Veri-Tax Benefit

advertisement

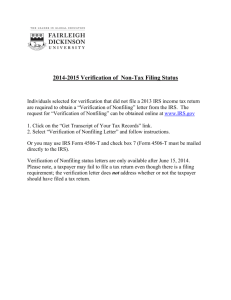

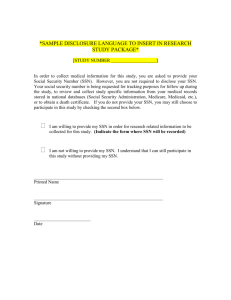

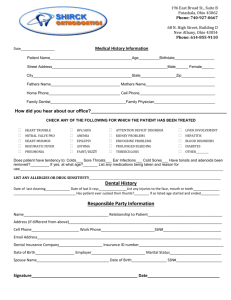

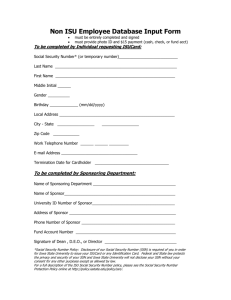

Specializing in Customer Happiness Verification Suite 4506-T Income Verification Veri-Tax provides the industry’s fastest and most secure method of electronic Form 4506-T processing directly with the Internal Revenue Service. Our process accelerates and simplifies income verification while providing an unparalleled level of transaction security and fraud prevention. Social Security Number Verification Veri-Tax offers four different SSN verification reports to help avoid fraud and verify identity fast. Verification of Accounts Veri-Tax’s Verification of Accounts automates the tedious calculation of assets by electronically pulling information directly from a borrower’s accounts and providing real-time financial status analysis. Verification of Employment Veri-Tax’s well-qualified and persistent staff delivers unbiased third party VOEs so you can confidently fund a loan quickly. Veri-Tax’s verification of employment reports saves you time by securely returning detailed employment data and employee salary history. www.veri-tax.com (800) 969-5100 Features and Benefits • • • • • 24-48 hour IRS tax transcript turnaround time Custom tax transcript summary sheet Bulk ordering available 4506-T E-sign options Tax transcripts and wage information include: 1040, 1065, 1120, W-2, K-1, and 1099 • Instant and free tax transcript authentication tool • SSN Match: Instantly verifies if SSN and name match • SSN Deluxe: Reports SSN year and state issuance, checks death index, and delivers all aliases and addresses associated to an SSN • SSN Prime 89: Form SSA-89 Processing delivers 100% accurate results from the Social Security Administration • SSN Complete: Combines all three SSN verification reports and searches Patriot Act database for a match result • Direct access to over 14,000 financial institutions • Account transaction detail, direct deposit balances, and cash flow analysis • Equivalent to electronic bank statements • Account monitoring options (30, 60, 90 days) • Verifies other asset and liability accounts including credit cards, auto loans, and retirement accounts • Online ordering and detailed real-time processing updates • Written verifications typically verified within 72 hours and verbal VOEs completed in under 24 hours • Fannie Mae Form 1005 returned with salary history, hire and termination dates, bonuses, commissions, and probability of continued employment CustomerHappiness@veri-tax.com Veri-Sight Performance Report The Veri-Sight Performance Report delivers the most accurate insight into each account’s performance and provides full transparency of Veri-Tax’s operational service levels. VSPR Metrics Include: Turnaround Time Order Volume • Order volume 4500 4011 March • Number of years ordered • Form types ordered 8 - 16 Hrs 16 - 24 Hrs February 3500 2974 24 - 32 Hrs 32 - 40 Hrs 40 - 48 Hrs • Turnaround time trends 3000 2500 • Rejection reasons • Rejection rates by user 3646 0 - 8 Hrs • Top ten user order volume • Rejection statistics 3941 4000 IRS Rejections 2000 1500 July Complete June 1000 IRS Problem • Raw IRS data • IRS downtime tracking 500 May 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 0 September October November December Security is our Highest Priority. Veri-Tax’s corporate-wide policies and procedures, employee access to client and borrower data, the information technology and disaster recovery plans, as well as the security of Veri-Tax’s financial systems, have passed the SSAE 16 Type II audit. This audit places Veri-Tax’s security standards on par with the largest financial institutions in the country. For more information on how Veri-Tax can help your organization, please contact: Veri-Tax 30 Executive Park, Suite 200 Irvine, CA 92614 (800) 969-5100 CustomerHappiness@veri-tax.com www.veri-tax.com