cs.wbn.bas.060 Determining non-operating effects on working

advertisement

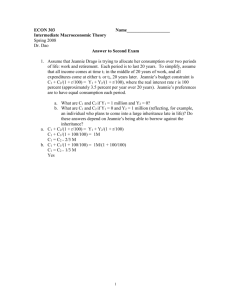

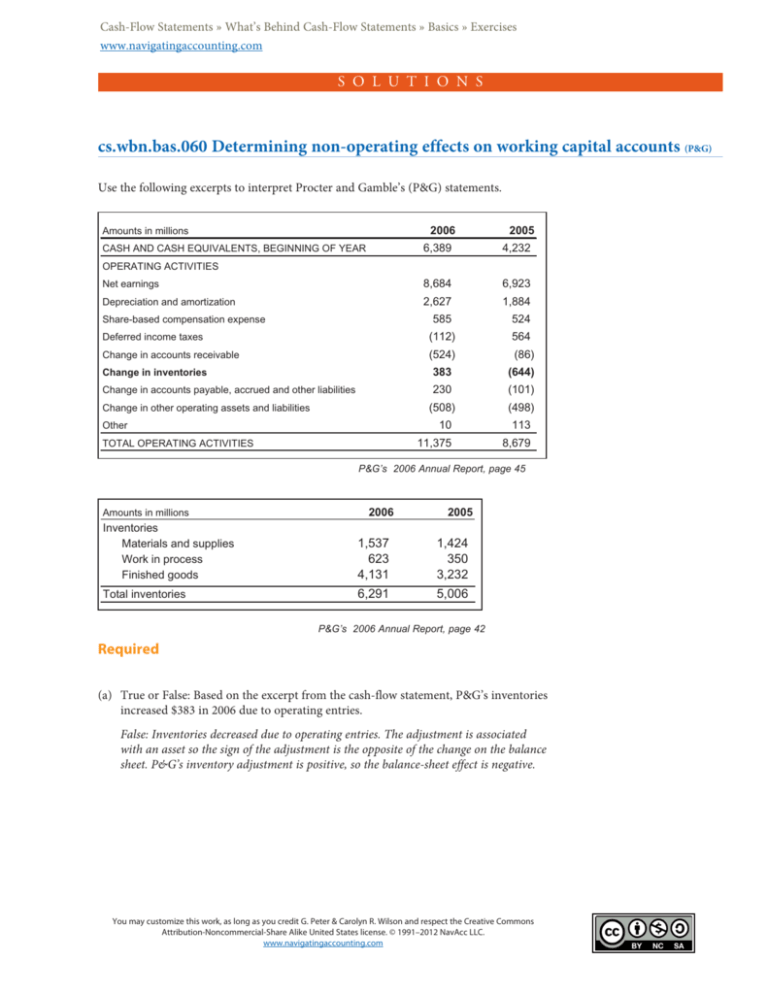

Cash-Flow Statements » What’s Behind Cash-Flow Statements » Basics » Exercises www.navigatingaccounting.com S O L U T I O N S cs.wbn.bas.060 Determining non-operating effects on working capital accounts (P&G) Use the following excerpts to interpret Procter and Gamble’s (P&G) statements. 2006 Amounts in millions 2005 6,389 4,232 Net earnings 8,684 6,923 Depreciation and amortization 2,627 1,884 CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR OPERATING ACTIVITIES 585 524 Deferred income taxes (112) 564 Change in accounts receivable Share-based compensation expense (524) (86) Change in inventories 383 (644) Change in accounts payable, accrued and other liabilities 230 (101) (508) (498) 10 113 11,375 8,679 Change in other operating assets and liabilities Other TOTAL OPERATING ACTIVITIES P&G’s 2006 Annual Report, page 45 Amounts in millions 2006 2005 Inventories Materials and supplies Work in process Finished goods 1,537 623 4,131 1,424 350 3,232 Total inventories 6,291 5,006 P&G’s 2006 Annual Report, page 42 Required (a) True or False: Based on the excerpt from the cash-flow statement, P&G’s inventories increased $383 in 2006 due to operating entries. False: Inventories decreased due to operating entries. The adjustment is associated with an asset so the sign of the adjustment is the opposite of the change on the balance sheet. P&G’s inventory adjustment is positive, so the balance-sheet effect is negative. You may customize this work, as long as you credit G. Peter & Carolyn R. Wilson and respect the Creative Commons Attribution-Noncommercial-Share Alike United States license. © 1991–2012 NavAcc LLC. www.navigatingaccounting.com 2 NAVIGATING ACCOUNTING® (b) True or False: Based on the excerpt of the cash-flow statement, it is reasonable to assume that inventories changed by $383 from 2005 to 2006 on P&G’s balance sheets. False: It is not reasonable to assume the cash flow adjustment is the same as the change in the related balance sheet account. Generally, this will not be true for large companies. If P&G acquires another company during the year, most of P&G’s assets and liabilities will increase because of the acquisition. If the acquired company had $20 of inventories on the date of the acquisition, P&G would transfer the inventories to its balance sheet. But this $20 increase is classified as an investing activity, not an operating activity. Thus, the change in P&G inventories for the year would be partly attributable to operating activities (such as selling products) and partly attributable to non-operating activities (e.g., acquiring other companies). The inventories adjustment in the operating section of P&G’s statement of cash flows