Oleochemicals Outlook

advertisement

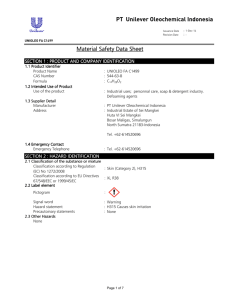

International Conference Oleochemicals Outlook 22-23 Aug, 2013 - Jakarta Le Meridien Jakarta Indonesia boasts as a favorable oleochemicals investment location as the nation offers readily available feedstock. With consumer demands and trends leaning towards natural ingredients and environmentally-friendly products, industry players and investors are gearing up for the shift towards oleochemicals. As Indonesia’s oleochemicals sector is mainly in the hands of the private sector, the nation’s government has since seen the need to up its stakes in this industry, spurring extensive investments in this field. Now we would like to describe the current situation ahead to “Oleochemical Outlook” conference in Jakarta. Industrial clusters have since been stipulated for the downstream palm oil industry, with the oleochemicals sector planned in Sei Mangke, North Sumatra, Kuala Enok, Duma, Riau and Maloy, East Kalimantan. Attractive incentives and tax schemes in the new tax regime, including lower export tax, has made Indonesia’s oleochemicals and palm oil downstream industries appealing. Recently, Executive Director of Indonesian Vegetable Oil Refiners Association (GIMNI), Sahat Sinaga, said that “investments will be channeled by 20 local and foreign processors, 12 of which will pour more than Rp 1 trillion into the palm oil downstream industry”, thereby boosting Indonesia’s oleochemical production capacity to 4.22 million tons in 2014. These investment plans include oleochemical and oleofood plants by leading industry players Sinar Mas Group, Musim Mas Group and Permata Hijau Group. PT Unilever Oleochemical is also one of the major players investing in Indonesia and has recently headlined with the groundbreaking of its Rp 1.45 trillion oleochemical plant in Sei Mangkei on June 28, 2013. The new oleochemical plant will take about 12 to 15 months to construct before coming onstream with a capacity of 200,000 tons per year. PT Unilever Indonesia Tbk (UNVR) is certainly conducting groundbreaking of its oleochemical plant in the Special Economic Zone Sei Mangkei, North Sumatra on June 28, 2013. Coordinating Minister for Economic Affairs Hatta Rajasa will be invited in the groundbreaking ceremony. Commissioner of PT Unilever Oleochemical Indonesia Sancoyo Antarikso said it allocated a capital expenditure totaling Rp1.45 trillion for the purchase of land and construction of oleochemical plant. On the other hand, Kao, manufacturer of downstream products and oleochemical field, will build a new plant of surfactant in order to expand its business base in Indonesia, and held a completion ceremony. Following to start running sequentially from August, it is expected to launch a new plat for household products such as laundry detergent and diapers by end of this year. The company relocates existing plant of surfactant to the new plant facilities, raises to 5% of conventional production capacity. In addition to building a full-house production system of laundry detergent in the household goods, they establish a system to switch diapers that had been imported to local production and take actively growing market. Kao Indonesia Chemicals (95% owned Kao) has secured a land of 120,000 square meters industrial park in Karawang in West Java province Karawang and will build new plant of surfactant there. Initial investment amounted to more that 4 billion yen, they produce industrial chemicals addition of surfactant used in raw materials for detergent and shampoo. Production facilities of existing plant in Bekasi, West Java province Tambun, will be integrated into new plan. The company starts “K15” three-years medium-term management plan by 2015 and has target of more than 30% overseas sales ratio. It has to be one of the growth strategy of strengthening oleochemical business, they aim and further business expansion in growth markets and strengthening through integration with end product. By the way, except Indonesia, they schedule for operation in the near future to expand 40% production capacity of higher alcohol to invest about 3 billion yen in the Philippines. Also, they build a factory of industrial chemical products, such as non-ionic surfactant