource. (Yongquist, 1997; After Hubbert, 1956) U.S. petroleum supply peaked in 1970 and has generally declined since then. United States' Petroleum Supply: 1950-2004 Million Barrels per Day 25 20 15 10 IMPORTS 5 0 1950 DOMESTIC 1960 1970 1980 U.S. DOE/EIA, Annual Energy Review 2004, table 5.1. 1990 2000 If the peak of discovery occurred before 1970, the peak in production should be about now. ASPO Newsletter No. 58, October 2005. Integrating Hubbert curves of the world’s conventional oil fields plus heavy, deepwater, and polar oil and NGLs, the ASPO sees a sharp peak at about 2010. ASPO, 2004 The optimists: the market system and technological change will make oil peaking a non-issue. Ø Resource scarcity is a myth Ø Mineral prices have declined despite depletion Ø Because of technological change More oil can be extracted from depleted fields Things that are not oil can “become oil” More can be done with less oil Ø The global economy will “decarbonize” What is oil? Ø Ø Ø Conventional Oil Liquid hydrocarbons of light and medium gravity and viscosity, in porous and permeable reservoirs. Plus enhanced recovery and NGLs Unconventional Oil Deposits of density > water (heavy oil) Viscosities > 10,000 cP (oil sands) Tight formations (shale oil = kerogen). But liquid hydrocarbon fuels can also be made from coal, natural gas, or biomass. Discovered Petroleum-Initially-in-Place SUBCOMMERCIAL COMMERCIAL Undiscovered Petroleum-Initiallyin-Place PETROLEUM-INITIALLY-IN-PLACE What is a resource? Technology + Economics + Uncertainty PRODUCTION RESERVES Proved (1P) Proved + Probable (2P) Proved + Probable + Possible (3P) Producing Being developed Development planned Technology proved CONTINGENT RESOURCES Technology not proved Best Low Estimate HIgh Estimate Non commercial Estimate Unrecoverable PROSPECTIVE RESOURCES Best Low Estimate HIgh Estimate Estimate Unrecoverable http://www.world-petroleum.org/ Not to scale PROSPECT LEAD PLAY SPE/WPC/AAPG joint definitions Do we know how much oil there is? Ahlbrandt et al., 2005 USGS and Campbell resource estimates differ: 1. Reserve growth 2. Uncertainty 3. 10 years’ production Estimated Conventional Oil + NGL Resources to 2030: USGS 2000 Estimated Petroleum Production to 2100: Colin Campbell 26/09/2005 5000 4500 5000 Gas Liquid 4500 Reserve Grow th Deepw ater + Polar 4000 4000 R.O. Future New Billions of Barrels Billions of Barrels 3500 Regular Oil Past 3000 2500 2000 3000 2500 2000 1500 1500 1000 1000 500 500 Cum. Production & Reserves as of 2004 0 Proved Reserves Cumulative R.O. Future Know n 3500 Undiscovered Cum. Production & Reserves as of 1995 0 95% ASPO Newsletter No. 58, October 2005. 50% Ahlbrandt et al., 2005 Probability Level 5% Pessimists dispute the USGS estimates with the following arguments: Ø OPEC members overstate proved reserves Ø Reserve growth methodology biased because it is based on US experience governed by SEC rules Ø Range of uncertainty exaggerated Ø Also, unconventional resources much smaller than some believe If non-OPEC production peaks or plateaus around 2010-2015, will OPEC provide? ExxonMobil, 2005. http://www.exxonmobil.com/Corporate/Citizenship/Corp_citizenship_energy_outlook.asp Or will OPEC make more money by leaving more oil in the ground? Cumlative Production and Revenues, 2003-2025: Middle East OPEC Members $7.1 $6.7 $6.6 $7.0 Billions of Barrels 250 200 $8.0 $6.0 235.4 $5.0 189.8 171.9 150 $3.0 Production 100 $2.0 Revenues 50 $4.0 $1.0 $0.0 0 Reference Case High A Oil Price High B Oil Price 2005 Annual Energy Outlook Case U.S. DOE/EIA, Annual Energy Outlook 2005. Trillions of 2003 Dollars 300 Most of the world’s hydrocarbons are unconventional or require technological progress to be usable. Estimated World Fossil Energy Resources (IPCC, 2000, Emissions Scenarios) Billion Barrels of Oil Equiv. 