advertisement

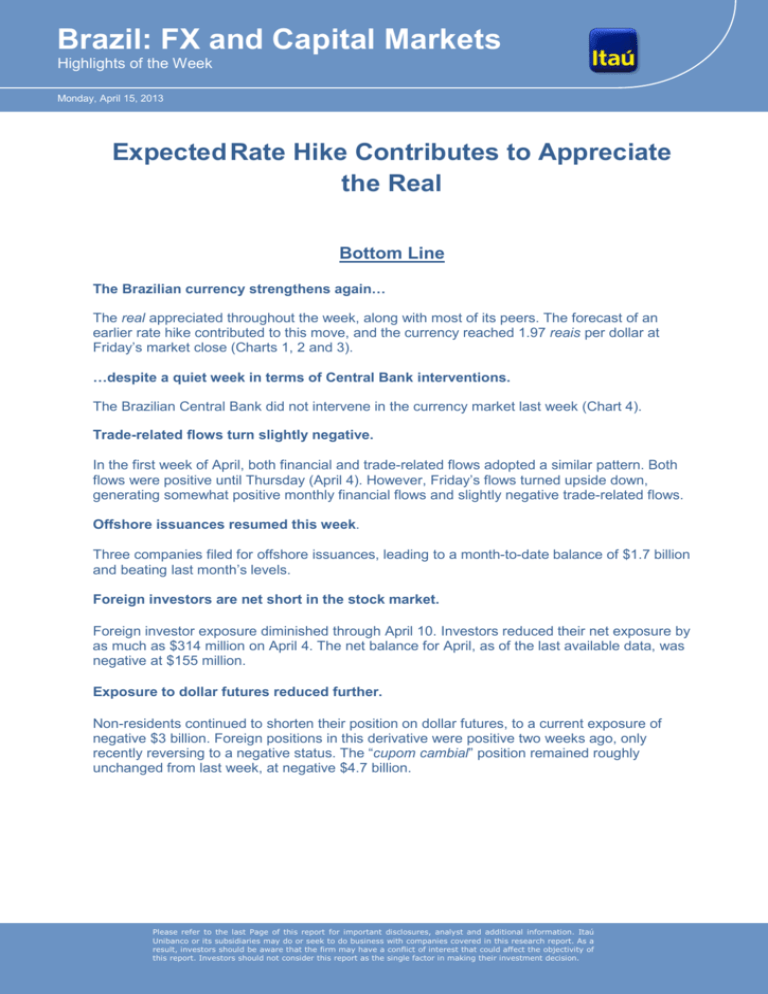

Brazil: FX and Capital Markets Highlights of the Week Monday, April 15, 2013 Expected Rate Hike Contributes to Appreciate the Real Bottom Line The Brazilian currency strengthens again… The real appreciated throughout the week, along with most of its peers. The forecast of an earlier rate hike contributed to this move, and the currency reached 1.97 reais per dollar at Friday’s market close (Charts 1, 2 and 3). …despite a quiet week in terms of Central Bank interventions. The Brazilian Central Bank did not intervene in the currency market last week (Chart 4). Trade-related flows turn slightly negative. In the first week of April, both financial and trade-related flows adopted a similar pattern. Both flows were positive until Thursday (April 4). However, Friday’s flows turned upside down, generating somewhat positive monthly financial flows and slightly negative trade-related flows. Offshore issuances resumed this week. Three companies filed for offshore issuances, leading to a month-to-date balance of $1.7 billion and beating last month’s levels. Foreign investors are net short in the stock market. Foreign investor exposure diminished through April 10. Investors reduced their net exposure by as much as $314 million on April 4. The net balance for April, as of the last available data, was negative at $155 million. Exposure to dollar futures reduced further. Non-residents continued to shorten their position on dollar futures, to a current exposure of negative $3 billion. Foreign positions in this derivative were positive two weeks ago, only recently reversing to a negative status. The “cupom cambial” position remained roughly unchanged from last week, at negative $4.7 billion. Please refer to the last Page of this report for important disclosures, analyst and additional information. Itaú Unibanco or its subsidiaries may do or seek to do business with companies covered in this research report. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should not consider this report as the single factor in making their investment decision. FX and Capital Markets Monday, April 15, 2013 Real: Weekly Evolution 2.005 2.000 1.995 Peer-currencies Weekly Performance 1 reais per dollar MXN; 0.82% 1.992 1.990 1.981 1.980 1.975 1.965 AUD; 1.19% 1.976 1.973 Daily Trading Range 1.970 8-Apr depreciation BRL; 0.80% 1.970 COP; 0.35% 1.960 9-Apr 10-Apr 11-Apr 12-Apr -1.50% -1.00% Source: Bloomberg and Itaú *30-day moving st. dev. of logdifferences BRL AUD JPY EUR 10 0.50% 4 billion dollars purchases (+) 5 12 0 10 -5 Swap Reverse swap Forward Spot 8 -10 6 4 Dec-12 -15 Jan-13 Feb-13 Mar-13 Jan-12 Apr-13 May-12 Daily Flows million dollars 5 Financial Trade-related 700 Sep-12 sales (-) Jan-13 Source: BCB and Itaú Source: Bloomberg and Itaú 1000 0.00% Central Bank Actions 3 MXN 14 -0.50% Source: Bloomberg and Itaú Currencies Volatility* 16 CLP; 0.30% appreciation 1.985 18 2 10 8 Exchange Rate Flows billion dollars Financial** Trade-related 6 4 400 2 0 100 -2 -200 -4 -6 -500 -8 -10 -800 1-Apr 2-Apr 3-Apr 4-Apr 5-Apr **services-related and capital flows Jan-12 May-12 Sep-12 Source: BCB and Itaú Source: BCB and Itaú Page 2 6 Jan-13 FX and Capital Markets Monday, April 15, 2013 Securities Issuances in the External 7 Market 16 billion dollars 14 11.7 12 10 8.4 8 5.5 6.4 6 4 5.8 4.0 2.4 1.32.5 1.5 1.4 2 Jul-12 1.6 1.7 0.2 0.1 0 Jan-12 Apr-12 5.1 Oct-12 Jan-13 Apr-13 Source: Valor Econômico and Itaú April 2013: Issuance Details Issuer 1 Foodstuff 2 Steel 3 Financial Institution / Private Equity Source: Valor Econômico Net Foreign Flows to Brazilian