Ch 12 : Intangible Assets Issues Characteristics of Intangible assets

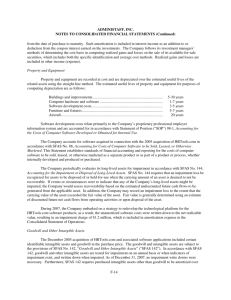

advertisement

Ch 12 : Intangible Assets Issues ► Characteristics of Intangible assets: Three Main Characteristics: (1) Identifiable, (2) Lack physical existence. (3) Not monetary assets. Normally classified as non-current asset. ► Valuation of Intangible assets: Purchased Intangibles: Recorded at cost. Includes all costs necessary to make the intangible asset ready for its intended use. Typical costs include: Purchase price. Legal fees. Other incidental expenses. مصروفات عرضية Internally Created Intangibles: Recorded as expenses except Research and Development Companies expense all research phase costs and some development phase costs. Certain development costs are capitalized once economic viability criteria are met. IFRS identifies several specific criteria that must be met before development costs are capitalized. Beginning of The Project Ready for Sale or use Research phase Expenses Expenses Development phase Capitalize Economic Viability ► Amortization of Intangibles Limited-Life Intangibles: Amortize by systematic charge to expense over useful life. Credit asset account or accumulated amortization. Useful life should reflect the periods over which the asset will contribute to cash flows. Amortization should be cost less residual value. IFRS requires companies to assess the residual values and useful lives of intangible assets at least annually. Indefinite-Life Intangibles: No foreseeable limit on time the asset is expected to provide cash flows. No amortization. Must test indefinite-life intangibles for impairment at least annually. Intermediate Accounting 2:IFRS Page 1 of 7 Ehab Abdou 97672930 Ch 12 : Intangible Assets Issues Accounting Treatment for Intangibles ► Types of Intangibles Six Major Categories: (1) Marketing-related. (2) Customer-related. (3) Artistic-related. (4) Contract-related. (5) Technology-related. (6) Goodwill. Marketing-Related Intangible Assets Examples: ►Trademarks or trade names, newspaper mastheads, Internet domain names, and noncompetition agreements. In the United States trademark or trade name has legal protection for indefinite number of 10 year renewal periods. Capitalize acquisition costs. No amortization. Customer-Related Intangible Assets Examples: ►Customer lists, order or production backlogs, and both contractual and non-contractual customer relationships. Capitalize acquisition costs. Amortized to expense over useful life. Artistic-Related Intangible Assets Examples: Plays, literary works, musical works, pictures, photographs, and video and audiovisual material. Copyright granted for the life of the creator plus 70 years. Capitalize costs of acquiring and defending. Amortized to expense over useful life. Intermediate Accounting 2:IFRS Page 2 of 7 Ehab Abdou 97672930 Ch 12 : Intangible Assets Issues Contract-Related Intangible Assets Examples: Franchise and licensing agreements, construction permits, broadcast rights, and service or supply contracts. Franchise (or license) with a limited life should be amortized to expense over the life of the franchise. Franchise with an indefinite life should be carried at cost and not amortized. Technology-Related Intangible Assets Examples: Patented technology and trade secrets granted by a governmental body. Patent gives holder exclusive use for a period of 20 years. Capitalize costs of purchasing a patent. Expense any R&D costs in developing a patent. Amortize over legal life or useful life, whichever is shorter. Goodwill Conceptually, represents the future economic benefits arising from the other assets acquired in a business combination that are not individually identified. Only recorded when an entire business is purchased. Goodwill is measured as the excess of ... Cost of the purchase over the FMV of the identifiable net assets purchased. Internally created goodwill should not be capitalized. Goodwill = Purchase Price – Fair market Value of net assets received Fair Value of Net assets = ( Fair Value of Assets – Fair Value of Liabilities ) = Book Value of net assets (Assets – Liabilities) (+ ) Under valued assets ( - ) Over Valued assets ( - ) Under valued Liabilities (+ ) Over Valued Liabilities Bargain Purchase Purchase price less than the fair value of net assets acquired. Amount is recorded as a gain by the purchaser. Impairment of Goodwill Companies must test goodwill at least annually. Impairment test is conducted based on the cash-generating unit to which the goodwill is assigned. Because there is rarely a market for cash-generating units, estimation of the recoverable amount for goodwill impairments is usually based on value-in-use estimates. Intermediate Accounting 2:IFRS Page 3 of 7 Ehab Abdou 97672930 Ch 12 : Intangible Assets Issues ► Practice on Amortization and Impairment: Ex. 12-156—Acquisition of tangible and intangible assets. Vasquez Manufacturing Company decided to expand further by purchasing Wasserman Company. The statement of financial position of Wasserman Company as of December 31, 2011 was as follows: Wasserman Company Statement of Financial Position December 31, 2011 Assets Plant assets (net) Inventory Receivables Cash Total assets $1,025,000 275,000 550,000 210,000 $2,060,000 Equity and Liabilities Share capital-ordinary Retained earnings Accounts payable $ 800,000 885,000 375,000 Total equity and liabilities $2,060,000 An appraisal, agreed to by the parties, indicated that the fair value of the inventory was $350,000 and the fair value of the plant assets was $1,225,000. The fair value of the receivables is equal to the amount reported on the statement of financial position. The agreed purchase price was $2,075,000, and this amount was paid in cash to the previous owners of Wasserman Company. Instructions 1. Determine the amount of goodwill (if any) implied in the purchase price of $2,075,000. Show calculations. 