Question 1 [20 marks, maximum one page single space] : a. Explain

advertisement

![Question 1 [20 marks, maximum one page single space] : a. Explain](http://s3.studylib.net/store/data/008883393_1-14479a605669534bb5d3f64edee995a3-768x994.png)

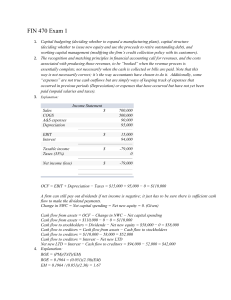

Question 1 [20 marks, maximum one page single space] : a. Explain the di¤erence between a market-value balance sheet and a book-value balance sheet. b. What is meant by over-the-counter trading? c. Distinguish between a …rm’s capital budgeting decision and …nancing decision. d. Based on the dividend growth model, what are the two components of the total return on a share of a stock? Which do you think is typically larger? Also, in the context of the dividend growth model, is it true that the growth rate in dividends and the growth rate in the price of the stock are identical? Question 2 [Part I and I I are separate - 20 marks]: Part I The …rm of Beryl Agatha had sales of $20,000 in 2005. The cost of goods sold was $13,000, general and administrative expenses were $2,000, interest expenses were $1,000, and depreciation was $2,000. Working capital increased $400 and capital expenditures were $1,800. The …rm’s tax rate is 35 percent. a. What are the …rm’s earnings before interest and taxes? b. What is the …rm’s net income? c. What is the …rm’s cash ‡ow from operating activities? Part II Determine the net income and also the cash ‡ow from operations for the following …rm: $500,000 sales, $10,000 cash dividends, $300,000 cost of goods sold, $20,000 administrative expense, $20,000 depreciation expense, $40,000 interest expense, and a tax rate of 34 percent. Question 3 [20 marks]: Part I Your landscaping company can lease a truck for $8, 000 a year (paid at year-end) for 6 years. It can buy the truck for $40, 000. The truck will be valueless after six years. a. If the interest rate your company can earn on its funds is 7 percent, is it cheaper to buy or lease? b. If the lease payments are an annuity due, is it cheaper to buy or lease? Part II On a recent trip south, you win the super jackpot in the Florida state lottery, with a payo¤ of $4,960,000. On reading the …ne print, you discover that you have the following two options: a. You receive $160,000 at the beginning of each year for 31 years. The income would be taxed at an average rate of 28%. Taxes are withheld when cheques are issued. b. You receive $1,750,000 now, but you do not have access to the full amount immediately. The $1,750,000 would be taxed at an average rate of 28%. You are able to take $446,000 of the after-tax amount now. The remaining $814,000 will be placed in a 30-year annuity account that pays $101,055 on a before-tax basis at the end of each year. Using a discount rate of 6%, which option should you select? Question 4 [20 marks]: Are the following statements true or false? Provide simple examples to support your assessment. a. If interest rates rise, bond prices rise. b. If the bond’s yield to maturity is greater than its coupon rate, the price is greater than the bond’s face value. c. High coupon bonds of a given maturity sell for lower prices than the otherwise identical low-coupon bonds. d. If interest rates change, the price of a high-coupon bond changes proportionately more than the price of a low-coupon bond of the same maturity and default risk. e. An investor who owns a 10%, 5-year Canada bond is wealthier if interest rates rise from 4% to 5%. Question 5 [Part I and I I are separate, 20 marks]: Part I The just paid dividend this year on a share of common stock is $10. Assuming dividends grow at a 5% rate for the foreseeable future, and that the required rate of return is 10%, what is the value of the share today? Last year? Next Year? Part II 1 Tattletale News Corp. has been growing at a rate of 20 percent per year, and you expect this growth rate in earnings and dividends to continue for another 3 years. a. If the just paid dividend were $2, what will the next dividend be? b. If the discount rate is 15 percent and the steady growth rate after 3 years is 4 percent, what should the stock price be