Form 1040NR - The Mountbatten Institute

advertisement

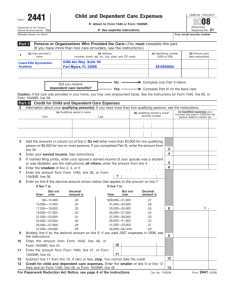

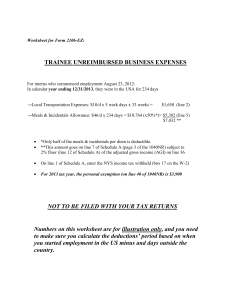

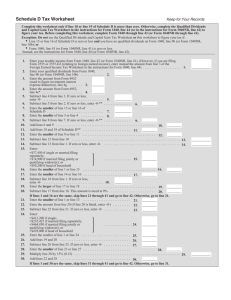

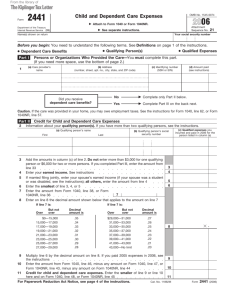

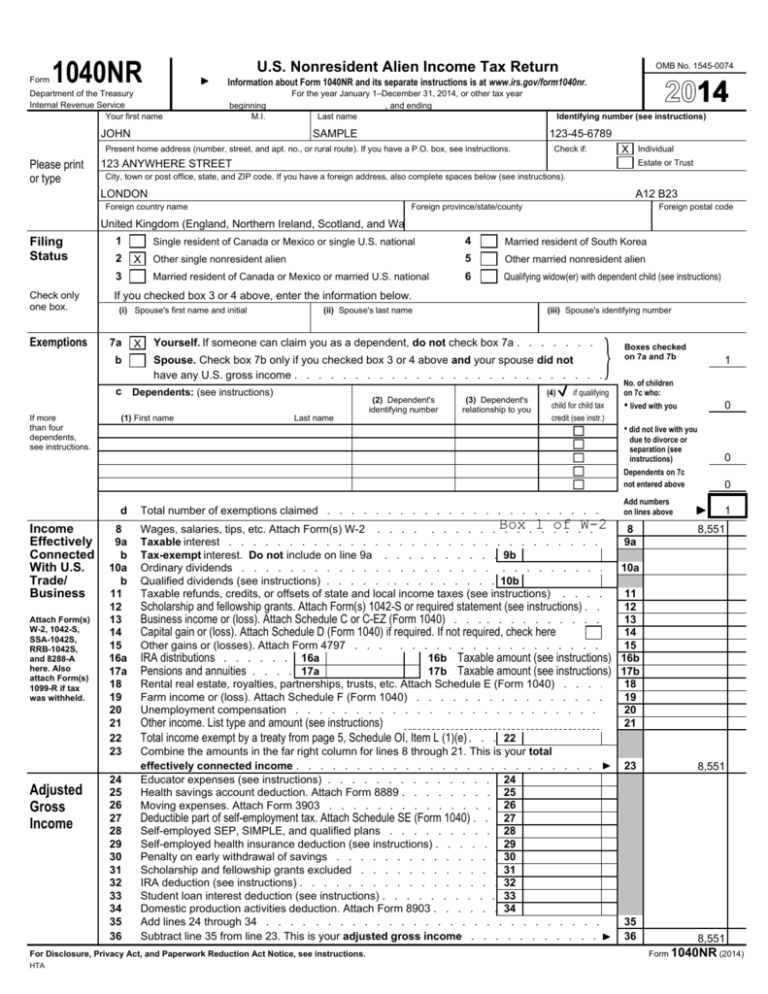

Form 1040NR U.S. Nonresident Alien Income Tax Return Information about Form 1040NR and its separate instructions is at www.irs.gov/form1040nr. Department of the Treasury Internal Revenue Service Your first name beginning M.I. JOHN For the year January 1–December 31, 2014, or other tax year , and ending Last name SAMPLE Identifying number (see instructions) 123-45-6789 Present home address (number, street, and apt. no., or rural route). If you have a P.O. box, see instructions. Please print or type OMB No. 1545-0074 Check if: 123 ANYWHERE STREET X Individual Estate or Trust City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). LONDON A12 B23 Foreign country name Foreign province/state/county Foreign postal code United Kingdom (England, Northern Ireland, Scotland, and Wales) Filing Status 1 2 X 3 Check only one box. Exemptions Single resident of Canada or Mexico or single U.S. national 4 Other single nonresident alien 5 Other married nonresident alien Married resident of Canada or Mexico or married U.S. national 6 Qualifying widow(er) with dependent child (see instructions) If you checked box 3 or 4 above, enter the information below. (i) Spouse's first name and initial 7a b X (ii) Spouse's last name on 7a and 7b Spouse. Check box 7b only if you checked box 3 or 4 above and your spouse did not 1 have any U.S. gross income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Enter Dependents on "Ln 7c - Dependents" tab below. (1) First name Last name d Income Effectively Connected With U.S. Trade/ Business Attach Form(s) W-2, 1042-S, SSA-1042S, RRB-1042S, and 8288-A here. Also attach Form(s) 1099-R if tax was withheld. Adjusted Gross Income 8 9a b 10a b 11 12 13 14 15 16a 17a 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 (2) Dependent's identifying number (3) Dependent's relationship to you (4) if qualifying child for child tax credit (see instr.) No. of children on 7c who: • lived with you 0 • did not live with you Total number of exemptions claimed . . . . . . . . . . . . . . . . . . . . . . . . due to divorce or separation (see instructions) 0 Dependents on 7c not entered above 0 Add numbers . on.lines . above . . . . . . 1. . . . . . . . . . . . . . . . Box .. .. ..1 . . . of . . . . .W-2 . . . . . . . .8. . . . . . . . . . .8,551 . .. .. .. .. .. . Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . Taxable interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9a. . . . . . . . . . . . Tax-exempt interest. Do not include on line 9a . . . . . . . . . . 9b . . . . . . . . . . . . . . . . . . . . . . Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10a . .. . . . . . . . . . . . Qualified dividends (see instructions) . . . . . . . . . . . . . . . . . . . . . . . .10b ...... . . . . . . . . . . . . . . . . . . . Taxable refunds, credits, or offsets of state and local income taxes (see instructions) . . . . . .11. . . . . . . . . . . Scholarship and fellowship grants. Attach Form(s) 1042-S or required statement (see instructions) . . . .12. . . . . . . . . . . . Business income or (loss). Attach Schedule C or C-EZ (Form 1040) . . . . . . . . . . . . . . . . . . . . . . . . . .13 . .. .. .. .. .. . . . . . . 14 Capital gain or (loss). Attach Schedule D (Form 1040) if required. If not required, check here Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15. . . . . . . . . . . . . . . IRA distributions . . . . . . . 16a . . . . . . . . . . 16b . . .Taxable . . . amount . . . (see . .instructions) . . . . . 16b . . . . . . . . . . . . Pensions and annuities . . . . .17a. . . . . . . . . . 17b . . Taxable . . . .amount . . .(see . instructions) . . . . . .17b . . . . . . . . . . . . Rental real estate, royalties, partnerships, trusts, etc. Attach Schedule E (Form 1040) . . . . . 18 . . . . . . . . . . . . Farm income or (loss). Attach Schedule F (Form 1040) . . . . . . . . . . . . . . . . . .19. . . . . . . . . . . Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . .. . . . . . . . . . . . . 20 . . . . . . . . . . . . 21 Other income. List type and amount (see instructions) Total income exempt by a treaty from page 5, Schedule OI, Item L (1)(e) . . . 22 . . . . . . . . . . . . . . . . . . . . . . Combine the amounts in the far right column for lines 8 through 21. This is your total effectively connected income . . . . . . . . . . . . . . . . . . . . . . . . . . . 23 . . . . . . 8,551 . . . . . . Educator expenses (see instructions) . . . . . . . . . . . . . . . 24. . . . . . . . . . . . . . . . . . . . . . Health savings account deduction. Attach Form 8889 . . . . . . . . . 25. . . . . . . . . . . . . . . . . . . . . . Moving expenses. Attach Form 3903 . . . . . . . . . . . . . . . 26. . . . . . . . . . . . . . . . . . . . . Deductible part of self-employment tax. Attach Schedule SE (Form 1040) . . . 27 . . . . . . . . . . . . . . . . . . . . . . Self-employed SEP, SIMPLE, and qualified plans . . . . . . . . . . 28. . . . . . . . . . . . . . . . . . . . . . Self-employed health insurance deduction (see instructions) . . . . . . 29 . . . . . . . . . . . . . . . . . . . . . . Penalty on early withdrawal of savings . . . . . . . . . . . . . . 30 . . . . . . . . . . . . . . . . . . . . . . Scholarship and fellowship grants excluded . . . . . . . . . . . . 31 . . . . . . . . . . . . . . . . . . . . . . IRA deduction (see instructions) . . . . . . . . . . . . . . . . . 32 . . . . . . . . . . . . . . . . . . . . . . Student loan interest deduction (see instructions) . . . . . . . . . . 33 . . . . . . . . . . . . . . . . . . . . . . Domestic production activities deduction. Attach Form 8903 . . . . . . 34 . . . . . . . . . . . . . . . . . . . . . . Add lines 24 through 34 . . . . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. ..35.. .. .. .. .. .. .. .. .. .. .. .. Subtract line 35 from line 23. This is your adjusted gross income . . . . . . . . . . . . . 36 . . . . . . 8,551 . . . . . . For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions. HTA (iii) Spouse's identifying number Yourself. If someone can claim you as a dependent, do not check box 7a . . . . . . . . . Boxes . . .checked . . . . . . . . . c Dependents: (see instructions) If more than four dependents, see instructions. Married resident of South Korea Form 1040NR (2014) JOHN SAMPLE 123-45-6789 Page 2 Amount from line 36 (adjusted gross income) . . . . . . . . . . . . . . . . . . . . . . 37. . . . . 8,551 . . . . . . Itemized deductions from page 3, Schedule A, line 15 . . Work .. . . . .. . . . First .. . . . .. .. . .. .. 38 . . . . . . .. . . . .. . . on . .. . . .F2106 . .. . . . . 8,210 Subtract line 38 from line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .39. . . . . . 341 . . . . . Exemptions (see instructions) . . . . . . . . . . . . . . . . . . . . .Given . . . . . . . 40 . . . . . . 3,950 . . . . . . Taxable income. Subtract line 40 from line 39. If line 40 is more than line 39, enter -0- . . . . . 