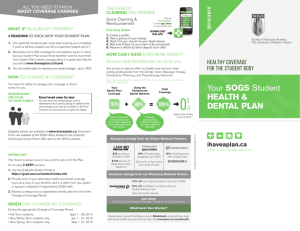

your sogs student health & dental plan

advertisement

About coverage changes What if I’m already covered? 3 reasons to stick with your student Plan: 1.Your parent’s insurance plan could stop covering you completely if you’re a full-time graduate student over 25, or a part-time student over 21. 2.Most plans don’t offer coverage for vaccinations, travel, or vision, but your student Plan covers those benefits—and for much less! Your student Plan’s travel coverage alone is a great deal. See for yourself at www.ihaveaplan.ca/travel. 3.You can combine plans to maximize your overall coverage—up to 100%. how do I change my coverage? You have the ability to manage your coverage so that it works for you. INTRODUCING THE PLAN TO YOUR FAMILY Enrol loved ones for less You can enrol your family (spouse and /or dependent children) each year by paying an additional fee, over and above your fee as a member of the Plan. Common law and same-sex couples are eligible. Eligibility details are available at www.ihaveaplan.ca. Enrolment forms are available at the SOGS office, located in the University Community Centre, Room 260, and on the SOGS website. OPTING OUT The choice is always yours if you wish to opt out of the Plan. It’s an easy 3-STEP process: 1.Use the Graduate Student Portal at https://grad.uwo.ca/student/index.cfm. 2. Provide proof of your alternative health and dental coverage (such as a copy of your benefits card or a letter from your parent’s or spouse’s employer) if requested by SOGS staff. the ease of claiming at your fingertips Quick Claiming & Reimbursement your plan on the Go Five Easy Steps: 1. Create a profile. 2. Take a picture of your receipt with your device. 3. Send it to your insurer via the Search “ ihaveaplan” application. to download now! 4. Have your claims processed in 5 days. 5. Receive a refund by direct deposit soon after. Society of Graduate Students Western University Download the App ihaveaplan_info-guide_sogs_09-15 All you need to know how can i save even more money? Discover what the Networks can do for you. Get access to special offers on health-care services when visiting professionals from the Dental, Vision, Massage Therapy, Chiropractic, Pharmacy, and Physiotherapy Networks. Here is an example of an average DENTAL claim made using a Studentcare Networks practitioner: Your Dental Plan Coverage Using the Studentcare Dental Network Total Coverage 70% 30% 100% You’re covered for the insured portion of your Plan regardless of the health practitioner you choose. However, by consulting a Network member, you’ll get additional coverage. 0 $ to pay Keep more money in your pocket! Independent specialists $50 off per eye on Standard LASIK $100 off per eye on Advanced Custom Wavefront 30% off prescription eyeglasses, up to $75 10% off selling prices with coupon code Discounts on eye exams and contact lenses Studentcare15 Exclusive savings from our Pharmacy Network Partner 10% off your total prescription costs (discount applied to your co-pay, up to a maximum of $25) 20% off regularly priced President’s Choice®, No Name®, Quo®, and Life Brand® products with your Student Savings Card when can i change my coverage? Free prescription delivery • Opt outs and enrolments for Fall Term students: Sept. 1 - 30, 2015 • Opt outs and enrolments for new Winter Term students only: Jan. 1 - 29, 2016 •Opt outs and enrolments for new Spring Term students only: May 1 - 31, 2016 coverage by students for students your sogs student health & dental plan Exclusive savings from our Vision Network Partners 3.Receive a refund on your tuition statement shortly after the end of the Change-of-Coverage Period. During the appropriate Change-of-Coverage Period: 2015/2016 And more! Dentists, Physiotherapists, Massage Therapists, and Chiropractors. Find more information about your Plan and extend your coverage by looking up a Studentcare Networks practitioner at www.ihaveaplan.ca. NEED HELP? www.ihaveaplan.ca / 1 866 358-4435 ihaveaplan.ca A Plan for your everyday adventures ! all you need to know detailed HEALTH & DENTAL What are you waiting for? about your plan PLAN benefits Visit www.ihaveaplan.ca to make the most out of your Plan! what is a health and dental plan? The Plan is a valuable service offered by your student society, SOGS, to provide its members with the extended health and dental coverage they need beyond provincial health care and other basic health-care programs. It is administered by Studentcare, the leading provider of student health and dental plans in Canada. More than Health Health Coverage Per Visit/ Purchase Per POLICY Year up to Prescription Drugs & Vaccinations 80% $3,500 The Plan is a collective approach to health care, which allows individual fees to be much lower than the cost of private health coverage. acupuncturist 80% $500 Who’s covered? chiropodist 80% $500 WHY A GROUP PLAN? All full-time graduate students at Western University who have paid their ancillary fees and who are members of SOGS are automatically covered by the SOGS Health & Dental Plan. Certain exceptions exist. Please check your student account to confirm if you have been charged the Plan fees. The following are eligible to enrol themselves in the Plan: Chiropractor 80% $500 Naturopath 80% $500 Per Visit/ Purchase Eye Exams, Eyeglasses, or contact lenses $200 laser eye surgery $150 A referral by a medical doctor is needed for visits to a massage therapist. Eligible every: Occupational Therapist 80% $500 WHat is THE group number? • Health, vision, and dental benefits insured by Desjardins Financial Security Life Assurance Company: Group Number Q1109 Osteopath 80% $500 Physiotherapist 80% $500 Podiatrist 80% $500 1 policy year up to For details on fees, visit the SOGS office located in the University Community Centre, Room 260. NEED HELP? Amount covered Eligible every: travel health coverage 120 days per trip Medical Incident $5M per incident Trip Cancellation $1.5K per trip Up to $1,500 per trip for pre-paid, non-refundable trip expenses in case of a medical emergency. Trip Interruption $5K per trip Up to $5,000 per trip in case of a medical emergency. Dental Society of Graduate Students (SOGS) Rm. 260, University Community Centre Western University London, ON N6A 3K7 dental Coverage details Visit ihaveaplan.ca to find out how you can extend coverage for a student exchange/internship of over 120 days. $ 5 00 up to in coverage per policy year insured portion studentcare dental network savings total coverage 70% 30% 100% 70% 20% 90% fillings, endodontics (root canals), periodontics (gum treatments) 70% 20% 90% what Other health services are covered? Major Restorative 20% 20% hospitalization, tutorial benefit, ambulance, dental accident, medical equipment, tuition insurance, and more. not covered Visit www.ihaveaplan.ca for complete details. Preventive Services Psychologist/ psychotherapist 80% $500 www.ihaveaplan.ca 1 866 358-4435 $5,000,000 in coverage travel Coverage • Travel benefits administered by Blue Cross: Group Number 97180 HOW MUCH DOES IT COST? Eye exams Must be performed by a licensed optometrist. Receipts for eyeglasses and contact lenses must include the prescribed strength, or provide the detailed prescription. 24 Go to www.ihaveaplan.ca to find out more about enrolment. an osteopath must be a doctor in osteopathic medicine. details months 4. Practicum or internship students on Work Term in the fall 5. Post-doctoral fellows and associates $350 in coverage Travel 2. Co-op students on Work Term in the fall 3. Students on leave Vision Coverage details the dispensing fee is limited to $8 per prescription, refill, or vaccination. The plan covers most medications legally requiring a prescription. See ihaveaplan.ca for more details. up to Vision 80% $500 Massage Therapist 1. Part-time students $10,000 in coverage recall exams, cleanings, x-rays, scaling Extraction of Impacted Teeth Speech Therapist 80% $500 Basic Services crowns, bridges, posts