General Motors Acceptance Corporation of Canada, Limited

advertisement

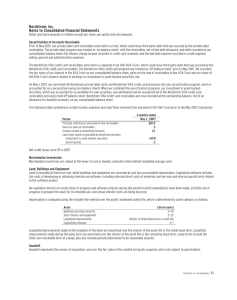

General Motors Acceptance Corporation of Canada, Limited CONSOLIDATED FINANCIAL STATEMENTS AND NOTES For the Year Ended December 31, 2004 General Motors Acceptance Corporation of Canada, Limited INCORPORATED UNDER THE LAWS OF CANADA 3300 BLOOR STREET WEST, SUITE 2800, TORONTO, ONTARIO M8X 2X5 ***** BOARD OF DIRECTORS PAUL D. BULL THOMAS E. DICKERSON Vice-President, Global Borrowings, General Motors Acceptance Corporation President, General Motors Acceptance Corporation of Canada, Limited WENDE M. RAPSON GEORGE F. HOWELL Legal Counsel and Corporate Secretary, General Motors Acceptance Corporation of Canada, Limited Former Manager, Toronto Branch, General Motors Acceptance Corporation of Canada, Limited ALAN P. FRANKLIN W. JAMES WATSON Treasurer and Comptroller, General Motors Acceptance Corporation of Canada, Limited Former President, General Motors Acceptance Corporation of Canada, Limited OFFICERS THOMAS E. DICKERSON President ALAN P. FRANKLIN WENDE M. RAPSON Treasurer and Comptroller Legal Counsel and Corporate Secretary MANAGEMENT’S RESPONSIBILITIES FOR CONSOLIDATED FINANCIAL STATEMENTS The following consolidated financial statements of General Motors Acceptance Corporation of Canada, Limited were prepared by management, which is responsible for their integrity and objectivity. The statements have been prepared in conformity with Canadian generally accepted accounting principles and, as such, include amounts based on judgments of management. Management is further responsible for maintaining a system of internal accounting controls, designed to provide reasonable assurance that the books and records reflect the transactions of the Company and that its established policies and procedures are carefully followed, and that the Company’s assets are safeguarded. Perhaps the most important feature of the system of control is that it is continually reviewed for its effectiveness and is augmented by written policies and guidelines, the careful selection and training of qualified personnel and an internal audit program. Deloitte & Touche LLP, an independent auditing firm, is engaged by the Shareholder to audit the consolidated financial statements of General Motors Acceptance Corporation of Canada, Limited and to issue a report thereon. The audit is conducted in accordance with Canadian generally accepted auditing standards which comprehend the consideration of internal accounting controls and tests of transactions to the extent necessary to form an independent opinion on the financial statements prepared by management. The Auditors’ Report appears on the following page. The Board of Directors’ responsibilities include, but are not limited to: (1) ensuring that management fulfills its responsibilities in the preparation of the consolidated financial statements and (2) recommending the engaging of the auditors. Representatives of management and the internal auditors meet regularly (separately and jointly) to assess the effectiveness of the system of internal controls. It is management’s conclusion that the system of internal accounting controls at December 31, 2004 provides reasonable assurance that the books and records reflect the transactions of the Company and that it complies with its established policies and procedures. s/ Thomas E. Dickerson Thomas E. Dickerson Director s/ Alan P. Franklin Alan P. Franklin Director 2 AUDITORS’ REPORT To the Shareholder of General Motors Acceptance Corporation of Canada, Limited: We have audited the consolidated balance sheets of General Motors Acceptance Corporation of Canada, Limited as at December 31, 2004 and 2003, and the consolidated statements of income and retained earnings and of cash flows for the years then ended. These financial statements are the responsibility of management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with Canadian generally accepted auditing standards. Those standards require that we plan and perform an audit to obtain reasonable assurance whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. In our opinion, these consolidated financial statements present fairly, in all material respects, the financial position of the Company as at December 31, 2004 and 2003, and the results of its operations and its cash flows for the years then ended in accordance with Canadian generally accepted accounting principles. s/ Deloitte & Touche LLP Deloitte & Touche LLP Chartered Accountants March 16, 2005 3 Consolidated Balance Sheet General Motors Acceptance Corporation of Canada, Limited December 31, December 31, 2004 2003 (in thousands) Assets Cash and cash equivalents Subordinated interests in securitization trusts, net Finance receivables and loans, net Investment in operating leases, net Income and other taxes receivable Notes receivable from affiliates Accounts receivable from affiliates Investments Other assets TOTAL ASSETS $ Liabilities Debt payable within one year Interest payable Income and other taxes payable Accrued expenses and other liabilities Future income taxes Debt payable after one year Total Liabilities Shareholder's Equity Capital stock without par value (authorized - unlimited, outstanding - 1,450,000 common shares) Contributed surplus Retained earnings Total Shareholder's Equity TOTAL LIABILITIES AND SHAREHOLDER'S EQUITY 2,785,666 444,452 6,385,266 7,079,305 19,618 2,552,074 25,388 797,500 759,350 $ 20,848,619 $ $ $ 7,166,238 171,889 983,763 777,327 9,778,720 18,877,937 50,000 1,920,682 1,970,682 $ 20,848,619 The Notes to Consolidated Financial Statements are an integral part of these statements. Approved by the Board: s/ Thomas E. Dickerson Director s/ Alan P. Franklin Director 4 2,366,000 406,908 8,105,023 5,746,415 2,118,528 50,981 1,084,392 521,733 $ 20,399,980 5,444,581 190,025 10,527 829,952 696,679 11,270,030 18,441,794 50,000 129,692 1,778,494 1,958,186 $ 20,399,980 Consolidated Statements of Income and Retained Earnings General Motors Acceptance Corporation of Canada, Limited Year Ended December 31, 2004 2003 (in thousands) Revenue Consumer Commercial Operating leases Total financing revenue Interest and discount Depreciation on operating leases Net financing revenue Other income Net financing revenue and other income $ Expense Operating expenses Provision for credit losses Total expenses Income before income taxes Income tax expense Net income Retained earnings, beginning of the year Retained earnings, end of the year 296,248 198,438 1,657,218 2,151,904 (824,516) (1,208,540) 118,848 258,990 377,838 167,358 (7,881) 159,477 218,361 76,173 142,188 1,778,494 $ 1,920,682 The Notes to Consolidated Financial Statements are an integral part of these statements. 5 $ 324,957 267,342 1,361,679 1,953,978 (822,075) (996,230) 135,673 267,867 403,540 183,066 25,938 209,004 194,536 61,108 133,428 1,645,066 $ 1,778,494 Consolidated Statement of Cash Flows General Motors Acceptance Corporation of Canada, Limited Year Ended December 31, 2004 2003 (in thousands) Operating Activities Net income Depreciation Provision for credit losses Gain on sale of finance receivables - Consumer Net change in: Other assets Accounts receivable from affiliates Interest payable Income and other taxes payable/receivable Accrued expenses and other liabilities Future income taxes Cash provided by operating activities $ Financing Activities Net change in short-term debt Issuance of long-term debt Repayment of long-term debt Repatriation of contributed surplus Cash provided by financing activities 142,188 1,211,128 (7,881) (33,641) $ 133,428 998,439 25,938 (33,520) (240,205) 25,593 (18,136) (30,145) 153,811 80,648 1,283,360 38,264 (24,543) 5,259 (64,108) 17,402 39,872 1,136,431 133,996 3,355,871 (3,259,520) (129,692) 100,655 (569,487) 5,056,440 (3,599,160) 887,793 Investing Activities Acquisitions of finance receivables and loans Liquidations of finance receivables and loans Proceeds from sales of finance receivables Purchases of operating lease assets Disposals of operating lease assets Net change in: Notes receivable from affiliates Investments Subordinated interests in securitization trusts Cash used in investing activities Increase in cash and cash equivalents Cash and cash equivalents at beginning of the year Cash and cash equivalents at end of the year (18,566,493) 17,746,679 2,581,093 (3,318,942) 777,512 (20,669,310) 18,745,693 2,275,277 (2,740,397) 1,166,852 (433,546) 286,892 (37,544) (964,349) 419,666 2,366,000 $ 2,785,666 845,233 (62,572) (439,224) 1,585,000 781,000 $ 2,366,000 Supplemental disclosure Cash paid for: Interest Taxes $ $ $ $ 840,290 53,179 The Notes to Consolidated Financial Statements are an integral part of these statements. 