41 . . . . . . . .0 . . . . a b 42 Tax (see instructions). Check if any tax is from: Form(s) 8814 Form 4972 Alternative minimum tax (see instructions). Attach Form 6251 . . . . . . . . . . . . . . . 43 . . . . . . . . . . . Excess advance premium tax credit repayment. Attach Form 8962 . . . . . . . . . . . . . . 44. . . . . . . . . . . Add lines 42, 43 and 44 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45. . . . . . . . . . . Foreign tax credit. Attach Form 1116 if required . . . . . . . . . . .46. . . . . . . . . . . . . . . . . . . . . 47 Credit for child and dependent care expenses. Attach Form 2441 Retirement savings contributions credit. Attach Form 8880 . . . . . . 48 . . . . . . . . . . . . . . . . . . . . . . Child tax credit. Attach Schedule 8812, if required . . . . . . . . . . 49 . . . . . . . . . . . . . . . . . . . . . . Residential energy credits. Attach Form 5695 . . . . . . . . . . . . 50. . . . . . . . . . . . . . . . . . . . . Form 1040NR (2014) Tax and Credits Other Taxes Payments Refund Direct deposit? See instructions. Amount You Owe Third Party Designee 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59a b 60 61 62 a b c d 63 64 65 66 67 68 69 70 71 72 73 a b 51 3800 8801 a b c Add lines 46 through 51. These are your total credits . . . . . . . . . . . . . . . . . . .52. . . . . . . . . . . Subtract line 52 from line 45. If line 52 is more than line 45, enter -0- . . . . . . . . . . . . .53. . . . . . . 0 . . . . Tax on income not effectively connected with a U.S. trade or business from page 4, Schedule NEC, line 15 . . . . . 54. . . . . . . . . . . Self-employment tax. Attach Schedule SE (Form 1040) . . . . . . . . . . . . . . . . . . 55 . . . . . . . . . . . a b 56 Unreported social security and Medicare tax from Form: 4137 8919 57 Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required Transportation tax (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . 58. . . . . . . . . . . Household employment taxes from Schedule H (Form 1040) . . . . . . . . . . . . . . . . 59a . . . . . . . . . . . First-time homebuyer credit repayment. Attach Form 5405 if required . . . . . . . . . . . . .59b . . . . . . . . . . . 60 Taxes from: a Form 8959 b Instructions; enter code(s) Add lines 53 through 60. This is your total tax . . . . . . . . . . . . . . . . . . . . . 61 . . . . . . . .0 . . . . Federal income tax withheld from: Form(s) W-2 and 1099 . . . . . . . . . . . . . . . . . . . . 62a . . . . . . . . . . . . . . . . . . . . . . Form(s) 8805 . . . . . . . . . . . . . . . . . . . . . . . . 62b . . . . . . . . . . . . . . . . . . . . . . Form(s) 8288-A . . . . . . . . . . . . . . . . . . . . . . . 62c . . . . . . . . . . . . . . . . . . . . . . Form(s) 1042-S . . . . . . . . . . . . . . . . . . . . . . . 62d . . . . . . . . . . . . . . . . . . . . . . 2014 estimated tax payments and amount applied from 2013 return . . . . .63. . . . . . . . . . . . . . . . . . . . . Additional child tax credit. Attach Schedule 8812 . . . . . . . . . . 64 . . . . . . . . . . . . . . . . . . . . . . Net premium tax credit. Attach Form 8962 . . . . . . . . . . . . . 65 . . . . . . . . . . . . . . . . . . . . . . Amount paid with request for extension to file (see instructions) . . . . . 66. . . . . . . . . . . . . . . . . . . . . Excess social security and tier 1 RRTA tax withheld (see instructions) . . . . 67 . . . . . . . . . . . . . . . . . . . . . . Credit for federal tax paid on fuels. Attach Form 4136 . . . . . . . . . 68. . . . . . . . . . . . . . . . . . . . . 69 a Credits from Form: 2439 b Reserved c Reserved d Credit for amount paid with Form 1040-C . . . . . . . . . . . . . 70 . . . . . . . . . . . . . . . . . . . . . . Add lines 62a through 70. These are your total payments . . . . . . . . . . . . . . . . 71 . . . . . . . .0 . . . . If line 71 is more than line 61, subtract line 61 from line 71. This is the amount you overpaid . . . . . . . 72 . . . . . . . . . . . . 73a Amount of line 72 you want refunded to you. If Form 8888 is attached, check here c Type: Routing number Checking Savings Other credits from Form: d Account number e If you want your refund check mailed to an address outside the United States not shown on page 1, enter it here. 74 75 76 74 Amount of line 72 you want applied to your 2015 estimated tax Amount you owe. Subtract line 71 from line 61. For details on how to pay, see instructions . . . . . . .75. . . . . . . 0 . . . . Estimated tax penalty (see instructions) . . . . . . . . . . . . . . 76 . . . . . . . . . . . . . . . . . . . . . . Do you want to allow another person to discuss this return with the IRS (see instructions)? Phone no. Designee's name Yes. Complete below. Sign Here Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Keep a copy of this return for your records. Your signature Paid Preparer Use Only Date Make sure you SIGN & Date Print/Type preparer's name Preparer's signature No Personal identification number (PIN) Your occupation in the United States If the IRS sent you an Identity Protection PIN, enter it here (see inst.) INTERN Date Check if self-employed Firm's name Firm's EIN Firm's address Phone no. PTIN Form 1040NR (2014) JOHN SAMPLE Form 1040NR (2014) 123-45-6789 Page Schedule A — Itemized Deductions (see instructions) Taxes You Paid Gifts to U.S. Charities Casualty and Theft Losses Job Expenses and Certain Miscellaneous Deductions 3 07 Box 17 of W-2 1 State and local income taxes . . . . . . . . . . . . . . . . . . . . . . . . .1 . . . . . . 92 . . . . . . . Caution: If you made a gift and received a benefit in return, see instructions. 2 3 Gifts by cash or check. If you made any gift of $250 or more, see instructions . . . . . . . . . . . . . . . . . 2. . . . . . . . . . . . . . . . . . . . . . . . Other than by cash or check. If you made any gift of $250 or more, see instructions. You must attach Form 8283 if the amount of your deduction is over $500 . . . . . . 3. . . . . . . . . . . . . . . . . . . . . . . . 4 Carryover from prior year . . . . . . . . . . . . . . . .4 . . . . . . . . . . . . . . . . . . . . . . . 5 Add lines 2 through 4 . . . . . . . . . .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .. .5. .. .. .. .. .. .. ..0 .. . . . . . 6 Casualty or theft loss(es). Attach Form 4684. See instructions . . . . . . . . . . . . 6. . . . . . . . . . . . . 7 Unreimbursed employee expenses—job travel, union dues, job education, etc. You must attach Form 2106 or Form 2106-EZ if required. See instructions 2106EZ Filer Bus Exp $ 8,289 7 8,289 This is from Form 2106EZ 8 Tax preparation fees . . . . . . . . . . . . . . . . . 8. . . . . . . . . . . . . . . . . . . . . . . . 9 Other expenses. See instructions for expenses to deduct here. List type and amount $ $ $ $ 9 10 Add lines 7 through 9 . . . . . . . . . . . . . . . . .10. . . . . 8,289 . . . . . . . . . . . . . . . . . . . 11 Enter the amount from Form 1040NR, line 37 . . . . . . . . 11. . . . . . 8,551 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 Multiply line 11 by 2% (.02) . . . . . . . . . . . . . . . 12 . . . . . . 171 . . . . . . . . . . . . . . . . . . 13 14 Subtract line 12 from line 10. If line 12 is more than line 10, enter -0- . . . . . . . . .13. . . . . 