would only pertain to the change in inventories associated with operating activities. By contrast, the change in inventories on the balance sheet would reflect all activities. (c) Based on the excerpt of inventories, as reported on P&G’s balance sheet, estimate the net effect of non-operating entries on total inventories. P&G’s balance sheet excerpt for fiscal 2005 and fiscal 2006 reports a $1,285 increase in inventories during fiscal 2006 (from $5,006 to $6,291). However, the operating section of P&G’s fiscal 2006 statement of cash flows shows a positive $383 “change in inventories” reconciliation adjustment. This means P&G’s inventories decreased by $383 during fiscal 2006 because of operating entries (since the asset-related adjustment is the negative of the balance sheet effect). The total change in inventories from the balance sheet is $1,285 and the change associated with operating events is negative $383, so we can determine the change due to non-operating events to be $1,668: $1,285 total change = -$383 operating change + $1,668 non-operating change In fact, most of the increase in inventories related to non-operating events is likely due to P&G’s acquisition of Gillette, which was recorded during fiscal 2006. The figure on the next page demonstrates the possibility that changes in assets (such as inventories and receivables) and liabilities (such as accounts payable) can be partly attributable to non-operating events (such as business acquisitions). This template can help you visualize the P&G inventories example. This may help you better understand how to interpret balance sheets, cash flow reconciliations, and how they are related. © 1991-2012 NavAcc LLC, G. Peter & Carolyn R. Wilson income to permanent owners’ equity Ending balances EXERCISE + = + + + 3 Other Assets Beginning balances The change in an asset due to operating Operating events events is the negative of the related The total change in an asset is reconciliation adjustment. determined by subtracting the beginning balance reported on The change in an asset due to non-operating events only can be derived. Non-operating events the balance sheet from the ending balance. Ending balances P&G Inventories June 30, 2005 $5,006 P&G reports a positive $383 inventories Operating events -$383 reconciliation adjustment for fiscal 2006. This corresponds to a $383 increase in inventories because of operating events. Inventories increased by $1,668 during Non-operating events $1,668 June 30, 2006 $6,291 fiscal 2006 because of non-operating events: $1,668 = $1,285 - (-$383). P&G’s balance sheet reports beginning and ending inventories of $5,006 and $6,291 for fiscal 2006. Thus, the total change in P&G’s inventories for fiscal 2006 is $1,285 = $6,291 - $5,006. © NavAcc LLC, G. Peter & Caroly © 1991-2012 NavAcc LLC, G. Peter & Carolyn R. Wilson