6 815,329 108,047 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Note 1. Significant Accounting Policies General Motors Acceptance Corporation of Canada, Limited (“GMACCL” or the “Company”), a wholly-owned subsidiary of General Motors Acceptance Corporation (“GMAC”), a Delaware corporation, was incorporated in 1953 under the laws of Canada. The Company is a financial services organization providing a diverse range of services to a national customer base. Consolidation and basis of presentation The consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles and include the accounts of the Company and its wholly-owned subsidiaries GMAC Leaseco Corporation (“Leaseco”), Canadian Securitized Auto Receivables Corporation (“CSAR”), Canadian Securitized Auto Receivables One Corporation (“CSAROC”) and Canadian Lease Auto Receivable Corporation (“CLARC”). Use of estimates and assumptions The preparation of the Company’s financial statements, in accordance with Canadian generally accepted accounting principles, requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. During the years presented, management has made estimates and valuation assumptions primarily related, but not limited, to the determination of the allowance for credit losses, the valuation of automotive lease residuals and the valuation of interests in securitized assets. Due to the inherent uncertainty involved in making estimates, actual results could differ from those estimates. Cash equivalents Cash equivalents are defined as short-term, highly liquid investments with maturities of 90 days or less. Finance receivables and loans Finance receivables and loans are reported at the principal amount outstanding, net of unearned income. Revenue is recorded over the term of the related finance receivable or loan using the interest method. Certain loan origination costs are deferred and amortized to consumer or commercial revenue over the life of the related finance receivable or loan using the interest method. Nonaccrual loans Consumer and commercial revenue recognition is suspended when finance receivables and loans are placed on nonaccrual status. Consumer receivables are placed on nonaccrual status when contractually delinquent for 120 days. Commercial receivables and loans are placed on nonaccrual status when contractually delinquent for 90 days. Revenue accrued but not collected at the date finance receivables and loans are placed on nonaccrual status is reversed and subsequently recognized only to the extent it is received in cash. Finance receivables and loans are restored to accrual status only when contractually current and the collection of future payments is reasonably assured. Impaired loans Commercial loans are considered impaired when the Company is no longer reasonably assured that it will be able to collect all amounts due according to the contractual terms of the loan agreement and the recorded investment in the loan exceeds its estimated fair value. If the recorded investment in impaired loans exceeds the estimated fair value, a valuation allowance is established as a component of the allowance for credit losses. The Company’s policy is to recognize interest income related to impaired loans on a cash basis. In addition to commercial loans specifically identified for impairment, the Company has portfolios of smaller-balance homogeneous loans that are collectively evaluated for impairment, as discussed within the allowance for credit losses accounting policy. Allowance for credit losses The allowance for credit losses is management's estimate of incurred losses in the lending portfolios. Portions of the allowance for credit losses are specified to cover the estimated losses on commercial loans specifically identified for impairment. The unspecified portion of the allowance for credit losses covers estimated losses on the homogeneous portfolios of finance receivables and loans collectively evaluated for impairment. Additions to the allowance for credit losses are made by charges to the provision for credit losses. Amounts determined to be uncollectible are charged against the allowance for credit losses. Additionally, losses arising from the sale of repossessed assets collateralizing automotive finance receivables and loans are charged to the allowance for credit losses. Recoveries of previously charged-off amounts are credited to the allowance for credit losses. 7 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The Company performs periodic and systematic detailed reviews of its lending portfolios to identify inherent risks and to assess the overall collectibility of those portfolios. The allowance relates to portfolios collectively reviewed for impairment, generally consumer finance receivables and loans, and is based on aggregated portfolio evaluations by product type. Loss models are utilized for these portfolios which consider a variety of factors including, but not limited to, historical loss experience, current economic conditions, anticipated repossessions or foreclosures based on portfolio trends, delinquencies and credit scores, and expected loss factors by receivable and loan type. Loans in the commercial portfolios are generally reviewed on an individual loan basis and, if necessary, an allowance is established for individual loan impairment. Loans subject to individual reviews are analyzed based on factors including, but not limited to, historical loss experience, current economic conditions, collateral performance, and performance trends within specific geographic and portfolio segments, and any other pertinent information, which result in the estimation of specific allowances for credit losses. The allowance related to specifically identified impaired loans is established based on discounted expected cash flows, observable market prices, or for loans that are solely dependent on the collateral for repayment, the fair value of the collateral. The evaluation of these factors for both consumer and commercial finance receivables and loans involves complex, subjective judgments. Securitizations The Company sells retail finance receivables and wholesale loans to a variety of securitization trusts. Subordinated interests in the sold receivables and loans are generally retained in the form of overcollateralization and cash reserve accounts. The Company’s retained interests are generally subordinate to investors’ interests. The receivables and loans are sold on a fully serviced basis. On sale, a servicing liability is recognized and amortized to other income over the estimated remaining life of the sold receivables and loans. In 2003, two bankruptcy-remote subsidiaries of GMACCL (CSAR and CSAROC) were formed to facilitate the Company’s securitization transactions. The Company recognizes gains and losses on securitizations of retail finance receivables and wholesale loans which qualify as sales under the Canadian Institute of Chartered Accountants ("CICA") Accounting Guideline (“AcG”)-12 – “Transfers of Receivables” at the date of transfer. Gains or losses on sales depend on the previous carrying amount of the finance receivables and loans involved in the transfer, which is allocated between the finance receivables and loans sold and the retained interests based on their relative fair values at the date of sale. Since quoted market prices are generally not available, GMACCL estimates the fair value of retained interests by determining the present value of future expected cash flows using modeling techniques that incorporate management’s best estimates of key variables, including credit losses, prepayment speeds, weighted average life and discount rates commensurate with the risks involved and the interest or finance rates on variable and adjustable contracts held by the securitization trusts. Credit loss assumptions are based upon historical experience and the characteristics of individual receivables and loans underlying the securities. Prepayment speed estimates are based on historical prepayment rates on similar assets. Discount rate assumptions are determined using data obtained from market participants, where available, or based on current relevant treasury rates plus a risk adjusted spread based on analysis of historical spreads on similar types of securities. Estimates of interest rates on variable and adjustable contracts are based on spreads over the applicable benchmark interest rate using market-based yield curves. Gains on sales are reported in other income. Recourse to the Company is limited to the right to future residual cash flows, a retained limited interest in the principal balance of the sold receivables and loans and certain cash deposits provided as credit enhancements for investors. The securitization trusts and their investors have no recourse to the Company’s other assets for failure of debtors to pay when due. Appropriate limited recourse loss allowances are established for expected credit losses on sold retail finance receivables. Secured financings The Company’s operating lease securitization transaction, which was completed on June 17, 2004, has been accounted for as a secured financing as the Company has retained substantial risks of ownership of the leased property. The sold operating leases remain on the balance sheet with the corresponding obligation (consisting of the debt securities issued) reflected as debt. The Company recognizes income on the operating leases and interest expense on the securities issued in the securitization. In 2004, a special purpose bankruptcy remote subsidiary of GMACCL (CLARC) was formed to facilitate the Company’s secured financing transactions. 