8,118 . . . . . . . . 15 Is Form 1040NR, line 37, over the amount shown below for the filing status box you checked on page 1 of Form 1040NR: Box 1 of W-2 Other—see instructions for expenses to deduct here. List type and amount Other Miscellaneous Deductions 14 Total Itemized Deductions Move this # to Line 38 Page 2 • $305,050 if you checked box 6, • $254,200 if you checked box 1 or 2, or • $152,525 if you checked box 3, 4, or 5? X No. Your deduction is not limited. Add the amounts in the far right column for lines 1 through 14. Also enter this amount on Form 1040NR, line 38. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter here and on Form 1040NR, line 38. 15 8,210 Form 1040NR (2014) JOHN SAMPLE Form 1040NR (2014) 123-45-6789 Page 4 Schedule NEC—Tax on Income Not Effectively Connected With a U.S. Trade or Business (see instructions) Enter amount of income under the appropriate rate of tax (see instructions) Nature of income 1 a b 2 a b c 3 4 5 6 7 8 9 10 a b 11 12 13 14 15 (a) 10% (b) 15% (c) 30% (d) Other (specify) 0% Dividends paid by: U.S. corporations . . . . . . . . . . . . . . . . . . . . . . . .1a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Foreign corporations . . . . . . . . . . . . . . . . . . . . . . .1b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Interest: Mortgage . . . . . . . . . . . . . . . . . . . . . . . . . . .2a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Paid by foreign corporations . . . . . . . . . . . . . . . . . . .2b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other . . . . . . . . . . . . . . . . . . . . . . . . . . . .2c. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Industrial royalties (patents, trademarks, etc.) . . . . . . . . . . . . .3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Motion picture or T.V. copyright royalties . . . . . . . . . . . . . . .4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other royalties (copyrights, recording, publishing, etc.) . . . . . . . . . .5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Real property income and natural resources royalties . . . . . . . . . . 6. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Pensions and annuities . . . . . . . . . . . . . . . . . . . . . . 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Social security benefits . . . . . . . . . . . . . . . . . . . . . 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Capital gain from line 18 below . . . . . . . . . . . . . . . . . . 9. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Gambling—Residents of Canada only. Enter net income in column (c). If zero or less, enter -0-. Winnings 10c Losses 0 Gambling winnings —Residents of countries other than Canada Note. Losses not allowed . . . . . . . . . . . . . . . . . . . . . 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Other (specify) 12 Add lines 1a through 12 in columns (a) through (d) . . . . . . . . . . . 13. . . . . . . 0. . . . . . . . 0. . . . . . . . 0. . . . . . . . 0. . . . . . . Multiply line 13 by rate of tax at top of each column . . . . . . . . .14. . . . . . . 0. . . . . . . . 0. . . . . . . . 0. . . . . . . . 0. . . . . . . Tax on income not effectively connected with a U.S. trade or business. Add columns (a) through (d) of line 14. Enter the total here and on Form 1040NR, line 54 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15. . . 0% . . 0 . 0. 0 Capital Gains and Losses From Sales or Exchanges of Property Enter only the capital gains and losses from property sales or exchanges that are from sources within the United States and not effectively connected with a U.S. business. Do not include a gain or loss on disposing of a U.S. real property interest; report these gains and losses on Schedule D (Form 1040). Report property sales or exchanges that are effectively connected with a U.S. business on Schedule D (Form 1040), Form 4797, or both. 16 17 18 (a) Kind of property and description (if necessary, attach statement of descriptive details not shown below) (b) Date acquired (mo., day, yr.) (c) Date sold (mo., day, yr.) (d) Sales price (e) Cost or other basis (f) LOSS If (e) is more (g) GAIN If (d) is more than (d), subtract (d) from (e) than (e), subtract (e) from (d) Enter on Ln 16 - Input or Ln 16 - Detail tab Add columns (f) and (g) of line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 . . ( . . . . . 0. . ) . . . . . . 0. . . . . Capital gain. Combine columns (f) and (g) of line 17. Enter the net gain here and on line 9 above (if a loss, enter -0-) 18 0 Form 1040NR (2014) Form 1040NR (2014) JOHN SAMPLE 123-45-6789 Page 5 Schedule OI — Other Information (see instructions) Answer all questions A Of what country or countries were you a citizen or national during the tax year? UNITED KINGDOM B In what country did you claim residence for tax purposes during the tax year? C Have you ever applied to be a green card holder (lawful permanent resident) of the United States? . . . . . . . . .Yes . . .X . No . . . . . D Were you ever: 1. A U.S. citizen? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes . . . .X . No . . . . . UNITED KINGDOM 2. A green card holder (lawful permanent resident) of the United States? . . . . . . . . . . . . . . . . . . .Yes . . .X . No . . . . . If you answer "Yes" to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that apply to you. E If you had a visa on the last day of the tax year, enter your visa type. If you did not have a visa, enter your U.S. immigration status on the last day of the tax year. J-1 F Have you ever changed your visa type (nonimmigrant status) or U.S. immigration status? . . . . . . . . . . . . Yes . . . X. . No . . . . . If you answered "Yes," indicate the date and nature of the change. G List all dates you entered and left the United States during 2014 (see instructions). Note. If you are a resident of Canada or Mexico AND commute to work in the United States at frequent intervals, check the box for Canada or Mexico and skip to item H . . . . . . . . . . . . . . Canada . . . . . . Mexico . . . . . . . . . . . . . . . Date entered United States mm/dd/yy Date departed United States mm/dd/yy Date entered United States mm/dd/yy Date departed United States mm/dd/yy 08/22/14 The numbers assume that you never left the US. Adjust them if you did. H Give number of days (including vacation, nonworkdays, and partial days) you were present in the United States during: 2012 0 , 2013 130 , and 2014 234 . I Did you file a U.S. income tax return for any prior year? . . . . . . . . . . . . . . . . . . . . . . . .X . .Yes . . . . No . . . . . . If "Yes," give the latest year and form number you filed . . . . . . 2013 . . . . . . 1040NR . . . . . . . . . . . . . . . . . . . . . . . . J Are you filing a return for a trust? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Yes . . .X . No . . . . . If "Yes," did the trust have a U.S. or foreign owner under the grantor trust rules, make a distribution or loan to a U.S. person, or receive a contribution from a U.S. person? . . . . . . . . . . . . . . . . . . . . . . . . Yes . . . .X . No . . . . . K Did you receive total compensation of $250,000 or more during the tax year? . . . . . . . . . . . . . . . . . Yes . . . X. .No. . . . . If "Yes," did you use an alternative method to determine the source of this compensation? . . . . . . . . . . . . Yes . . . X. .No. . . . . L Income Exempt from Tax—If you are claiming exemption from income tax under a U.S. income tax treaty with a foreign country, complete (1) and (2) below. See Pub. 901 for more information on tax treaties. 1. Enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the treaty benefit, and the amount of exempt income in the columns below. Attach Form 8833 if required (see instructions). (b) Tax treaty (c) Number of months (d) Amount of exempt (a) Country claimed in prior tax years income in current tax year article (e) Total. Enter this amount on Form 1040NR, line 22. Do not enter it on line 8 or line 12 . . . . . . . . . . . . . . . . . . . . 0 . . . . 2. Were you subject to tax in a foreign country on any of the income shown in 1(d) above? . . . . . . . . . . . .Yes . . . . No . . . . . Form 1040NR (2014) Form 2106-EZ Department of the Treasury Internal Revenue Service (99) OMB No. 1545-0074 Unreimbursed Employee Business Expenses Attach to Form 1040 or Form 1040NR. Information about Form 2106 and its separate instructions is available at www.irs.gov/form2106. Your name Occupation in which you incurred expenses JOHN SAMPLE Attachment Sequence No. 129A Social security number INTERN 123-45-6789 You Can Use This Form Only if All of the Following Apply. You are an employee deducting ordinary and necessary expenses attributable to your job. An ordinary expense is one that is common and accepted in your field of trade, business, or profession. A necessary expense is one that is helpful and appropriate for your business. An expense does not have to be required to be considered necessary. You do not get reimbursed by your employer for any expenses (amounts your employer included in box 1 of your Form W-2 are not considered reimbursements for this purpose). If you are claiming vehicle expense, you are using the standard mileage rate for 2014. Caution: You can use the standard mileage rate for 2014 only if: (a) you owned the vehicle and used the standard mileage rate for the first year you placed the vehicle in service, or (b) you leased the vehicle and used the standard mileage rate for the portion of the lease period after 1997. Part I Figure Your Expenses Copy these numbers from the worksheet 1 Complete Part II. Multiply line 8a by 56¢ (.56). Enter the result here . . . . . . . . . . . . . . . .1 . . . . . . . . 0. . . . . . 2 Parking fees, tolls, and transportation, including train, bus, etc., that did not involve overnight travel or commuting to and from work . . . . . . . . . . . . . . . . . . . . . . . .2 . . . . . . 1,650 . . . . . . . . 3 Travel expense while away from home overnight, including lodging, airplane, car rental, etc. Do not include meals and entertainment . . . . . . . . . . . . . . . . . . . . . . . . . . 3. . . . . . . 1,280 . . . . . . . . 4 Business expenses not included on lines 1 through 3. Do not include meals and entertainment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 . . . . . . . . . . . . . . . 5 Meals and entertainment expenses: $ 10,718 x 50% (.50). (Employees subject to Department of Transportation (DOT) hours of service limits: Multiply meal expenses incurred while away from home on business by 80% (.80) instead of 50%. For details, see instructions.) . . . . 5. . . . . . . 5,359 . . . . . . . . 6 Total expenses. Add lines 1 through 5. Enter here and on Schedule A (Form 1040), line 21 (or on Schedule A (Form 1040NR), line 7). (Armed Forces reservists, fee-basis state or local government officials, qualified performing artists, and individuals with disabilities: See the instructions for special rules on where to enter this amount.) . . . . . . . . . . . . . . . . . . .6 . . . . . . 8,289 . . . . . . . . Part II Information on Your Vehicle. Complete this part only if you are claiming vehicle expense on line 1. 7 When did you place your vehicle in service for business use? (month, day, year) 8 Of the total number of miles you drove your vehicle during 2014, enter the number of miles you used your vehicle for: a Business b Commuting (see instructions) c Other 9 Was your vehicle available for personal use during off-duty hours? . . . . . . . . . . . . . . . . . . . . . . Yes . . . .No. . . . . 10 Do you (or your spouse) have another vehicle available for personal use? . . . . . . . . . . . . . . . . . . . Yes . . . . No . . . . . 11 a Do you have evidence to support your deduction? . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes . . . . No . . . . . b If "Yes," is the evidence written? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes . . . . No . . . . . For Paperwork Reduction Act Notice, see your tax return instructions. HTA Form 2106-EZ (2014) Worksheet for Form 2106-EZ: TRAINEE UNREIMBURSED BUSINESS EXPENSES For August 2013 Intake, whose last day of placement was August 21, 2014: In calendar year ending 12/31/2014, they were in the USA for 233 days. →Local Transportation Expenses: $10/d x 5 work days x 33 weeks = $1,650 (line 2) →Meals & Incidentals Allowance: $46/d x 233 days = $10,718 (x50%*)= $5,359 (line 5) $7,009 ** ● You can also deduct your airfare expenses if needed ($1,280 is used in this sample) *Only half of the meals & incidentals per diem is deductible. **This amount goes on line 7 of Schedule A (page 3 of the 1040NR) and is subject to 2% floor (line 12 of Schedule A) of the adjusted gross income (AGI) on line 36 On line 1 of Schedule A, enter the NYS income tax withheld (box 17 on the W-2) For 2014 tax year, the personal exemption (on line 40 of 1040NR) is $3,950 NOT TO BE FILED WITH YOUR TAX RETURNS Numbers on this worksheet are for illustration only, and you need to make sure you calculate the deductions’ period based on when you started employment in the US minus any days outside the country. IT-203 New York State Department of Taxation and Finance Nonresident and Part-Year Resident 2014 Income Tax Return New York State • New York City • Yonkers 14 For the year January 1, 2014, through December 31, 2014, or fiscal year beginning ............................................................ and ending ............................................................ For help completing your return, see the instructions, Form IT-203-I. Your first name and middle initial Your last name (for a joint return, enter spouse's name on line below) JOHN SAMPLE Spouse's first name and middle initial Spouse's last name Your date of birth (mm-dd-yyyy) 123-45-6789 Spouse's date of birth (mm-dd-yyyy) Spouse's social security number Mailing address (see instructions, page 13) (number and street or PO box) Apartment number 123 ANYWHERE STREET New York State county of residence NR City, village, or post office State ZIP code LONDON Country (if not United States) School district name UNITED KINGDOM (ENGLAND, NR NORTHERN IRELAND, SCOTLA Taxpayer's permanent home address (see instr., pg 13) (no. and street or rural route) State Your social security number ZIP code Apartment no. City, village, or post office School district code number Taxpayer's date of death Spouse's date of death Country (if not United States) Decedent information A Filing status (mark an X in one box): X E New York City part-year residents only (see page 14) Single (1) Number of months you lived in NY City in 2014 .................................... (2) Number of months your spouse lived Married filing joint return (enter both spouses' social security numbers above) in NY City in 2014 ................................................................................... Married filing separate return F (enter both spouses' social security numbers above) Enter your 2-character special condition code E4 if applicable (see page 14) ............................................................................. If applicable, also enter your second 2-character special condition code ................................................................................... Qualifying widow(er) with dependent child G New York State part-year residents (see page 15) B Did you itemize your deductions on your 2014 Enter the date you moved into federal income tax return? ................................................................................................................................................................................................................. Yes X No or out of NYS (mm-dd-yyyy) ......................................................................... C Can you be claimed as a dependent on another On the last day of the tax year (mark an X in one box): taxpayer's federal return? .................................................................................................................................................................................................................. Yes No X 1) Lived in NYS ........................................................................................... D1 Did you have a financial account located in a 2) Lived outside NYS; received income from foreign country? (see pg. 14) ............................................................................................................................................................................................................... Yes No X NYS sources during nonresident period ................................................. D2 Yonkers residents and Yonkers part-year residents only: 3) Lived outside NYS; received no income from (1) Did you receive a property tax freeze credit? NYS sources during nonresident period ................................................. (see page 14) ............................................................................................................................................................................................................................... Yes No H New York State nonresidents (see page 15) (2) If Yes, enter Did you or your spouse maintain the amount ................................................................................................................................................................................................................................ .00 living quarters in NYS in 2014? ..................................................................... Yes No (if Yes, complete Form IT-203-B) D3 Did you receive a family tax relief credit? (see page 14) ....................................................................................................................................................................................................................................... Yes No X Head of household (with qualifying person) I Dependent exemption information (see page 15) First name and middle initial Last name Relationship If more than 6 dependents, mark an X in the box. For office use only Social security number Date of birth (mm-dd-yyyy) Page 2 of 4 IT-203 (2014) Enter your social security number 123-45-6789 Federal income and adjustments 1 2 3 4 5 6 7 8 9 (see page 16) Federal amount New York State amount Whole dollars only Whole dollars only 8,551 .00 8,551 .00 1 1 Wages, salaries, tips, etc. ............................................................................................................................................................................................ .00 .00 2 2 Taxable interest income .............................................................................................................................................................................................. .00 .00 3 3 Ordinary dividends ....................................................................................................................................................................................................... Taxable refunds, credits, or offsets of state and local .00 .00 4 4 income taxes (also enter on line 24) .......................................................................................................................................................................... .00 .00 5 5 Alimony received ......................................................................................................................................................................................................... .00 .00 6 6 Business income or loss (submit a copy of federal Sch. C or C-EZ, Form 1040) .......................................................................................................................................... .00 .00 7 7 Capital gain or loss (if required, submit a copy of federal Sch. D, Form 1040) .............................................................................................................................................. .00 .00 8 8 Other gains or losses (submit a copy of federal Form 4797) ........................................................................................................................................... .00 .00 9 9 Taxable amount of IRA distributions. Beneficiaries: mark X in box .00 10 .00 10 Taxable amount of pensions/annuities. Beneficiaries: mark X in box 10 11 Rental real estate, royalties, partnerships, S corporations, .00 11 .00 11 trusts, etc. (submit a copy of federal Schedule E, Form 1040) ....................................................................................................................................... 12 Rental real estate included .00 12 in line 11 (federal amount) .......................................................................................................................................................................................... .00 13 .00 13 Farm income or loss (submit a copy of federal Sch. F, Form 1040) .............................................................................................................................................. 13 .00 14 .00 14 Unemployment compensation ..................................................................................................................................................................................... 14 .00 15 .00 15 Taxable amount of social security benefits (also enter on line 26) ....................................................................................................................................... 