Equities 3000 2000 8 6 4 million dollars 0 0 -2 -1000 -4 -2000 -6 -3000 -8 -5000 Net Foreigners' Exposure to Currency Derivatives 9 billion dollars 2 1000 -4000 Value (mill. $) 275 750 700 Maturity 2023 2023 2018 Apr-12 Jul-12 Dollar futures "Cupom cambial" -12 Net exposure Oct-12 Dec-12 -10 Spot market Index futures Oct-12 Jan-13 Apr-13 Source: BMF, Bovespa and Itaú Feb-13 Source: BMF Bovespa, Bloomberg e Itaú Page 3 Apr-13 FX and Capital Markets Monday, April 15, 2013 Macro Research - Itaú Ilan Goldfajn – Chief Economist Tel: +55 11 3708-2696 Click here to visit our digital research library. Relevant Information 1. This report has been prepared and issued by the Macro Research Department of Banco Itaú Unibanco S.A. (“Itaú Unibanco”). This report is not a product of the Equity Research Department of Itaú Unibanco or Itaú Corretora de Valores S.A. and should not be construed as a research report (‘relatório de análise’) for the purposes of the article 1 of the CVM Instruction NR. 483, dated July 06, 2010. 2. This report aims at providing macroeconomics information, and does not constitute, and should not be construed as an offer to buy or sell, or a solicitation of an offer to buy or sell any financial instrument, or to participate in any particular trading strategy in any jurisdiction. The information herein is believed to be reliable as of the date on which this report was issued and has been obtained from public sources believed to be reliable. Itaú Unibanco Group does not make any express or implied representation or warranty as to the completeness, reliability or accuracy of such information, nor does this report intend to be a complete statement or summary of the markets or developments referred to herein. Opinions, estimates, and projections expressed herein constitute the current judgment of the analyst responsible for the substance of this report as of the date on which it was issued and are, therefore, subject to change without notice. Itaú Unibanco Group has no obligation to update, modify or amend this report and inform the reader accordingly. 3. The analyst responsible for the production of this report, whose name is highlighted in bold, hereby certifies that the views expressed herein accurately and exclusively reflect his or her personal views and opinions and were prepared independently and autonomously, including from Itaú Unibanco, Itaú Corretora de Valores S.A. and other group companies. 4. This report may not be reproduced or redistributed to any other person, in whole or in part, for any purpose, without the prior written consent of Itaú Unibanco. Additional information on the financial instruments discussed in this report is available upon request. Itaú Unibanco and/or any other group companies is not, and will not be liable for any investment decisions (or otherwise) based on the information provided herein. 5. This material is provided and authorized by Itau BBA International Limited pursuant to Section 21 of the Financial Services and Markets Act 2000. Itau BBA International Limited is located at 20th floor, 20 Primrose Street, London, United Kingdom, EC2A 2EW and is regulated by the Financial Services Authority (FRN 575225) – FSA register: http://www.fsa.gov.uk/register/firmBasicDetails.do?sid=293537. Itau BBA International Limited Lisbon Branch, is located in Portugal at Rua Tierno Galvan, Torre 3, 11º Andar 1099-048 and is regulated by Banco de Portugal for the conduct of business only/ Itau BBA International Limited overseas financial branch located in Madeira is regulated by Banco de Portugal for the conduct of business only. Itau