8 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Investment in operating leases Investments in operating leases are reported at cost plus deferred lease origination costs less accumulated depreciation. Income from operating lease assets, which includes lease origination fees net of lease origination costs, is recognized as operating lease revenue on a straight-line basis over the scheduled lease term. Depreciation of vehicles is generally provided on a straight-line basis to an estimated residual value over a period of time consistent with the term of the underlying operating lease agreement. The Company evaluates its depreciation policy for leased vehicles on a regular basis. The Company has significant investments in the residual values of assets in its operating lease portfolio. The residual values represent an estimate of the values of the assets at the end of the lease contracts and are initially recorded based on residual values established at contract inception by using independently published residual value guides and estimates. Realization of the residual values is dependent on the Company's future ability to market the vehicles under then prevailing market conditions. Over the life of the lease, GMACCL evaluates the adequacy of its estimate of the residual value and may make adjustments to the extent the expected value of the vehicle (including support payments from General Motors Canada Limited (“GMCL”)) at lease termination changes. In addition to estimating the residual value at lease termination, the Company also evaluates the current value of the operating lease asset and tests for impairment to the extent necessary, based on market considerations and portfolio characteristics. Impairment is determined to exist if the undiscounted expected future cash flows are lower than the carrying value of the asset. When a lease vehicle is returned to GMACCL, the Company reclassifies the asset from investment in operating leases to other assets at the lower of cost or estimated fair value, less costs to sell. Repossessed assets Assets are classified as repossessed and included in other assets when physical possession of the collateral is taken. Repossessed assets are carried at the lower of the outstanding balance at the time of repossession, or the fair value of the asset. Losses on the periodic revaluation of repossessed assets are charged to operating expenses. Gains and losses on the sales of repossessed assets subject to operating leases are recorded to depreciation expense. Losses arising from the sale of repossessed assets collateralizing automotive finance receivables and loans are charged to the allowance for credit losses. Net costs of maintaining and operating repossessed assets are expensed as incurred. Property and equipment Property and equipment, stated at cost net of accumulated depreciation and amortization, are reported within other assets on the balance sheet. Derivative instruments and hedging activities Effective January 1, 2004, the Company adopted AcG-13 – “Hedging Relationships”, the new accounting guideline issued by the CICA, which increases the documentation, designation and effectiveness criteria to achieve hedge accounting subsequent to the adoption date. This standard is to be applied prospectively and retroactive application is not permitted. The guideline requires the discontinuance of hedge accounting for hedging relationships previously established that do not meet the criteria at the date it is first applied. AcG-13 does not change the method of accounting for derivatives in hedging relationships, but the Emerging Issues Committee of the CICA issued EIC-128 – “Accounting for Trading, Speculative or Non-Hedging Derivative Financial Instruments”, which was adopted concurrently with AcG-13 and requires fair value accounting for derivatives that do not qualify for hedge accounting. The Company is party to derivative financial instruments that it uses in the normal course of its business to reduce its exposure to fluctuations in interest rates and foreign currency exchange rates. The Company enters into these transactions for purposes other than trading. These financial exposures are managed in accordance with corporate policies and procedures. The objectives of the derivative financial instruments portfolio are to manage interest rate and currency risks by offsetting a funding obligation, adjusting fixed and floating rate funding levels, and facilitating securitization transactions. As part of the approval process, management identifies the specific financial risk that the derivative transaction will minimize and the appropriate instrument to be used to reduce the risk. If it is determined that a high correlation between a specific transaction risk and the instrument does not exist, the transaction is generally not approved. 9 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The primary classes of derivatives used by the Company are interest rate and foreign currency swaps. Those instruments involve, to varying degrees, elements of credit risk in the event that a counterparty should default, and market risk as the instruments are subject to interest and foreign currency exchange rate fluctuations. Credit risk is managed through the continual monitoring and approval of financially sound counterparties. Market risk is mitigated as derivatives are generally hedges of underlying transactions. Cash receipts or payments on these agreements occur at periodic contractually defined intervals. Interest rate swaps Interest rate swaps are contractual agreements with a notional amount between the Company and another party to exchange payments representing the net difference between a fixed and floating interest rate or between different floating interest rates, periodically over the life of the agreements without exchange of the underlying notional amounts. The Company uses swaps to alter its fixed and floating interest rate exposures. Interest rate swaps that are designated, and effective, as hedges of underlying debt obligations are not marked to market, but the cash payments are recorded as an adjustment to interest expense recognized over the lives of the underlying debt agreements. Interest rate swaps are reviewed at inception and on an ongoing basis to ensure they remain effective as hedges in managing interest rate exposure. Interest rate swaps that are not designated in an effective hedging relationship are carried at fair value with the changes in fair value, including any payments and receipts made or received, being recorded in Other Income. Foreign currency swaps Foreign currency swaps are used to economically hedge foreign exchange exposure on foreign currency denominated debt by converting the funding currency to Canadian dollars. Foreign currency swaps are legal agreements between two parties to purchase one currency and sell another currency, for a price specified at the contract date, with delivery and settlement at both the effective date and maturity date of the contract. Foreign currency swap agreements are not designated as hedges for accounting purposes. As such, they are carried at fair value on the balance sheet with the changes in fair value being recorded as an adjustment to interest expense in the period in which they occur. Realized and unrealized gains or losses associated with derivative financial instruments, which have been terminated, dedesignated from a hedging relationship or cease to be effective prior to maturity, are deferred under Other Assets and Other Liabilities on the balance sheet and recognized in income on a basis consistent with the underlying hedged item. In the event a designated hedged item is sold, extinguished or matures prior to the termination of the related derivative financial instrument, any realized or unrealized gain or loss on such derivative financial instrument is recognized in income. Income taxes The Company uses the asset and liability method of accounting for income taxes. Under this method, future income tax assets and liabilities are measured to reflect the net tax effects of the temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. The future income tax assets and liabilities are computed based on the tax rates that are expected to be in effect when the underlying items of income and expense are expected to be realized. Future income tax assets are recognized subject to management’s judgment that realization is more likely than not. Reclassifications Certain amounts in prior periods have been reclassified to conform to the current period’s presentation. Accounting and reporting developments In June 2003, the CICA issued AcG-15 – “Consolidation of Variable Interest Entities”. AcG-15 addresses consolidation and disclosure by business enterprises of variable interest entities, representing those entities whose total equity investment at risk is not sufficient to permit the entity to finance its activities without additional subordinated financial support or whose equity investors do not have the characteristics of a “controlling financial interest”. The standard explains how to identify variable interest entities and how an enterprise assesses its interests in a variable interest entity in order to decide whether to consolidate that entity. AcG-15 requires an enterprise to consolidate a variable interest entity when that enterprise has a variable interest, or combination of variable interests, that will absorb a majority of the entity’s expected losses as defined in AcG-15, receive a majority of the entity’s expected residual returns, as defined in AcG-15, or both. AcG-15 applies to annual and interim periods beginning on or after November 1, 2004. The Company will comply with AcG-15 beginning in the first interim reporting period in 2005. 