15 .00 16 .00 16 Other income (see page 22) Identify: 16 8,551 .00 17 8,551 .00 17 Add lines 1 through 11 and 13 through 16 ................................................................................................................................................................ 17 18 Total federal adjustments to income (see page 22) Identify: .00 18 .00 18 8,551 .00 19 8,551 .00 19 Federal adjusted gross income (subtract line 18 from line 17) 19 New York additions (see page 23) 20 Interest income on state and local bonds (but not those .00 20 .00 20 of New York State or its localities) ................................................................................................................................................................................ .00 21 .00 21 Public employee 414(h) retirement contributions ........................................................................................................................................................ 21 .00 22 .00 22 Other (Form IT-225, line 9) ............................................................................................................................................................................................................... 22 8,551 .00 23 8,551 .00 23 Add lines 19 through 22 ............................................................................................................................................................................................... 23 New York subtractions (see page 24) 24 Taxable refunds, credits, or offsets of state and .00 24 .00 24 local income taxes (from line 4) ................................................................................................................................................................................. 25 Pensions of NYS and local governments and the .00 25 .00 25 federal government (see page 24) ............................................................................................................................................................................. .00 26 .00 26 Taxable amount of social security benefits (from line 15) ............................................................................................................................................. 26 .00 27 .00 27 Interest income on U.S. government bonds ................................................................................................................................................................ 27 .00 28 .00 28 Pension and annuity income exclusion ....................................................................................................................................................................... 28 .00 29 .00 29 Other (Form IT-225, line 18) .......................................................................................................................................................................................... 29 .00 30 .00 30 Add lines 24 through 29 ............................................................................................................................................................................................... 30 8,551 .00 31 8,551 .00 31 New York adjusted gross income (subtract line 30 from line 23) ......................................................................................................................................... 31 8,551 .00 32 Enter the amount from line 31, Federal amount column ........................................................................................................................................... 32 You get to deduct the higher of your ietmiz ed deductions from page 3 of 1040NR or $7800 standard Enter your standard deduction (table on page 26) or your itemized deduction (from Form IT-203-D). Standard deduction or itemized deduction 33 (see page 26) X Standard – or – 7,800 .00 Mark an X in the appropriate box: ............................................................................................................................................ Itemized 33 751 .00 34 Subtract line 33 from line 32 (if line 33 is more than line 32, leave blank) ....................................................................................................................... 34 000 .00 35 Dependent exemptions (enter the number of dependents listed in Item I; see page 26) ................................................................................................... 35 751 .00 36 New York taxable income (subtract line 35 from line 34) .............................................................................................................................................. 36 Name(s) as shown on page 1 Enter your social security number JOHN SAMPLE 123-45-6789 Tax computation, credits, and other taxes 37 38 39 40 41 42 43 IT-203 (2014) Page 3 of 4 (see page 26) 751 .00 37 New York taxable income (from line 36 on page 2) ..................................................................................................................................................... 38Use tax table 31 .00 New York State tax on line 37 amount (see page 27 and Tax computation on pages 60, 61, and 62) .............................................................................. Given 45 .00 39 New York State household credit (page 27, table 1, 2, or 3) .......................................................................................................................................... .00 40 Subtract line 39 from line 38 (if line 39 is more than line 38, leave blank) ....................................................................................................................... .00 41 New York State child and dependent care credit (see page 28) ................................................................................................................................... .00 42 Subtract line 41 from line 40 (if line 41 is more than line 40, leave blank) ....................................................................................................................... .00 43 New York State earned income credit (see page 28) .................................................................................................................................................... .00 44 Base tax (subtract line 43 from line 42; if line 43 is more than line 42, leave blank) ........................................................................................................... 