BBA International Limited also has representative offices in France, Germany, Spain and Colombia which are authorized to conduct limited activities by the Financial Services Authority and the business activities conducted are regulated by Banque de France, Bundesanstalt fur Finanzdienstleistungsaufsicht (BaFin), Banco de España and Superintendencia Financeira de Colombia respectively. None of the offices and branches deal with retail clients. For any queries please contact your relationship manager. For more information go to: www.itaubba.co.uk Additional Note to reports distributed in: (i) U.K. and Europe: Itau BBA UK Securities Limited, authorised and regulated by the Financial Services Authority (FSA), is distributing this report to investors who are Eligible Counterparties and Professional Clients, pursuant to FSA rules and regulations. If you do not, or cease to fall within the definition of Eligible Counterparty or Professional Client, you should not rely upon the information contained herein and should notify Itau BBA UK Securities Limited immediately. The information herein does not apply to, and should not be relied upon by retail customers. Investors wishing to purchase or otherwise deal in the securities covered in this report should contact Itau BBA UK Securities Limited at Level 20 The Broadgate Tower, 20 Primrose Street, London EC2A 2EW, UK; (ii) U.S.A: Itau BBA USA Securities, Inc., a FINRA/SIPC member firm, is distributing this report and accepts responsibility for the content of this report. Any US investor receiving this report and wishing to effect any transaction in any security discussed herein should do so with Itau BBA USA Securities, Inc. at 767 Fifth Avenue, 50th Floor, New York, NY 10153; (iii) Asia: This report is distributed in Hong Kong by Itaú Asia Securities Limited, which is licensed in Hong Kong by the Securities and Futures Commission for Type 1 (dealing in securities) regulated activity. Itaú Asia Securities Limited accepts all regulatory responsibility for the content of this report. In Hong Kong, any investors wishing to purchase or otherwise deal in the securities covered in this report should contact Itaú Asia Securities Limited at 29th Floor, Two IFC, 8 Finance Street – Central, Hong Kong; (iv) Japan: This report is distributed in Japan by Itaú Asia Securities Limited – Tokyo Branch, Registration Number (FIEO) 2154, Director, Kanto Local Finance Bureau, Association: Japan Securities Dealers Association; (v) Middle East: This report is distributed by Itau Middle East Limited. Itau Middle East Limited is regulated by the Dubai Financial Services Authority and is located at Suite 305, Level 3, Al Fattan Currency House, Dubai International Financial Centre, PO Box 482034, Dubai, United Arab Emirates . This material is intended only for Professional Clients (as defined by the DFSA Conduct of Business module) no other persons should act upon it; (vi) Brazil: Itaú Corretora de Valores S.A., a subsidiary of Itaú Unibanco S.A authorized by the Central Bank of Brazil and approved by the Securities and Exchange Commission of Brazil, is distributing this report. If necessary, contact the Client Service Center: 4004-3131* (capital and metropolitan areas) or 0800-722-3131 (other locations) during business hours, from 9 a.m. to 8 p.m., Brasilia time. If you wish to re-evaluate the suggested solution, after utilizing such channels, please call Itaú’s Corporate Complaints Office: 0800-570-0011 (on business days from 9 a.m. to 6 p.m., Brasilia time) or write to Caixa Postal 67.600, São Paulo-SP, CEP 03162-971. * Cost of a local call. Page 4