today? c. What is your prediction for the stock price in one year? d. Show that the expected rate of returns equals the discount rate? Note: PVIFA (r; t) = [1 ¡ 1=(1 + r)t ]=r FVIFA (r; t) = [(1 + r)t ¡ 1]=r YTM = [C i + (Pp ¡ Pm )=n]=[(P p + P m )=2] where C i is the coupon; P p the par value; Pm the current market value; and n is the maturity. PVIF (r; t) = [1=(1 + r)t ] FVIF (r; t) = [(1 + r)t 2 Solutions for the Midterm Solution 1: a. For some assets, depreciation expense is an accurate portrayal of reduction in market value. However, it is not at all uncommon for market value to be distinctly di¤erent from depreciated book value. This can be especially true for land, which is not depreciated but has often appreciated if it has been on the books for a long period of time. In a similar manner, liabilities may have a di¤erent market value if market interest rates on similar liabilities have changed su¢ciently since the liability was issued. Finally, investors and analysts may have critical information about the future prospects for the …rm that has not been incorporated into current generally accepted accounting principles. b. “Over-the-counter” refers to trading that does not take place on a centralized exchange such as the New York Stock Exchange. Trading of securities on NASDAQ is over-the-counter, because NASDAQ is a network of security dealers linked by computers. Although some corporate bonds are traded on the New York Stock Exchange, most corporate bonds are traded over-the-counter, as are all U.S. Treasury securities. Foreign exchange trading is also over-the-counter. c. Examples of the capital budgeting decision for a …rm could include: a decision to replace all of the …rm’s personal computers, a decision to expand the size of the production facility, a decision to buy a corporate jet, a decision to expand production into two new product lines, et cetera. Examples of the …nancing decision for a …rm could include: a decision to issue corporate bonds rather than expand a bank loan, a decision to ‡oat a new issue of common stock, a decision to denominate a loan in Japanese yen rather than Canadian dollars, a decision to roll over short-term …nancing rather than borrow for a longer term, et cetera. d. The two components are the dividend yield and the capital gains yield. For most companies, the capital gains yield is larger. This is easy to see for companies that pay no dividends. For companies that pay dividends, the dividend yields are rarely over …ve percent and are often much less. Yes, if the dividend grows at a steady rate, so does the stock price. In other words, the dividend growth rate and the capital gains yield are the same. Solution 2: Part I a) What are the …rm’s earnings before interest and taxes? Sales $10,000 Cost of goods sold 6,500 G & A expenses 1,000 Depreciation expense 1,000 EBIT 1,500 b) What is the …rm’s net income? EBIT 1,500 Interest expense 500 Taxable income 1,000 (35%) 350 Net income $ 650 c) What is the …rm’s cash ‡ow from operating activities? Ans: Cash ‡ow from operations = net income + depreciation expense 650+1,000 = $1,650 Part II Sales $500,000 Cost of Goods Sold 300,000 Administrative Expense 20,000 Depreciation Expense 20,000 EBIT 160,000 Interest Expense 20,000 Income Taxes 47,600 Net Income $ 92,400 Adding depreciation expense to net income provides a cash ‡ow from operations of $112,400. Solution 3: 3 Part I a. Compare the present value of the lease to cost of buying the truck. Present Value of lease = 8; 000 ¤ P V IF A(7%; 6) = ¡$38; 132:32: It is cheaper to lease than buy because by leasing the truck will cost only $38,132.32, rather than $40,000. Of course, the crucial assumption here is that the truck is worthless after 6 years. If you buy the truck, you can still operate it after 6 years. If you lease it, you must return the truck and replace it. b. If the lease payments are payable at the start of each year, then the present value of the lease payments are: PV annuity due lease = 8; 000 + 8; 000 ¤ P V IF A(7%; 5) = 8; 000 + 32; 801:58 = $40; 801:58: Note too that PV of an annuity due = PV of ordinary