Components of GDP

advertisement

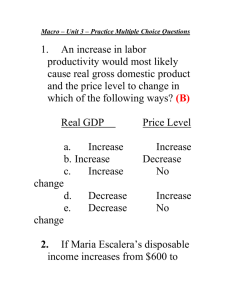

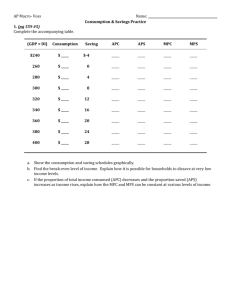

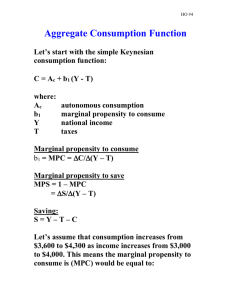

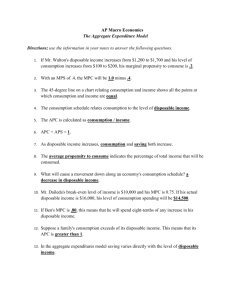

CH 6:Components of GDP Components of GDP The expenditure approach of measuring GDP is one of the widely used and comparatively easier methods to analyze the economic performance of a country. For this approach we will go over the components of GDP in more detail here. As discussed earlier it consists of household sector, business sector, government sector and the foreign sector. GDP is a big number. In 2011 US GDP was estimated to be about 15.1 Trillion dollars. About 2/3rd of the GDP was from the household sector consumption expenditure. Private domestic investment was 11% of the total expenditure while the government expenditure was 19%. Since imports exceeded exports, net foreign sector contribution to the GDP was negative 4%. The composition is presented as As discussed in the earlier chapter there are four components in the GDP as measured by expenditure approach. They are Household, business, government and foreign sectors. We simply add them up to find the total value of the products. Thus GDP = C + I + G + Xn How much is Trillion dollars? It is the number followed by 12 zeroes. So, 15.1 Trillion is written as 15,100,000,000,000. GDP is generally presented in the unit of Billion so US GDP for the year 2011 was $15,100 Billion. Household sector Individual Households spend their income in various items, some on durable goods such as furniture, car, TV and some non-durable goods such as food, clothing, gas etc. The amount of expenditure mostly depends on their income. If they don’t spend, it becomes their saving and if they spend more than their current income, then they borrow either from the past or from the future income. This is exactly true for the nation as a whole. Sometimes we refer GDP as national income. But strictly speaking they are not the same as indicated in the earlier section. CH 6:Components of GDP The consumption expenditure (total households expenditure of a nation) depends on mainly the current level of disposable income (DI). The disposable income is the income level available for consumption expenditure after deducting the tax. Higher is the level of DI higher will be the consumption expenditure. But it is to be noted that, the consumption expenditure, in general increases by a smaller amount than the increase in DI. Further, there are many other factors that affect the consumption level such as credit availability, or the expectation of employment level in the future or the expectation of social security income in the future and so on. For example, if people get credits easily, they may spend now without thinking of the future. Saving basically means the consumption expenditure of the future. The relationship between disposable income Y and the consumption expenditure C can be presented as C = a + bY This equation is called a consumption function. The slope coefficient ‘b’ is the called marginal propensity to consume (MPC) and is positive. The positive value indicates that the consumption expenditure C would increase if the national income level Y increases. (The positive value may also mean that the consumption expenditure C would decrease if the national income level Y decreases.) The value of b in general will be less than 1. This means that as the income level increases by certain amount, increase in expenditure will be less than the increase in income. It also means that if income decreases by certain amount, the expenditure decreases but by less than the decrease in income. The income that is not spent must have been saved. That is, savings S= Y – C The relation shows that as we increase consumption expenditure, savings will be smaller. That is to say that the more we spend, the less we save. A low savings rate means that there will be less money available for capital investment for new plants and equipment. This will lead to a low productivity growth rate for a country. Without enough savings, we cannot raise our productivity. If the productivity does not grow it is almost impossible for an economy to grow fast. Savings includes personal saving, business saving, and a government saving (that is a budget surplus). Other Determinants of consumption function Besides disposable income there are various factors that affect the level of household expenditure. According to Milton Friedman, a Nobel laureate in economics, people gear their consumption to their expected lifetime average earnings more than to their current income. The other major determinants of consumption are Credit Availability People tend to spend more with increased availability of credit to them. Even though they have to pay it later, people do not think a lot while buying items they love if it is available in credit. Stock of assets in the hands of consumers The most liquid asset is the cash. When people have cash on hand, they tend to spend more than if they don’t. Similarly, if people do have lots of wealth, even though not in the form