The Implicit Costs of Trade Credit Borrowing by

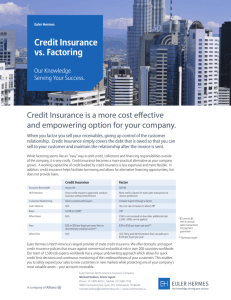

advertisement