10 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited A number of the Company’s securitization-related variable interests are held in qualifying special purpose entities and, therefore, are exempt from this standard. The remainder of the Company’s securitization-related variable interests are held in multi-seller securitization trusts. GMACCL has certain other interests in variable interest entities for which a preliminary primary beneficiary analysis has been performed. Management believes that consolidation will not be required under AcG-15, however, a final analysis must be completed. In the event consolidation is required, management does not anticipate that there will be a material impact on the Company’s financial position, results of operations, or cash flows. Note 2. Cash and Cash Equivalents Cash and cash equivalents is comprised of collateralized short-term overnight call loans and high quality trust and bank obligations totaling $2,785.7 million and $ 2,366.0 million as at December 31, 2004 and 2003, respectively. Note 3. Finance Receivables and Loans The composition of finance receivables and loans outstanding was as follows: December 31, 2004 Consumer Retail automotive Commercial Wholesale Leasing and lease financing Term loans to dealers and other Total commercial Total finance receivables and loans1 and 2 2003 (in thousands) $ 4,212,688 $ 5,541,549 1,467,063 361,060 381,209 2,209,332 $ 6,422,020 1,786,411 496,739 357,034 2,640,184 $ 8,181,733 1 Net of unearned income of $392,580 and $574,423 at December 31, 2004 and 2003, respectively. 2 The aggregate amount of gross finance receivables and loans maturing in the next four years is as follows: $3,304,925 in 2005; $1,389,334 in 2006; $1,061,536 in 2007; $637,213 in 2008; $421,592 in 2009 and thereafter. Prepayments may cause actual maturities to differ from scheduled maturities. The following table presents an analysis of the activity in the allowance for credit losses on finance receivables and loans: December 31, 2004 2003 (in thousands) Allowance at beginning of year Provisions charged to income1 Charge-offs Recoveries and other Allowance relating to sold receivables Allowance at end of year $ 76,710 (7,881) (16,864) (50) (15,161) $ 36,754 $ 76,920 25,938 (15,591) (1,934) (8,623) $ 76,710 1 During 2004, the Company reduced its allowance for credit losses by $20.3 million as a result of revised estimates in respect of incurred losses associated with its consumer loan portfolio based on observed trends over an extended period of time with regard to underwriting quality, delinquency, repossessions, net losses and economic factors. The $36.8 million allowance established for credit losses as at December 31, 2004, represents management’s estimate of incurred credit losses in the finance receivable and loan portfolio based on assumptions management believes are likely to occur. 11 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Note 4. Sale of Finance Receivables The Company securitizes automotive financial assets as a funding source. The Company sold retail finance receivables with contractual principal aggregating $2,688.6 million in 2004 and $2,549.7 million in 2003. The outstanding balance of sold retail finance receivables totaled $3,304.9 million and $2,886.1 million at December 31, 2004 and 2003, respectively. The Company has also sold wholesale loans on a revolving basis resulting in a decrease in the balance of wholesale loans outstanding of $2,551.1 million and $2,385.0 million at December 31, 2004 and 2003, respectively. The Company is committed to sell eligible loans arising in certain dealer accounts to a maximum of $2,597.0 million. The outstanding securitized balance may increase or decrease from time to time within the maximum program limits to reflect fluctuations in available wholesale loan levels. In the aforementioned securitizations, the Company retains servicing responsibilities and subordinated interests. The Company receives the rights to future cash flows remaining after the investors in the securitization trusts have received their contractual payments. The investors and the securitization trusts have no recourse to the Company’s other assets for failure of debtors to pay when due. The Company’s retained interests are subordinate to investors’ interests and their value is subject to credit and prepayment risks on the transferred assets. The Company sells the receivables on a fully serviced basis. No further compensation for servicing is received after the initial sale. The Company maintains cash collateral accounts for certain retail finance receivables and all current wholesale loan securitizations at predetermined amounts in the unlikely event that deficiencies occur in cash flows owed to the investors. The amounts available in such cash collateral accounts are recorded in other assets and totaled $97.0 million as of December 31, 2004 and $81.7 million as of December 31, 2003. The following table summarizes pre-tax gains on securitizations and certain cash flows received from and paid to securitization trusts related to receivables and loans sold. December 31, 2004 Retail Wholesale (in millions) Pre-tax gains on securitizations1 Proceeds from new securitizations Other cash flows received on retained interests Collections reinvested in revolving wholesale securitizations $ 33.6 $ 2,396.1 $ 65.2 n/a $ $ December 31, 2003 Retail Wholesale (in millions) 54.9 185.0 - $ 33.5 $ 2,275.3 $ 47.2 $ 13,288.4 n/a $ $ 54.9 - $ 8,315.9 1Due to the short-term and floating rate nature of wholesale loans, the fair value consideration received approximates cost. Key economic assumptions used in measuring the estimated fair value of retained interests in retail finance receivables sales1 as of the dates of such sales, were as follows: December 31, 2004 2003 Annual prepayment rate2 Weighted-average life (in years) Expected credit losses3 Discount rate Servicing liability Variable returns to securitization investors 0.93% - 0.97% 1.61 – 1.77 0.40% 9.50% 1.00% 30 day Canadian BA rate 0.89% 1.58 – 1.64 0.75% 9.50% 1.00% 30 day Canadian BA rate 1The fair value of retained interests in wholesale securitizations is assumed to approximate the carrying value due to the short-term nature of wholesale loans. 2Based on the weighted average maturity (WAM) for finance receivables. 3A reserve totaling $12.3 million and $21.4 million at December 31, 2004 and 2003, respectively, has been established for expected credit losses on sold retail finance receivables entered into after the adoption of AcG-12 “Transfers of Receivables” on April 1, 2001. 12 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The table below outlines the sensitivity of the current fair value of retained interests in securitizations of retail finance receivables1 completed subsequent to March 31, 2001 resulting from 10% and 20% adverse changes in the key economic assumptions used to measure the fair value. December 31, 2004 (in thousands) Fair value of retained interests $ 314,818.6 Annual prepayment rate Impact of 10% adverse change2 Impact of 20% adverse change2 0.54% – 1.20% $ (847.9) $ (1,767.6) Discount rate Impact of 10% adverse change Impact of 20% adverse change $ $ 9.50% (3,052.9) (6,020.5) Expected credit losses Impact of 10% adverse change Impact of 20% adverse change $ $ 0.40% (1,812.8) (3,625.9) Variable returns to securitization investors (annual rate) Impact of 10% adverse change Impact of 20% adverse change 2.83% - 3.50% $ (4,277.9) $ (8,553.2) 1The fair value of retained interests in wholesale securitizations is assumed to approximate carrying value due to the short-term nature of wholesale loans. 