of cash, they still tend to spend more than the people who do not have much wealth. They know that wealth can be converted into cash if needed to. Consumer Expectations Consumer expectation plays a big role in determining their expenditure of the people. If the people start feeling that the economy would be in downturn, they start saving for the bad times but if they feel that their income level would go up soon, they start spending even before they get the increased income. CH 6:Components of GDP Marginal propensity to consume (MPC) Formally, the marginal propensity to consume b is defined as = , , = ∆ ∆ The value of MPC depends on various factors. Typically it varies from 0.8 to 1.0 for many countries. For the US, currently it is estimated somewhere about 0.95. This means that for every dollar increase in income level, the economy spends 95 cents on consumption expenditure. Since the remaining part is the savings we can define marginal propensity to save (MPS) as = , = ∆ ∆ In the equation, the intercept term ‘a’ is called autonomous consumption expenditure. This autonomous consumption expenditure indicates that the economy needs to spend ‘a’ amount even if the income level is zero. For example, people need to spend for food and shelter kind of things even if their current income level drops to zero. This expenditure must have come either from the past saving or from the future savings. Further, since the increased income must either be consumed or saved it must be true that MPC + MPS = 1 Example 6.1 Calculate MPC and MPS from the data given below Disposable income Consumption $15,000 $12,000 17,000 13,600 Answer MPC = (13600 - 12000)/(17000 - 15000) = 0.80 MPS = 1 - MPC = 0.20 Average propensity to consume (APC) We define the average propensity to consume as = = Note that APC does not indicate the idea of change. Further we can define average propensity to save (APS) as = = Also, since the income must either be consumed or saved it must be true that APC + APS = 1 When expenditure is more than income, APC can be greater than 1 but in that case APS must be negative; meaning that, there will be a negative saving (or borrowing). Graphical Presentation of Consumption function To analyze the economy in simpler terms we plot the consumption function in a graph. The graph looks like CH 6:Components of GDP Intercept term of the consumption function shows the autonomous consumption expenditure. People have to survive and have to make some expenditure even if there is no income. The expenditure may have come from the past saved income or from the future saving (which may be borrowed in the present time). The slope term reflects the expenditure habit of people when income changes. When income level of the people increases by, say $100, they may not spend the entire increased money amount. In general, they save some. If they spend $80 for each $100 increased income, the slope term, b = 0.8. The slope term is called the marginal propensity to consume (MPC) and thus MPC is 0.8 in this example. [Also, since MPC + MPS = 1, MPS = 0.2]. Autonomous Consumption versus Induced Consumption When disposable income is “0”, there will still be some consumption. We call that consumption level as the autonomous consumption (AC). It is called autonomous because it is independent of change in disposable income. In the equation, C = a + bY ‘a’ represents the autonomous consumption. Induced consumption (IC) is that part of consumption that varies with the level of disposable income. As disposable income rises, induced consumption rises. As disposable income falls, induced consumption falls. In a more general format, consumption function is presented as CH 6:Components of GDP Along with the consumption function a reference line is also presented. The reference line is a 450 line so that any point in the reference line, national income will be equal to expenditure. This makes it easier to compare whether the national expenditure is higher or lower than the national income along the consumption function line, C. For example, at $200 level of national income consumption line is above reference line, indicating that the consumption is higher than income. That is, at $200 level of national income there is dis-saving; people spend more than their income. At this level of income households would be dis-saving, or borrowing about $180. This is the difference between the reference line and the consumption function, C at National income Y= $200. Similarly at $700 level of national income, consumption line is below the reference line, indicating saving in the economy. At this level of income, households would be saving about $120. This is the difference between the reference line and the consumption function, C at National income Y= $700. When the national income level is at $500, consumption expenditure and national income are equal. At this level, the consumption line intersects the reference line. Business Sector Even though the business occupies only about 11 percent of the total expenditure in GDP, this sector is very important to make the economy grow in the future. Investment