Employer Guidebook - New Mexico Workers Compensation

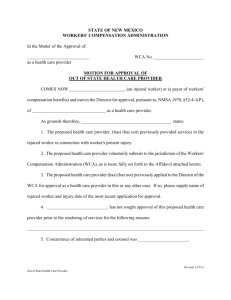

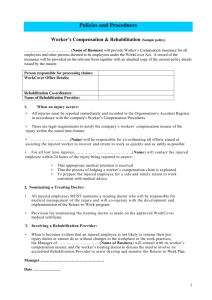

advertisement