25000 20000 Tech-Progress Undiscovered 15000 Reserves Consumed 10000 5000 0 Oil Conv. Oil Unconv. Gas Conv. Gas Unconv. Coal DECARBONIZATION or RE-CARBONIZATION? Ausubel, 2003. Conventional fuels from unconventional fossil resources are likely to increase CO2 emissions. Well-to-Pump GHG Emissions of Gasoline from Oil Sands WTP GHGs Emissions, g/mmBtu 60,000 Surface Mining In-Situ Production 50,000 40,000 30,000 20,000 10,000 ut u uc lea r, f ut u as ol in e: N G O S O S G as ol in e: C oa l, f G ,f e: N as ol in re re re ut u od ay G ,t G O S O S G e: N as ol in G O S as ol in e: N C e: as ol in G Larsen, Wang, et al., 2004, Argonne National Lab. uc lea r, f ut u oa l, f G ,f N e: O S ut ur e re re ut u od ay G ,t as ol in G O S G O S C on v. C ru de as ol in e: N G as ol in e 0 One can construct scenarios in which oil use peaks as a result of declining demand, but are we on that path? Oil Consumption by Region IIASA/WEC C1 Scenario, IEO Low Growth, Champagne GYOW Scenario 6 5 GTOE 4 Rest of World FSU 3 Other OECD Canada 2 United States 1 0 2000 2010 Greene, Hopson & Li, 2003. 2020 2030 2040 2050 IF the world continues on its present path and IF OPEC expands output at <2%/yr., massive quantities of unconventional liquid fuels will be required. World Oil Production from Conventional and Unconventional Resources: Reference/USGS 10 9 8 7 Change vs. Scenario GTOE 6 Shale Oil 5 Heavy+Bitumen Conventional MEA 4 Conventional ROW 3 2 1 0 2000 2010 Greene, Hopson & Li, 2003. 2020 2030 2040 2050 How quickly and smoothly can environmentally sensitive unconventional production expand? World Oil Production from Heavy Oil and Oil Sands: Reference/USGS 3.0 2.5 GTOE 2.0 Former USSR 1.5 South America Canada 1.0 0.5 0.0 2000 2010 Greene, Hopson & Li, 2003. 2020 2030 2040 2050 The oil well is half… A. Full B. Empty C. None of the above We look forward to your contributions to understanding this important issue. Thank you. What is a resource? Ø Total petroleum initially in place: “…that quantity of petroleum which is estimated to exist originally in naturally occurring accumulations.” Proved Reserves (SPE/WPC 2005): “…quantities of petroleum which, by analysis of geological and engineering data, can be estimated with reasonable certainty to be commercially recoverable, from a given date forward, from known reservoirs and under current economic conditions, operating methods, and government regulations.” Ø Unproved Reserves (SPE/WPC 2005): “Unproved reserves are based on geologic and/or engineering data similar to that used in estimates of proved reserves; but technical, contractual, economic, or regulatory uncertainties preclude such reserves being classified as proved.” Ø – Probable: “…at least a 50% probability…” – Possible: “…at least a 10% probability…” World Petroleum Council, http://www.world-petroleum.org/ What is a resource? Ø Ø Ø Contingent Resources: “…those quantities of petroleum which are estimated, on a given date, to be potentially recoverable from known accumulations, but which are not currently considered to be commercially recoverable.” Prospective Resources: “…those quantities of petroleum which are estimated, on a given date, to be potentially recoverable from undiscovered accumulations.” Estimated Ultimate Recovery: “…is not a resource category as such, but a term which may be applied to an individual accumulation of any status/maturity (discovered or undiscovered)…defined as those quantities of petroleum which are estimated, on a given date, to be potentially recoverable from an accumulation, plus those quantities already produced therefrom.” World Petroleum Council, http://www.world-petroleum.org/ Others use somewhat different definitions: USGS 2000 Ø Ø Ø Ø Reserve (Field) Growth: “The increases in known petroleum volume that commonly occur as oil and gas fields are developed.” Undiscovered Resources: “Resources postulated from geologic information and theory to exist outside of known oil and gas fields.” Potential to be added in 30 years. Total Petroleum Systems, Assessment Units, Fields, and Pools. USGS DDS 60, Ch. GL, 2000.