is carried out by this sector so as the raise the productivity and hence to enhance faster economic growth. There are three types of business firms: Proprietorships, Partnerships, and Corporations. Proprietorship Proprietorships are owned by individuals. They are almost always small businesses. Grocery stores, barbershops, restaurants, family farms, gas stations, etc are run as simple proprietorship businesses. The main advantage of a proprietorship is that you can be your own boss. There will be a plenty of incentives to run the business as efficiently as possible. The major disadvantages of a proprietorship is that it has unlimited liability. If the business fails, the owner will be responsible to pay back all its debts from his/her private property. Partnership Some law and accounting firms have hundreds of partners but many partnerships are owned by two or more people. It is easier to raise more capital; the work and responsibility can be divided among the partners according to their skills. Even in partnership the major disadvantage is that it has unlimited liability. If the business fails, the owners will be responsible to pay back all its debts from their private property. Partnerships must be dissolved when one partner dies or wants to leave the business. Corporation A corporation is a legal person. Most corporations are small firms. Corporations are owned by the stockholders It is easier to raise money by selling stock. Most corporations are not publicly held. Major advantage of a corporation is that it has limited liability. If the business fails, the stockholders will be responsible to pay back business debts only up to their stake in their business. The business can have a perpetual life. Double taxation may be a major disadvantage of a corporation. CH 6:Components of GDP As shown in the pie chart, in 2008 there were more than two thirds proprietorship firms, and they brought less than 5% of the total receipt. On the other hand, there were less than 20 percent business corporations but they brought more than 80 % of the total receipt in the economy. Top 10 US Companies, 2012 Rank 1 2 3 4 5 6 7 8 9 10 Company Exxon Mobil Wal-Mart Stores Chevron ConocoPhillips General Motors General Electric Berkshire Hathaway Fannie Mae Ford Motor Hewlett-Packard Revenues ($ millions) 452,926 446,950 245,621 237,272 150,276 147,616 143,688 137,451 136,264 127,245 Profits ($ millions) 41,060 15,699 26,895 12,436 9,190 14,151 10,254 -16,855 20,213 7,074 Source: Fortune, July 2012 Top 10 Global Companies, 2012 Rank 1 2 3 4 5 6 7 8 9 10 Company Royal Dutch Shell Exxon Mobil Wal-Mart Stores BP Sinopec Group China National Petroleum State Grid Chevron ConocoPhillips Toyota Motor Revenues ($ millions) 484,489 452,926 446,950 386,463 375,214 352,338 259,142 245,621 237,272 235,364 Profits ($ millions) 30,918 41,060 15,699 25,700 9,453 16,317 5,678 26,895 12,436 3,591 Source: Fortune, July 2012 Investment Investment is the most volatile sector in our economy. Fluctuations in GDP are largely fluctuations in investment. Recessions are touched off by declines in investment. Recoveries are brought about by rising investment. “Investment” is the thing that really makes the economy to grow. Investment is any new plant and equipment, additional inventory, new residential housing. CH 6:Components of GDP Investment in Plant and Equipment Businesses purchase new plant and equipment either to expand their business or to improve their output capabilities. Either way this will help the economy to grow. Investment in plant and equipment is more stable than inventory. Even in bad years companies will still invest a substantial amount in new plant and equipment. This is mainly because old and obsolete factories, office buildings, and machinery must be replaced. This is the depreciation part of investment. Residential Construction Residential construction involves in replacing old housing as well as in adding to it. It fluctuates considerably from year to year. Mortgage interest rates play a dominant role in residential construction. How Does Savings Get Invested? Money saved is put into stocks and bonds. Banks loan money based on their demand deposits and reserve requirements. Businesses take this money and buy new plant, equipment, and add to their inventory. Corporations also use “retained earnings” and “depreciation allowances”. Gross Investment versus Net Investment In the equation GDP = C + I + G + Xn The “I” represents the gross investment. Gross investment includes the depreciation part as well. Depreciation is taking into account for the fact that plant & equipment wear out and houses deteriorate. They have to be replaced. Just replacing will not add the new capital to make the economy grow. So we have to look at the net investment to see whether the economy is ready to grow or not. Gross investment - depreciation = net investment Example: Suppose at the start of the year there are 10 machines. During the year 6 new machines are bought. This is the gross investment. Suppose four of them were simply to replace the old ones. At the end of the year, there