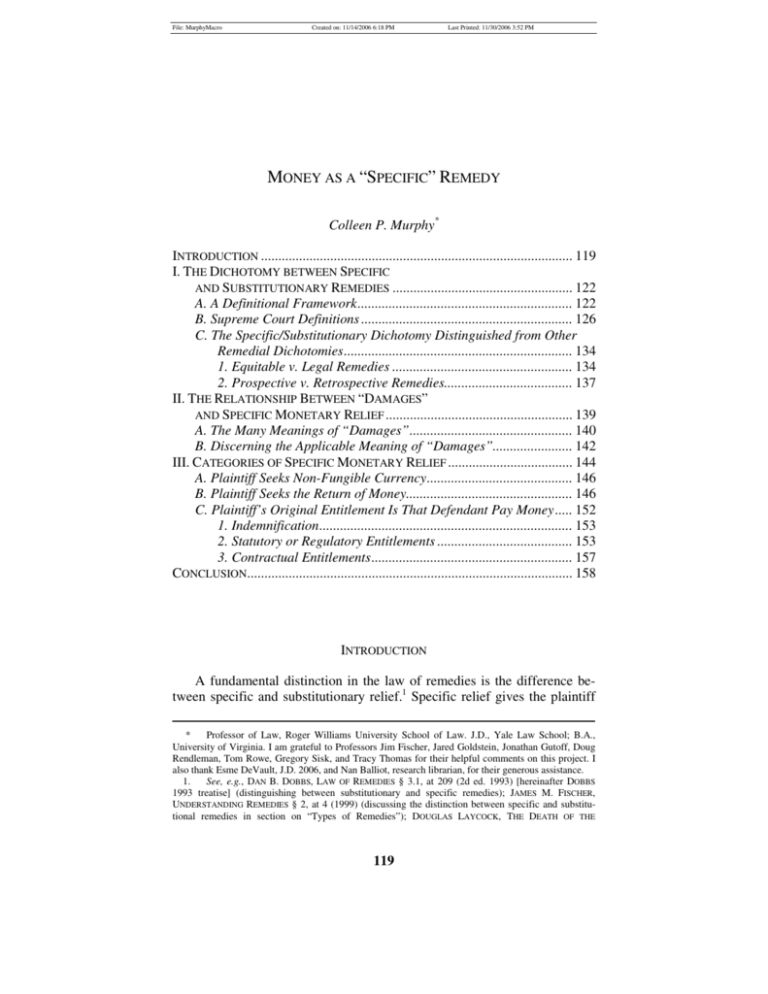

119 MONEY AS A “SPECIFIC” REMEDY Colleen P. Murphy

advertisement