Ketimpangan Pendapatan dan Kesempatan di Indonesia

advertisement

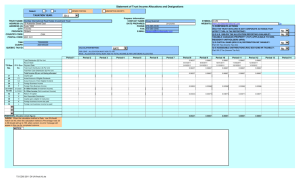

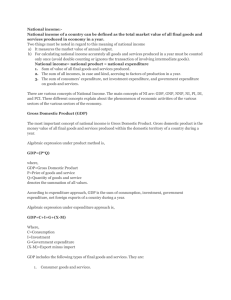

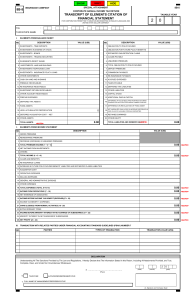

KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Ketimpangan Pendapatan dan Kesempatan di Indonesia Kunta W.D. Nugraha Peneliti Senior Badan Kebijakan Fiskal, Kementerian Keuangan Konferensi INFID Jakarta, 26 – 27 November 2013 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Topik • Ketimpangan pendapatan di Indonesia • Menuju pendapatan final • Pengaruh pendapatan non-market, bantuan sosial dan subsidi terhadap ketimpangan pendapatan d t • Kesimpulan 2 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Semakin tinggi pertumbuhan ekonomi, semakin tinggi pula ketimpangan pendapatan 3 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Beberapa konsep penting 4 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Menuju pendapatan final Gross income Income tax All market income Net income Wages/sala Business & nonries business income Financial income Consumpti on of own production Income in-kind Actual income Taxes on production Final income Disposable i income Income after t taxes Benefits inkind Cash transfers CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Definisi cash transfers dan benefits in-kind Items 1 Cash Cash Transfers Transfers Education ‐ BOS ‐ Scholarship Health ‐ Basic Health Definition Grants for operational school for 41.9 million students Grants for poor students ‐ 2.4 million students in SD&SMP ‐ 0.9 million students in SMA ‐ 0.2 million students in Univ Grants for operational of Puskesmas Items 2 Subsidies Energy ‐ Fuel ‐ Electricity Food ‐ Fertilizer Definition Price subsidy on unleaded, diesel, kerosene and gas Price subsidy on electricity below 6,600 Watt Price subsidy on fertilizer ‐ Paddy Price subsidy on paddy ‐ Rice Price subsidy for poor household for 15 kg/month ‐ Standard Hospital St d d H it l Grants for standard hospital G t f t d dh it l Social Security ‐ Conditional ‐ Unconditional Grants for poor household for 720,000 households Grants for poor household for 19,1 million households Public Service Obligation ‐ Train (KAI) Ship (Pelni) Price subsidy for KAI, Pelni, ‐ Posindo and Antara ‐ Post Office ‐ News Agency 3 Public Spending ‐ Education ‐ Health Central and local expenditure on Central and local expenditure on education Central and local expenditure on health CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Pengaruh pendapatan non-market sangat besar, terutama untuk kelompok paling miskin (US$ using PPP 2008) 7 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Cash transfers and benefits in-kind cenderung propoor, kecuali subsidi (US$ using PPP 2008) Deciles Lowest Second Third Fourth Fifth Sixth Seventh Eighth Ninth Highest Benefits In‐Kind Cash Transfers Subsidies Health Education 121.7 87.1 83.4 41.2 19.8 19.7 19.5 18.5 18.8 16.4 294.9 224.6 233.9 253.3 269.3 279.0 301.0 350.0 424.1 656.2 51.7 52.3 41.9 45.3 37.7 37.5 33.8 29.6 30.5 17.5 266.7 173.0 169.8 167.6 169.6 170.5 177.1 180.4 187.9 208.4 Total 735.0 537.0 529.1 507.4 496.5 506.6 531.5 578.5 661.3 898.5 8 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Education, basic health and social security are pro-poor (US$ using PPP 2008) Ed Education i Deciles Lowest Second Third Fourth Fifth Sixth Seventh Eighth Ninth Highest B i H lh Basic Health BOS Scholarships Puskesmas Hospital 14.1 14.2 14.1 13.6 13.3 13.3 13.8 13.4 13.6 13.4 19.7 2.3 0.7 0.3 0.1 ‐ ‐ ‐ ‐ ‐ 1.8 2.2 1.9 1.8 1.4 1.4 1.1 1.0 0.9 0.5 7.0 6.7 5.3 6.0 5.0 5.0 4.6 4.1 4.3 2.5 SSocial Security i lS i Un‐ Conditional conditional 63.5 61.8 61.5 19.6 ‐ ‐ ‐ ‐ ‐ ‐ 15.6 ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ ‐ CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Semua subsidi adalah pro-rich, kecuali beras (US$ using PPP 2008) Energy Deciles Lowest Second Third Fourth Fifth Sixth Seventh Eighth Ninth Highest Food Fuel Electricity Fertilizer Rice/Paddy 171.3 125.8 130.5 141.1 149.4 153.5 163.9 194.9 235.1 374.6 90.8 67.2 71.6 80.0 88.5 94.0 104.6 121.3 153.7 238.3 18.3 15.6 16.3 17.4 17.5 18.0 19.5 21.4 24.0 32.7 12.4 14.7 14.0 13.2 12.0 11.5 11.0 9.9 8.3 5.6 Public P bli Service Obligation 2.1 1.4 1.5 1.7 1.9 1.9 2.0 2.5 2.9 5.0 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Subsidi BBM adalah pro-rich (US$ using PPP 2008) CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Distribusi pendapatan per kapita cenderung menyempit, % Market Income Market Income Deciles Gross All Market Net Income Income Income Market Income and Non‐Market Income Market Income and Non‐Market Income Actual Income Income Disposible After Taxes Income Final Income LLowestt Second Third Fourth Fifth Sixth Seventh Eighth i hh Ninth Highest 1.5 15 3.5 4.6 5.6 6.7 7.9 9.4 11.3 11 3 14.7 34.8 1.5 15 3.5 4.6 5.7 6.8 8.1 9.6 11.5 11 15.0 33.7 2.2 22 4.2 5.0 6.0 7.0 8.1 9.6 11.4 11 14.5 32.0 8.1 81 6.8 7.1 7.6 8.2 8.5 9.2 10.2 10 2 12.1 22.2 8.8 88 7.5 6.9 7.4 8.0 8.4 9.1 10.1 10 1 11.9 21.9 9.3 93 7.8 7.2 7.5 7.9 8.3 9.0 9.9 99 11.7 21.4 9.7 97 7.9 7.4 7.7 8.1 8.4 9.0 10.0 10 0 11.7 20.1 Total 100.0 100.0 100.0 100.0 100.0 100.0 100.0 12 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA 40 30 30 30 20 20 20 10 10 10 0 0 0 Gross income Equality line Actual income Equality line Final income Highest 40 Ninth 40 Eighth 50 Seventh 50 Sixth 50 Fifth 60 Fourth 60 Third 60 Second 70 Highest 70 Ninth 70 Eighth 80 Seventh 80 Sixth 80 Fifth 90 Fourth 90 Third 100 Second 100 90 Lowest 100 Lowest Perbaikan distribusi pendapatan dapat dilihat pada Lorentz Curve Equality line Gross Income Actual Income Final Income Gini Coefficient 0.42 0.21 0.17 Percentile Ratios P90/P50 P10/P50 3.39 0.34 2.06 0.83 1.82 0.87 13 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Kesimpulan (1) • Non Non-market market income – Ignoring the non-market income component seriously overestimates the degree of income inequality. inequality – For example: Indonesian official Gini coefficient in 2008 is 0.35 0 35 using household consumption consumption, but I found that Gini coefficient can be 0.21 using household market and non-market income 14 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Kesimpulan (2) • Cash transfers and benefits in-kind in kind – Government programs in health and education improve income distribution distribution, but not subsidies subsidies. – Most of subsidies are price subsidies which apply to all consumers and rich households consume more more. 15 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA Policy Responses • Calculation of income inequality need to accommodate non-market income to avoid misleading results which could lead p poor p policy. y • Maintaining and increasing further cash transfers and public pub c spe spending d go on health ea t a and d educat education. o • Reform the subsidy system from price subsidies to targeted subsidies or other pro-poor pro poor programs. 16 CRICOS #00212K KEMENTERIAN KEUANGAN REPUBLIK INDONESIA T i k ih Terimakasih 17 CRICOS #00212K