will be 12 machines. The actual gain in this process is 2 machines. This is the net investment. Building Capital Investment involves sacrifice (on someone’s part). To invest we must work more and we must consume less (save). Marx “Capital is created by labor but stolen by capitalist” Assume it takes $3 to keep a person alive for 24 hours. Assume that one person can use a machine to produce $3 worth of cloth in 6 hours. The capitalist owns the machine and pays $3 for 12 hours work. Here, 12 hours of work produces $6 worth of cloth and the capitalist pays $3 in wages and creates a surplus of $3 for himself (doing nothing, just using its machine as Marx claims). Is it really the exploitation of the worker by the capitalist? The missing point in the Marx’s argument is that ‘how the capitalist did brought his capital in the first place?’ The capitalist must have worked more and consumed less in order to save more so that he would be able to have the machine long time back. If the capitalist would have to give the value of money that the worker would produce, he would have no incentive to get the machine in the first place. There would be no capital building, and no growth in the economy. CH 6:Components of GDP Determinants of the Level of Investment The Sales Outlook You won’t invest if the sales outlook is bad. If sales are expected to be strong the next few months the business is probably willing to add inventory. If sales outlook is good for the next few years, firms will probably purchase new plant and equipment. Capacity Utilization Rate This is the percent of plant and equipment that is actually being used at any given time. You won’t invest if you have a lot of unused capacity. During recessions, why build more when you are not using all of what you have. The Interest Rate and the Expected Rate of Profit (ERP) You won’t invest if interest rates are too high. In general, the lower the interest rate, the more business firms will borrow. To know how much they will borrow and whether they will borrow, you need to compare the interest rate with the expected rate of profit. Even if they are investing their own money they need to make this comparison. Firms won’t invest unless the expected profit rate is high enough. Firms invest when their sales outlook is good, their capacity utilization rate is high and their expected profit rate is high enough. Technology and innovations Advancement in technology and innovation gives the business incentives to invest more and to get benefit from it. Technology particularly will be helpful in reducing the cost of production. Technological advancement have stimulated an investment spree in smart phones, computer tablets, video conferencing and so on. Other factors Manufacturing is a shrinking part of U.S. economy due to imports and increasing investment overseas by U.S. Companies. Trend in Capital investment In the beginning capital investment will contribute a lot in the increasing growth rate of an economy. However as the capital investment increases, it may be subject to a diminishing return and growth rate may not be as high as in the initial stage of investment. But still capital investment has lot to do with the growth in the economy. Following chart shows the level of capital investment in different countries for the last 50 years. In recent years, China and India have been devoting lot of their resources in capital investment. In 1962, China had only about 10% of GDP directed to capital investment; by 1987 it increased to 37% and by 2011 it reached to 48% of GDP. Similarly, India also has been increasing its share of capital investment in the last 50 years. Capital investment in the US has declined from 19% in 1987 to 15% of GDP in 2011. This may not be a very good sign to continue economic growth in the US. CH 6:Components of GDP Graphing the C+I line When income level increases, consumption will increase but by the lesser amount than the increase in income. This makes the savings increase; there will be more investment money available for the businesses to invest. But, to keep the things simple, we assume the level of investment stays the same at all levels of income. If there were no government, the national income level would have been $650; because the consumption expenditure along with investment expenditure is equal national income when the national income level is at $650. This is sometimes called the equilibrium level of income of the economy with no government and no international trade. At this level, the consumption line intersects the reference line. At this level of income, there would be a saving of about $100 from the household which is equivalent to the investment by the business sector. Notice that without the business sector, the equilibrium level of income was $500 (C was equal to Y at $500 without Investment sector) but now with investment of $100 the economy went to be equilibrium at $650, an increase of $150, not just $100. This is because of the multiplier effect. We will discuss the multiplier effect in the next chapter. Government Sector The Growing Economic Role of