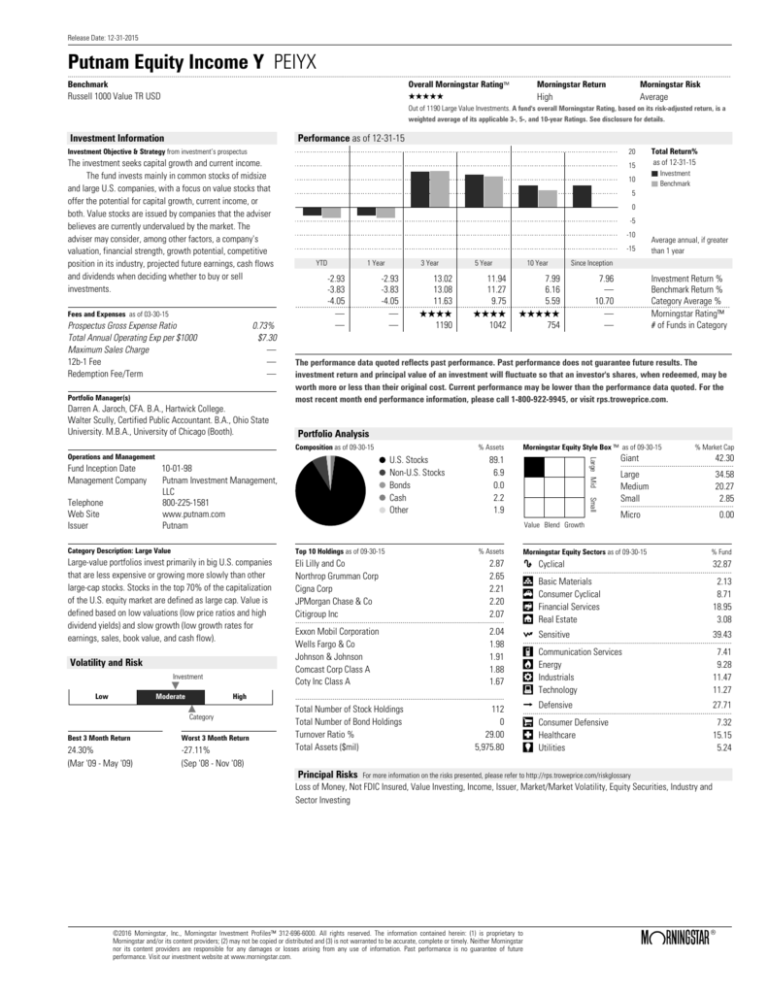

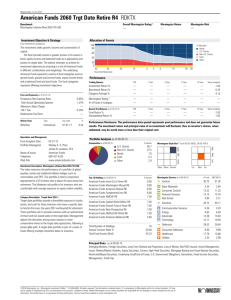

Release Date: 12-31-2015

Putnam

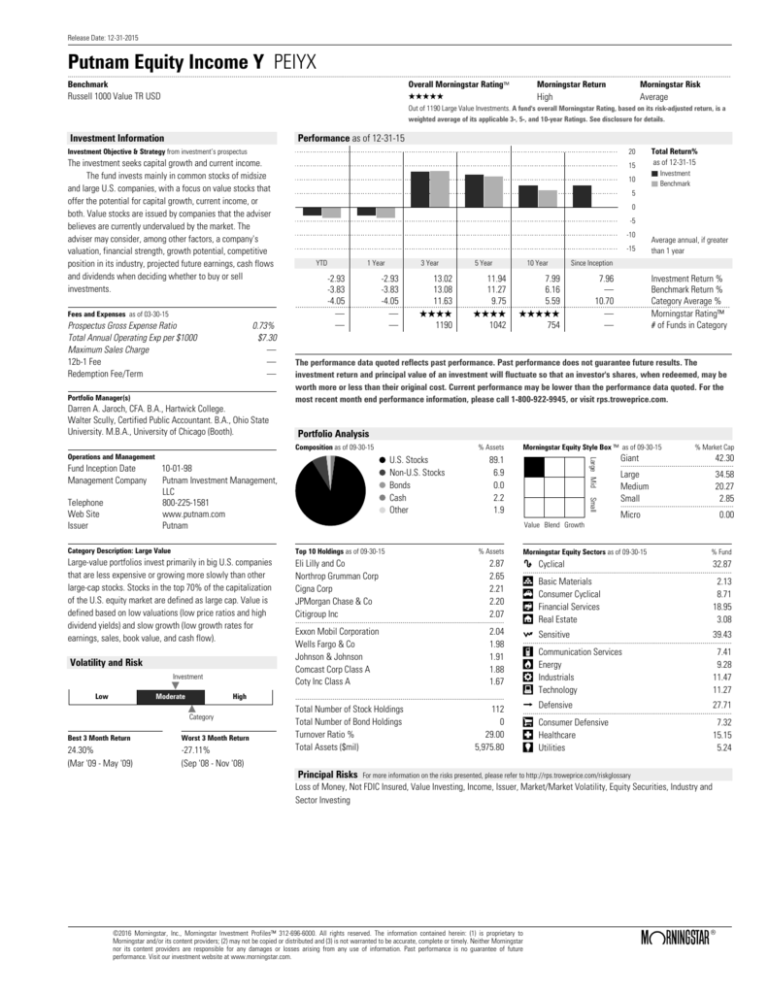

Equity Income Y PEIYX

....................................................................................................................................................................................................................................................................................................................................................

Benchmark

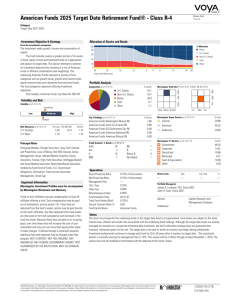

Overall Morningstar Rating™

Morningstar Return

Morningstar Risk

Russell 1000 Value TR USD

QQQQQ

High

Average

Out of 1190 Large Value Investments. A fund's overall Morningstar Rating, based on its risk-adjusted return, is a

weighted average of its applicable 3-, 5-, and 10-year Ratings. See disclosure for details.

Investment Information

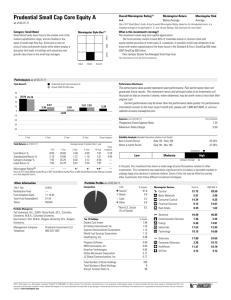

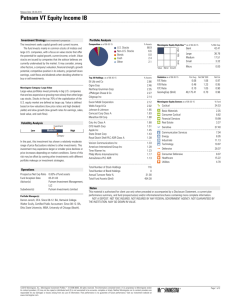

Performance as of 12-31-15

Investment Objective & Strategy from investment’s prospectus

20

The investment seeks capital growth and current income.

The fund invests mainly in common stocks of midsize

and large U.S. companies, with a focus on value stocks that

offer the potential for capital growth, current income, or

both. Value stocks are issued by companies that the adviser

believes are currently undervalued by the market. The

adviser may consider, among other factors, a company's

valuation, financial strength, growth potential, competitive

position in its industry, projected future earnings, cash flows

and dividends when deciding whether to buy or sell

investments.

15

Fees and Expenses as of 03-30-15

Prospectus Gross Expense Ratio

Total Annual Operating Exp per $1000

Maximum Sales Charge

12b-1 Fee

Redemption Fee/Term

0.73%

$7.30

.

.

.

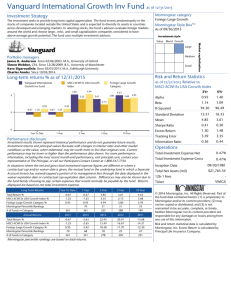

Portfolio Manager(s)

Darren A. Jaroch, CFA. B.A., Hartwick College.