annuity ¤(1 + r). Therefore, with immediate payment, the value of the lease payments increases from its value in the previous problem to $38; 132 ¤ 1:07 = $40; 801 which is greater than $40,000 (the cost of buying a truck). Therefore, if the …rst payment on the lease is due immediately, it is cheaper to buy the truck than to lease it. Part II Option one: this cash ‡ow is an annuity due. To value it, you must use the after-tax amounts. The after-tax payment is $160,000 (1 - 0.28)=$115,200. Value all except the …rst payment using the standard annuity formula, then add back the …rst payment of $115,200 to obtain the value of this option. Value = $115,200 + $115,200 [PVIFA(30,0.06)] Value = $115,200 + $115,200 (13.76483)=$1,700,908.53 Option two: this option is valued similarly. You are able to have $446,000 now; this is already on an after-tax basis. You will receive an annuity of $101,055 for each of the next thirty years. Those payments are taxable when you receive them, so your after-tax payment is $72,759.60 [=$101,055(1-0.28)]. Value = $446,000 + $72,759.60 [PVIFA(30,0.06)] Value = $ 446,000 + $72,759.60 (13.76483) =$1,447,523.52 Since option one has a higher present value, you choose it. Solution 4: a. False. Since a bond’s coupon payments and principal are …xed, as interest rates rise, the present value of the bond’s future cash ‡ow falls. Hence, the bond price falls. Example: Two-year bond 3% coupon, paid annual. Current YTM = 6% P rice = 30 ¤ annuityf actor(6%; 2) + 1000=(1 + :06)2 = 945 If rate rises to 7%, the new price is: P rice = 30 ¤ annuityf actor(7%; 2) + 1000=(1 + :07)2 = 927:68 b. False. If the bond’s YMT is greater than its coupon rate, the bond must sell at a discount to make up for the lower coupon rate. For an example, see the bond in a. In both cases, the bond’s coupon rate of 3% is less than its YTM and the bond sells for less than its $1,000 par value. c. False. With a higher coupon rate, everything else equal, the bond pays more future cash ‡ow and will sell for a higher price. Consider a bond identical to the one in a. but with a 6% coupon rate. With the YTM equal to 6%, the bond will sell for par value, $1,000. This is greater the $945 price of the otherwise identical bond with a 3% coupon rate. d. False. Compare the 3% coupon bond in a with the 6% coupon bond in c. When YTM rises from 6% to 7%, the 3% coupon bond’s price falls from $945 to $927.68, a -1.8328% decrease (= (927.68 - 945)/945). The otherwise identical 6% bonds price falls to 981:92(= 60 ¤ annuityf actor(7%; 2) + 1000=(1 + :07)2) when the YTM increases to 7%. This is a -1.808% decrease (= 981:92 ¡ 1000=1000), which is slightly smaller. The prices of bonds with lower coupon rates are more sensitivity to changes in interest rates than bonds with higher coupon rates. e. False. As interest rates rise, the value of bonds fall. A 10 percent, 5 year Canada bond pays $50 of interest semi-annually (= :10=2 ¤ $1; 000): If the interest rate is assumed to be compounded semi-annually, the per period rate of 2% (= 4%/2) rises to 2.5% (=5%/2). The bond price changes from: Price = 50 *annuity factor (2%; 2 ¤ 5) + 1000=(1 + :02)10 = $1; 269:48 to: Price = 50 *annuity factor(2:5%; 2 ¤ 5) + 1000=(1 + :025)10 = $1; 218:80 The wealth of the investor falls 4%(= $1; 218:80 ¡ $1; 269:48=$1; 269:48). Question 5: 1) The value today (P0 ) is: 4 P0 = D1 =(r ¡ g) = $10(1:05)=(:10 ¡ :05) = $210: The value last year (P¡1 ) = D0 =(r ¡ g) = $10=(:10 ¡ :05) = $200 ¡ ¢ The value of the stock next year (P1 ) = D2 =(r ¡ g) = (D1 (1 + g)) = (r ¡ g) = D0 (1 + g) 2 = (r ¡ g) = $10(1.05)2 =(:10 ¡ :05) = $220:50 Notice that the price increases at the same growth rate that the dividends increase; that is : P¡1 £ (1 + g) = $200 £ 1:05 = $210 = P0 P0 £ (1 + g) = $210 £ 1:05 = $220:50 =P1 2) 31. a. DIV1 = $2*1.20 = $2.40 b. DIV1 = $2.40; DIV2 = $2.88, DIV3 = $3.456 P3 = 3.456 * 1.04/(.15 - .04) = $32.675 P0 = 2.40/1.15 + 2.88/1.15 2 + (3.456 + 32.675)/1.15 3 = $28.02 c. P1 = 2.88/1.15 + (3.456 + 32.675)/1.152 = $29.825 d. d. Capital gain = P1 - P0 = $29.825 - $28.02 = 1.805 r = (2.40 + 1.805)/28.02 = .15 = 15% 5