Government Most of the growth over the past seven decades was due to the Depression and World War II. Since 1945 the roles of government at the federal, state, and local levels have expanded. The seeds of that expansion were sown during the Roosevelt administration. • The government exerts four basic influences – It spends more than $3.0 trillion – It levies even more in taxes – It redistributes hundreds of billions of dollars – It regulates the economy Government expenditure includes all three levels of the government, Federal, State and the local. How is congress to finance these expenditures? Federal taxing power is authorized by the US constitution. Unlike expenditure bill, all bills for raising revenue shall originate in the House of Representatives. Federal government is not required to finance all its expenditures by taxation. It can borrow money on the credit of the United States. Similarly state government is also empowered by the state constitution for spending and taxing to its people with some limitations, such as with no discriminations to its citizens. How big is the government? One way to measure the size of the government is by the volume of annual expenditure. The government purchases goods and services, transfers income to people, business or other governments; pays interest for its debt. Currently total CH 6:Components of GDP expenditure (including state & local governments) runs little more than $3.0 trillion dollars in the US. Figures on government expenditures are easily available and widely quoted. Typically when expenditures go up people conclude that government has grown and vice versa. Of course, measuring government size by the volume of expenditure is also not without pitfalls. Some hidden costs and accounting methods may not show very true picture of the expenditure as well and may be misleading as a measure of size of the government. But as long as the limitations are understood, conventionally defined government expenditure yields a useful insight and can be used as a rough but useful measure of the size of the government. Major components of the government expenditure Of course there are thousands of headings in which the government spends on but they can be grouped in few major headings such as National defense, Social security and safety net programs, Medicare and Medicaid, internal affairs, transportation and so on. Following diagram presents how these programs have been changing in the last 50 years. Source: NPR Defense spending has been declining as a percentage of total spending but it is still the largest component of government spending. Next to defense, social security covers almost 20 % of the total spending. Medicaid, Medicare and other health services are in the rise. Revenue The government has to get its revenue to spend for different projects. It does so by collecting tax from the people. CH 6:Components of GDP Remember, businesses do not pay taxes. Businesses act only as intermediaries between people and the government. Ultimately, it is the people who pay the tax, and feel the burden of the tax. Consider when a business sells a bottle of wine, you pay, say $10, to the shop and the tax collector who was watching the business all the time takes $ 1 from the business. That is business receives only $ 9. What the business will do next time? If the equilibrium market price is $10, he will raise the price to $11.When the tax collector takes $1, still the business will receive $10 as price of wine. (Actually, if the market were competitive, business will be in loss and some of the business will leave the market, making the supply curve shift to the left, making the price equal to $11). Moral of the story: It is the customer of wine, who pays the tax, not the business. But this is not the end of the story. When the price is raised to $11, will the consumer still buy the same quantity of wine? Then? Then, total production has to be reduced. If production is reduced two things might happen: Producers receive less profit. Producers will lay-off some of its workers. (Or reduce the wage, reduce the bonus and so on.) That is, the workers are also paying some of the tax indirectly. Depending on how the tax is collected, many factors determine who will be sharing the tax burden and by how much. There are two types of taxes Direct taxes The tax is paid by individuals and firms directly. For example, income taxes and value-added taxes (VAT). Indirect taxes The tax is levied on goods and services and will be paid by the people only if they use it. There are three types of tax rate structures Progressive tax In this type of tax, the rate increases with higher income. Income tax in the US is a progressive tax. People with higher income pay higher tax not only in amount but also in the rate. It places a greater burden on those best able to pay and little or no burden on the poor Regressive tax In this type of tax, the rate falls with higher income. It places a heavier burden on the poor than on the rich. Tax on goods and services is a regressive tax. (Suppose that the tax on a bottle of beer is $2. Two people