2An adverse change in the fair value of retained interests may result from either an increase or decrease in prepayment speeds, depending upon the characteristics of each securitization and the related residual cash flows. Due to the composition of the Company’s sold retail finance receivables, this amount represents the net adverse impact of a decrease in prepayment speeds. These sensitivities are hypothetical and should be used with caution. As the figures indicate, changes in fair value based on adverse variations in assumptions generally cannot be extrapolated because the relationship of the change in assumption to the change in fair value may not be linear. Also, in this table, the effect of a variation in a particular assumption on the fair value of the retained interest is calculated without changing any other assumption. In reality, changes in one factor may result in changes in another, which may magnify or counteract the sensitivities. Expected static pool net credit losses include actual incurred losses plus projected net credit losses divided by the original balance of the outstandings comprising the securitization pool. The table below displays the expected static pool net credit losses for 2004 and 2003 based on securitizations occurring in that year. Static pool losses are not applicable to wholesale loan securitizations due to their short-term nature. Expected static pool net credit losses as of: December 31, 2004 December 31, 2003 Retail finance receivables securitized in 2004 2003 0.33% n/a 0.33% 0.32% 13 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The following table presents components of securitized financial assets and other assets managed, along with quantitative information about delinquencies and net credit losses: Retail automotive Wholesale Leasing and lease financing Term loans to dealers and other Total managed portfolio1 Securitized finance receivables and loans Total finance receivables and loans Total finance receivables and loans 2004 2003 (in millions) Amount 60 days or more past due 2004 2003 (in millions) Net credit losses 2004 2003 (in millions) $ 7,517.5 4,018.2 361.1 381.2 12,278.0 5,856.0 $ 6,422.0 $ 6.2 1.0 $ 7.2 $ 20.4 $ 20.4 $8,427.6 4,171.4 496.8 357.0 13,452.8 5,271.1 $8,181.7 $ 6.2 1.8 $ 8.0 $ 18.9 (0.1) $ 18.8 1Managed portfolio represents finance receivables and loans on the balance sheet or that have been securitized. Note 5. Investment in Operating Leases, Net Investment in operating leases was as follows: December 31, 2004 2003 (in thousands) Vehicles, at cost Accumulated depreciation Investment in operating leases, net $ 9,323,052 (2,243,747) $ 7,079,305 $ 7,267,732 (1,521,317) $ 5,746,415 The future lease payments due from customers for vehicles on operating leases at December 31, 2004 totaled $3,660.9 million and are due as follows: $1,710.1 million in 2005; $1,179.8 million in 2006; $609.6 million in 2007; $161.0 million in 2008; and $0.4 million in 2009. Note 6. Investments In 1999, the Company acquired 100% of the outstanding shares of GMAC Commercial Finance (Holdings) Limited (“Commercial Finance”), formerly GMAC Commercial Credit (Holdings) Limited, and 60% of the outstanding shares of Interleasing (UK) Limited (“Interleasing”) from GMAC for fair market value consideration equal to $797.5 million and $252.2 million, respectively. In conjunction with these acquisitions, the Company entered into an agreement with GMAC and the acquired entities under which GMAC unilaterally nominates the board of directors of those entities and therefore ultimately determines their strategic investing, financing and operating policies. Accordingly, the Company has not consolidated these investments and has recorded these investments on a cost basis. In addition, the Company has an agreement with GMAC whereby GMAC unconditionally guarantees the Company’s investment in Commercial Finance and Interleasing. Income associated with these investments will be recorded when received. In January 2002, GMAC injected $34.7 million into the Company which was recorded as an increase to contributed surplus. These funds were invested in Interleasing to maintain the Company’s 60% ownership interest. On October 13, 2004, the Company sold its shares in Interleasing to General Motors Acceptance Corporation, Continental (“Continental”), an affiliated company. Proceeds on the sale were $286.9 million. No gain or loss was realized on the sale. Consideration was received through the issuance of an interest bearing promissory note by Continental. The Company received full payment on the promissory note prior to December 31, 2004. 14 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The recorded investment in Commercial Finance at December 31, 2004 was $797.5 million. Commercial Finance had consolidated total assets of approximately $1.9 billion at December 31, 2004 and $2.1 billion at December 31, 2003, the majority of which represented loans receivable relating to the group’s asset-based lending activities and goodwill arising on acquisition of subsidiaries. Consolidated total liabilities as at December 31, 2004 and December 31, 2003 are approximately $1.2 billion and $1.5 billion, respectively, substantially all of which relates to financing provided by other GMAC affiliated companies. Note 7. Other Assets Other assets consisted of: December 31, 2004 2003 (in thousands) Property and equipment, at cost Accumulated depreciation Net property and equipment Restricted cash collections for securitization trusts Cash reserves held for securitization trusts Servicer advances Accrued interest and operating lease receivables Investment in used vehicles held for sale Non-performing assets, net Unamortized debt issuance costs Derivative assets Deferred insurance and warranty premiums on lease contracts Prepaid pension asset Other assets Total other assets $ 7,981 (2,299) 5,682 80,247 179,605 7,718 27,539 45,373 8,999 22,843 237,765 119,575 23,737 267 $ 759,350 $ 8,096 (2,507) 5,589 25,780 82,494 5,491 23,527 32,366 9,187 21,420 196,600 101,394 17,545 340 $ 521,733 Note 8. Lines of Credit with Banks Established committed revolving lines of credit with banks totaled $1.25 billion at December 31, 2004 and 2003, of which $625 million will expire on June 13, 2005 and $625 million will expire on June 16, 2008. 15 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Note 9. Debt Payable Within One Year Weighted Average Interest Rate December 31, 2004 December 31, 2004 2003 (in thousands) Short-term notes Domestic Foreign 1 Total principal amount Unamortized discount Total 2.706% 2.803% Bank loans and overdrafts 4.250% $ Other notes and debentures payable within one year Domestic 5.449% Foreign 2 2.896% Total Total unsecured financing Total secured financing Total debt payable within one year 1 2 $ 2,272,692 50,550 2,323,242 (7,239) 2,316,003 $ 2,131,775 58,011 2,189,786 (6,482) 2,183,304 5,483 4,187 3,466,034 1,131,609 4,597,643 6,919,129 2,939,338 317,752 3,257,090 5,444,581 247,109 - 7,166,238 $ 5,444,581 Denominated in U.S. dollars Denominated in US Dollar, Japanese Yen, New Zealand Dollar, Polish Zloty, Czech Koruna, Euro, Danish Krone, British Pound Sterling and Norwegian Krone. The Company has entered into foreign currency swap agreements to fully hedge its exposures related to notes and debentures payable in foreign currencies. All of the above debt, with the exception of secured financing, is guaranteed by GMAC. Effective July 1, 2000, all new guaranteed debt entered into by the Company became subject to a guarantee fee. In respect of its guarantee of short-term notes, GMAC was paid $4.2 million in 2004 and $5.0 million in 2003. This fee is excluded from the weighted average interest rates above. 