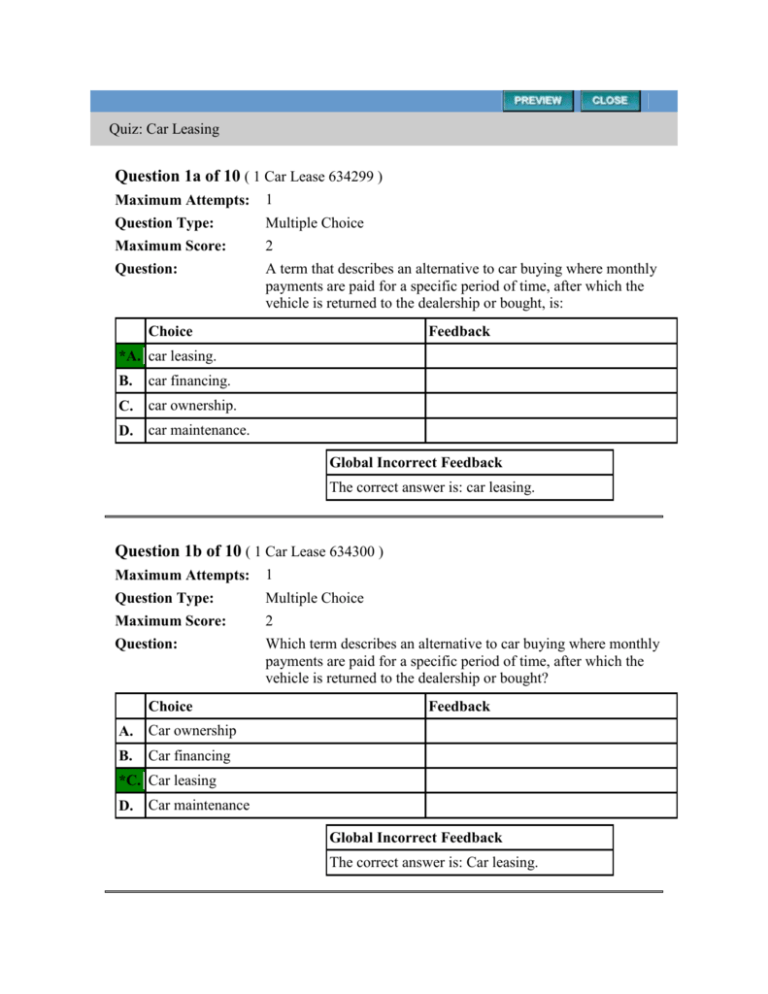

Quiz: Car Leasing Question 1a of 10 ( 1 Car Lease 634299

advertisement