Mr. A with income of $1000 per day, and Mr. B with income of $100 per day, both drink 5 bottles of Beer on a particular day. In that case both will pay $10 as tax. But, the tax amount for Mr. B is 10% of his income, while the tax amount for Mr. A is only 1% of his income. That is richer guy is paying 1% of his income as tax, while the poorer guy is paying 10% of his income as tax. This is what is called a regressive tax) Proportional tax In this type of tax, the rate is constant. If there were a flat income tax, it will be a proportional tax. It places an equal burden on the rich, the middle class, and the poor. The Average Tax Rate and the Marginal Tax Rate Average tax rate is the tax paid on every dollar of the income. If the tax rate changes with the level of income, marginal tax rate is the tax rate paid on the last dollar earned. For a progressive tax system the marginal tax rate changes at different levels of income. CH 6:Components of GDP Example 6.2 If your taxable income was $40,000 and you paid $3,000 in federal income tax, what was your average tax rate? Answer Average Tax = 3000/40000 = 0.0750 = 7.5 % Example 6.3 Suppose marginal tax rate at different level of income is different as given below. Income Level Marginal Tax Rate 0 - $100 0% $101 - $200 10% $201 - $300 12% $301 - $400 15% $401 - $500 28% $501 - $600 50% > $600 80% Then the average tax rate can be calculated as follows. Income Level Marginal Tax Rate 0% Tax for the given income group $0 $0 0.00% $101 - $200 10% $10 $10 5.00% $201 - $300 12% $12 $22 7.30% $301 - $400 15% $15 $37 9.30% $401 - $500 28% $28 $65 13.00% $501 - $600 50% $50 $115 19.20% 0 - $100 > $600 Total Taxes Average Tax Rate 80% Revenue Composition Sources of Federal Revenue Personal Income Tax The personal income tax is the largest source of federal revenue. The Social Security and Medicare taxes These are the Payroll Taxes. The Payroll Tax is the fastest growing source of federal revenue. The Corporate Income Tax The corporate income tax is a tax on a corporation’s profits. Excise Taxes An excise tax is a sales tax aimed at specific goods and services. This accounts for about 4 percent of federal revenue. Most excise taxes are levied by the federal government, but state and local governments often levy taxes on the same items. Excise taxes tend to reduce consumption of certain products of which the federal government takes a dim view. Excise taxes are usually regressive. CH 6:Components of GDP Sources of State and Local Tax Revenue Personal income tax State income tax structure is very similar to federal income tax. Tax rate however is much lower than the federal system (somewhere below 12%). Similarly, deductibles and exemptions are also different for different states. This tax accounts for about half of all state revenue. Sales Tax This tax is a source of almost half of all taxes collected by the states. It is also a highly regressive tax. Property taxes This is the main source of local government. This provides almost 80 percent of all local tax revenue. The changes in the federal government revenue composition in the last 50 years are presented in the following charts Largest portion of the US federal revenue is the direct individual income tax. It consists of about 47% of the total CH 6:Components of GDP revenue. This proportion has not changed much. The proportion of corporate income tax and excise tax both have shrunk, but the social insurance and retirement receipts has increased in the last 50 years. Expenditure on education, health, welfare, police protection and prisons are the major ones for the State and Local Government. The largest government purchase is defense. These end up in the “G” part of GDP. Note that, social security payment is a federal responsibility but it is a transfer payment and ends up in the “C” part GDP. Graphing the C+I + G line Government expenditure depends on how the congress allows the government to spend. The government expenditure may or may not depend on the level of disposable income. To make the analysis simple, we assume that the government expenditure remains constant regardless of the level of disposable income. With closed economy where there were no export or import, the national income level would have been $900; because total of the consumption expenditure from the household (C), Investment expenditure from the business (I) and the government expenditure (G) together is equal to national income when the national income level is at $900. At this level, the consumption line intersects the reference line. At this level of income households would be saving about $240. (The difference between the reference line and the consumption function, C at National income Y= $900) Economic Role of Government Provision of Public Goods and Services One of the major roles of the government is to provide public goods and services to the people. • Some examples – Defense of the country – Maintenance of internal order – A nationwide highway network – Provision of a money supply – Public education – Running the criminal justice system – Environmental protection