2. Prepare the journal entry to record the acquisition of Wasserman Company. Solution 12-156 1- The amount of goodwill Purchase price Less Fair Value of tangible net assets acquired: Book value of net assets ($2,060,000 – $375,000) Appraisal increment—inventory Appraisal increment—plant assets Total fair value of tangible net assets acquired Goodwill Intermediate Accounting 2:IFRS Page 4 of 7 $2,075,000 $1,685,000 75,000 200,000 1,960,000 $ 115,000 Ehab Abdou 97672930 Ch 12 : Intangible Assets Issues 2- The Journal entry will be as follows: Date Accounts Plant assets Inventory Receivable Cash Goodwill Accounts Payable Cash Dr. 1,225,000 350,000 550,000 210,000 115,000 Cr. 375,000 2,075,000 Ex. 12-145 Barkley Corp. obtained a trade name in January 2010, incurring legal costs of $15,000. The company amortizes the trade name over 8 years. Barkley successfully defended its trade name in January 2011, incurring $4,900 in legal fees. At the beginning of 2012, based on new marketing research, Barkley determines that the recoverable amount of the trade name is $12,000. Instructions Prepare the necessary journal entries for the years ending December 31, 2010, 2011, and 2012. Show all computations. Solution 12-145 2010 Dec. 31 2011 Dec. 31 2012 Dec. 31 Amortization Expense - Trade Name Trade Name ($15,000 ÷ 8 years) 1,875 Amortization Expense – Trade Name Trade Name [($15,000 - $1,875 + $4,900) ÷ 7 years] 2,575 Loss on Impairment Trade Name 3,450 1,875 2,575 3,450 Carrying value = $15,000 - $1,875 + $4,900 - $2,575 = $15,450 Carrying value = $15,450 Recoverable amount = (12,000) Loss on impairment = $ 3,450 Ex. 12-148—Carrying value of patent. Sisco Co. purchased a patent from Thornton Co. for $180,000 on July 1, 2008. Expenditures of $68,000 for successful litigation in defense of the patent were paid on July 1, 2011. Sisco estimates that the useful life of the patent will be 20 years from the date of acquisition. Instructions Prepare a computation of the carrying value of the patent at December 31, 2011. Intermediate Accounting 2:IFRS Page 5 of 7 Ehab Abdou 97672930 Ch 12 : Intangible Assets Issues Solution 12-148 Cost of patent Amortization 7/1/08 to 7/1/11 [($180,000 ÷ 20) × 3] Carrying value at 7/1/11 Cost of successful defense Carrying value Amortization 7/1/11 to 12/31/11 [$221,000 × 1/(20 – 3) × 1/2] Carrying value at 12/31/11 $180,000 (27,000) 153,000 68,000 221,000 (6,500) $214,500 Ex. 12-153—Impairment of copyrights. Presented below is information related to copyrights owned by Wamser Corporation at December 31, 2010. Cost $2,700,000 Carrying amount 2,350,000 Recoverable amount 1,400,000 Assume Wamser will continue to use this asset in the future. As of December 31, 2010, the copyrights have a remaining useful life of 5 years. Instructions (a) Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2010. (b) Prepare the journal entry to record amortization expense for 2011. (c) The recoverable amount of the copyright at December 31, 2012 is $1,500,000. Prepare the journal entry (if any) necessary to record this increase in fair value. Solution 12-153 (a) December 31, 2010 Loss on Impairment ................................................................................ Copyrights ................................................................................... Carrying amount Recoverable amount Loss on impairment (b) 950,000 $2,350,000 1,400,000 $ 950,000 December 31, 2011 Amortization Expense ............................................................................ Copyrights ................................................................................... New carrying amount Useful life Amortization 950,000 280,000 280,000 $1,400,000 ÷ 5 years $ 280,000 (c) Copyrights............................................................................................... Recovery of Impairment Loss .................................................. [$1,500,000 – ($1,400,000 – $280,000)] Intermediate Accounting 2:IFRS Page 6 of 7 380,000 380,000 Ehab Abdou 97672930 Ch 12 : Intangible Assets Issues Pr. 12-158—Goodwill, impairment. On May 31, 2011, Armstrong Company paid $3,500,000 to acquire all of the common stock of Hall Corporation, which became a division of Armstrong. Hall reported the following statement of financial position at the time of the acquisition: Non-current assets Current assets $2,700,000 900,000 Total assets $3,600,000 Equity Non-current liabilities Current liabilities Total equity and liabilities $2,500,000 500,000 $ 600,000 $3,600,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Hall was $2,800,000. At December 31, 2011, Hall reports the following statement of financial position information: Current assets Non-current assets (including goodwill recognized in purchase) Current liabilities Non-current liabilities Net assets $ 800,000 2,400,000 (700,000) (500,000) $2,000,000 It is determined that the recoverable amount value of the Hall division is $2,100,000. Instructions (a) Compute the amount of goodwill recognized, if any, on May 31, 2011. (b) Determine the impairment loss, if any, to be recorded on December 31, 2011. (c) Assume that the recoverable amount of the Hall division is $1,900,000 instead of $2,100,000. Prepare the journal entry to record the impairment loss, if any, on December 31, 2011. Solution 12-158 (a) Goodwill = Fair value of the division less the fair value of the identifiable assets. $3,500,000 – $2,800,000 = $700,000. (b) No impairment loss is recorded, because the recoverable amount of Hall ($2,100,000) is greater than the carrying value ($2,000,000) of the new assets. (c) Computation of impairment loss: Recoverable amount of Hall division Carrying value of division Loss on impairment $1,900,000 2,000,000 $ (100,000) Loss on Impairment ............................................................................ Goodwill .................................................................................. Intermediate Accounting 2:IFRS Page 7 of 7 100,000 100,000 Ehab Abdou 97672930