Walter Scully, Certified Public Accountant. B.A., Ohio State

University. M.B.A., University of Chicago (Booth).

10

0

-5

-10

-15

YTD

1 Year

3 Year

5 Year

10 Year

Average annual, if greater

than 1 year

Since Inception

-2.93

-2.93

13.02

11.94

7.99

7.96

Investment Return %

-3.83

-3.83

13.08

11.27

6.16

.

Benchmark Return %

-4.05

-4.05

11.63

9.75

5.59

10.70

Category Average %

................................................................................................................................................................................................................

.

.

.

Morningstar Rating™

QQQQ

QQQQ QQQQQ

.

.

1190

1042

754

.

# of Funds in Category

The performance data quoted reflects past performance. Past performance does not guarantee future results. The

investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be

worth more or less than their original cost. Current performance may be lower than the performance data quoted. For the

most recent month end performance information, please call 1-800-922-9945, or visit rps.troweprice.com.

Portfolio Analysis

% Assets

10-01-98

Putnam Investment Management,

LLC

800-225-1581

www.putnam.com

Putnam

Morningstar Equity Style Box ™ as of 09-30-15

89.1

6.9

0.0

2.2

1.9

Small

U.S. Stocks

Non-U.S. Stocks

Bonds

Cash

Other

Large Mid

Operations and Management

Telephone

Web Site

Issuer

Investment

Benchmark

5

Composition as of 09-30-15

Fund Inception Date

Management Company

Total Return%

as of 12-31-15

Value Blend Growth

% Market Cap

Giant

42.30

Large

Medium

Small

34.58

20.27

2.85

..........................................................

..........................................................

Micro

0.00

Category Description: Large Value

Top 10 Holdings as of 09-30-15

Morningstar Equity Sectors as of 09-30-15

% Fund

Large-value portfolios invest primarily in big U.S. companies

that are less expensive or growing more slowly than other

large-cap stocks. Stocks in the top 70% of the capitalization

of the U.S. equity market are defined as large cap. Value is

defined based on low valuations (low price ratios and high

dividend yields) and slow growth (low growth rates for

earnings, sales, book value, and cash flow).

Eli Lilly and Co

Northrop Grumman Corp

Cigna Corp

JPMorgan Chase & Co

Citigroup Inc

2.87

2.65

2.21

2.20

2.07

Cyclical

32.87

2.13

8.71

18.95

3.08

Exxon Mobil Corporation

Wells Fargo & Co

Johnson & Johnson

Comcast Corp Class A

Coty Inc Class A

2.04

1.98

1.91

1.88

1.67

Sensitive

39.43

7.41

9.28

11.47

11.27

Volatility and Risk

Investment

Low

Moderate

High

Category

Best 3 Month Return

Worst 3 Month Return

24.30%

(Mar '09 - May '09)

-27.11%

(Sep '08 - Nov '08)

% Assets

...........................................................................................................

...........................................................................................................

Total Number of Stock Holdings

Total Number of Bond Holdings

Turnover Ratio %

Total Assets ($mil)

Principal Risks

112

0

29.00

5,975.80

...........................................................................................................

Basic Materials

Consumer Cyclical

Financial Services

Real Estate

...........................................................................................................

Communication Services

Energy

Industrials

Technology

Defensive

27.71

Consumer Defensive

Healthcare

Utilities

7.32

15.15

5.24

...........................................................................................................

For more information on the risks presented, please refer to http://rps.troweprice.com/riskglossary

Loss of Money, Not FDIC Insured, Value Investing, Income, Issuer, Market/Market Volatility, Equity Securities, Industry and

Sector Investing

©2016 Morningstar, Inc., Morningstar Investment Profiles™ 312-696-6000. All rights reserved. The information contained herein: (1) is proprietary to

Morningstar and/or its content providers; (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar

nor its content providers are responsible for any damages or losses arising from any use of information. Past performance is no guarantee of future

performance. Visit our investment website at www.morningstar.com.