Redistribution of Income The government does redistribute hundreds of billions of dollars every year – Social security redistributes money from those currently working to those who have retired – Welfare for the poor • Examples are food stamps, Medicaid, disability payments, and unemployment benefits – Welfare for the rich • Examples are subsidies to corporate farmers and tax breaks for defense contractors, oil companies, and other large corporations CH 6:Components of GDP Stabilization • Two basic goals of the federal government – Stable prices with little or no inflation – Low unemployment • An economic rate of growth high enough to keep the unemployment rate to a minimum Economic Regulation • The government provides the economic rules of the game – This must be done within the social and political context in which the economy operates • The government must allow individuals and business firms to operate with the maximum degree of freedom • There is little agreement as to how far economic freedom may be extended without interfering with society as a whole or the economic rights of specific individuals or business firms Foreign Sector The basis for international trade is that a nation can import a particular good or service at a lower cost than if it were produced domestically. In other words, if you can buy it cheaper than you can make it you buy it. This maxim is true for individuals and nations. This is called specialization and exchange Examples of Specialization and Exchange We have been a major exporter of wheat, corn, and soybeans since colonial times. Initially, we had an abundance of land. Eventually we came to have a tremendous stock of farm equipment. We used to be a major exporter of steel and textiles. Now other nations produce these more cheaply. After WWII, we produced more than sixty percent of the world’s oil supply and exported much of this. Now, we have exhausted most of our easily extractible reserves and import more than half of our oil. If we didn’t import oil, gasoline could easily be $10 a gallon. Graphing the C+I + G+ Xn line For the last 50 years US import has been increasing steadily more than the increase in export. That is the net export is negative. We are the net importer. Notice that the line consisting of C+I+G+Xn is drawn below the line consisting C+I+G. This simply indicates that the value of Xn is negative. In an open economy with export or import, the national income level would have been about $840; because total of the consumption expenditure from the household (C), Investment expenditure from the business (I) the government expenditure (G) and the net of export (Xn) together is equal to national income when the national income level is at $840. This is the equilibrium level of the economy. At this level, the consumption line intersects the reference line. At this level of income households would be saving about $200. (The difference between the reference line and the consumption function, C at National income Y= 840) CH 6:Components of GDP Questions for discussion 1. 2. 3. 4. Explain why rich people may have higher marginal propensity save than the poor people? Sometimes we can hear the argument that business investment is not affected by the current sales. Are current sales really ignored in investment decision? What other factors need to be considered to see the change in business investment environment? The marginal propensity to consume (MPC) for a nation is .85. Explain what this means. Explain the difference between autonomous consumption and induced consumption. 5. From the following table find the GDP National income account Personal consumption expenditures (C) Exports (X) Federal government spending (G) State and local government spending (G) Imports (M) Gross private domestic investment (I) Billions of dollars $1,000 120 200 400 20 75 6. Draw a graph of the consumption function C= $150 + 0.8Y a. At what level of income do household begin to save? Designate the point in the graph as ‘A’. b. What happens to consumption if income increases by $200 beyond the “breakeven” level of point ‘A’. Point out how much will be the consumption and how much will be the saving, if any? 7. Suppose the participants of the economy have the following spending plans: C= 10 + 0.8Y I = 20 G= 30 Xn = 10 a. What is the value of equilibrium output? b. How much consumers are saving at equilibrium? 8. The rate a. b. c. 9. Fill in the missing values for marginal propensity to consume (MPC), average propensity to consume (APC), disposable income (Yd) and consumption expenditure (C) in the following table. of return on an investment on new machinery is 10% in an economy where the inflation rate is 4 percent. If the market nominal interest rate is 15% percent, will the investment be carried out? If the nominal interest is 12% percent, will the machinery be purchased? If the nominal interest is 10% will the machinery be purchased? Disposable Income(Yd) 200 400 ........ 1000 Consumption Expenditure(C) ......... ......... 500 900 APC MPC 1.3 ......... 1.0 ........ 0.8 ........ ........ 