and laundry detergent to an investment of about 5 billion yen, operating next year in Jinshan, Shanghai in China. Back to subject, as well as surfactant in Indonesia, the second plant as a new factory of household goods is also under construction. It has built in the land of 140,000 square meters adjacent to the new plant of surfactant, it is planed running at the end of the year. Investment is about 10 billion yen. Kao Indonesia (capital of 50% is Kao, the rest funded local consumer goods major Rodamasu) responsible for the manufacture and sale of household goods. In addition to the production of laundry detergent in the first plant in West Java province Cikarang Bekasi, it has commissioned production in cooperation factory for household goods now. As it was decided the construction of new second plant mainly because the first plant has outgrown, it is expected that in-house production switch all after second plant running. Disposable diapers had been imported and sold so far, it is able to embark on local production due to demand. Indonesia, the world’s biggest palm oil producer, will spend at least US$2.7 billion to build crude palm oil (CPO) processing facilities until 2014 to further boost the country’s CPO production capacity, an executive from the palm oil producer association has said. The new facilities will boost Indonesia’s processing capacity to 39.46 million tons a year in 2014, which will comprise 30.9 million tons for refining and fractionation capacity, 4.22 million tons for oleochemical production capacity and 4.34 million tons for biodiesel manufacturing capacity of 4.34 million tons. [ Tax structure in Indonesia ] In the first quarter of this year, investors have spent around $1.02 billion on new processing facilities. The new investments are expected to increase the country’s total processing capacity to 30.9 million tons a year by year’s end, a 19.31 percent increase from the past year. Local industry players have said that the inflow of such sizeable investments was attributed to the government’s decision to change the export tax structure in late 2011, which effectively makes investments in the downstream industry more attractive. The new tax structure generates a margin of export tax on crude palm oil and downstream products, such as RBD palm olein of between 5.5 percent and 9.5 percent, making Indonesian products more competitive than those produced by Malaysian producers. Under the new tax regime, the export tax on processed palm oil products declines from 25 percent to 10 percent. At the same time, a progressive tax is also charged on crude palm oil (CPO) with levies starting at 22.5 percent whenever the commodity’s prices shore up beyond $750 per ton. For every $50 price rise from the ceiling, exporters must pay an export tax of 1.5 percent. This measure supports the Industry Ministry’s aim to see palm oil exports comprise 60 percent processed products and 40 percent crude palm oil by 2015. Prior to the introduction of the tax rule, CPO made up 60 percent of overall exports, while processed palm oil represented the other 40 percent. However, a marked change took place last year that saw processed oil account for 61 percent of total exports, while CPO represented 39 percent. Sahat said that the domestic downstream industry aimed to push up processed palm oil output for exports to 21.7 million tons this year, up 4.63 percent from last year. This figure would account for 62.6 percent of Indonesia’s palm oil exports throughout 2013. While the new tax rule proved to help boost the utilization of domestic refining capacity and to provide a competitive edge for Indonesia’s palm oil exports, it should be further supported by other policies to spur more industry growth, he added. “The impact of the tax rule has been positive but we need other instruments to draw more sizeable investments in the future,” Sahat said, referring to easier procedures to obtain a tax holiday facility and a simplified tax system, particularly for the payment of value-added tax restitution. Introduced in late 2011, the tax holiday facility offers five-to-10 year tax breaks in five industrial sectors — base metal, oil refining and petrochemicals, renewable energy and telecommunication equipment — with an investment of at least Rp 1 trillion. [Oleochemical Outlook conference ] Oleochemical sector in Indonesia and global outlook will be discussed by the best executives in Oleochemical Outlook conference in Jakarta, 22-23 August 2013. Conference will be conducted in the following schedule. This Conference is opened by Centre for Management Technology, and please register from the link in advertisement page. Day 1 - [22 Aug, 2013 - Thursday] Mr. Ashok D.Pol, Vice President, Sales & Marketing – 08:00 Registration & Coffee Oleochemicals VVF(India) Limited 09:00 Chairman’s Welcome Remarks & Introduction 10:45 09:10 ALTERNATIVES PALM TO OLEO – VALUE ADDITION FEEDSTOCK – DEMAND/SUPPLY & THROUGH INTEGRATION - Supply consistency & price outlook - Developing oleo business & where the industry will - Supply of CPO, PKO, Coconut Oil, Tallow and stearin be heading in the next 5 years? - Price volatility & trends - Sustainability initiatives and how RSPO will value - Alternative feedstock consideration add to the downstream industry Mr. Chris de Lavigne, Global VP, Industrial Practices - Challenges facing the industry Frost & Sullivan Mr. Steve Goei, COO PT. Socimas 09:40 ASIA OLEOCHEMICAL 11:20 MARKET INDONESIA – GROWING OLEO & DOWNSTREAM INDUSTRY OUTLOOK - Demand/supply projections - Fatty alcohols and fatty acids growth prospect - Staying competitive in an increasingly crowded - How are industry reacting to new capacities coming market on-stream? - CPO tax incentives & its competitiveness against - How will supply/demand change? Malaysia - Will margins be further squeezed? - Oleochemicals investment update - Growing importance of sustainability & its impact on - Progress of developing downstream market oleo industry Mr. Togar Sitanggang, Chairman Apolin (Indonesian Oleochemicals Manufacturers Association) 11:50 TECHNOLOGY Mr. Manfred Hoffmann, Director Sales Business CHINA’S OLEOCHEMICALS MARKET & Group Oleochemicals Lurgi GmbH DOWNSTREAM DEMAND 16:50 Discussion followed by End of Day One - Demand/supply projections Day 2 - [23 Aug, 2013 - Friday] - Downstream market trends & emerging applications 09:00 Chairman’s Introduction - Feedstock challenges 09:10 SOAP NOODLE OUTLOOK Dr. Douglas Furtek, Director - Operational Innovation - Global demand & projections R&D Teck Guan Group (Malaysia, Indonesia, China) Mr. Sovakar Nayak, Vice President 12:20 Discussion followed by Networking Lunch Resources Pte Ltd 13:45 Afternoon Chairman’s Introduction 09:45 13:50 ECONOMIC OUTLOOK IN INDONESIA CLEANING MARKET - Impact of global performance on Indonesia's growth TRENDS Pte Ltd - Fiscal & monetary policy implications 10:15 - Risks & challenges Refreshment Bank Danamon 14:20 TECHNOLOGY VS TRADITIONAL CULTURE OF RURAL INDIA AND THE CHALLENGES FOR SUSTAINABLE DEVELOPMENT AND Discussion followed by Networking RENEWABLE SURFACTANTS FROM BIOREFINERY Mr. John YS Lim, General Manager-Asia Elevance Renewable Sciences Singapore Pte Ltd 11:15 MCT – MEDIUM CHAIN TRIGLYCERIDE Mr. Ritum Jain, CEO Safechem Industries 14:50 CARE 10:45 LATEST INNOVATIONS & PERFORMANCE OF INDISPENSABLE FABRIC Mr. Aseem Puri, Marketing Director Unilever Asia - Is Indonesia ready for AEC 2015? Mr. Anton H Gunawan, Chief Economist IN Palms SKIN CARE MARKET & TRENDS IN AND NEW APPLICATION POSSIBILITIES - Market demand and supply INDONESIA - New applications with MCT - Emerging trends and its impact on formulation 11:45 LATEST ADVANCEMENT/ DEVELOPMENT - Changing lifestyle & its impact on product OF innovations & ingredients selection SECTOR Mr. Samuel Eduard Pranata, Marketing Director Martha Tilaar Group 15:20 Discussion OLEO APPLICATION IN INDUSTRIAL - Focus on polymers, lubricants, textile, coatings & etc Dr . Zainab Idris, Head of Process Engineering and followed by Networking Designs Malaysian Palm Oil Board (MPOB) Refreshment 12:15 Final Discussion followed by Closing Lunch 15:50 13:45 End of Conference BIODIESEL INDUSTRY OUTLOOK - MALAYSIA EXPERIENCE - Supply and demand outlook - Is it on the wane again? The impact on global oleochemicals market - Impact on the crude palm oil price in specific - setting up of the Malaysia Biodiesel Co. Ir. Samsudeen Ganny, Chief Operating Officer Mission Biotechnologies Sdn Bhd 16:20 DEVELOPMENT IN OLEOCHEMICALS