16 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Note 10. Debt Payable After One Year Maturity Date Contract Rate December 31, Currency Denomination (in millions) 2004 2003 (in thousands) January, 2005 7.000% USD 200 February, 2005 (1) ¥ 6,000 February, 2005 8.250% NZD 100 February, 2005 (2) USD 30 March, 2005 7.000% CAD 100 March, 2005 7.750% USD 250 April, 2005 (3) € 26 April, 2005 7.000% CZK 1,000 April, 2005 12.250% PLN 100 July, 2005 5.250% DKK 400 October, 2005 7.500% NZD 100 November, 2005 6.125% DKK 400 December, 2005 6.625% CAD 100 February, 2006 6.125% DKK 600 March, 2006 6.250% CAD 100 May, 2006 6.250% CAD 100 September, 2006 6.125% CAD 100 November, 2007 6.125% DKK 400 February, 2008 6.000% DKK 500 May, 2008 7.000% CAD 10 June, 2008 4.500% € 50 June, 2008 4.500% € 25 September, 2008 (4) € 400 September, 2008 7.750% NZD 100 December, 2008 5.750% CAD 100 June, 2009 (5) € 50 June, 2009 (6) € 15 December, 2010 6.625% GBP 200 September, 2011 7.125% AUD 200 Notes with original maturities up to ten years with a weighted average interest rate at December 31, 2004 of 5.78% Total unsecured financing $ Total secured financing Total debt payable after one year $ (1) Interest at a rate of 0.10% above the 3 month JPY LIBOR rate (2) Interest at a rate of 0.21% above the 3 month US LIBOR rate (3) Interest at a rate of 0.20% above the 3 month EURIBOR rate (4) Interest at a rate of 1.75% above the 3 month EURIBOR rate (5) Interest at a rate of 1.5% above the 6 month EURIBOR rate (6) Interest at a rate of 1.5% above the 6 month EURIBOR rate 17 131,984 100,000 100,000 100,000 87,989 109,987 10,000 81,811 40,906 654,490 86,513 100,000 81,811 24,543 463,655 187,484 $ 258,220 72,369 84,632 38,733 100,000 322,775 41,656 50,286 34,473 87,550 84,632 87,550 100,000 131,324 100,000 100,000 100,000 87,550 109,437 10,000 81,472 40,736 651,774 84,630 100,000 462,561 - 7,031,423 9,392,596 7,847,670 11,270,030 386,124 - 9,778,720 $ 11,270,030 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The Company has entered into foreign currency swap agreements to fully hedge its exposures related to notes and debentures payable in foreign currencies. All of the above debt, with the exception of secured financing, is guaranteed by GMAC. Effective July 1, 2000, all new guaranteed debt entered into by the Company became subject to a guarantee fee. In respect of its guarantee of debt due after one year, GMAC was paid $40.8 million in 2004 and $33.4 million in 2003. The following table presents the maturity of long-term debt at December 31, 2004. The maturity of the debt is based on contractual terms, assuming that no repurchases will occur. 2006 2007 2008 2009 2010 2011 and thereafter Long-term debt Unamortized discount Total long-term debt (in thousands) $ 3,358,583 2,287,434 2,340,245 1,147,337 479,055 187,510 9,800,164 (21,444) $ 9,778,720 Note 11. Secured Financing On June 17, 2004, Leaseco entered into a Master Concurrent Lease Agreement ("MCLA") with Canadian Auto Retail Lease Trust No. 1 (the “CARLT 1"). The Company acts as Administrative Agent for the CARLT 1 pursuant to the Administration Agreement. In accordance with the MCLA, CARLT 1 will be entitled to receive the lease payments from the underlying lessees and CARLT 1 will also have an option to acquire the underlying vehicles upon termination of the underlying lease or the occurrence of other certain limited events. This transaction was accounted for as a secured financing. As at December 31, 2004, the net book value of operating leases was $759.9 million and the outstanding financing was $633.2 million. The Company maintains cash collateral accounts for certain lease securitizations at predetermined amounts in the unlikely event that deficiencies occur in cash flows owed to investors. The amounts available in such cash collateral accounts are recorded in other assets and totaled $83.1 million as of December 31, 2004. Note 12. Accrued Expenses and Other Liabilities Accrued expenses and other liabilities was as follows: December 31, 2004 2003 (in thousands) Dealer credit account plan Customer security deposits Employee compensation and benefits Derivative liabilities Securitization trustee payable Deferred income Accounts payable and other liabilities Total accrued expenses and other liabilities $ 239,043 45,100 46,993 156,363 164,267 132,454 199,543 $ 983,763 18 $ 223,753 35,794 44,135 81,914 167,324 53,607 223,425 $ 829,952 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Note 13. Interest and Discount Interest and discount expense includes $714.8 million in 2004 and $699.6 million in 2003, applicable to indebtedness initially incurred for terms of more than one year. Note 14. Other Income Details of other income were as follows: Year Ended December 31, 2004 2003 (in thousands) Excess interest and other ongoing revenue from securitizations Gains on securitizations Service fee revenue from GMCL Interest income on cash and cash equivalents Gain on non-hedging securitization derivatives, net Other Total other income $ 79,799 88,567 36,207 41,041 2,315 11,061 $ 258,990 $ 86,672 88,387 49,159 35,502 8,147 $ 267,867 Note 15. Transactions with Affiliates The Company enters into transactions with related parties, in the normal course of business, on the same basis as non-related parties. Balance Sheet A summary of the effect of transactions with affiliated companies on GMACCL’s balance sheet was as follows: December 31, 2004 2003 (in thousands) Dealer receivables due from GMCL 1 $ 136,839 $ 127,018 Notes receivable from affiliates GMCL 2 $ 1,775,789 $ 1,557,923 GMAC Commercial Finance Corporation – Canada 3 251,612 348,437 GMAC Commercial Mortgage of Canada, Limited 3 205,140 103,023 319,533 109,145 GMAC Residential Funding of Canada, Limited 3 $ 2,552,074 $ 2,118,528 Accounts receivable from affiliates GMCL $ 39,188 $ 62,393 GMAC (13,800) (11,412) $ 25,388 $ 50,981 Repatriation of contributed surplus $ 1 129,692 - GMACCL provides wholesale financing and term loans to dealerships whereby GMCL has an ownership interest. These amounts are included in finance receivables and loans. 2 The Company sold to GMCL, $498.6 million in 2004, and $398.6 million in 2003, of vehicles subject to operating leases. The Company continues to service these leases. Under a loan agreement, the Company also makes secured loans to GMCL to fund their vehicle leasing program and GMCL may prepay all or any portion of these loans, at any time. The rate of interest is based on a spread over the bankers’ acceptance rate or government treasury note related to the term of the loan. 3 The Company has agreements to provide funding to related Canadian corporations wholly owned by GMAC. The revolving lines of credit and advances may be prepaid in total, or any portion thereof, at any time. Interest payable on advances is determined based on a spread over the average monthly commercial paper portfolio rate. 19 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Income Statement A summary of the effect of transactions with affiliated companies on GMACCL’s income statement was as follows: Year Ended December 31, 2004 2003 (in thousands) Net financing revenue Interest on notes receivable from affiliates Guarantee fee paid to GMAC Interest on wholesale settlements 1 Consumer lease payments 2 GMCL lease residual value support Wholesale subvention from GMCL Other income Service fee revenue from GMCL 3 Off-lease vehicle administration fees charged to GMCL 4 Expenses Payments to GMAC for technical and administrative services Payments to GMCL for administrative services Insurance premiums paid to Motors Insurance Corporation $ 95,625 45,002 11,680 9,702 (2,313) 813 $ 121,727 38,441 13,107 6,669 18,270 1,849 36,207 2,906 49,159 1,992 21,433 1,342 2 19,855 1,293 98 1 The settlement terms related to the wholesale financing of certain GM products are at shipment date. To the extent that wholesale settlements with GMCL are made prior to the expiration of transit, interest is received from GMCL. 2 GMCL sponsors lease pull-ahead programs whereby consumers are encouraged to terminate lease contracts early in conjunction with the acquisition of a new General Motors (“GM”) vehicle. Under these programs, GMCL waives the customer’s remaining payment obligation and reimburses GMACCL for the waived payments. 3 GMACCL administers operating lease receivables on behalf of GMCL and receives a servicing fee. 4 GMACCL charges an administration fee for the sale of off-lease vehicles owned by GMCL at auction. Note 16. Income Taxes The significant temporary differences giving rise to the Company’s future net income tax liability for 2004 and 2003 of $777.3 million and $696.7 million, respectively, are as follows: December 31, 2004 Assets Liabilities (in thousands) Lease transactions Loss carryforwards and minimum tax credits Provision for financing losses Pension and other post retirement benefits Securitizations Other Derivative mark to market Total future income taxes December 31, 2003 Assets Liabilities (in thousands) $ 806,797 $ 26,248 21,103 7,461 $ 747,312 $ 25,205 36,056 7,333 28,724 4,385 $ 59,197 20 24,338 6,377 1,003 $ 836,524 $ 74,971 $ 771,650 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The significant components of income tax expense are as follows: Year Ended December 31, 2004 2003 (in thousands) Current income tax expense (recovery) Future income tax expense (recovery) relating to temporary differences Future income tax expense (recovery) relating to reduction in tax rate Total income tax expense $ (1,486) 82,159 (4,500) $ 76,173 $ 29,861 57,247 (26,000) $ 61,108 A reconciliation of the statutory income tax rate to the effective tax rate for the years 2004 and 2003 follows: December 31, 2004 % Combined federal and provincial statutory income tax rate Large corporations tax Change in tax rate for future income taxes Other items Effective tax rate 35.0 6.5 (2.1) (4.5) 34.9 2003 % 37.2 8.2 (13.4) (0.6) 31.4 At December 31, 2004, the Company has provincial minimum tax credits of $26.2 million for income tax purposes that expire as follows: $0.8 million in 2006; $4.9 million in 2007; $4.2 