Reserved Power Trust

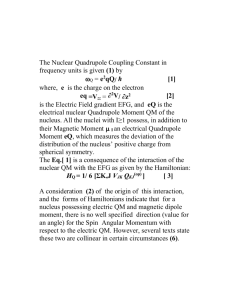

advertisement

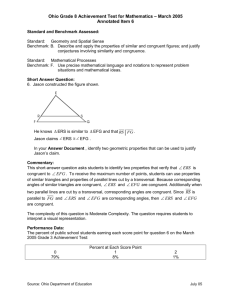

Wealth Solutions fact sheet Reserved Power Trust A trust is a legal arrangement allowing a person (“the settlor”) to transfer assets to a third party (“the trustee”) to be administered for the benefit of those chosen by the settlor (“the beneficiaries”). The trust is administered in accordance with the terms set out in the trust instrument. Reserved Power Trust One of the most common type of trust is a discretionary one, in which the trustees have full control and management of the assets and their eventual distribution. While this type of trust does offer many benefits, at EFG we know how important it is for solutions to be crafted in accordance with client needs. Key features With a Reserved Power Trust, the settlor can retain one or more powers in relation to the trust, or have them held by a third party, without affecting the validity of the structure. Under a number of international trust laws settlors, or a third party nominated by them, (“the power holder”) may generally reserve any or all of the following powers (although it is not recommended that too many powers are retained): Revoke, vary or amend the trust instrument in whole or in part. Appoint either income or capital of the trust property. Retain any limited beneficial interest in the trust property. Act as a director or officer of any company wholly or partly owned by the trust. Give binding directions to the trustee in connection with the purchase, holding or sale of the trust property. Appoint, add or remove any trustee, protector or beneficiary. Change the governing law and the forum for administration of the trust. or Restrict the exercise of any powers or discretions of the trustee by requiring that they shall only be exercisable with the consent of the settlor (or any other specified person). Advantages Reserved Power Trusts are particularly appropriate where the settlor would wish the trustees to invest in non-professionally managed assets, such as execution-only trades or in non-diversified assets, such as single lines of stock. 2 Retaining investment powers can also be advantageous where the settlor or nominated power holder is an experienced investor. A settlor may wish to continue acting as a director of an investment or holding company which is being placed into trust. Generally, the trustees would prefer to take over as directors. However, under directions given by the power holder, the trustee would be in a position to take over ownership of the company in question but not be responsible for the management of the corporate vehicle. Reserving administration powers gives the power holder flexibility in controlling the dispositive provisions of the trust according to changing circumstances including the ability to add or remove beneficiaries. The settlor may also retain the power to remove the trustee and appoint new trustees in the event of a dispute, without having to revert to statutory provisions. Reserved Power Trust Risks Onshore legal and tax rules may limit the nature and extent of the powers that can be reserved by a settlor before they compromise or negate the advantages of a Reserved Power Trust. It may be more appropriate for a family advisor to hold the reserved power. As such it is important to obtain professional onshore tax, legal and risk mitigation advice before the trust is established to ensure it achieves its desired objectives. Let’s start a conversation EFG Wealth Solutions provides fiduciary, corporate, fund administration, custodian and depositary services to high net worth individuals, corporate and institutional clients. It is part of EFG International, a global private banking group active in around 30 locations worldwide. EFG provides a range of solutions encompassing banking, credit, wealth structuring and investments. Start a conversation with us today to find out how you can benefit from a relationship with EFG. Please get in touch with your usual contact at EFG Wealth Solutions or: Julie Collins, Head of Business Development T: + 44 1534 605 690 E: julie.collins@efgwealthsolutions.com www.efginternational.com facebook.com/EFGInternational twitter.com/EFGInt Important Information EFG Wealth Solutions believe that the information in this publication is accurate. However, it is unavoidably general in content and should not be relied upon in making a specific decision. EFG and its affiliates do not provide advice, recommendations or opinions regarding legal and/or tax matters under any circumstances. To the extent that this communication, anything referenced herein, or any items attached hereto may concern tax matters, they are not intended to be used, and cannot be used, for the purpose of avoiding tax liabilities or penalties that may be imposed by law, foreign and domestic. EFG Wealth Solutions strongly recommend that before making a decision to create a structure, clients should take professional legal and tax advice in their country of residence. EFG Wealth Solutions is part of EFG International and includes the following: EFG Wealth Solutions (Jersey) Limited and its Jersey subsidiaries regulated by the Jersey Financial Services Commission; EFG Fund Services, a division of EFG Wealth Solutions; EFG Wealth Solutions (Singapore) Limited regulated by the Monetary Authority of Singapore; EFG Bank & Trust (Bahamas) Ltd regulated by the Central Bank of The Bahamas; EFG Wealth Management, (Cayman) Ltd and EFG Investment Services (Cayman) Ltd regulated by the Cayman Islands Monetary Authority; EFG Bank (Luxembourg) S.A. regulated by the Commission de Surveillance du Secteur Financier; EFG Private Bank (Channel Islands) Limited regulated by the Guernsey Financial Services Commission; and EFG Investment Services, Inc. incorporated in the United States of America. Issued by EFG Wealth Solutions (Jersey) Limited, P O Box 641, No 1 Seaton Place, St Helier, Jersey JE4 8YJ Channel Islands. Publication date: July 2015