44 45 Income percentage New York State amount from line 31 8,551 .00 (see page 28) 46 47 48 49 50 Federal amount from line 31 ÷ 8,551 .00 Round result to 4 decimal places = 45 1.0000 .00 46 Allocated New York State tax (multiply line 44 by the decimal on line 45) ....................................................................................................................... .00 47 New York State nonrefundable credits (Form IT-203-ATT, line 8) .................................................................................................................................. .00 48 Subtract line 47 from line 46 (if line 47 is more than line 46, leave blank) ....................................................................................................................... .00 49 Net other New York State taxes (Form IT-203-ATT, line 33) .......................................................................................................................................... .00 50 Total New York State taxes (add lines 48 and 49) ....................................................................................................................................................... New York City and Yonkers taxes and credits .00 51 Part-year New York City resident tax (Form IT-360.1) ................................................................................................................................................ See instructions on pages 28 Part-year resident nonrefundable New York City and 29 to compute New York .00 52 child and dependent care credit ............................................................................................................................................................................. City and Yonkers taxes, .00 52a 52a Subtract line 52 from 51 ............................................................................................................................................................................................ credits, and surcharges. .00 53 Yonkers nonresident earnings tax (Form Y-203) ......................................................................................................................................................... 53 54 Part-year Yonkers resident income tax surcharge .00 54 (Form IT-360.1) ......................................................................................................................................................................................................... .00 55 Total New York City and Yonkers taxes (add lines 52a, 53, and 54) ......................................................................................................................... 55 51 52 56 .00 56 Sales or use tax (See the instructions on page 29. Do not leave line 56 blank.) .......................................................................................................... Voluntary contributions 57a 57b 57c 57d 57e 57f 57g 57h 57i 57j (see page 30) .00 57a Return a Gift to Wildlife ....................................................................................................................................................................................... .00 57b Missing/Exploited Children Fund ........................................................................................................................................................................ .00 57c Breast Cancer Research Fund ........................................................................................................................................................................... .00 57d Alzheimer's Fund ................................................................................................................................................................................................ .00 57e Olympic Fund ($2 or $4) ...................................................................................................................................................................................... .00 57f Prostate and Testicular Cancer Research and Education Fund ........................................................................................................................ .00 57g 9/11 Memorial ..................................................................................................................................................................................................... .00 57h Volunteer Firefighting & EMS Recruitment Fund ................................................................................................................................................ .00 57i Teen Health Education ....................................................................................................................................................................................... .00 57j Veterans Remembrance ..................................................................................................................................................................................... .00 57 Total voluntary contributions (add lines 57a through 57j) ........................................................................................................................................... 57 58 Total New York State, New York City, and Yonkers taxes, sales or use tax, .00 58 and voluntary contributions (add lines 50, 55, 56, and 57) ...................................................................................................................................... Page 4 of 4 Enter your social security number IT-203 (2014) 123-45-6789 .00 59 Enter amount from line 58 ........................................................................................................................................................................................... 59 Payments and refundable credits 60 61 62 63 64 65 66 (see page 31) .00 60 Part-year NYC school tax credit (also complete E on front; see page 31) ........................................................................................................................................... .00 61 Other refundable credits (Form IT-203-ATT, line 17) ..................................................................................................................................................... Submit your wage and tax 92 .00 62 Total New York State tax withheld .............................................................................................................................................................................. statements with your return .00 63 Total New York City tax withheld ................................................................................................................................................................................ (see page 31). .00 64 Total Yonkers tax withheld .......................................................................................................................................................................................... .00 65 Total estimated tax payments/amount paid with Form IT-370 ...................................................................................................................................................... 92 .00 66 Total payments and refundable credits (add lines 60 through 65) ............................................................................................................................. Your refund, amount you owe, and account information (see pages 32 through 35) 92 .00 67 Amount overpaid (if line 66 is more than line 59, subtract line 59 from line 66) .............................................................................................................. 