Eagle Ford Shale - Scotia Howard Weil

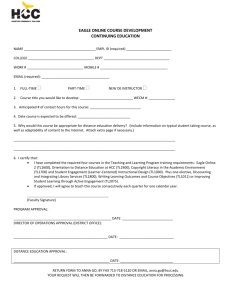

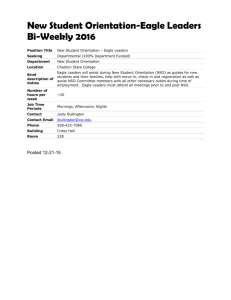

advertisement