million in 2008; $4.1 million in 2009; $2.9 million in 2010; $3.8 million in 2012; $3.6 million in 2013; and $1.9 million in 2014. For financial reporting purposes, a future tax asset of $26.2 million has been recognized in respect of these minimum tax credits. Realization of the minimum tax credits is dependent on future taxable income. Although realization is not assured, management believes that it is more likely than not that they will be realized. Note 17. Fair Value of Financial Instruments The estimated fair value of financial instruments was as follows: Financial assets Subordinated interests in securitization trusts Finance receivables and loans, net Notes receivable from affiliates Financial liabilities Debt December 31, 2004 Book Estimated Value Fair Value (in thousands) $ 444,452 $ 512,878 6,385,266 6,397,876 2,552,074 2,534,395 $ 16,944,958 $ 17,058,724 21 December 31, 2003 Book Estimated Value Fair Value (in thousands) $ 406,908 8,105,023 2,118,528 $ 16,714,611 $ 461,511 8,121,463 2,076,886 $ 16,886,713 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The Company has developed the fair value estimates using available market information or other appropriate valuation methodologies. Considerable judgment is required in interpreting market data to develop estimates of fair value, so the estimates are not necessarily indicative of the amounts that could be realized or would be paid in a current market exchange. The effect of using different market assumptions and/or estimation methodologies may be material to the estimated fair value amounts. Fair value information presented herein is based on information available at December 31, 2004 and 2003. Although management is not aware of any factors that would significantly affect the estimated fair value amounts, such amounts have not been updated since those dates and, therefore, the current estimates of fair value at dates subsequent to December 31, 2004 and 2003 may differ significantly from these amounts. The following describes the methodologies and assumptions used, by financial instrument in the above table, to determine fair value: Subordinated interests in securitization trusts The fair value was estimated by discounting the underlying expected cash flows using current market rates. Finance receivables and loans, net The fair value was estimated by discounting the expected future cash flows using applicable spreads to approximate current rates applicable to each category of finance receivables and loans. The carrying value of wholesale receivables and other receivables where interest rates adjust on a short term basis with applicable market indices (generally the prime rate) are assumed to approximate fair value. Notes receivable from affiliates The fair value was estimated by discounting the expected future cash flows using applicable spreads to approximate current rates. Debt The fair value of debt was determined by using quoted market prices for the same or similar issues, if available, or based on the current rates offered to the Company for debt with similar remaining maturities. Commercial paper and demand notes have an original term of less than 365 days and, therefore, the carrying amount of these liabilities is considered to approximate fair value. Fair value of derivative instruments are excluded from these amounts. Interest rate swaps The fair value of the existing interest rate swaps was estimated by discounting expected cash flows using quoted market interest rates. The notional balances of interest rate swap instruments of $8,293.9 million and $9,597.9 million at December 31, 2004 and 2003, respectively. The unrealized gain was $156.5 million in 2004 and $265.8 million in 2003. Foreign currency swaps The fair value of the existing foreign currency swaps was estimated by discounting expected cash flows using quoted market exchange rates. The notional balances of foreign currency swap instruments of $3,067.0 million and $3,256.8 million at December 31, 2004 and 2003, respectively. The unrealized loss was $17.0 million in 2004 and $10.9 million in 2003. Derivatives that were dedesignated from pre-existing hedging relationships on January 1, 2004, when AcG-13 was first adopted, were recorded at fair value on the balance sheet. The cumulative unrealized gain of $17.8 million up to that date was deferred and recorded in Other Liabilities and will be amortized into interest expense and other income over the remaining term of the original hedging relationship. For the twelve months ended December 31, 2004, $11.2 million of the cumulative unrealized gain has been amortized into income with $3.1 million credited against interest expense and $8.1 million recorded in other income. Credit risk These aforementioned swap instruments contain an element of credit risk in the event that the counterparties are unable to meet the terms of the agreements. However, the Company minimizes the risk exposure by limiting counterparties to those major banks and financial institutions which meet established guidelines. In the unlikely event that a counterparty fails to meet the terms of an interest rate or foreign currency swap agreement, risk is limited to the fair value of the instrument. 22 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Concentration of credit risk The Company’s business is to provide financing for GM products and GM dealers. Wholesale and dealer loan financing relates to GM dealers, with security provided by GM vehicles (for wholesale) and GM dealership property (for loans). For wholesale financing, the Company is also provided further protection by GMCL factory repurchase programs. Retail contracts and operating lease assets relate to the secured sale and registered lease, respectively, of GM vehicles. The majority of retail contracts and operating lease assets are geographically diversified throughout Canada. Note 18. Guarantees, Commitments and Contingencies Guarantees The Company has standard indemnification clauses in certain of its funding arrangements that would require the Company to pay counterparties for increased costs due to certain changes in laws or regulations. Since any changes would be dictated by legislative and regulatory actions, which by their nature are unpredictable, the Company is not able to estimate a maximum exposure under these arrangements. In connection with certain asset sales and securitization transactions, the Company typically delivers standard representations and warranties to the purchaser regarding the characteristics of the underlying transferred assets. These representations and warranties conform to specific guidelines, which are customary in securitization transactions. These clauses are intended to ensure that the terms and conditions of the sales contracts are met upon transfer of the asset. Prior to any sale or securitization transaction, the Company performs due diligence with respect to the assets to be included in the sale to ensure that they meet the purchaser’s requirements, as expressed in the representations and warranties. Due to these procedures, the Company believes that the potential for loss under these arrangements is remote. Accordingly, no liability is reflected in the Consolidated Balance Sheet related to these potential obligations. The maximum potential amount of future payments the Company could be required to make would be equal to the current balances of all assets subject to such securitization or sale activities. The Company does not monitor the total value of assets historically transferred to securitization vehicles or through other asset sales. Therefore, the Company is unable to develop an estimate of the maximum payout under these representations and warranties. Commitments Future minimum rental payments required under operating leases, primarily for real property, with noncancelable lease terms that expire after December 31, 2004, were as follows: 2005 2006 2007 2008 2009 Total minimum payment required (in thousands) $ 4,597 3,011 1,682 1,409 310 $ 11,009 Contingencies The Company is subject to potential liability under laws and government regulations and various claims and legal actions that are pending or may be asserted against it. The aggregate ultimate liability of the Company under these laws, government regulations, claims and actions was not determinable at December 31, 2004. After consultation with counsel, it is the opinion of management that such liability is not expected to have a material adverse effect on the Company’s consolidated financial condition, results of operations or cash flows. Note 19. Employee Benefit Plans Pension The Company participates with certain affiliated companies in Canada in a defined benefit pension plan that covers substantially all of its employees. Benefits under the plan are generally related to an employee’s length of service, salaries and, where applicable, contributions. An actuarial valuation is performed each year to determine the present value of the accrued pension benefits based on projections of employees’ compensation levels to time of retirement. 