67 68 Amount of line 67 to be refunded direct debit paper X check ... 68 92 .00 Mark one refund choice: deposit (fill in line 73) - or card - or - See pages 32 and 33 for information about your three 69 Amount of line 67 that you want applied refund choices. .00 69 to your 2015 estimated tax (see instructions) ............................................................................................................................................................. See page 33 for payment 70 Amount you owe (if line 66 is less than line 59, subtract line 66 from line 59). To pay by electronic options. and fill in lines 73 and 74. If you pay by check funds withdrawal, mark an X in the box .00 70 or money order you must complete Form IT-201-V and mail it with your return. ..................................................................................................... 71 Estimated tax penalty (include this amount on line 70, See page 36 for the proper .00 71 or reduce the overpayment on line 67; see page 33) ..................................................................................................................................................... assembly of your return. .00 72 Other penalties and interest (see page 33) ................................................................................................................................................................... 72 73 Account information for direct deposit or electronic funds withdrawal (see page 34). If the funds for your payment (or refund) would come from (or go to) an account outside the U.S., mark an X in this box (see pg. 34) 73a Account type: Personal checking - or - 73b Routing number Personal savings - or - 73c Account number Business checking Business savings - or - CHECK WITH YOUR BANK ABOUT THIS .00 74 Electronic funds withdrawal (see page 34) ................................................................................................................................................................... Date Amount Third-party Print designee's name designee? (see instr.) Yes No E-mail: Paid preparer must complete (see instr.) Preparer's signature Designee's phone number Date Taxpayer(s) must sign here Preparer's NYTPRIN Your signature Firm's name (or yours, if self-employed) Preparer's PTIN or SSN Address Employer identification number NYTPRIN excl. code E-mail: Personal identification number (PIN) SIGN HERE Your occupation INTERN Spouse's signature and occupation (if joint return) Date Daytime phone number | E-mail: See instructions for where to mail your return. $0 - $5,999 Instructions for Form IT-203 Access our Web site at www.tax.ny.gov 51 2014 New York State Tax Table If your New York adjusted gross income (line 32 of Form IT-203) is more than $104,600, you cannot use these tables. See Tax computation — New York AGI of more than $104,600 beginning on page 60 to compute your tax. Failure to follow these instructions may result in your having to pay interest and penalty if the income tax you report on your return is less than the correct amount. In this New York State tax table, the taxable income column is the amount from Form IT-203, line 37. If line 37 (taxable income) is – At least But less than Example: Mr. and Mrs. Jones are filing a joint return. Their taxable income on line 37 of Form IT-203 is $38,275. First, they find the 38,250 - 38,300 income line. Next, they find the column for Married filing jointly and read down the column. The amount shown where the income line and filing status column meet is $1,826. This is the tax amount they must write on line 38 of Form IT-203. If line 37 (taxable income) is – And you are – Single or Married filing separately Married filing jointly * Head of a household At least But less than Married filing jointly * At least But less than 38,200 38,250 38,300 38,350 38,250 38,300 38,350 38,400 Head of a household And you are – Single or Married filing separately Married filing jointly * Head of a household Your New York State tax is: If line 37 (taxable income) is – And you are – Single or Married filing separately If line 37 (taxable income) is – At least But less than 2,136 2,139 2,142 2,145 1,823 1,826 1,829 1,832 1,969 1,973 1,976 1,979 And you are – Single or Married filing separately Married filing jointly * Head of a household Your New York State tax is: $0 13 25 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 $13 25 50 100 150 200 250 300 350 400 450 500 550 600 650 700 750 800 850 900 950 1,000 1,000 1,000 1,050 1,100 1,150 1,200 1,250 1,300 1,350 1,400 1,450 1,500 1,550 1,600 1,650 1,700 1,750 1,800 1,850 1,900 1,950 1,050 1,100 1,150 1,200 1,250 1,300 1,350 1,400 1,450 1,500 1,550 1,600 1,650 1,700 1,750 1,800 1,850 1,900 1,950 2,000 $0 1 2 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 $0 1 2 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 $0 1 2 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 Your New York State tax is: 41 43 45 47 49 51 53 55 57 59 61 63 65 67 69 71 73 75 77 79 41 43 45 47 49 51 53 55 57 59 61 63 65 67 69 71 73 75 77 79 41 43 45 47 49 51 53 55 57 59 61 63 65 67 69 71 73 75 77 79 2,000 2,000 2,050 2,100 2,150 2,200 2,250 2,300 2,350 2,400 2,450 2,500 2,550 2,600 2,650 2,700 2,750 2,800 2,850 2,900 2,950 2,050 2,100 2,150 2,200 2,250 2,300 2,350 2,400 2,450 2,500 2,550 2,600 2,650 2,700 2,750 2,800 2,850 2,900 2,950 3,000 3,000 3,000 3,050 3,100 3,150 3,200 3,250 3,300 3,350 3,400 3,450 3,500 3,550 3,600 3,650 3,700 3,750 3,800 3,850 3,900 3,950 * This column must also be used by a qualifying widow(er) 3,050 3,100 3,150 3,200 3,250 3,300 3,350 3,400 3,450 3,500 3,550 3,600 3,650 3,700 3,750 3,800 3,850 3,900 3,950 4,000 Your New York State tax is: 81 83 85 87 89 91 93 95 97 99 101 103 105 107 109 111 113 115 117 119 81 83 85 87 89 91 93 95 97 99 101 103 105 107 109 111 113 115 117 119 81 83 85 87 89 91 93 95 97 99 101 103 105 107 109 111 113 115 117 119 Your New York State tax is: 121 123 125 127 129 131 133 135 137 139 141 143 145 147 149 151 153 155 157 159 121 123 125 127 129 131 133 135 137 139 141 143 145 147 149 151 153 155 157 159 121 123 125 127 129 131 133 135 137 139 141 143 145 147 149 151 153 155 157 159 4,000 4,000 4,050 4,100 4,150 4,200 4,250 4,300 4,350 4,400 4,450 4,500 4,550 4,600 4,650 4,700 4,750 4,800 4,850 4,900 4,950 4,050 4,100 4,150 4,200 4,250 4,300 4,350 4,400 4,450 4,500 4,550 4,600 4,650 4,700 4,750 4,800 4,850 4,900 4,950 5,000 5,000 5,000 5,050 5,100 5,150 5,200 5,250 5,300 5,350 5,400 5,450 5,500 5,550 5,600 5,650 5,700 5,750 5,800 5,850 5,900 5,950 5,050 5,100 5,150 5,200 5,250 5,300 5,350 5,400 5,450 5,500 5,550 5,600 5,650 5,700 5,750 5,800 5,850 5,900 5,950 6,000 Your New York State tax is: 161 163 165 167 169 171 173 175 177 179 181 183 185 187 189 191 193 195 197 199 161 163 165 167 169 171 173 175 177 179 181 183 185 187 189 191 193 195 197 199 161 163 165 167 169 171 173 175 177 179 181 183 185 187 189 191 193 195 197 199 Your New York State tax is: 201 203 205 207 209 211 213 215 217 219 221 223 225 227 229 231 233 235 237 239 201 203 205 207 209 211 213 215 217 219 221 223 225 227 229 231 233 235 237 239 201 203 205 207 209 211 213 215 217 219 221 223 225 227 229 231 233 235 237 239