10. Suppose that the consumption function in a particular economy is given by the following table Disposable Income (Billion $) 400 500 600 700 800 Consumption Expenditure (Billion $) 300 360 410 440 470 If firms want to invest $140 billion, what is the equilibrium value of GDP? CH 6:Components of GDP 11. Use the consumption Schedule data below to answer the following questions Consumption Schedule (Billions of dollars per year) Disposable income Consumption 100 200 300 400 500 150 200 250 300 350 Saving APC APS MPC MPS ---------------- ---------------- ---------------- ------------- ------------- a. Plot the consumption as a function of disposable income. b. Calculate saving schedule, APC, APS, MPC and MPS. c. Determine the break-even income. d. What is the relation between MPC and the MPS? APC and APS? 12. Explain how each of the following affects the consumption schedule: a. The expectation is that a prolonged recession will occur in the next year. b. Stock prices rise sharply. c. The price level rises by 10%. d. The interest rate on consumer loans rises sharply. e. Income taxes increase. Multiple Choice Questions 1. Consider a consumption function. If disposable income is greater than the break-even level of disposable income, then households will be: a. investing. b. borrowing. c. dissaving. d. saving. 2. Economists refer to the simple relationship between consumption and disposable income as: a. autonomous consumption. b. the marginal propensity to consume. c. the absolute disposable income hypothesis. d. disposable income. e. the consumption function. 3. That part of disposable income not spent on consumption is defined as: a. transitory disposable income. b. permanent disposable income. c. disposable income. d. autonomous consumption. e. saving. 4. If disposable income is $400 billion, consumption spending is $380 billion, and MPC is 0.5, what is the level of saving? a. $20 billion. b. $210 billion. c. $380 billion. d. $590 billion. e. $780 billion. 5. If income increases from $110,000 to $120,000 and consumption from $108,000 to $114,000, the marginal propensity to consume is: a. 0.40. CH 6:Components of GDP b. 0.60. c. 0.94. d. 1.60. 6. Use the table below to answer the following question. Income (Dollars) 60,000 66,000 Consumption (Dollars) 58,000 62,000 What is the marginal propensity to consume? a. 0.33. b. 0.67. c. 0.96. d. 1.5. 7. Mathematically, the marginal propensity to consume is: a. consumption divided by income. b. the change in consumption divided by the change in income. c. income divided by consumption. d. the change in income divided by the change in consumption. 8. The fraction of each added dollar of disposable income that is used for consumption is called the: a. average propensity to consumer (APC). b. autonomous consumption rate (ACR). c. marginal consumption propensity (MCP). d. marginal propensity to consume (MPC). 9. The slope of the consumption function is called the: a. autonomous consumption rate. b. marginal consumption rate. c. average propensity to consume. d. marginal propensity to consume. 10. Following table gives Disposable income and consumption data Disposable Income (Y) 0 1,000 2,000 3,000 4,000 5,000 Change in Disposable Income 1,000 1,000 1,000 1,000 1,000 Consumption (C) 500 1,400 2,200 2,900 3,500 4,000 When disposable income (Y) is increased from $1,000 to $2,000, the marginal propensity to consume is: a. 0.2. b. 0.6. c. 0.8. d. 1.0. e. 1.25. 11. The marginal propensity to save (MPS) is computed as the change in: a. savings divided by the change in saving. b. savings divided by the change in disposable personal income. c. saving divided by the change in GDP. d. None of these. 12. The marginal propensity to save is: a. the change in saving induced by a change in consumption. b. (change in S) / (change in Y). c. 1 - MPC / MPC. CH 6:Components of GDP d. (change in Y - bY) / (change in Y). e. 1 - MPC. 13. The relationship between MPC and MPS is: a. 1 + MPC = MPS. b. 1 - MPC = MPS. c. 1 + MPS = MPC. d. MPC - MPS = 1. 14. Consider the Consumption function (Exhibit 1) The marginal propensity to save (MPS) is: a. 0.25. b. 0.50. c. 0.75. d. 0.90. 15. Consider the Aggregate expenditures function (Exhibit 2) Dissaving occurs: a. at $5 trillion. b. between 0 and $4 trillion. c. where disposable income is greater than $4 trillion. d. at $8 trillion. 16. As shown in Exhibit 2, autonomous consumption is: a. 0. b. $1 trillion. c. $2 trillion. d. $3 trillion. e. $6 trillion. 17. As shown in Exhibit 2, this economy is in macro equilibrium at: a. $2 trillion. b. $4 trillion. CH 6:Components of GDP c. $6 trillion. d. $8 trillion. 18. Given the Consumption function (Exhibit 3) In Exhibit 3, the level of autonomous consumption for consumption function C is: a. $100. b. $150. c. $50. d. $0. e. $200. 19. In Exhibit 3, when disposable income is equal to zero, saving is equal to: a. $0. b. $100. c. -$50. d. -$100. e. $50. 20. In Exhibit 3, a. b. c. d. e. the value of the marginal propensity to consume is: 0.75. 0.80. 0.50. 0.25. 0.20. 21. In Exhibit 3, a. b. c. d. e. the value of the marginal propensity to save is: 0.50. 0.25. 0.20. 0.80. 0.75.