23 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited The measurement dates for the 2004 and 2003 year-end valuations were November 30, 2004 and November 30, 2003, respectively. Funding decisions in respect of plan assets occur annually based on the previous year valuations. As of the above valuation dates, the percentage of the fair value of total plan assets represented by each major category of plan assets were as follows: Asset Category (%) Equity Securities Debt Securities Real Estate Total 2004 61 33 6 100 2003 61 32 7 100 Other post-retirement benefits The Company participates in various post-retirement medical, dental, vision and life insurance plans. The Company accrues post-retirement benefit costs over the active service period of employees to the date of full eligibility for such benefits. 24 Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Pension Plan December 31, 2004 2003 (in thousands) $ 115,449 $ 109,968 2,506 2,406 7,520 7,424 118 111 13,891 3,376 (7,661) (7,836) 131,823 115,449 Change in benefit obligations Benefit obligation at beginning of year Service cost Interest cost Plan participants’ contributions Actuarial loss Benefits paid Plan amendments and other Benefit obligation at end of year Change in plan assets Fair value of plan assets at beginning of year Actual return on plan assets Employer's contributions Plan participants’ contributions Benefits paid Fair value of plan assets at end of year Funded status Unrecognized actuarial loss Past service cost Net amount recognized 87,147 9,834 10,542 118 (7,476) 100,165 81,793 8,462 4,429 111 (7,648) 87,147 (31,658) 48,641 6,754 $ 23,737 (28,302) 38,039 7,808 $ 17,545 Other Post-retirement Benefits December 31, 2004 2003 (in thousands) $ 60,324 $ 49,972 1,883 1,565 3,739 3,518 1,480 873 (927) (1,002) (3,025) 5,398 63,474 60,324 (63,474) 20,930 127 $ (42,417) December 31, 2004 2003 (in thousands) Components of expense Service cost Interest cost Expected return on plan assets Amortization of past service cost Recognized net actuarial loss Amortization of transitional obligation Other Net expense $ $ Weighted-average assumptions Discount rate Expected rate of return on plan assets Rate of compensation increase 2,506 7,520 (8,274) 1,114 1,729 (245) 4,350 6.00% 8.75% 4.00% 25 $ $ 2,406 7,424 (7,592) 1,264 1,566 10 5,078 6.75% 8.75% 4.00% (60,324) 20,027 1,089 $ (39,208) December 31, 2004 2003 (in thousands) $ $ 1,883 3,739 127 1,480 7,229 6.00% 4.00% $ $ 1,565 3,518 98 873 6,054 6.75% 4.00% Notes to Consolidated Financial Statements General Motors Acceptance Corporation of Canada, Limited Note 20. Subsequent Event Securitization On January 17, 2005, the Company sold a pool of retail finance receivables to Canadian Capital Auto Receivables Asset Trust. The contractual principal balance totaled $477.7 million and the proceeds received was approximately $413.4 million. Secured Financing On January 19, 2005, Leaseco entered into a Master Concurrent Lease Agreement (“MCLA”) with Canadian Auto Retail Lease Trust No. 2. The original net book value of the lease assets, which were subject to the MCLA, was approximately $766.4 million and the financing received was approximately $744.1 million. Credit Ratings Substantially all of GMAC and the Company’s debt has been rated by nationally recognized statistical rating organizations. As of March 16, 2005, all of GMAC’s and the Company’s ratings were within the investment grade category. Concerns over the competitive and financial strength of GM, including how it will fund its health care liabilities, resulted in GMAC and the Company experiencing a series of negative rating actions since 2001, with GMAC’s and the Company’s current credit ratings representing the lowest levels in history. In the fourth quarter of 2004, all of the nationally recognized rating agencies downgraded GMAC’s and the Company's credit ratings. On February 14, 2005, one rating agency (Moody’s Investors Service, Inc.) revised the outlook of GMAC and the Company from stable to negative. On March 16, 2005, the rating agencies lowered the credit rating and/or outlook of GMAC and the Company as summarized in the table below. Rating Agency Commercial Paper Outlook Dominion Bond Rating Service Limited R-1 (low) Negative BBB (high) Negative March 16, 2005 Fitch, Inc. F-3 Negative BBB- Negative March 16, 2005 Moody’s Investors Service, Inc. Prime-2 Negative Baa1 Credit Watch (Negative) March 16, 2005 Standard & Poor’s Ratings Services A-3 Negative BBB- Negative March 16, 2005 Senior Debt Outlook Date of Last Action The cost and availability of unsecured financing is influenced by credit ratings, which are intended to be an indicator of the creditworthiness of a particular company, security, or obligation. Lower ratings generally result in higher borrowing costs as well reduced access to capital markets. However, because of management’s focus on diversifying and expanding the Company’s funding sources over the past few years, and based on the Company’s current liquidity position, management believes that the Company has taken appropriate steps to withstand further action by the rating agencies, if that were to occur in the future. The Company’s liquidity, as well as its ongoing profitability, is in large part dependent upon its timely access to capital and the costs associated with raising funds in different segments of the capital markets. Over the past several years, the Company’s funding strategy has focused on managing liquidity risk through the development of diversified funding sources across a varied investor base and management of debt maturities over a longer period of time, thereby, increasing the amount of available cash balances ($2.8 billion at December 31, 2004 as compared to $2.4 billion at December 31, 2003 and $0.8 billion at December 31, 2002). This strategy, combined with a continuous prefunding of requirements, is designed to meet the Company’s ongoing cash flow requirements. In developing the funding strategy, management considers market conditions, prevailing interest rates, liquidity needs, and the desired maturity profile of its liabilities. The diversity of the Company’s funding sources enhances funding flexibility, limits dependence on any one source of funds, and results in a more cost effective long-term strategy. This strategy has helped the Company maintain liquidity during periods of weakness in the capital markets, changes in the Company’s business, or changes in the Company’s credit ratings. ***** 26 GENERAL MOTORS ACCEPTANCE CORPORATION OF CANADA, LIMITED The business of GMACCL is financed by capital funds, intermediate and long-term debt, short, medium, and long-term notes offered on a continuous basis and borrowings under bank lines of credit. The Company offers its commercial paper in Canada directly to investors, in physical note or book-entry form, to mature on any business day selected by the investor, with a maximum maturity of 365 days. GMACCL commercial paper is available payable to a named payee and is issued on a discount or interest-bearing basis at identical yields. GMACCL commercial paper is payable upon maturity at the registered office of the Company (the minimum investment may vary depending on province of residence). GMACCL also sells medium-term notes in Canada through dealer agents and directly to the public on a continuous basis. These notes are offered by prospectus and may be issued in registered form for any maturity of over one year. The minimum investment is $25,000 with interest payable monthly, quarterly, semi-annually or annually to the registered holder. At the option of the investor, notes with maturities from more than one year to less than two years may also be offered with interest payable at maturity. Both the principal and interest payable with respect to medium-term notes are paid at the registered office of the Company. General Motors Acceptance Corporation, a Delaware corporation, unconditionally guarantees both principal and interest on GMACCL’s commercial paper and medium-term notes. The commercial paper and medium-term notes are offered by the Company across Canada. A prospectus for medium-term notes and additional information may be obtained by contacting the Company’s registered office located at: 3300 Bloor Street West Suite 2800 Toronto, Ontario M8X 2X5 Toronto area investors Phone: (416) 234-6616 Quebec investors Phone: (514) 856-8244 Investors outside of Toronto and Quebec Phone: (800) 268-2508 Prevailing rates for GMACCL commercial paper and medium-term notes in Canada may be obtained by calling the following numbers: Toronto area investors Phone: (416) 234-6629 Quebec investors Phone: (514) 856-8872 Investors outside of Toronto and Quebec Phone: (800) 268-2506 GENERAL MOTORS ACCEPTANCE CORPORATION OF CANADA, LIMITED