Accounting For Managers

advertisement

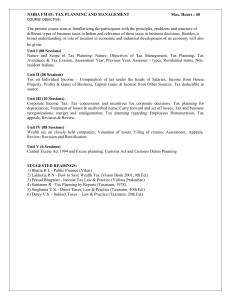

Course Sheet (With suggested guidelines) Course Code ACCT 521 Course Title Accounting for Managers Credits 4 Course Objectives Accounting information is the channel through the management reveals information regarding the economic activities undertaken by the business, strategies adopted, expectations about the future and the actual results. Information intermediaries such as auditors, analysts and regulators ensure that the information communicated fairly represents the performance of the business and also assist the end users i.e. lenders and investors in interpreting such data. Similarly this channel also helps managers to communicate information about the product /project level performance to the CEO and who in turn allocates resources based on the current performance and expected opportunities. Effective control systems play the intermediating role of both communicating information correctly and also aligning the actions of managers with the overall organizational objectives. Set in this background, the learning objectives for this course are: 1. Understandthe framework for preparation and presentation of financial statements 2. Evaluatethe extent to which financial statements reflect a fair view of the underlying economic substance of the firm and also appreciatethe element of subjectivity involved in measuring the same 3. Understandthe meaning and consequence of accounting policy choices that require trade-off between relevance and reliability 4. Demonstratemastery of the concepts and language of accounting so they can be used as effective management tools for communication, monitoring and resource allocation 5. Familiarizewith the management accounting theories and practices for evaluating firm’s economic Condition and making organizational decisions Course Description The course is split into two modules. The first module (25 sessions) on financial accounting is aimed at the person who wants to be a knowledgeable user of accounting information as against the preparer of accounting reports. Hence the stress is on the analytical uses of the accounting information by managers and outside analysts rather than procedural details that the practicing accountant needs to know. The second module on Management Accounting (15 sessions) builds on the first module. For decision making, the management needs much more detailed financial information than that contained in the General Purpose Financial Statements. This part delves into issues such as: “How are full cost measured and what it is used for?”; “What are the different methods of allocating indirect costs?” and finally “How to choose among the alternative course of action based on differential costs and revenues?” Course Delivery This course primarily employs the case method as the basis for covering important accounting issues and concepts. Cases are supplemented with stylized problems, tutorials and lecturettes. The case dharma mandates that there is no “one-and-only-one solution” to the case and therefore the entire emphasis is on evaluating the multiple choices that the protagonist can make. The philosophy is never “student v/s student” or “all students v/s the teacher” but always “the class & the teacher v/s the case”. Practitioners shall take 25% of the sessions. The Practitioners shall be predominantly from the ‘Big Four’ audit firms. Tutorials and Assignments are used to supplement the learnings from cases. Textbook Accounting Text and Cases by Robert Anthony, David Hawkins and Kenneth Merchant (13th Edition), The McGraw-Hill Companies Reference Books & Additional Reading Material 1. 2. 3. 4. Financial Accounting by Needles & Powers (11th Edition), South Western Cengage Learning Financial Accounting by Gary Porter & Curtis Norton (6th Edition), Cengage Learning Managerial Accounting by Garrison, Noreen & Brewer (11th Edition), Tata Mcgraw Hill Introduction of Management Accounting by Horngreen, Sundem, Stratton, Burgstahler and Schatzberg (14th Edition), Pearson 5. Indian Accounting Standards (Ind AS) & IFRSs for Finance Executives by T.P Ghosh (2nd Edition), Taxmann Publications Pvt Ltd 6. IFRS – A Briefing for Chief Executives, Audit Committees and Board of Directors issued by IASB 7. Red Book on International Financial Reporting Standards issued by IASB